Institutional Trade Persistence and Long-term Equity Returns

- Amil Dasgupta, Andrea Prat, and Michela Verardo

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

Recent studies show that single-quarter institutional herding positively predicts short-term returns. Motivated by the theoretical herding literature, which emphasizes endogenous persistence in decisions over time, we estimate the effect of multi-quarter institutional buying and selling on stock returns. Using both regression and portfolio tests, we find that persistent institutional trading negatively predicts long-term returns: persistently sold stocks outperform persistently bought stocks at long horizons. The negative association between returns and institutional trade persistence is not subsumed by past returns or other stock characteristics, is concentrated among smaller stocks, and is stronger for stocks with higher institutional ownership.

Data Sources:

IBES, CRSP, CDA/Spectrum, and COMPUSTAT from 1983-2004

Alpha Highlight:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Strategy Summary:

- Positive and negative persistence is defined as the number of consecutive quarters a stock is either bought or sold by the aggregate institutional portfolio.

- For example, a stock sold by institutions for 3 straight quarters would have a persistence score of -3, while a stock bought for 4 straight quarters would have a persistence score of +4.

- A stock with a persistence score of +5 would also be in the +2, +3, and +4 portfolios.

- Paper first performs regression analysis to predict the future eight-quarter market adjusted return of a stock based on trade persistence, past returns, and other controls.

- The regression predicts an approximately 1% decrease in future returns for a one-standard deviation positive increase in persistence. Thus persistence may affect future stock returns

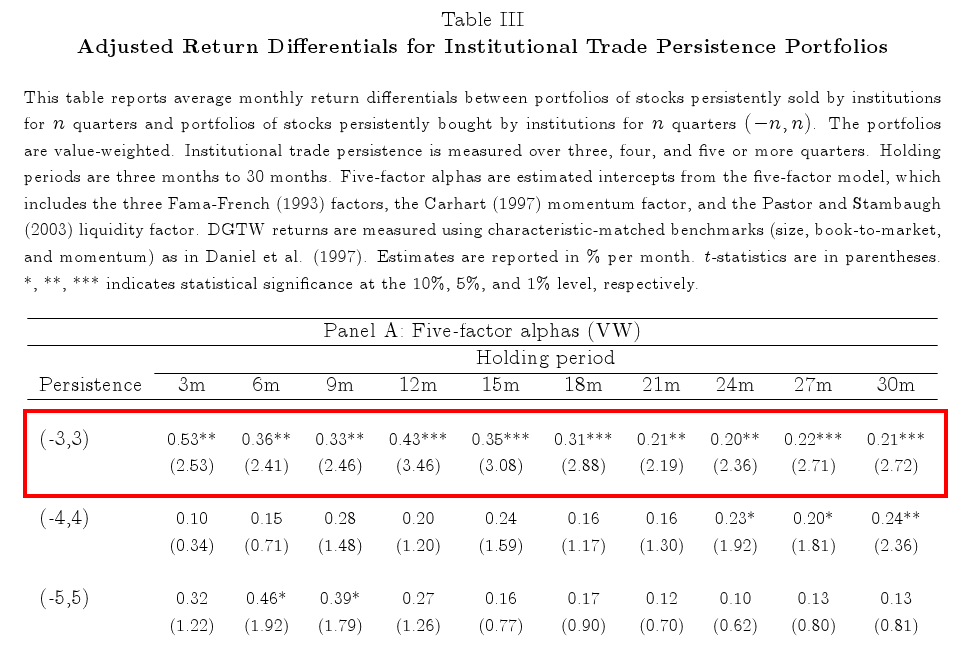

- To measure calendar-time returns, create portfolios based on a three, four, and five quarter trade persistence.

- So buy stocks sold by institutional investors (persistence score of -3, -4, or -5) and sell stocks bought by institutional investors (persistence score of +3,+4, or +5).

- Buying stocks with a -3 persistence and selling stocks with a +3 persistence yields 0.53%, 0.43%, and 0.20% 5-factor alpha per month for a 3-month, 12-month, and 24-month holding period respectively.

Commentary:

-

The reversal strategy works the best for stocks in the lowest tercile of market capitalization (small stocks), which may be difficult to short.

-

As the holding period increases, the alpha for the (-3,+3) portfolio decreases, so may need to rebalance more often.

-

Would expect to find largest returns in the (-5, +5) portfolio, however only find significant alpha in the smallest firms (Table V in the paper).

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.