The core source for institutional ownership data is derived from 13F filings, from a form filed by large asset managers that manage over $100mm in 13(f) securities (e.g., stocks). Beware of this data!

Garbage in, garbage out

Here is a link to the SEC’s List of Section 13(f) filings database, which is updated on a quarterly basis. Many academic studies and marketplace products/strategies rely on 13F filings to establish measures of so-called “institutional ownership.” The research that uses institutional ownership metrics to test an argument is interesting and often compelling, however, few readers ever question the data source that underlies “institutional ownership.” Could there be a case of “garbage in, garbage out” when it comes to this data?

My gut has always said, “Yes.”

As a PhD grad student and a former finance professor, I used to be buried in the Thomson-Reuters Institutional Holdings (13F) Database, which is a collection of 13F files for all filers over time.

The database is not a pretty sight–institutional ownership data errors are not rare, they are the norm. However, there are two possible reasons for the database issues:

- Thomson-Reuters is doing a bad job

- The underlying source data is no good

13F data stinks?

Turns out #2 might be the culprit. A new paper by Anne Anderson and Paul Brockman, appropriately titled, “Form 13F (Mis)Filings,” highlights the issues with the source 13F filing data submitted by 13F filers. The abstract says it all:

We examine the reliability of Form 13F filings and document the widespread presence of significant reporting errors…Overall, our evidence shows that the widespread reliance on 13F filings for institutional ownership figures is unwarranted.

Ouch. That is quite an indictment!

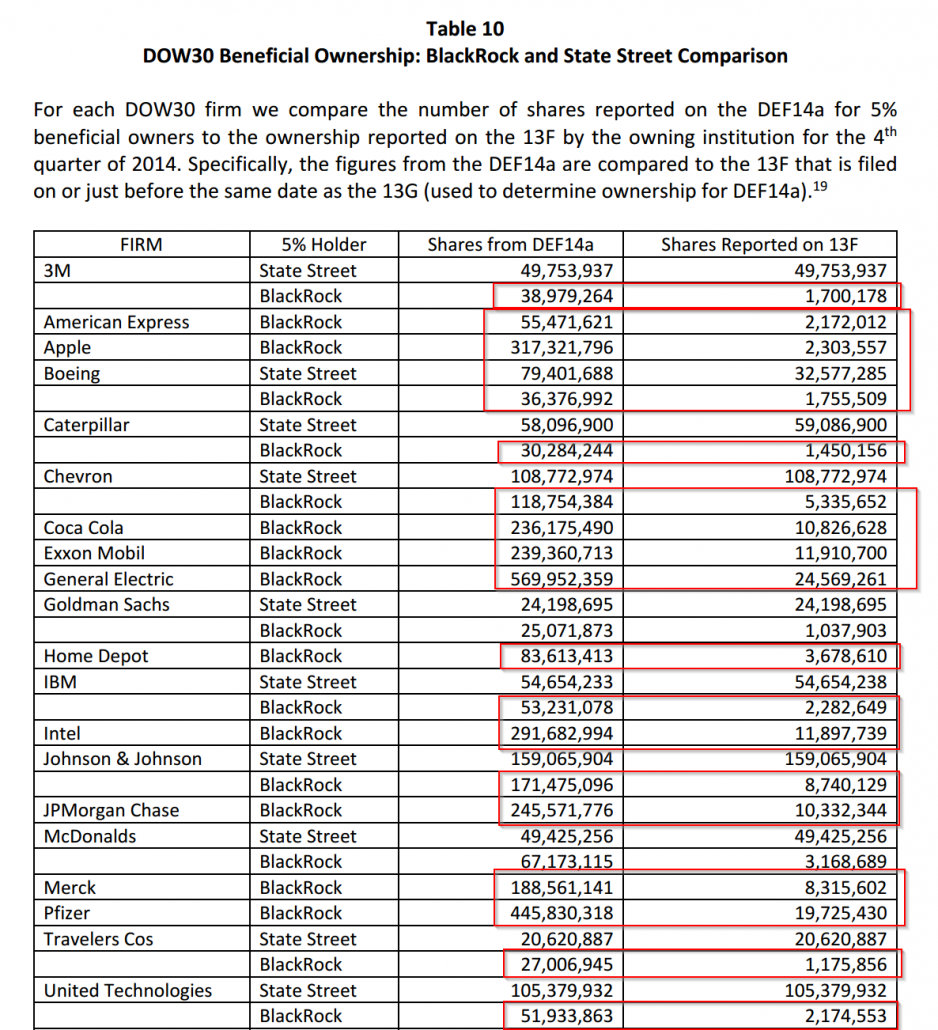

Here is a table from the paper highlighting the vast differences in shares reported on proxy statements (DEF 14a) and 13F–note the huge differences. Perhaps some of these can be easily explained, but the extraordinary differences are a bit startling…

Is this due to the fact State Street is a custodian versus Blackrock , which is an advisor/manager? What about beneficial ownership versus advisor control of 13F securities? h.t. Brad B. @ alphaclone)

So what’s the bottom line on 13F filings?

Perhaps we should follow the SEC’s own advice as it pertains to 13F filings:

The reader should not assume that information is accurate and complete.

Readers should make sure they understand their data provider who provides 13F data and also recognize that the underlying data provided to the SEC is not held to the same level of scrutiny as other filings (e.g., financial statement data).

For other research papers related to institutional investors, read:

Distracted Institutional Investors

How do Institutional Investors approach Climate Risks?

Institutional Investment Strategies: Keep it Simple

Active Fee Over Time: Retail and Institutional Trends Over Time

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.