Momentum Factor Investing in 19th Century Imperial Russia

- William Goetzmann and Siman Huang

- JFE, forthcoming.

- A version of this paper can be found here.

What are the research questions?

Momentum is often considered the “premier anomaly” because of the large historical excess returns generated by the process.(1) For efficient market hypothesis proponents, momentum has a problem — deriving an exclusively risk-based foundation for momentum is difficult, if not impossible (discussion here). Without a purely risk-based hypothesis, one needs to rely on behavioral theories to understand why momentum returns exist in equilibrium. Of course, with additional theories comes additional problems. First, when one relies on multiple theories the ability to fit a theory to data is much higher and researchers often worry that the empirical results from momentum might just be an exceptional case of data mining. Second, with more theories comes more predictions (often in conflict), which need to be assessed and tested using data.

The authors seeks to address the following questions:

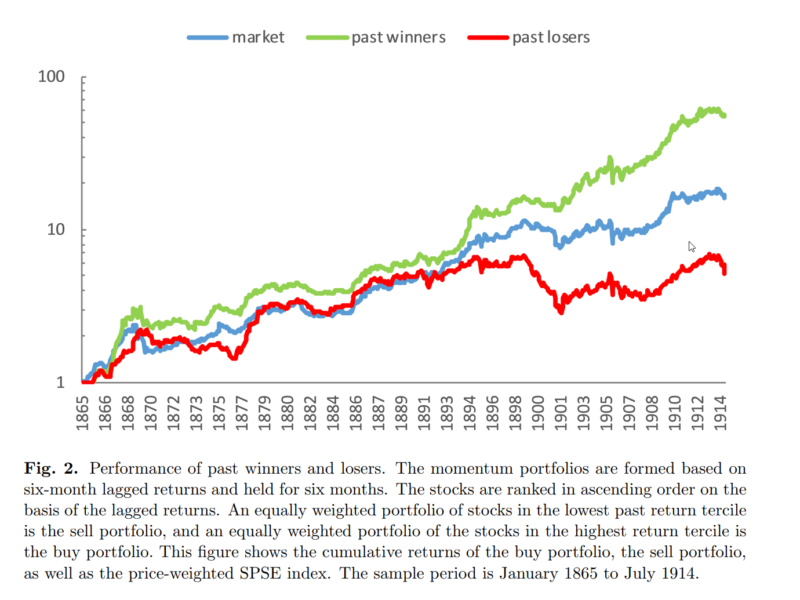

- Is momentum data-mined? This paper addresses the data-mining issue by testing a truly unique out-of-sample test of the traditional cross-sectional momentum effect.

- Why does momentum exist? The paper addresses alternative theories for “why momentum exists” using a unique laboratory of the St. Petersburg Stock Exchange from January 1865 to July 1914.

What are the Academic Insights?

- YES. Momentum effects are very strong in the author’s sample suggesting that prior results are unlikely to be attributable to “data-mining.”

- Overreaction. There is little evidence that momentum effects are driven by the institutional theory (covered here), “crash risk”, or macro-economic sensitivity. The evidence from the paper supports the behavioral theory of overreaction and not underreaction to positive news.

Why does it matter?

Momentum is one of the more hotly debated factor anomalies. This paper allows the authors to test competing theories. The results are absolutely fascinating and we highly recommend readers dig in and explore the entire paper. I personally found it interesting that the classic “12-2 momentum” was the best performing metric, highlighting that there is something unique about the annual lookback horizon. I also found it interesting that overreaction and not underreaction seems to be the dominant explanation for momentum. In our book, Quantitative Momentum, we came down on the underreaction effect as the likely dominant explanation (i.e., we are wrong according to this paper). The smart money would suggest that there probably isn’t a single answer to “why momentum exists,” but the real answer should be “all of the above.”

The most important chart from the paper

Abstract

Some of the leading theories of momentum have different empirical predictions that depend on market composition and structure. The institutional theory predicts lower momentum profits in markets with less agency. Behavioral theories predict lower momentum profits in markets with more sophisticated investors. One risk-based theory predicts occasional momentum crashes. In this paper, we use a dataset from a major 19th century equity market to test these predictions. We find no evidence to support the institutional theory due to the lack of delegated management. We exploit a regulatory change in the middle of our sample period to test behavior theories. We find evidence consistent with overreaction theories of momentum. We find no evidence to support a rare disaster theory.

References[+]

| ↑1 | We found the concept so compelling we’ve written a book on the subject and developed our own Quantitative Momentum Index and we are naturally value investors who hate the idea of momentum! |

|---|

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.