Morgan Housel had a post on the idea of conflicting skill sets. Morgan makes the following comment:

F. Scott Fitzgerald said intelligence is “the ability to hold two opposing ideas in your head at the same time and still retain the ability to function.”

It’s so hard to do. But there are all kinds of examples of when it’s necessary in investing.

Similarly, the ETF industry is made up of conflicting ideas. We’re a relatively new industry (first ETF established in 1993), but the majority of the rules governing the industry are based on the Investment Company Act of 1940. We tout new strategies like smart beta, yet we pitch them based off of 200-year-old backtests (Value and Momentum are two examples). We make ETF investment portfolio decisions at a definitive point in time as static ideas, but then have to implement those portfolios/strategies in a dynamic world.

Although the ETF industry is relatively young, we’re seeing it follow a similar path to other industries. The growth of the industry has attracted more competition–there are 92 firms today versus less than 50 firms five years ago– and the added competition is forcing previously comfortable firms to make difficult pricing decisions on their new and existing ETFs.

The generally accepted idea is that the low-cost firms are winning at the expense of everyone else.(1) But that is slightly misguided, as there is more than one way an operating company can compete in the ETF world.

The companies that are focusing on one (or two) core competencies are the companies that are growing and winning in the ETF industry.

While many in the financial media focus on one competitive advantage (cost), below we describe the three competitive advantages where firms can compete (hint: price is only one of them).

State Street and iShares duking it out!

The Three Pillars of Competitive Advantages to Win

In any industry, there are generally three ways you can win:

- Be the low-cost leader

- Provide great customer service

- Provide great product (also known as providing value for your customer)

A firm that creates value for its clients is totally different than being the lowest cost firm, or being a firm that provides great customer service. Most successful firms are dominant in one area and have a strong competency in a second area. Even Walmart (lowest cost) wants to have its customers to have a decent experience, so they come back to the store again. But they can’t provide the same customer experience in their stores as Tiffany’s. Ritz Carlton and Mercedes Benz are examples of companies that combine numbers two and three. They provide great customer service, and they provide a great product…but they can’t also be the low-cost leader, nor do they want to compete in that area.

As the ETF industry has matured through the years, the companies that are winning (and are likely to continue to win), are those who focus on succeeding in one (or two) of the three areas above.

Competitive Advantage #1: Low-Cost Leadership

Assets are flowing into the firms that are winning via low-cost leadership. And this makes sense. When you’re operating on razor thin margins, you need a lot of scale. When we think of low-cost firms in ETFs, we think of Vanguard and Schwab (and iShares, which we’ll get to further down in this post).

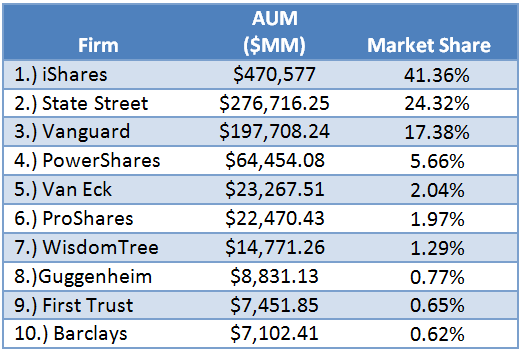

Here’s the AUM and market share leaders from 5-21-2012 (as far back as ETF.com has the data) versus today:

The Past: Top 10 by AUM (5/21/12)

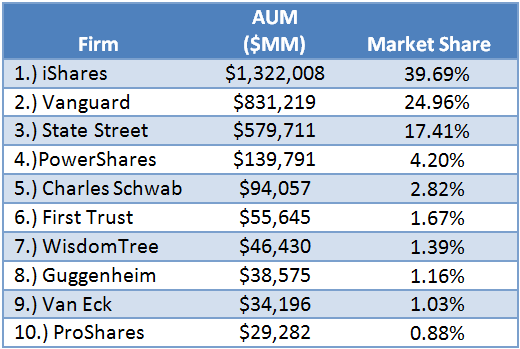

The Present: Top 10 by AUM (11/28/17)

By being the low-cost leader in the industry, Vanguard moved from being third on the list, with 17% market share, to second on the list with 25% market share. Schwab moved from not even being in the top ten (at a 0.5% market share) to being fifth with a 3% market share.

Again, for any industry, it is expected that the low-cost leader to have the largest scale. If you’re going with a low-cost leadership strategy, you need larger volume to offset your lower margins. Vanguard and Schwab moving up the market share of AUM is to be expected when viewed through that lens. And, as long as they continue to follow this strategy and no serious competition beats them at being the low-cost leaders, I expect their market share to continue to rise.

