The rules around IRAs are really complicated and Wes asked if we could share our flow charts on the subject so others could potentially benefit from the work we’ve done to help make the IRA decision tree more manageable.

There are the standard rules about contribution limits and Required Minimum Distributions and then there are all of the exceptions to those rules. And then to make it even more complicated, there are the exceptions to the exceptions. I recently sat for a financial planning exam where most of the questions on the test dealt with the exceptions to concepts – it was assumed that test takers knew the standard rules.

There is an opportunity to better educate advisors and investors about some of the most common IRA rules (and their exceptions) without putting them to sleep. If you had a better handle on the rules, you’d be able to make more informed financial decisions.

My solution to the current problem is to turn key concepts into flowcharts. What follows are a series of flowcharts depicting common issues that I address with my clients. This might just be the most fun you ever have learning about IRA rules!

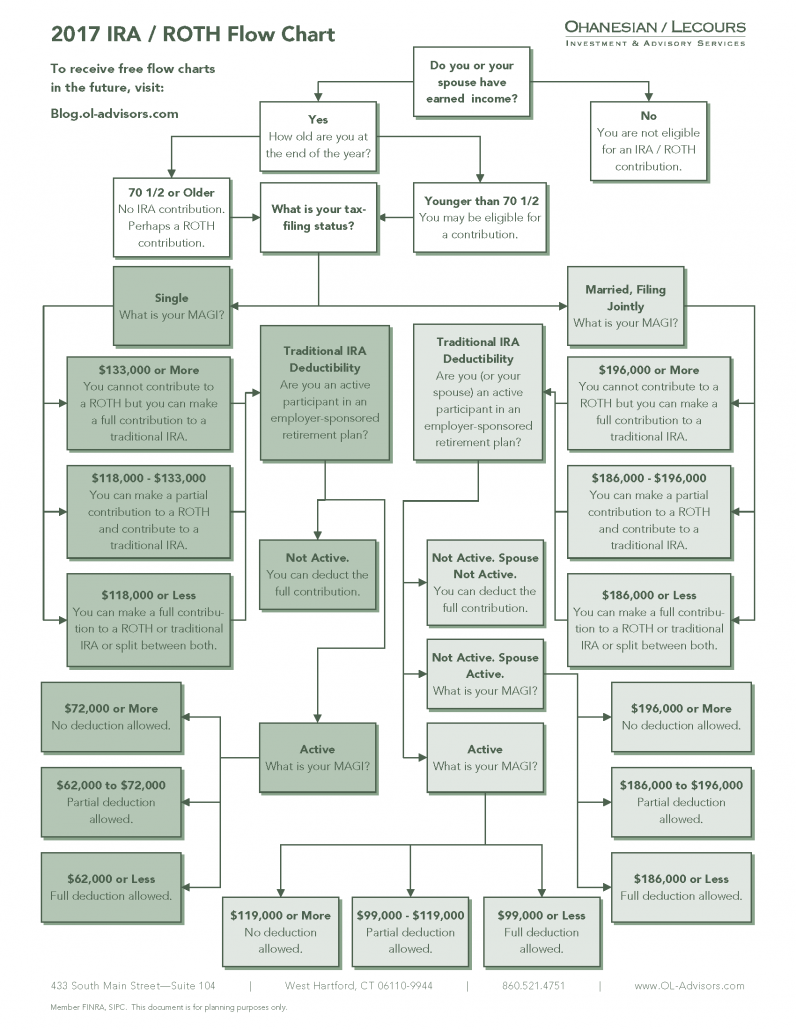

Let’s start with rules around contributions

There are several questions that must be asked to determine if you can make a contribution:

- Do you have earned income?

- And if so, how much?

- Are you 70.5 or older?

- Are you married?

- Are you actively contributing to an employer-sponsored plan?

Based on your answers, we can determine if you can or can’t contribute.

The following flowchart puts it all together:

If you work through the flowchart and discover that you can contribute, you are limited to $5,500 (or $6,500 if you’re 50 or older). Before we move on, there is one exception to call out: if you haven’t filed your taxes for 2016, you have until April 17th to make a contribution for 2016. So, you could actually contribute $11,000 ($5,500 for 2016 and $5,500 for 2017).

