Harry Houdini is perhaps the best-known magician of all time, gaining notoriety in the early 20th century through his daring escape acts. Houdini escaped from straight jackets while suspended from chains, fought his way out of submerged mailbags, and performed a “buried alive” stunt.

Crowds loved it.

Of course, these tricks were merely sophisticated illusions–seemingly supernatural feats accomplished through sleight of hand or the use of fake equipment. Houdini’s genius was in pulling off an impossible trick in a way that did not betray his secrets. He was a master showman and a king of the stage.

Are value funds providing value exposure or are they master showmen?

Similar to vaudeville stages of yesteryear, today’s investing world is filled with entertainers and showmen who, like Houdini, try to appeal to the crowd by conveying that they are doing something special and unique that no one else is doing. Consider value investing. If you google “value investing fund,” you will find links to dozens of different funds with the word “value” in the name. And why not? Investing crowds love anything that has to do with “value.” The value style even has its own column in Morningstar’s style box.

But what exactly is a “value” fund anyway?

We think the definition of a value fund should be one that invests in value stocks (hope this isn’t too controversial).

And what are value stocks, as defined in the academic research?

There are many ways to value invest. For example, the most aspirational and honorable version of value investing involves the identification of the largest discount between theoretical intrinstic value and the current market price. Think Warren Buffett. Think Lou Simpson. Think Julian Robertson. This form of value investing could involve an investor buying a great firm at a reasonable price (e.g., growing at 30% per year with a P/E of 25) or buying a boring firm at a bargain basement price (e.g., a firm with flat growth selling at a P/E of 5), which has been described as “cigar butt” investing. And while this traditional version of value investing is often practiced by traditional “stock-pickers”–some extremely successful, others not so much–this isn’t the form of value investing we discuss. We focus on systematic value investing approaches and not traditional value investing to define “value investing” for the following reasons:

1) Traditional approaches cannot be easily tested (i.e., we can’t test how people felt when they woke up) and 2) systematic value approaches can be easily tested and analyzed. Moreover, the systematic form of value investing generates what academic researchers deem the “value anomaly” and this approach can be summarized in 2 words: “buy cheap.” Cheap could be classified via price-to-earnings, book-to-market, EBIT/TEV, dividend yield, and so forth. We have an academic paper which explores many of these valuation metrics. Here are more details and an update on our original valuation horse race paper. There are also hundreds of papers on the subject of the value anomaly (here and here are research compilations).

Bottomline: buy cheap, systematically.

The academic value investing workhorse: book-to-market

Book value of equity to market (B/M) is an accounting measurement that’s been around for a long time. Because it’s simple, well understood, and there is a long time series of data, B/M is useful for long-term studies of value stocks. For example, Ken French’s web site offers book equity data that goes back to the 1920s. Today, many think of book-to-market as a somewhat generic, heavily exploited, and crude way to measure value. We agree and so do others. Regardless, we think it would be difficult to argue that the cheapest decile of stocks, sorted by book-to-value, should not qualify as a basis for creating a generic “deep value stock” benchmark portfolio.

The market-cap weighted cheapest decile of stocks sorted based on book-to-market (B/M) is a reasonable “deep value benchmark index” for those looking to capture any expected excess returns that may be associated with the value anomaly as it is documented in academic research. Surely, the performance of any active “value fund” should be more similar to this generic B/M “deep value index,” and less like the generic passive market, otherwise, you aren’t buying a value exposure, you’re buying a passive market exposure. Return streams don’t lie.

To see how this plays out in practice, we examine recent stretches of performance for 1) a mainstream value ETF offered by Vanguard–explicit closet-indexers–and compare its performances to 2) our “deep value” (B/M) index and 3) the biggest S&P 500 ETF — SPY. The analysis is meant to highlight how easy it is to spot closet-indexing by simply looking at past performance. The data is all publicly available so others can replicate and extend our analysis.

A few steps to follow when assessing whether a value fund is actually a value fund:

- Compare the performance of a so-called “active” fund to the broad market (e.g. S&P 500).

- Compare the same active fund to a concentrated factor portfolio (e.g., the deep value B/M index mentioned above).

- If the performance tracks the broad market–whoops, you’ve got a closet-indexer.

- If the performance tracks a concentrated factor portfolio–congrats, you’ve identified a unique portfolio exposure.