Competitive Advantage #2: Deliver Great Service

It’s an interesting point to focus on the firms that are moving up in market share by total AUM. I’m often looking at weekly and monthly flows to identify the new hot products, and I’m always monitoring firm AUM rankings. These figures are good headline numbers.

Large AUM is a necessary, but not a sufficient, winning formula in the ETF business. What are the rules to win?

If we define the winner as the firm that’s gathered the largest amount of assets, then yes, Vanguard is doing a great job at moving up the league tables. In business, there’s more than one way to win, however.

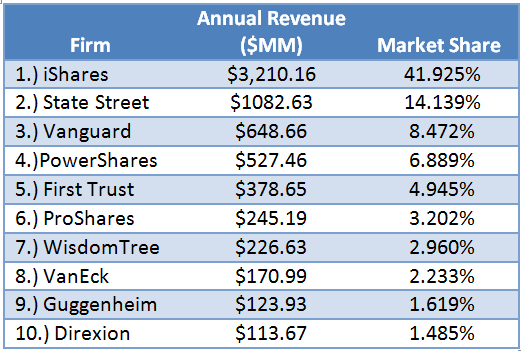

Here’s the list of top ten issuers re-weighted by the amount of revenue they produce (first chart) across the top ten issuers by AUM (second chart, and same as the one above).

Top 10 by Annual Revenue (11/28/17)

Top 10 by AUM (11/28/17)

When we look at the rankings based on revenue, we see that the rankings are different than those based on AUM figures.

For example, First Trust moves up the list by focusing on being one of the leaders in point number two, great service. They’re not fighting the low-cost battle. By focusing on service, they moved from 10th on the AUM market share list in 2012 with .6% of market share, to 6th on the list with 2% market share. And their focus on service puts them in fifth when we rank the top ten by revenue generated.

Vanguard and Schwab moved up the market share lists by focusing on being the low-cost leaders. First Trust moved up the AUM and revenue lists by focusing on providing great service to their clients.

Competitive Advantage #3: Great Products

The other firms in either top ten list are largely there due to excelling at point number three (great product/ provide value to their clients). ProShares and Direxion are much higher ranked when ranking firms off of revenue, due to their higher priced leveraged products. Due to the short-term average holding period for leveraged ETFs, investors using those products are looking for secondary market liquidity first (and the lower trading costs that come with that), making expense ratios less of a concern. The value-add of the increased liquidity is worth the higher fees.

Guggenheim has RSP as their product winner, Wisdomtree has the currency-hedged ETFs that they rode to maintain their market share in the top 10, State Street has the first-mover ETF (SPY), Invesco PowerShares has QQQ for the bulk of their assets, and Van Eck has their two gold miners ETFs (GDX and GDXJ) as their flagship products. These products are all great products in their respective categories.

These firms are winning by focusing on these winners.

iShares: Going for the Trifecta–low-cost, great service, and great products?

In the discussions above we don’t talk about the firm with the number one position in market share: iShares.

iShares is taking on the challenge of competing in all three areas (product, service, and low-cost)…and excelling. This is a very difficult feat to pull off.

iShares has achieved this unique circumstance by segmenting their products into suites and branding them as so. The iShares Core is basically a standalone company that is fighting with Vanguard and Schwab. There’s no great service or best product battle here. There’s only one question for investors when they’re buying the S&P 500 market cap weighted (or similar funds): who’s the cheapest?

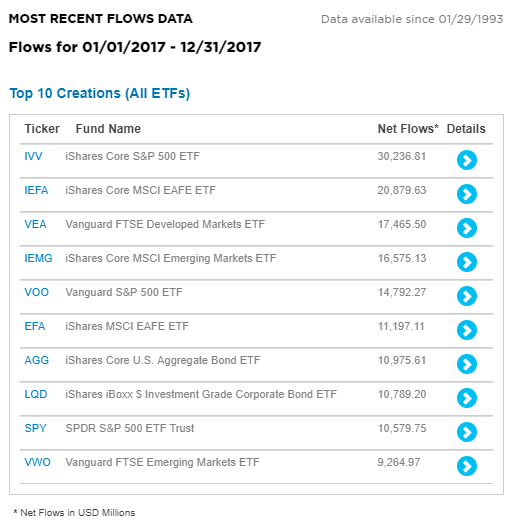

The data for fund flows for full year 2017 shows the following:

That’s some stunning data. iShares’ IVV and Vanguard’s VOO are number one and five, respectively, for inflows year to date. State Street’s SPY is number nine in inflows year to date. iShares and Vanguard charge a measly 5 bps less, at 4 bps, each versus SPY at 9 bps. If I reran this data and excluded the month of December, SPY would’ve been the number one fund in outflows for the year. Christmas was good to SPY. To be fair, it was only one year that SPY had fewer inflows. It had more inflows in 2016, 2014, and 2013. It lagged IVV in 2015. So you could argue this is a one-off. In our new fiduciary first world though, the trend of the lowest cost S&P 500 ETF winning in total flows is likely to continue.

I used to believe that SPY had an impenetrable moat due to its enormous liquidity (which would fall under point 3, value to the customer) and its “low enough” price. But the S&P 500 market cap weighted index is the Walmart of ETFs. Customers want the lowest price, and “good enough” liquidity is all that is required to keep them coming back.

Because we have recently witnessed SPY’s vulnerability in real-time, when I look at iShares, and gaze at what seems to be an incredible moat, it gives me pause: Why can’t other firms such as Vanguard and Schwab do to them, what they are doing to State Street and SPY?

If SPY can’t win on liquidity and brand alone, and is sucked into the low-cost battle over a few bps, what’s to protect iShares MSCI EAFE ETF (EFA), the fifth largest ETF in the US at an expense ratio of 32 basis points? Vanguard’s FTSE Developed Markets ETF (VEA) is close to EFA in AUM and charges only seven basis points for largely the same exposure. And Schwab’s International Equity ETF is putting additional pressure on the international developed market cap weighted category with their Schwab International Equity ETF (SCHF) at six(!) basis points and $14 billion in AUM. A year ago, I would’ve pointed to SPY as the example of how you can hold higher fees for similar exposures, but now that argument appears bunk.

OK. Liquidity and brand aren’t enough to stay ahead as the “great product” leader. Developing innovative new product types is another way to maintain your lead as the great product leader. iShares has done a good job on this front as well. For example, they have their suite of factor ETFs. But with Oppenheimer Funds, JP Morgan, John Hancock, launching their own factor tilted ETFs, and Vanguard launching their own suite of factor ETFs (at what you know will be rock bottom prices), and Goldman Sachs has their own ultra low-cost multifactor ETF and…well you get the point. The price wars are on here too. If your factor product isn’t differentiated in some sustainable way that provides value to your clients, the long-term way to win is either service or low cost.

From a great service perspective, the battle is raging as well. One way firms are looking to provide their clients with great service is by providing them with the best financial tech available. At Alpha Architect, we offer our own suite of fintech tools to assist advisors in building ETF portfolios. Wisdomtree is making a large push here through the acquisition of Junxure, through a fintech company they have a large holding in, AdvisorEngine. And iShares has their own tools. Like the list of ETF issuers offering factor tilted portfolios, the list of ETF issuers focusing on providing their clients better service through financial tech is growing.

Whether it was the Roman Empire, Germany in WWII, or the French in the Napoleonic Wars, a multi-front war is shown again and again to be a losing proposition. The point of listing all the competition iShares is facing on all three fronts, is that attempting to compete in all three is impossible. Competitors are likely to widdle away iShares lead in each category by maintaining extreme focus on a particular area or a set of areas. There is no precedent for a firm being the best at everything. Competition prevents this from becoming a reality. Moreover, the Warren Buffett “fat wallet” problem slowly erodes away a competitors ability to compete on product (and potentially service). If you have too much capital to allocate, you are somewhat limited in your ability to differentiate your offering, because the only offering you can provide is broad market exposure.

Conclusion

The low-cost firms in any industry are going to have the largest amount of market share when looking at it in terms of the amount of product sold. However, low-cost leadership isn’t everything. Firms can compete on product and service. But what’s the bottom line? Firms need to focus on their competitive advantage. As long as you’re providing great service and/or great value to your clients, your firm is likely to grow.

Whatever industry you may be in, you can apply the above thinking to your business to help clarify your business’s strengths. Once you’ve decided what your strength is, develop a clear plan on how to capitalize on that strength and worry less about competing in the other areas. As Yogi Berra said, “You’ve got to be very careful if you don’t know where you are going, because you might not get there.”

Acknowledgements

Thank you to Ken Ewell for helping with my thoughts on this piece, and to Tao Wang for assisting in gathering the data.

About the Author: Ryan Kirlin

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.