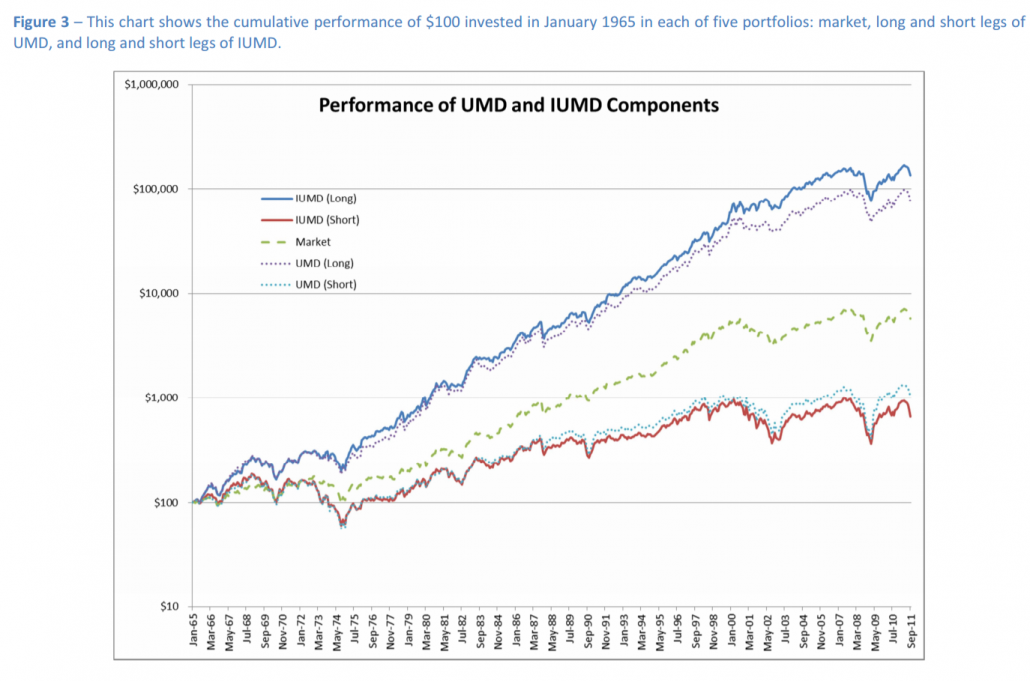

Momentum is the tendency for assets that have performed well (poorly) in the recent past to continue to perform well (poorly) in the future, at least for a short period of time. The momentum effect is one of the most pervasive asset pricing anomalies documented in the financial literature: Stocks with highest returns over the past six to 12 months continue to deliver above-average returns in the subsequent period.

In 1997, Mark Carhart, in his study “On Persistence in Mutual Fund Performance,” was the first to use cross-sectional (or relative) momentum, together with the three Fama–French factors (market beta, size, and value), to explain mutual fund returns. Initial research on cross-sectional momentum was published by Narasimhan Jegadeesh and Sheridan Titman, authors of the 1993 study “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency.”

As my co-author, Andrew Berkin, and I show in “Your Complete Guide to Factor-Based Investing,” the evidence supporting the momentum factor (both cross-sectional and time-series, or absolute momentum) and premium is persistent across time, pervasive around the globe and across asset classes, robust to various definitions, and implementable. We also provide well-documented behavioral explanations for the factor’s existence.

One of the critiques of cross-sectional momentum is that it has a dark side, being subject to crashes (though this is only true for long-short portfolios, not long-only portfolios), such as the one that occurred in 2009 when the Fama-French French momentum factor (UMD, or up minus down) returned -83 percent. (See for example, “Momentum Crashes,” by Kent Daniel and Toby Moskowitz.)

