In their seminal 1993 paper, “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency,” Narasimhan Jegadeesh and Sheridan Titman reported significant returns to buying winners and selling losers in the U.S. equity market, now referred to as the “cross-sectional momentum anomaly.”(1) In 1997, Mark Carhart, in his study “On Persistence in Mutual Fund Performance,” created a factor based on cross-sectional (or relative) momentum, together with the three Fama-French factors (market beta, size, and value), to explain mutual fund returns. Subsequently, the momentum factor was often used by academic researchers and practitioners as a supplement to the workhorse Fama-French three-factor model as the fourth factor used in standard asset pricing models.(2)

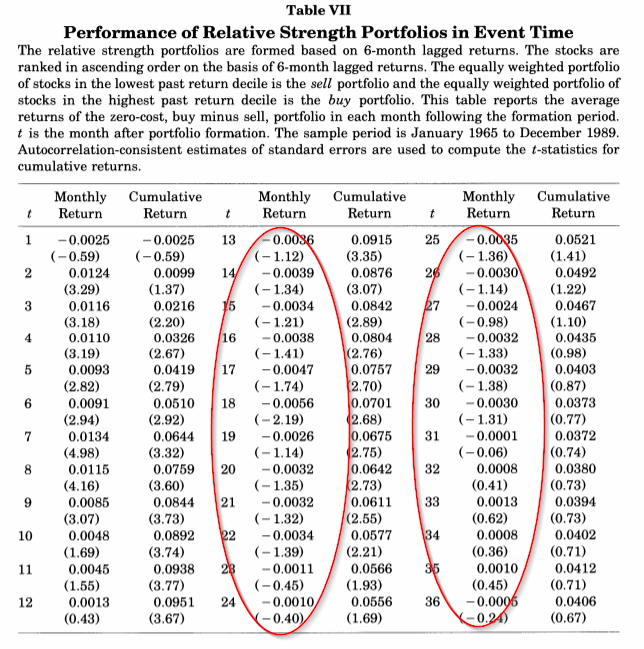

A less famous, though equally important, price pattern was also found in the original Jegadeesh and Titman paper — long-term reversals. For example, in Table 7 from the original paper, the authors highlight the “U” shape of momentum returns:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Whereas prices are characterized by momentum over the short run of three to 12 months, prices reverse over the long run (beyond the first year). While the academic literature demonstrates that individual investors tend to be performance chasers, there’s a strong body of evidence documenting the reversal of long-term stock returns. For example, in the study “Does the Stock Market Overreact?”, which appeared in the July 1985 issue of the Journal of Finance, authors Werner F.M. De Bondt and Richard Thaler documented the reversal of long-term stock returns.(3) De Bondt and Thaler found that for U.S. stocks classified based on their returns over the past three to five years, “losers” outperform “winners” over the following three to five years. De Bondt and Thaler, as well as other researchers, attribute this long-term return reversal to investor overreaction. This, of course, is a challenge to the notion of market efficiency. Today, quantitative investment firms focused on momentum strategies incorporate reversals into their momentum strategies: most of their models focus on momentum formation periods in the three to 12-month range.(4)

Momentum and Reversals: The International Evidence

Douglas W. Blackburn and Nusret Cakici contribute to the literature on reversals with their study “Overreaction and the Cross-section of Returns: International Evidence,” which appears in the June 2017 issue of the Journal of Empirical Finance. (shorter summary is available here). They investigated whether the price reversal pattern is present in global equity markets. Importantly, their dataset included equity returns from 23 developed countries categorized into the regions of North America, Europe, Japan and Asia over the period from 1993 through 2014. Thus, they provide an out-of-sample test, both in time and geography, of the findings of Jegadeesh and Titman.

For example, the following table highlights univariate sorts on three-year momentum portfolios:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Besides Europe, the evidence generally supports the notion that three-year losers tend to be winners and three-year winners tend to be losers, highlighting the well-established long-term reversal phenomenon.

The following is a summary of their findings:

- Using the three-year historical cumulative return (REV) as their measure of reversal, there is an economically and statistically significant price reversal in global equity markets. However, the results are true only for equal-weighted portfolios, not cap-weighted. Thus, the findings are likely limited to small-cap stocks, a conclusion the authors themselves drew.

- Average monthly returns on the portfolio that goes long high REV stocks (winners) and shorts low REV stocks (losers) were -0.80 percent (2.32 t-statistic) in North America, -0.54 percent (2.03 t-statistic) in Asia and -1.03 percent (2.87 t-statistic) in Japan. However, average returns for Europe are insignificant with an average return of 0.28 percent (0.92 t-statistic).