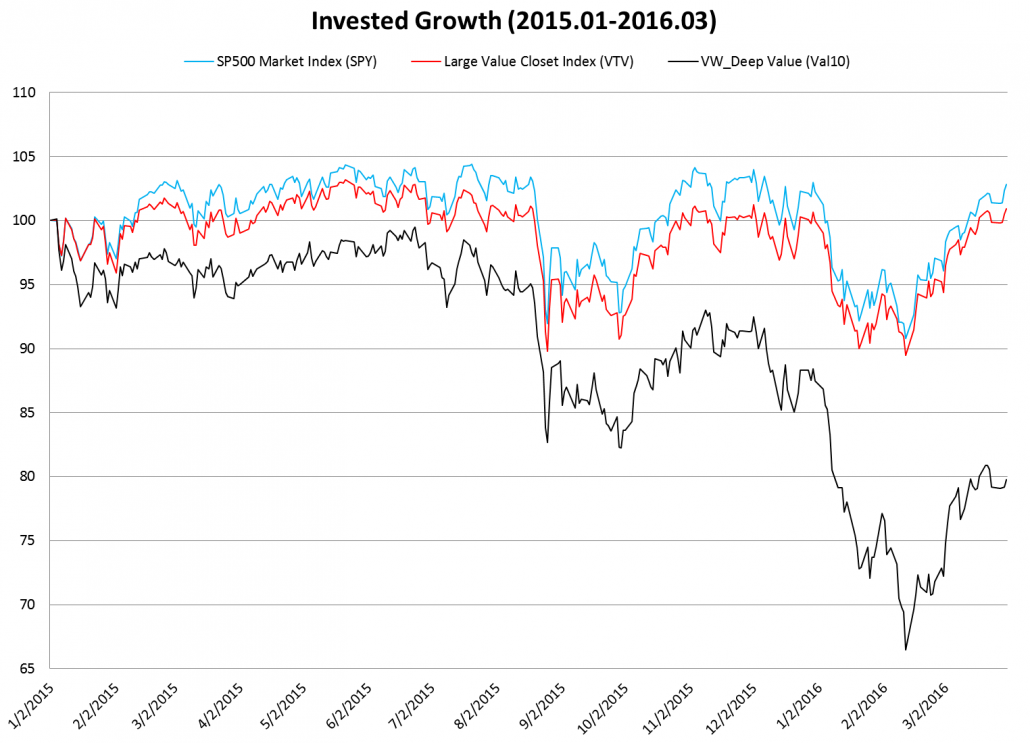

Let’s look at some recent data on deep value (2015 –>)…

We look at the daily returns of various portfolios from 1/1/2015 to 3/31/2016. Results for the deep value index is gross of fees and the ETFs are net of costs. We end at 3/31/2016 because this is the latest update from the Ken French database. All returns are total returns and include the reinvestment of distributions (e.g., dividends).

- Deep Value= The value-weight returns to the top decile formed on B/M, ie. “Val10”. Daily data is from French database (data).

- Closet Index Value= We look at the Vanguard large cap value (ticker: VTV) ETF. Daily data is from Yahoo Finance.

- SP500 Market Index = S&P 500 ETF (ticker: SPY). Daily data is from Yahoo Finance.

A chart of the invested growth of these various strategies are shown below:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The Vanguard value fund is based on the CRSP value indices, which actually use B/M as a core element of their measure to ascertain “value.” In theory, if the Vanguard value fund is delivering active value exposure, their performance should more closely match the Deep Value Index described above, and they should not shadow the S&P 500. But that is the theory; in practice, these closet indexing funds are noisy index funds with a modest value tilt.

But this is expected.

Vanguard is explicitly closet-indexing. And to be clear, Vanguard doesn’t make a claim that they are trying to deliver a differentiated active return series that is designed to exploit the documented value anomaly. Got it–Vanguard is being transparent–we love it. All Vanguard claims is that they can deliver a cheaper closet-indexing value exposure than the other closet-indexers, many of whom claim to be active value investors providing differentiated value exposures.

But how can one assess this claim?

Turns out, identifying the closet indexing value funds and the genuinely active value funds is easy in 2015 — did the performance totally suck or did it roughly match the passive index? Although this may sound strange, under the assumption that one understood the exposures they were supposedly buying, one should be content with an active value fund that was pummeled in 2015. Why? It means you were really investing in value. However, if a so-called active value fund roughly tracked the S&P 500 in 2015, then we should paradoxically become more inquisitive about this value fund–is it delivering heavy exposure to value or is it essentially delivering the S&P 500?