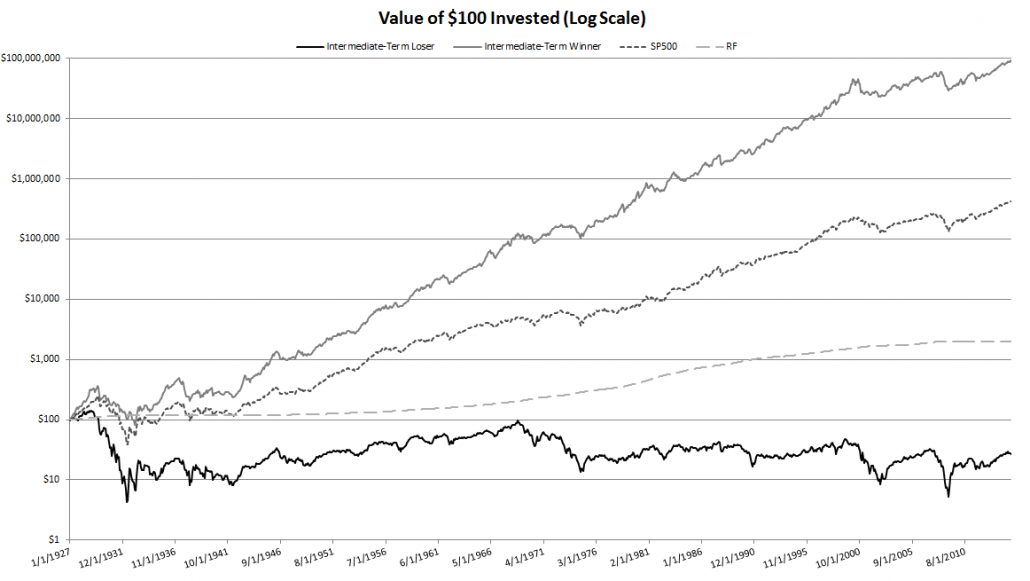

Crashes to cross-sectional momentum occur because the long leg of momentum has positive exposures to the styles that performed well in the recent past, while the short leg is exposed to those that underperformed. For example, in bear markets, high beta stocks tend to underperform while low beta stocks outperform. As a result, momentum can exhibit negative returns if the market experiences a sharp turn. Below is Table 2 from the Momentum Crashes paper, which highlights some of the horrible monthly returns associated with the long/short momentum factor.

Dealing with Momentum Crashes

A way to reduce the risk of cross-sectional momentum crashes was presented in the 2016 published paper, “Idiosyncratic Momentum: U.S. and International Evidence,” by Denis B. Chaves (working paper version here under the title, “Eureka! A Momentum Strategy that Also Works in Japan”). Chaves utilized a regression approach to remove the return component due to market beta and thus produced a new definition of momentum with reduced volatility. His results held over a sample of 21 countries as well as in the United States.

