Momentum is the tendency for assets that have performed well (poorly) in the recent past to continue to perform well (poorly) in the future, at least for a short period of time. In 1997, Mark Carhart, in his study “On Persistence in Mutual Fund Performance,” was the first academic to use momentum, together with the three Fama-French factors (market beta, size and value), to explain mutual fund returns. Robert Levy published one of the earliest formal studies on cross-sectional momentum in 1967, but the real academic interest for momentum (a form of technical analysis) was inspired by Narasimhan Jegadeesh and Sheridan Titman, authors of the 1993 study “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency.”(1)

The academic literature has investigated the existence and performance of two different types of momentum. The first is called cross-sectional momentum. This is the type of momentum that Jegadeesh and Titman, as well as Carhart, studied and is used in the four-factor model (beta, size, value and momentum).(2) Cross-sectional momentum measures relative performance, comparing the return of an asset relative to the returns of other assets within the same asset class. Thus, in a given asset class, a cross-sectional momentum strategy may buy the 30 percent of assets with the best relative performance and short-sell those with the worst relative performance. Even if all the assets had risen in value, a cross-sectional momentum strategy would still short the assets with the lowest returns. Similarly, if all assets have fallen, the cross-sectional momentum strategy will go long assets with the smallest losses and go short assets with the largest losses.

The other type of momentum is called time-series momentum.(3) It is also referred to as “trend-following” because it measures the trend of an asset with respect to its own performance. Unlike cross-sectional momentum, time-series momentum is defined by absolute performance. A time-series momentum strategy may purchase assets that have been rising in value and short-sell assets that have been falling. In contrast to cross-sectional momentum, if all assets rise in value, then none of them would be shorted.

The academic literature, which is summarized in the chapter about momentum in my new book, “Your Complete Guide to Factor-Based Investing,” which I co-authored with Andrew Berkin, the director of research at Bridgeway Capital Management, demonstrates that both types of momentum have delivered premiums that have been persistent over time, pervasive across both asset classes and geography, and robust to various definitions (see here for the Alpha Architect review of our book).

David Smith, Na Wang, Ying Wang and Edward Zychowicz contribute to the literature on momentum with their paper, “Sentiment and the Effectiveness of Technical Analysis: Evidence from the Hedge Fund Industry,” which was published in the December 2016 issue of the Journal of Financial and Quantitative Analysis. Their work examines how investor sentiment affects the effectiveness of technical analysis strategies (which include the use of moving averages as well as momentum) used by hedge funds (which are considered sophisticated investors).

The Theory Behind Sentiment and Momentum Strategies

The study was motivated by prior research that has focused on “investor sentiment,” which is the propensity of individuals to trade on noise and emotions rather than facts. Sentiment causes investors to have beliefs about future cash flows and investment risks that aren’t justified. Two researchers, Malcolm Baker and Jeffrey Wurgler, constructed an investor sentiment index based on six measures: trading volume as measured by NYSE turnover; the dividend premium (the difference between the average market-to-book ratio of dividend-payers and non-payers); the closed-end fund discount; the number and first-day returns of IPOs; and the equity share in new issues. Data is available through Wurgler and New York University.

Baker, Wurgler and Yu Yuan, authors of the May 2012 study, “Global, Local, and Contagious Investor Sentiment,” were the first to investigate the effect of global and local components of investor sentiment on major stock markets, at the level of both the country average and the time series of the cross-section of stock returns.

The authors concluded:

Global sentiment is a statistically and economically significant contrarian predictor of market returns. Both global and local components of sentiment help to predict the time series of the cross-section; namely, they predict the returns on high sentiment-beta portfolios such as those including high volatility stocks or stocks of small, distressed, and growth companies.

Their findings help to explain the poor performance of individual investors who, on average, are noise-chasers. Following the crowd, like sheep to the slaughter, some investors tend to rush into whatever is the latest, new thing, be it the “tronic” era of the ’60s, the nifty-fifty era of the ’70s, the biotech era of the ’80s or the dot.com era of the ’90s, driving prices to levels that predict low future returns.

Research has also found that, during periods of high sentiment, the optimistic views of not-fully-rational investors tend to drive security overpricing. Rational investors can’t eliminate this overpricing due to impediments to short selling—there are limits to arbitrage that prevent rational investors from exploiting the anomaly.

For example:

- Many institutional investors (such as pension plans, endowments and mutual funds) are prohibited by their charters from taking short positions.

- Investors are unwilling to accept the risks of shorting because of the potential for unlimited losses. Even traders who believe that a stock’s price is too high know that they can be correct (indeed, the price may eventually fall) but still face the risk that the price will go up before it goes down. Such a price move, requiring additional capital, can force the traders to liquidate at a loss.