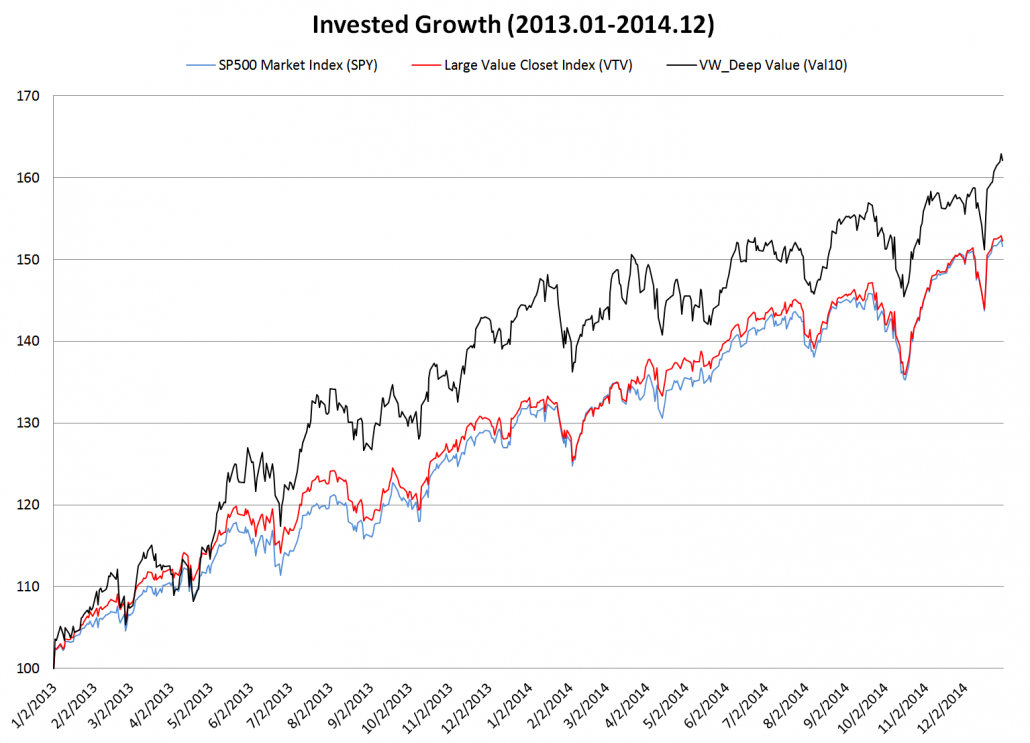

Let’s look at some deep value data prior to 2015…

Here we look at the same group of portfolios mentioned in the last section, but track their invested growth from 2013 to the end of 2014. The black line represents the Ken French deep value B/M portfolio, the red line is the Vanguard closet-index value fund and the blue line is an S&P exposure.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Takeaways:

- Deep value had a much better run over this period and did what it was supposed to do–buy cheap stocks and get exposure to deep value. From 2013 to 2014 it had a good run.

- Meanwhile, the closet-indexing Vanguard value fund did what it was supposed to do — track the broad index, with a little noise.

Owners of true active value funds, whose performance looked like the deep value index, would be very happy with their performance and also happy that they got what they were paying for — differentiated active value risk. Owners of closet indexing value funds, proclaiming to be active value funds, were probably less happy with passive index performance and little differentiated active value risk.

Do Any Active Value Funds Actually Deliver Deep Value Exposure?

Recall that the academic research associated with the outperformance of “value” as a portfolio construct involves buying cheap stocks. And these cheap stock portfolios are highly concentrated on a characteristic, for example, high book-to-market stocks, or low P/E stocks. Given this evidence, one would think we would find value funds in the marketplace that deploy high-conviction characteristics-focused portfolios to exploit these anomalies.

Sadly, these funds are few and far between…

Instead, value-centric asset managers focus on asset collection, not alpha (see discussions here and here). Closet-indexing is a great way to achieve asset collection, and accommodate scale, when mixed with powerful marketing and confused buyers. But unfortunately, 1) closet-indexing funds are not exploiting the documented anomaly they intend to exploit and 2) they are really just noisy reincarnations of a product that is already available in the market at extraordinarily low-costs — passive index funds!

So what’s the bottomline?

If you are going to be a systematic value manager, be a value manager. Don’t mess around — embrace active value risk and deliver what you are supposedly getting paid to offer. And if you’re going to simply replicate a noisy version of a passive index fund and label it as a “value fund,” call a spade a spade and change the name of the fund to the “closet-indexing value fund.” But don’t call it a value fund, because you aren’t really delivering active value exposure. We think words should matter.

Given the current lineup of value funds currently available in the marketplace, you might make the case that the value investing world is full of Houdini-like entertainers: “Step right up and look over here at our value fund! We are better value investors than the others!” Similar to Houdini, these fund providers like to get the crowd excited by talking about “value investing” and calling themselves “value” funds. But is it true, or is it all just an illusion and really what they are is just great entertainers?

We would argue that there is no magic in the realm of active value investing. The high-level procedure is clear based on academic research: buy cheap stocks, with conviction. And because the design is transparent, the ability to identify high-flying Houdini’s — practitioners who are not doing something special at all — is easy: If an active value fund’s performance doesn’t roughly resemble the performance of a simple deep value index, such as the one engineered by Ken French, then that fund is a value myth and provides no value magic, in expectation.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.