- Risk-adjusted returns on the winner minus loser REV portfolio relative to regional four-factor models are also economically and statistically significant with -0.84 percent (3.71 t-statistic) for North America, -0.91 percent (4.31 t-statistic) for Asia and -0.75 percent (4.18 t-statistic) for Japan. Again, Europe yields an insignificant result of 0.05 percent (0.26 t-statistic).

- Short-term continuations and long-term reversals co-exist in international equity markets. For all four regions, the results from double sorting on MOM and REV show significant returns to the contrarian reversal strategy for nearly all MOM quintiles. The largest winner minus loser REV portfolio returns are found within the quintile of stocks with the worst performance over the past twelve months — for North America, Europe, Japan and Asia, respectively, average returns are -1.88 percent, -1.18 percent, -2.00 percent and -1.76 percent. They also found significant returns on the momentum long-short portfolio in nearly all REV quintiles with the largest returns found within the quintile of high REV stocks.

- Price reversals remain significant when controlling for other characteristics known to explain the cross-section of returns — size, book-to-market equity, and momentum. However, this was not significant in Asia, and perverse in Europe, leaving just North America and Japan.

Blackburn and Cakici concluded:

Our results do show that reversals are primarily isolated to the set of stocks in the bottom 10% of market capitalization (77% to 85% of the total number of stocks depending on the region), stocks characterized by high arbitrage costs that prevent arbitrageurs from taking full advantage of mispricing…. That the long-term reversals return pattern is no longer found at least for the set of big stocks characterized by low arbitrage costs provides some evidence that global market efficiency has increased.

This last point is consistent with limits to arbitrage preventing sophisticated investors from fully correcting mispricings, especially in smaller stocks where transaction costs are higher.

Further Research on Momentum and Reversals

It’s important to note that we should also have some skepticism about the results as they are not as pervasive around the globe as we would prefer to see. In addition, it would have been helpful if Blackburn and Cakici had performed tests of robustness using various definitions, such as five-year reversal and not just three-year. In order for us to have strong confidence in results, we want to see persistence, pervasiveness, and robustness. With that said, Blackburn and Cakici’s findings are consistent with those found by Graham Bornholt, Omar Gharaibeh and Mirela Malin in their study, “Industry Long-Term Return Reversal,” which appeared in the September 2015 issue of the Journal of International Financial Markets, Institutions and Money. The authors were motivated by the following logic:

Since an industry’s returns will tend to mirror its underlying health, its past long-term returns may be predictive of such reversals in its fortunes. If investors are slow to recognize that structural changes in an industry will produce a reversal in its fortunes then low (high) past long-term returns will tend to be followed by high (low) returns in the future. That is, investor underreaction to structural change may also produce return reversal.

However, they also note: “One obstacle that reduces the efficiency of traditional contrarian strategies is that not all long-term losers and winners are equally ready to begin to reverse their past long-term performances.”

To overcome this problem, in addition to investigating a traditional “pure” contrarian strategy, the authors also examined a “late-stage strategy.” A late-stage strategy “is a double-sort strategy that exploits the recent short-term performances of securities to select those showing indications of being more ready to reverse their long-term past performances. The late-stage strategy is long a portfolio of long-term losers with relatively good recent short-term returns and is short a portfolio of long-term winners with relatively poor recent short-term returns.” They add:

The key insight of the late-stage approach is that late-stage strategies should outperform corresponding pure contrarian strategies because a number of long-term losers and winners that show no signs of reversing have been excluded from the late-stage portfolios.

Using data from Ken French’s website, Bornholt, Gharaibeh and Malin’s study covered 48 U.S. industries over the period from July 1963 through December 2013. The long-term loser (LL) portfolios consisted of the 25 percent of industries that had the lowest returns over the past 36, 48, 60, 72, 84, 96, 108, 120 or 132 months. The long-term winner (LW) portfolios consisted of the 25 percent of industries that had the highest past returns over the same timeframes.

The pure contrarian strategy (LL-LW) buys the long-term loser portfolio and sells the long-term winner portfolio. Portfolios are held for 3, 6, 9 and 12 months. However, consistent with previous studies, the authors maintained a 12-month gap (consistent with intermediate momentum) between the end of the formation period and the beginning of the holding period. For example, in their study, De Bondt and Thaler found that the first year after the end of the formation period didn’t provide significant contrarian profits. Additionally, the authors observed that other studies had found that adding the 12-month gap “improves the performance of the pure contrarian strategy and generates stronger findings because this procedure helps avoid any long-term reversals being offset by the short-term continuation of returns.”

