One of the big problems for the first formal asset pricing model developed by financial economists, the Capital Asset Pricing Model (CAPM), was that it predicts a positive relationship between risk and return. However, the historical evidence demonstrates that while the slope of the security market line is generally positive (higher-beta stocks provide higher returns than low-beta stocks), it is flatter than the CAPM suggests.

Importantly, the quintile of stocks with the highest beta meaningfully underperforms the stocks in the lowest-beta quintile in both U.S. and international markets — the highest-beta stocks provide the lowest returns while experiencing much higher volatility (explored in this simulation study). Over the last 50 years, defensive stocks have delivered higher returns than the most aggressive stocks, and defensive strategies, at least those based on volatility, have delivered significant Fama-French three-factor alphas.

This runs counter to economic theory, which predicts that higher expected risk is compensated with higher expected return.

The superior performance of stocks with low idiosyncratic volatility was documented in the literature in the 1970s — by Fischer Black (in 1972) among others — even before the size and value premiums were “discovered.” The low-volatility anomaly has been demonstrated to exist in equity markets around the globe. What’s interesting is that this finding is true not only for stocks, but for bonds as well.(1)(2)

Over the past few years, we have had a series of academic papers published that have demonstrated that the returns to low-volatility strategies are well explained by the Fama-French five-factor asset pricing model (which includes the newer factors of profitability and investment, as well as market beta, size and value) and the term factor. The research has also provided us with three main explanations for the low-volatility anomaly:

- Many investors are either constrained by the use of leverage or have an aversion to its use. Such investors who seek higher returns do so by investing in high-beta (or high-volatility) stocks — despite the fact that the evidence shows they have delivered poor risk-adjusted returns. Limits to arbitrage, including aversion to shorting and the high cost of shorting such stocks, prevent arbitrageurs from correcting the pricing mistakes.

- There are individual investors who have a “taste,” or preference for, lottery-like investments. This leads them to “irrationally” (from an economic perspective) invest in high volatility stocks (which have lottery-like distributions) despite their poor returns — they pay a premium to gamble. In other words, a preference for lotteries may generate a demand for high-volatility stocks that is not warranted by the stocks’ fundamentals.

- Mutual fund managers who are judged against benchmarks have an incentive to own higher-beta stocks. In addition, managers’ bonuses are options on the performance of invested stocks, and thus more valuable for high-volatility stocks.

How is Investor Attention Related to the Low-Volatility Anomaly?

Ching-Chi Hsu and Miao-Ling Chen contribute to the literature on the low-volatility anomaly with their study, “The Timing of Low-volatility Strategy,” which appears in the November 2017 issue of Finance Research Letters. Their study explores the role of investor attention and its impact on a low-volatility strategy. To capture data on investors with a preference for lottery-type stocks, they used daily stock returns to calculate the average of the five highest daily returns for each firm in each month as a proxy for investor attention. Stocks with the highest average of the five daily highest daily returns are classified as the high-investor-attention decile and the stocks with the lowest average of the five daily highest daily returns are classified as low-investor-attention decile.

Hsu and Chen state:

Intuitively, when highly positive returns observed in the past are more frequent, and investors with a preference for lotteries might believe that extreme return is more likely to be realized again. Accordingly, this calculation may capture the propensity for investors to speculate.

They used three stock characteristics to identify stocks that might be perceived as lotteries: (1) idiosyncratic volatility, (2) idiosyncratic skewness, and (3) stock price (investors with a preference for skewness prefer “cheap bets” and thus prefer low-priced stocks). Their data set covered all stocks trading on the NYSE, AMEX and NASDAQ from July 1965 to October 2015. Returns were adjusted for exposure to the four Carhart factors (market beta, size, value and momentum).

The following is a summary of their findings:

- Investors with a preference for lotteries tend to seek high-investor-attention stocks for speculation, causing them to overvalue high-volatility stocks.

- The high-attention stocks tend to have high market betas, low prices, high idiosyncratic volatility, greater skewness and are less liquid. This preference can be reinforced by increasing optimism about the future payoffs of higher-idiosyncratic-volatility stocks. Thus, there is greater demand for high-idiosyncratic-volatility stocks with high investor attention, and the low-volatility strategy is more profitable.

- Idiosyncratic volatility increases monotonically from low-investor-attention to more speculative high-investor-attention stocks, and the data has high statistical significance. In addition, stock prices monotonically decrease moving from low to high investor attention deciles — influenced by the lottery characteristics, investors are likely to find low-priced stocks attractive because they perceive them to be a “cheap bet.”

- A low-volatility strategy for high-investor-attention stocks (HAX) is more profitable than low-investor-attention stocks (LAX).