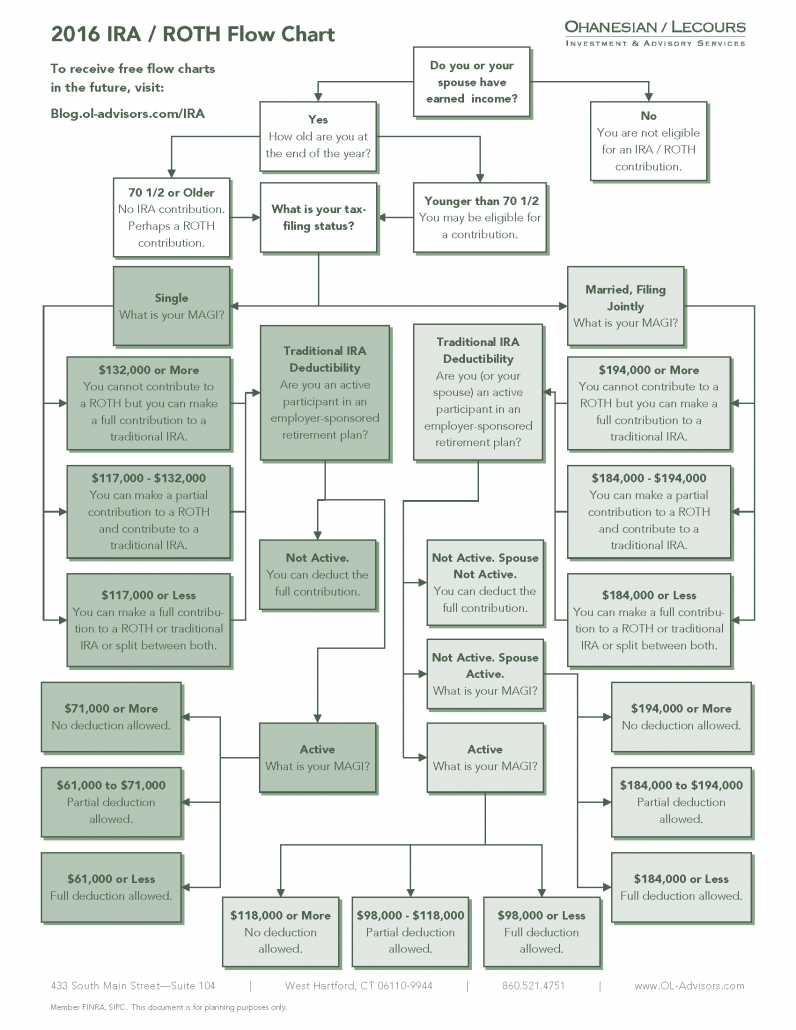

But be sure to use the numbers from 2016 to determine that you are still eligible:

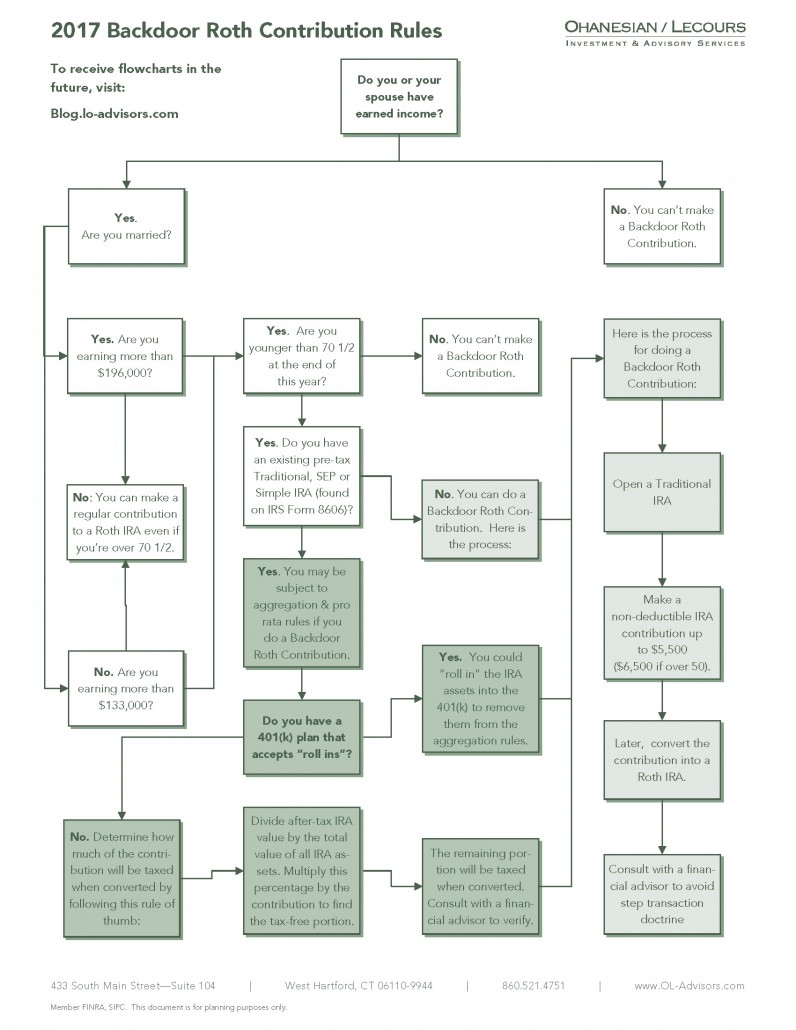

What happens if you earn too much to contribute to a Roth IRA?

We see this a lot. If you’re maxing out contributions to your tax deferred accounts, then it is time to explore a concept called the Backdoor Roth IRA Contribution. The general concept is that you make a non-deductible contribution to an IRA and then convert it to a Roth IRA. But as you will see, the exceptions become the real sticking point. For example, if you have an existing IRA this option can lose its allure very quickly.

But don’t give up hope, follow the flowchart and see if there are some work-arounds for your situation:

The Backdoor Roth Contribution has been subject to some IRS inquires surrounding Step Transaction Doctrine. Basically, the IRS may collapse all of these steps into a single non-eligible ROTH IRA contribution and penalize you accordingly. To avoid step-doctrine, you should convert the non-deductible IRA contribution into a Roth IRA after a certain period of time. Depending on your financial advisor or tax expert advice, that period of time could range from one statement period, to three months or one year.