For the late-stage strategy, the first sort is the same as for the pure contrarian strategy. The second sort is based on the most recent X month returns, where X = 3, 6, 9, 12, 24, 36, 48 or 60 months. This means that returns are from the last X months of the formation period. From the long-term loser portfolio, the 25 percent of industries with the largest X month returns (the recent winners) are chosen for the long portfolio. Similarly, from the long-term winner portfolio, the 25 percent of industries with the worst X month performance (the recent losers) are chosen for the short portfolio. As with the pure contrarian strategy, all portfolios in the late-stage contrarian strategy are held for 3, 6, 9 or 12 months.

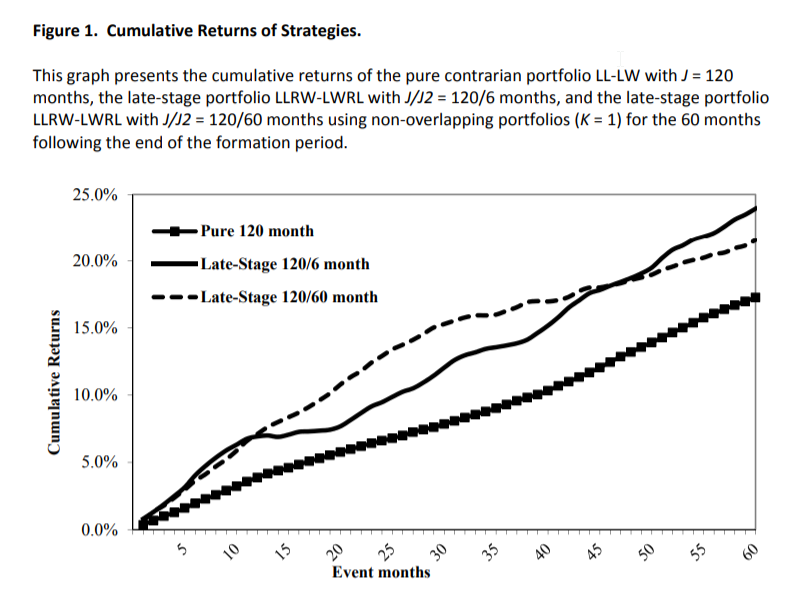

While a 12-month gap is used between the end of the formation period and the beginning of the holding period in the pure contrarian strategy, the design of the late-stage strategy means that problems arising from short-term continuation offsetting the evidence of long-term reversal are avoided. Thus, their late-stage strategy follows the methodology of prior research and uses only a one-month gap between the formation and the holding periods. Here is a chart of the key result that late stage strategies perform better than a pure contrarian strategy:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

The following is a summary of Bornholt, Gharaibeh and Malin’s findings:

- There is strong evidence of reversal in long-term industry returns.

- There is strong evidence (both in terms of large returns and statistical significance) that profits produced by contrarian strategies with long formation periods (96, 108, 120 and 132 months) rather than the formation periods typically used in studies of stock return reversals (36, 48 and 60 months) are greater.

- Pure contrarian strategies do not produce statistically significant profits if there is no gap between the formation and the holding periods.

- The reversal in long-term industry returns leads to valuation changes over the following 10 years that seem difficult to reconcile with the notion of investor overreaction.

- The late-stage strategy exhibits significant evidence of reversal in industry returns and has consistently larger profits than the traditional, pure contrarian strategy. This is consistent with a 2013 study on international markets by Mirela Malin and Graham Bornholt, “Long-Term Return Reversal: Evidence from International Market Indices.”

- The reversal of past long-term performance continues for at least the first five years post-formation.

- As might be expected, the long-term losers have increasing book-to-market ratios in the pre-formation period while the long-term winners have decreasing book-to-market ratios. In the post-formation period, the long sides of both strategies show shrinking book-to-market ratios over the whole 120 months after formation. This slow recovery in valuations for long-term loser industries seems to take too long to be simply the result of reversal from a past overreaction.

- Results were not due to the influence of a few outliers.

- The long-term return reversal in industry returns cannot be explained by the Fama-French three-factor model.

In their search for a possible explanation of the reversal strategy’s success, and as theory and logic would predict, Bornholt, Gharaibeh and Malin found that “poor 60-month returns do indeed signal a long period of increasing industry concentration.” Importantly, they did find that “conventional contrarian strategies with the 36-month, 48-month, and 60-month formation periods that are commonly used in stock-level studies and with a gap of twelve months between the end of the formation period and the beginning of the holding period do not provide evidence of long-term reversal in industry returns.”

However, the authors did find that the late-stage contrarian methodology consistently produced stronger evidence than the traditional, pure contrarian approach. They also concluded that “the reversal in long-term industry returns continues for many years, with valuation effects observed up to 10 years after commencement.” For example, the 10-year late-stage contrarian strategy with a six-month holding period produced a significant risk-adjusted return of 5.8 percent per year, on average, over the sample period.

Conclusion

The bottom line is that the research shows that short-term momentum and long-term reversals coexist in global equity markets.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.