- Shorting can be expensive. Traders have to borrow a stock to go short and many stocks are costly to borrow because the supply available from institutional investors is low (overvalued stocks tend to be overweighted by individual investors and underweighted by institutional investors, who are the lenders of shares). The largest anomalies tend to occur in small stocks, which are costly to trade in large quantity (both long and especially short). The volume of such shares available to borrow is limited (because they tend to be owned by individual investors) and borrowing costs are often high.

While these limits to arbitrage can prevent sophisticated investors from fully correcting mispricings during periods of high sentiment, during periods of low sentiment, the views of not-fully-rational investors may not be reflected as underpricing because sophisticated investors can simply hold long positions. The result is that high-sentiment overpricing is more prevalent than low-sentiment underpricing.

Empirical Tests on Sentiment and Momentum Investing

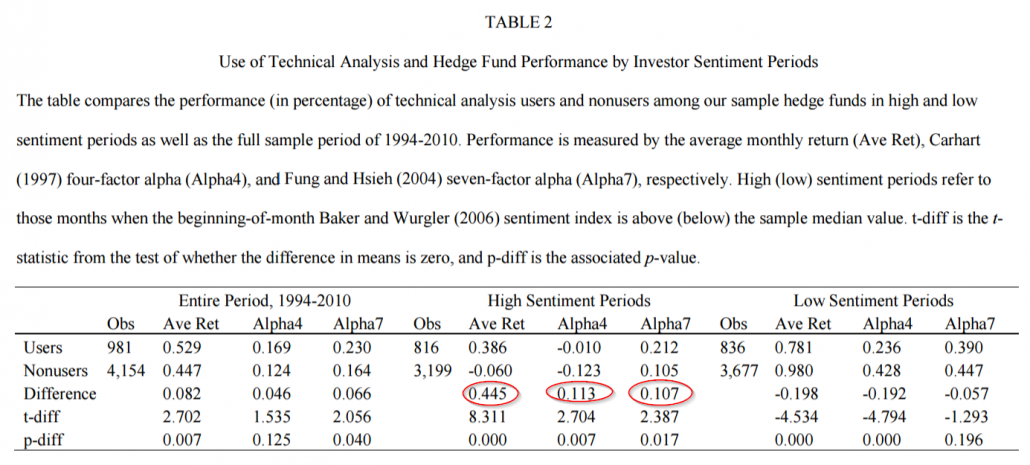

To test the hypothesis that technical analysis would be more powerful in high-sentiment environments, Smith and his co-authors used a sample of hedge funds that are self-reported users of momentum strategies (about one in five hedge funds). The sentiment index they employ is the aforementioned one created by Baker and Wurgler. Their sample covered the period from 1994 through 2010. The authors found that during high-sentiment periods, users of technical analysis strategies on average significantly outperformed nonusers—by 5.3 percent per annum in terms of average returns (44.5 bps/month), by 1.4 percent per annum relative to a four-factor model (11.3 bps/month), and by 1.3 percent per annum relative to a seven-factor hedge fund model (10.7 bps/month). However, during periods of low sentiment, technical analysis usage was found to be less valuable and even counterproductive. The differences in performance were statistically significant. (see the table below for details).

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

They also found that these strategies reduced risk, including downside risk, particularly during periods of high sentiment. Additionally, they found that during periods of high sentiment technical analysis users exhibited better market-timing ability than nonusers. Their results were robust to a variety of controls, including fund characteristics and sub-period analysis.

There was another interesting finding. Hedge funds that report using fundamental analysis tend to underperform nonusers during periods of high sentiment. Conversely, the authors did find some evidence that fundamental analysis users outperform nonusers during periods of low sentiment. In periods of low sentiment, sophisticated fundamental investors are not confronted with limits to arbitrage that prevent them from fully expressing their views, thus market prices are more rational. The explanation for the superior performance of technical analysis in high-sentiment periods is that the slow diffusion of information creates momentum.

Concluding Thoughts

One quibble with the paper is they did not investigate alternative investment sentiment measures. For example, in the paper, “Investor Sentiment Aligned: A Powerful Predictor of Stock Returns,” the authors highlight that the Baker Wurgler sentiment methodology can be improved along several dimensions (that article is summarized here by Alpha Architect). Adding a set of robustness tests using this alternative would add to the paper and help alleviate concerns that the results are driven by a particular measure for sentiment.

Quibbles aside, this is a compelling paper that improves our understanding of financial markets. The authors do a good job explaining the behavioral mechanisms behind how and why momentum strategies work, and is part of the growing body of work in the field of behavioral finance, specifically on how sentiment drives prices and allows anomalies to persist.

References[+]

| ↑1 | Here is a short background on the basics of calculating momentum. |

|---|---|

| ↑2 | Practitioners often refer to cross-sectional momentum as “relative strength.” |

| ↑3 | Practitioners often call this form of momentum “absolute momentum.” See here for an example of how market participants might use both cross-sectional and time-series momentum as an investment system. |

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.