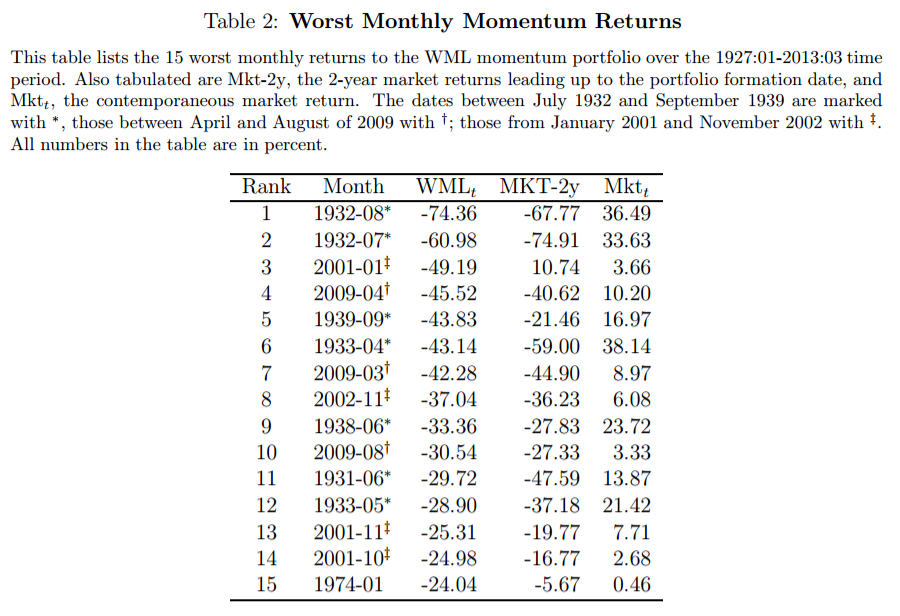

The chart below highlights the effectiveness of idiosyncratic momentum (IUMD) relative to traditional momentum (UMD).

Interestingly, Chaves found that this new version of momentum also works in Japan, where using the traditional academic definition of momentum produces weak results (although Cliff Asness would argue the result isn’t weak).

Idiosyncratic momentum was first investigated by Roberto C. Gutierrez and Christo A. Prinsky in their study “Momentum, Reversal, and the Trading Behaviors of Institutions,” which was published in the February 2007 issue of the Journal of Financial Markets. They identified two types of momentum in stock returns — one due to returns relative to other stocks (the traditional cross-sectional measure) and one due to firm-specific abnormal returns (idiosyncratic momentum), where abnormal is determined by a stock’s idiosyncratic return variation. They found that despite similar performances over the first year, these momentum portfolios perform dramatically differently beyond year one — relative-return momentum reverses strongly (producing returns of -0.40 percent per month in months 13 through 60), while abnormal-return momentum continues for years (producing returns of 0.20 percent per month in months 13 through 60).

Gutierrez and Prinsky also found that institutional investors contribute to both types of momentum they buy relative-return winners and sell relative-return losers at rates far above average, but buy abnormal-return winners and sell abnormal-return losers as if they were any other stock. These results suggest that institutions chase relative returns, possibly resulting in an overreaction, but institutions ignore firm-specific abnormal returns, possibly resulting in an underreaction.