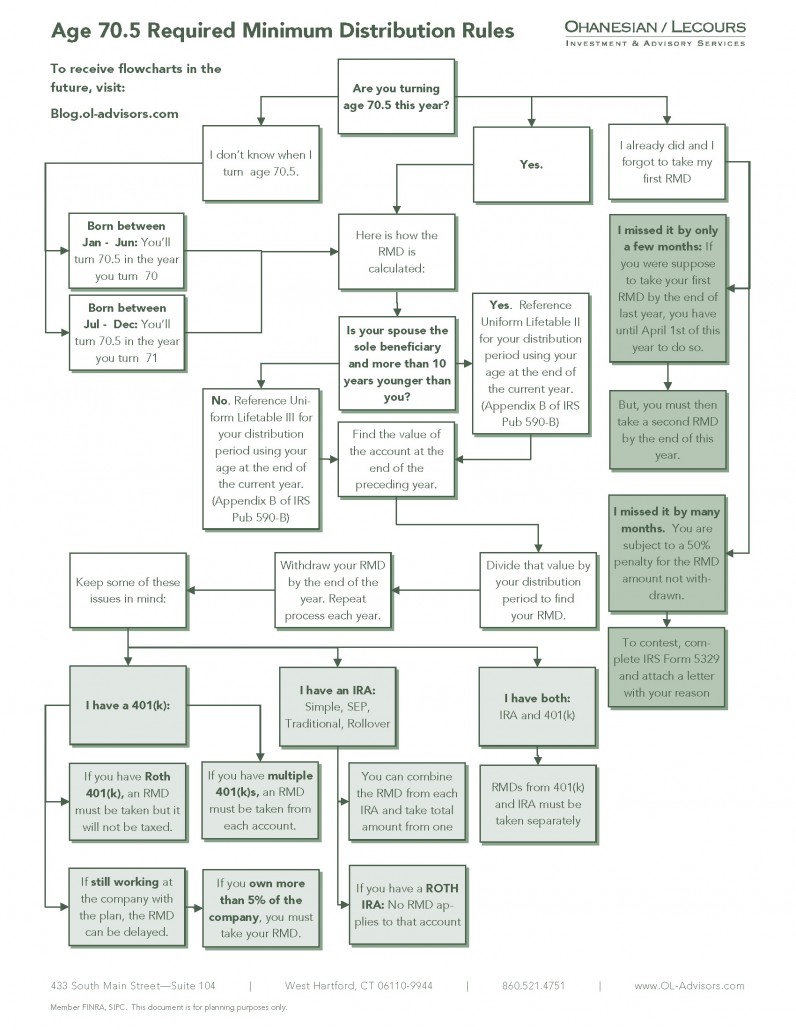

Required Minimum Distribution Rules

After spending the majority of this post focusing on contributions, let’s turn our attention to distributions. Once your turn 59.5, you can take a taxable distribution from the account. But once you turn 70.5, the government will force you to take a distribution, commonly referred to as a Required Minimum Distribution (RMD). The amount varies based on several factors including your age, the age of your spouse, and the size of the account. These rules apply to other qualified accounts as well – 401(k), Roth 401(k), Sep IRA and rollover IRAs. But, the rules are not uniform and it is easy to confuse them. For example, if you are still working when you should begin taking your RMD, you have the option to delay the RMD from a 401(k) but no such option is available in the IRA. This next flowchart captures the most common issues that arise for someone turning 70.5 and trying to understand all the RMD issues:

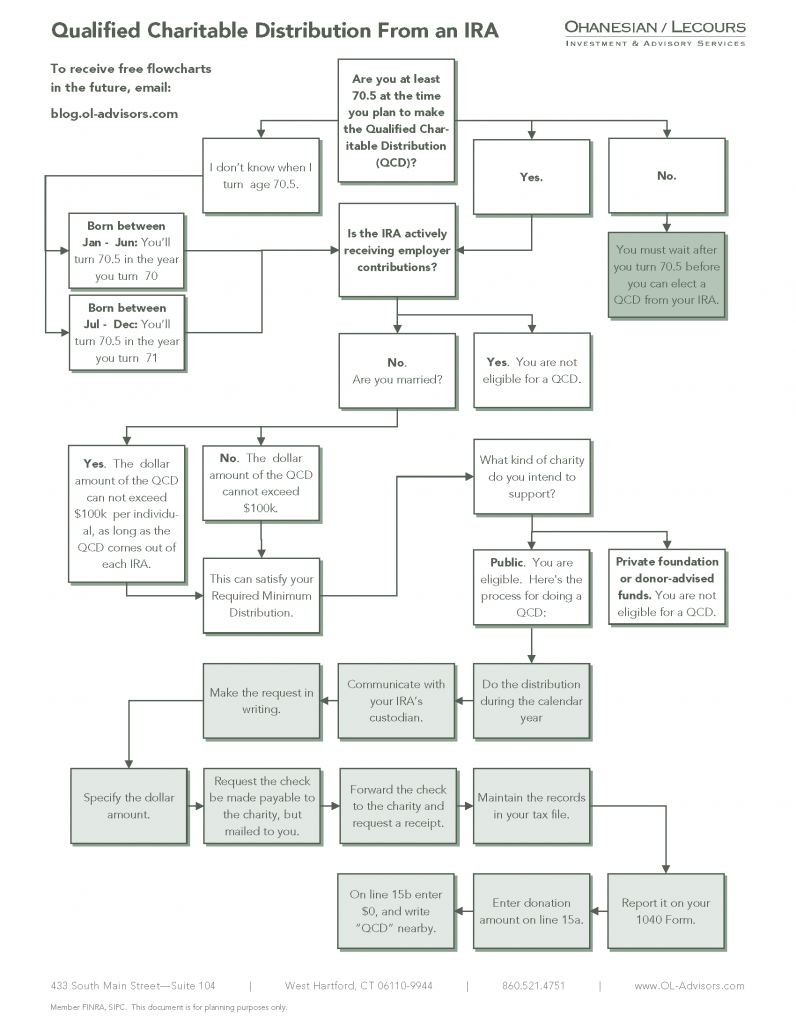

For some fortunate investors, they are in a position where they don’t need the income from the RMD. There are lots of options to put the RMD back to work. Investors could take the RMD, pay the tax, and reinvest it in a taxable brokerage account. Or take the RMD, pay tax and use the rest to pay for a life insurance policy. In both cases, taxes are being paid. But if you are charitably inclined, it may make sense to shift the giving to the IRA’s RMD and avoid taxes altogether. The concept is referred to as the Qualified

Charitable Distribution and is the subject of our final flowchart:

Conclusions

These flowcharts cover about 50% of the questions we get about IRAs. In the coming months I will be working on flowcharts about SEP IRAs, differences between IRA’s and 401(k)s, Roth conversions, taking IRA distributions before 59.5, and social security issues around divorce. If you have an idea for a flowchart, send me a note ([email protected]) or if you want to sign up to receive flowcharts in the future.

About the Author: Michael Lecours, CFP®

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.