Well, I was midway through a formal book review on Larry and Andrew’s new book, “Your Complete Guide to Factor-Based Investing,” when I noticed that the team over at GestaltU already wrote the review I was going to write — great job and I encourage everyone to read it.

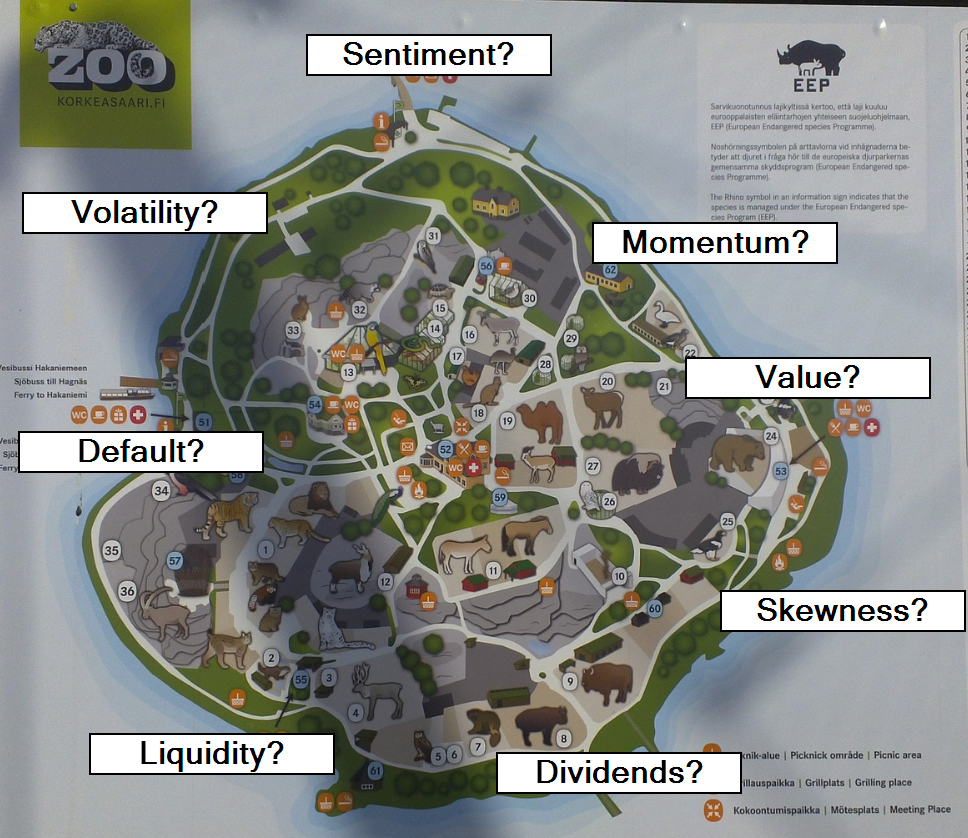

So we won’t rehash what has already been said about Larry and Andrew’s book, instead, I’ll bullet point our thoughts (with links to various research articles) on a variety of topics discussed in the book. Also, I want to encourage anyone interesting in factor investing to grab a copy of this book and take the content to heart. Larry and Andrew do an exceptional job exploring the factor zoo and summarizing which animals you should potentially visit.

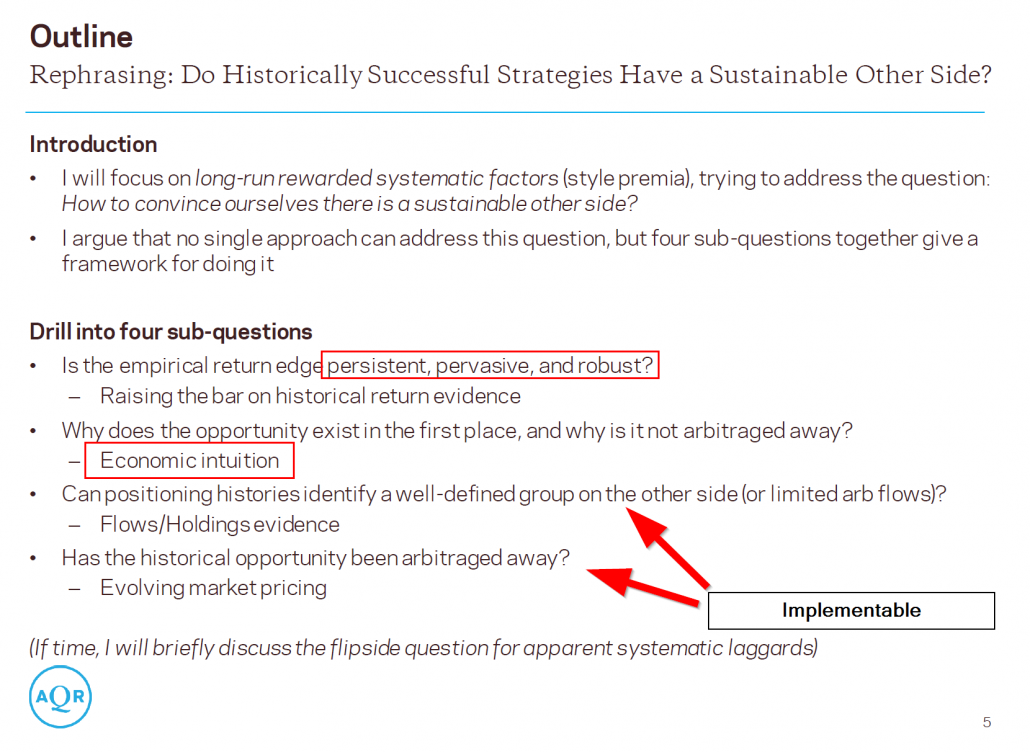

A Framework for Identifying Investment Factors

First, I really like the framework the authors posit for the selection of “factors.” Here are the 5 elements which are described in the GestaltU review:

- Be persistent over a long period of time, and across several market cycles;

- Be pervasive across a wide variety of investment universes, geographies, and sometimes asset classes;

- Be robust to various specifications;

- Have intuitive explanations grounded in strong risk and/or behavioural arguments, with reasonable barriers to arbitrage; and,

- Be implementable after accounting for market impacts and transaction costs.

Many of these concepts are described in detail by Antti Ilmanen in one of the most impressive and informative slide decks I’ve seen in a long time.

Note the 5 elements are essentially described in the deck: persistent, pervasive, robust, intuitive, and implementable

Bottomline? When Swedroe/Berkin and the AQR crew are aligned on something, we should probably consider it a good idea.

What Factors “Matter” According to Berkin/Swedroe?

- Market beta

- Size

- Value

- Momentum

- Profitability & Quality

- Term

- Carry

- Low-volatility

- Default

- Time series momentum (i.e., trend-following)

Our Thoughts on These Factors

Larry and Andrew do a wonderful job documenting a lot of the literature related to each of the factors discussed. In the section below we list all of their factors and articles we’ve done on these same subjects (some are discussed in the book). We also provide a high-level score based on our take on the evidence. In general, we pretty much agree with almost all of the sentiments expressed in the book (Warning. Warning. Warning. Group think alert, group think alert!).

Here is our ranking system:

- Gold (top-tier factor)

- Silver (solid factor)

- Bronze (second-tier factor)

The list of Larry/Andrew’s favorite factors with our rough rank order of evidence and sustainability out of sample.

- Market beta

- Gold. Pure risk. Legit.

- Term Factor

- Gold. Pure risk. Legit.

- Momentum Factor

- Gold. Part risk, part systematic mispricing. Fans since we wrote an entire book on it.

- Momentum investing simulations

- Our quantitative momentum philosophy

- Facts, Fiction, and Momentum Investing

- Our “momentum investing” blog post category (a repository of research we’ve highlighted that relates to momentum)

- Quantitative Momentum (Larry Swedroe review)

- Stocks on the Move

- Gold. Part risk, part systematic mispricing. Fans since we wrote an entire book on it.

- Value Factor

- Gold. Part risk, part systematic mispricing. Fans since we wrote an entire book on it.

- Value investing simulations

- Our quantitative value philosophy

- Facts, Fiction, and Value Investing

- Our “value investing” blog post category (a repository of research we’ve highlighted that relates to value investing)

- Quantitative Value Book (Larry Swedroe review)

- The Intelligent Investor

- The Little Book that Beats the Market

- Gold. Part risk, part systematic mispricing. Fans since we wrote an entire book on it.

- Trend Following Factor (i.e., time series momentum)

- Gold. Part risk, part systematic mispricing. Huge fans.

- Meb Faber’s “so easy a caveman could read it” investigation of trend-following strategies. Must read.

- Downside protection model (outlines some basics)

- The world’s longest trend-following backtest

- DIY Financial Advisor

- Trend following with Managed Futures

- Dual Momentum Investing

- Our “tactical asset allocation” blog post category (a repository of research we’ve highlighted that relates to asset allocation)

- Our “trend-following” blog post category (includes research that discusses trend-following)

- Gold. Part risk, part systematic mispricing. Huge fans.

- Size Factor

- Silver. Part risk, maybe part systematic mispricing.

- Does the Size Effect Exist?

- Control your junk and it works better

- Our “size investing” blog post category (a repository of research we’ve highlighted that relates to value investing)

- Silver. Part risk, maybe part systematic mispricing.

- Carry Factor

- Silver. Mostly risk, potentially some systematic mispricing.

- Commodity Futures

- FX Good Carry, Bad Carry

- Our “managed futures” blog post category (includes research that discusses carry)

- Silver. Mostly risk, potentially some systematic mispricing.

- Profitability & Quality Factors

- Bronze. Systematic mispricing? Risk? Unclear. Best used as supplement for size/value factors.

- Low-volatility (or low-beta) Factor

- Bronze. Systematic mispricing? Best used as supplement for size/value/momentum factors.

- Evidence-based low-volatility discusion

- Not so simple: Low volatility and valuations

- Low volatiliy and value investing

- Our “low-volatility” blog post category (includes research that discusses low volatility)

- Bronze. Systematic mispricing? Best used as supplement for size/value/momentum factors.

- Default (or credit) Factor

- Bronze. Systematic mispricing? Doesn’t pay to own credit risk, historically.

There you have it on the factors. But always remember: no pain, no gain. Financial markets — while perhaps not the greatest at setting perfect prices — are extraordinarily good at matching buyers and sellers. In the end, a factor can only work to the extent they earn a natural risk/mispricing premium that investors are willing to pay in order to offload the exposure. To the extent that the market determines that the risk/mispricing premium isn’t worth the costs, these factors can vanish in the blink of an eye.

Good luck!

PS. We have a monster factor investing post coming out tomorrow. Stay tuned.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.