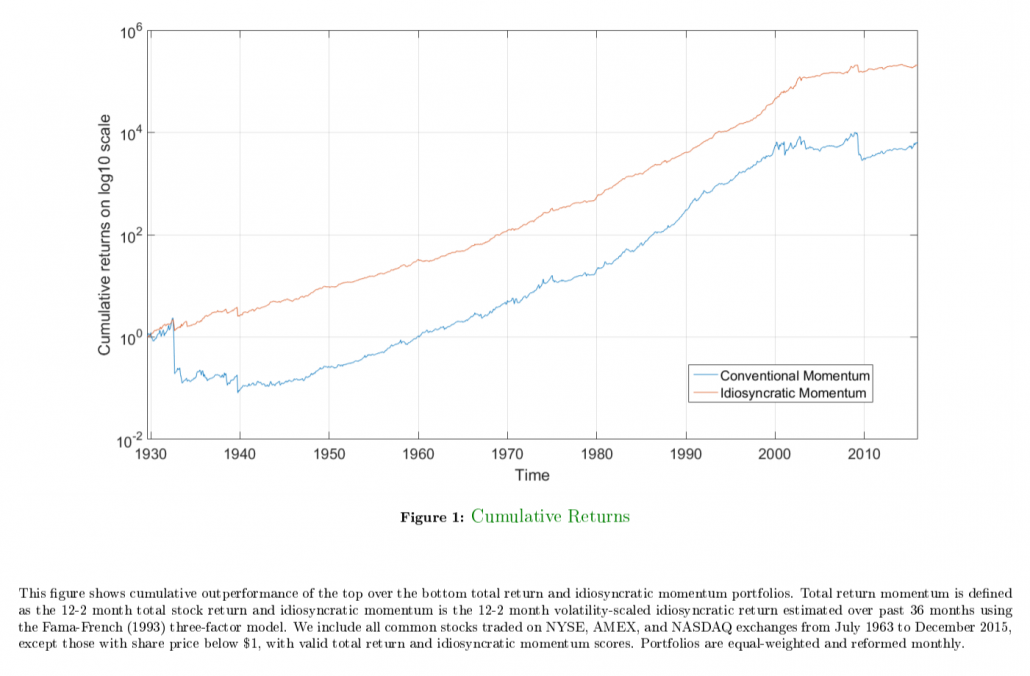

David Blitz, Matthias X. Hanauer, and Milan Vidojevic, contribute to the literature on momentum with their April 2017 paper “The Idiosyncratic Momentum Anomaly.” This study was built on the 2011 paper by David Blitz, Joop Huij, and Martin Martens “Residual Momentum” which was published in the June 2011 issue of the Journal of Empirical Finance. Their data sample covers the period from 1926 through 2015. The following is a summary of their findings:

- Idiosyncratic momentum (iMOM) cannot be explained by any of the established asset pricing factors, such as market, size, value, operating profitability, and investment, even if the total return momentum factor is included.

- Idiosyncratic momentum subsumes total return momentum in some tests, while the converse is never the case.

- Overconfidence, overreaction, and risk-based explanations that arguably explain conventional momentum cannot explain idiosyncratic momentum.

- The existence of idiosyncratic momentum profits is consistent with the underreaction to news (slow diffusion of information) hypothesis.

- Idiosyncratic momentum forecasts high short and long-term excess returns, while conventional momentum forecasts high short-term and negative long-term excess returns.

- There’s a monotonically decreasing pattern in excess returns, Sharpe ratios, and factor adjusted returns (i.e. alphas) going from high (Decile 1) to low (Decile 10) idiosyncratic and total return momentum portfolios. The D1-D10 idiosyncratic momentum portfolio generates a monthly return of 1.39 percent, somewhat lower than that of total return momentum (1.54 percent), but with a substantially lower volatility. The Sharpe ratio of the idiosyncratic momentum strategy is 0.48 per month, almost double that of conventional momentum (0.25).

- The Fama-French five-factor (beta, size, investment, profitability, and value) model is unable to explain the extreme decile return spreads of the two strategies, and the t-statistic is substantially higher for idiosyncratic than for conventional momentum despite the lower abnormal return.

- A portfolio that is long idiosyncratic momentum winners and short losers within past conventional momentum winners generates high returns continually over the next five years.

- Idiosyncratic momentum shows robust performance in international equity markets, including the one market where conventional momentum is known to be ineffective — Japan.

- Importantly, idiosyncratic momentum is significantly less affected by market dynamics (bull vs. bear markets) and, thus, to crash risk — the return in up months following bear markets, particularly hurtful for conventional momentum, is -0.18 percent and statistically indistinguishable from zero (t-stat = -0.39).

The chart below highlights both the effectiveness of their idiosyncratic momentum strategy and its ability to avoid so-called momentum crashes over time.

The findings of Blitz, Hanauer, and Vidojevic are supported by those of Joop Huij and Simon Lansdorp in their March 2017 paper “Residual Momentum and Reversal Strategies Revisited.” They found that relative to conventional momentum strategies, residual (idiosyncratic) momentum strategies have significantly higher return-to-risk ratios, are robust across different global stock universes and hold up out-of-sample (2009 through 2015) after the publication of the first results.

Summary

David Blitz, Hanauer, and Vidojevic make a strong case for using iMOM instead of the conventional total return momentum. It produces only slightly lower returns, but greatly reduces the crash risk and results in an almost doubling of the Sharpe ratio. Note that their firm, Robeco Asset Management, uses iMOM in its strategies, and AQR Capital Management also uses idiosyncratic momentum as part of its overall momentum strategies. (Full disclosure: My firm, Buckingham Strategic Wealth, recommends AQR funds in constructing client portfolios.) There are other related ideas to iMOM, such as “frog in the pan” momentum (used by Alpha Architect) and “return consistency” discussed in Grinblatt and Moskowitz (2004). It will be interesting to see if money managers will incorporate the research on momentum into their investment processes in the future.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.