- Conditioned on high investor attention, the profitability of a low-volatility strategy significantly increases due to lower returns on higher-idiosyncratic-volatility stocks.

- Investors’ propensity for gambling-type strategies (a preference for lottery-like distributions) leads to negative returns with high-idiosyncratic-volatility stocks.

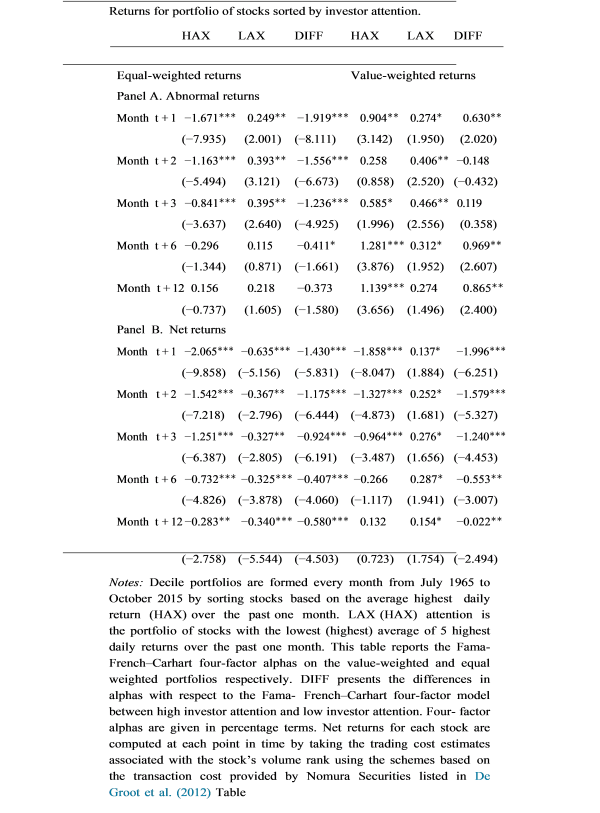

As you can see in the following table, which is from the study, the difference in alphas between high-investor-attention and low-investor-attention portfolios (DIFF) monotonically decrease in months succeeding portfolio formation from a highly significant -1.919 (t-statistic of −8.111) to an insignificant -0.373 (t-statistic of -1.580) for equal-weighting.

In sum, our results provide a behavioral foundation for behavioral biases where individual investors have a preference for lotteries. Such investors are seeking high investor attention stocks to purchase in preference to high volatility stocks, and these erroneous beliefs cause high volatility stocks to be overpriced, thereby leading a low-volatility strategy to be more profitable.

Conclusions Regarding the Low-Volatility Anomaly

Hsu and Chen’s results provide a behavioral explanation for the low-volatility anomaly based on investors’ propensity to gamble. Remember, despite the publication of the findings, limits to arbitrage can prevent sophisticated investors from correcting the mispricing. This is especially true because the most overpriced stocks tend to be low-priced, less liquid and costlier to short (they have higher securities lending fees). With that said, investors should be aware that the publication of academic findings, along with the bear market of 2008, led many investors to seek out ways to reduce the risk of equities. This led to a large increase in the flow of funds into low-volatility strategies. For example, as of October 2017, the three largest low-volatility strategy funds, the iShares Edge MSCI Minimum Volatility USA ETF (USMV), iShares Edge MSCI Minimum Volatility EAFE ETF (EFAV) and PowerShares S&P 500 Low Volatility ETF (SPLV), have almost $30 billion in total assets under management. The increased cash flows have impacted valuations. The result is that while, historically, low-volatility strategies have loaded on the value factor, they now are in a growth regime. When low-volatility stocks have value exposure, on average they outperformed the market by 2.0 percent; when low-volatility stocks have growth exposure, they have underperformed by 1.4 percent on average.

The bottom line is that investors do not need to invest in low-volatility stocks (which are now much more highly priced) to exploit the low-volatility anomaly. The reason is that it’s mostly about the very poor performance of high-volatility stocks. And the poor performance of high-volatility stocks can be avoided simply by screening out stocks with the negative characteristics of high idiosyncratic volatility, high skewness and low prices. Mutual funds, such as those run by Dimensional Fund Advisors, have been using such screens for decades.(3)

References[+]

| ↑1 | A series of papers on the subject of low-volatility/low-beta investing are available here. |

|---|---|

| ↑2 | A prior piece I wrote on the subject is available here. |

| ↑3 | (Full disclosure: My firm, Buckingham Strategic Wealth, recommends Dimensional funds in constructing client portfolios.) |

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.