My Advisor Perspective article of June 17, 2019 discussed the regime shifting nature of the low volatility anomaly—low volatility stocks have outperformed high volatility stocks, providing both higher returns while experiencing lower volatility. For example, in his 2012 paper, “Enhancing a Low-Volatility Strategy is Particularly Helpful When Generic Low Volatility is Expensive,” Pim van Vliet found that while, on average, low-volatility strategies tend to have exposure to the value factor, that exposure is time varying. The low-volatility factor spends about 62% of the time in a value regime and 38% of the time in a growth regime. The regime-shifting behavior affects the performance of low-volatility strategies. When low-volatility stocks have value exposure, they, on average, outperformed the market by 2.0%. However, when low-volatility stocks have growth exposure, they have underperformed by 1.4%, on average.

Along the same lines, Luis Garcia-Feijóo, Lawrence Kochard, Rodney Sullivan and Peng Wang, authors of the 2015 study “Low-Volatility Cycles: The Influence of Valuation and Momentum on Low-Volatility Portfolios,” found that there was no alpha in a four-factor model except in extremely cheap low-volatility environments.

The above findings provide a clue to perhaps finding ways to improve on a simple low volatility strategy. In their short paper “A Multi-factor Strategy For Index Enhancement,” the research team at QMA, a PGIM (Prudential) company, sought to determine if they could enhance indexing strategies (of which low volatility is one). They begin by noting that one of the most powerful biases that drives stock behavior is investors’ tendency to overpay for stocks that have the possibility (however remote) of a very large payoff. Jack Vogel covered this subject in a blog post here. In statistical terms, these stocks are described as having high positive “skew.” The positive skew results from the long right tail in the distribution. Securities with such distributions are often referred to as “lottery” stocks. Investor preference for this type distribution (trading the likelihood of lower returns for the small hope of a ginormous return) leads to high valuations and lower future returns. What many investors may not be aware of is that is another group of stocks that exhibit positive skew.

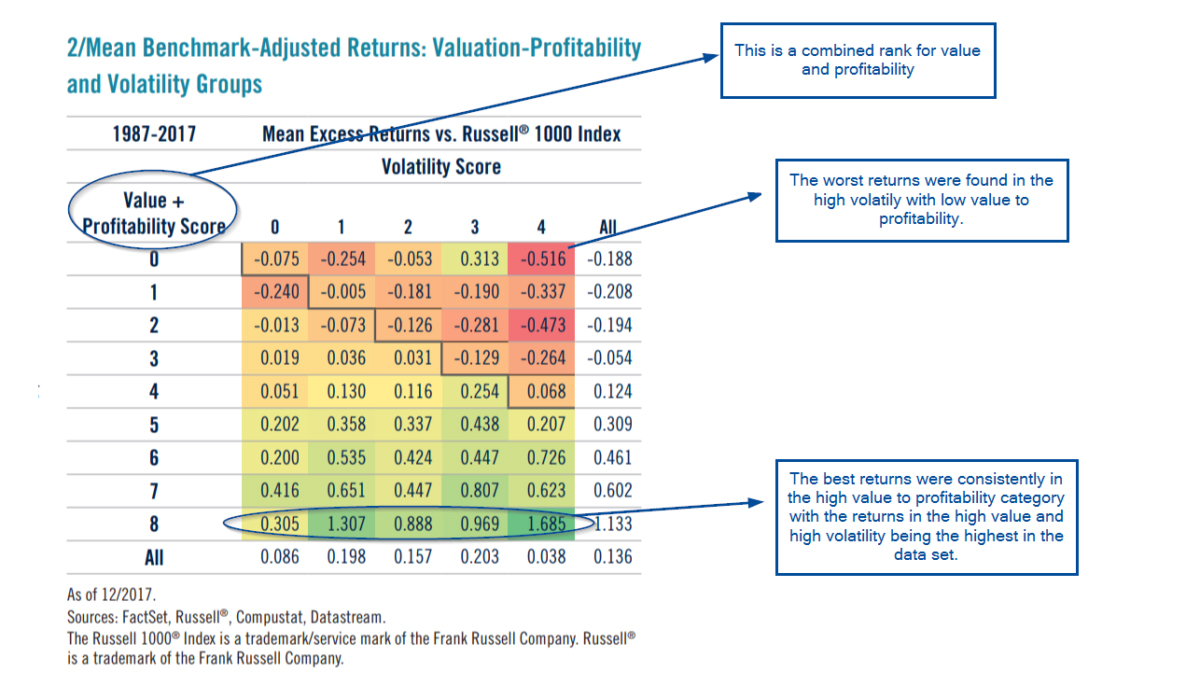

The second group of stocks with positive skewness are “safety” stocks—those with relatively small chance of a very large loss. Investor preference for such stocks could also lead to their valuations being high and future expected returns low. The authors proposed improving on simple index strategies by avoiding two groups of stocks—the high volatility stocks with high valuations and low profitability, and the low volatility (safety) stocks with high valuations and low profitability. To construct their multi-factor portfolio, they first sorted firms into quintiles within a sector according to the ratio of their book-to-market value (B/M), assigning the most expensive firms (lowest B/M) to the first quintile (Quintile 0) and the cheapest (highest B/M) to the fifth (Quintile 4). They used a similar methodology to assess quality (profitability), basing sector quintile ranks on the ratio of gross margin to total assets, with Quintile 0 encompassing the least profitable firms and Quintile 4 the most profitable. They added these quintile ranks to obtain a combined rank for valuation and profitability that ranged between 0 (the most expensive companies with the lowest profits) and 8 (the cheapest and most profitable). They then classified all companies in the universe into quintiles for volatility according to their standard deviation of returns in the prior 90 days—companies in Quintile 0 were the least volatile and those in Quintile 4 were the most volatile. That gave them a dual score of 0-8 for value and profitability and 0-4 for volatility. To construct the portfolios, they avoided all companies whose volatility score was either equal to or above their score of value plus profitability and rebalanced monthly. Their data sample covers the period 1987-2017.

The following is a summary of their findings:

- It is not necessary to avoid all high-volatility stocks, only those that are expensive and less profitable. This is consistent with the finding that not all small growth stocks perform poorly. The poor performance of the asset class is due to those that have high investment and low profitability.

- Not all low-volatility stocks outperform. Those that are expensive relative to their profitability actually underperform the market.

- Stocks avoided mostly underperformed the benchmark, while those selected mostly outperformed.

- Stocks with the most significant underperformance are those in the most volatile quintile (Quintile 4) that are also the most expensive relative to their profitability (combined value and profitability scores of 0 – 3).

- High-volatility stocks that are profitable and cheap (Quintile 4, value-profitability scores of 4 – 8) actually have positive benchmark-adjusted returns.

- Low volatility stocks that are expensive with low profitability (value-profitability scores of 0 – 1) underperform.

- In a test of the pervasiveness of their model, applying their multi-factor elimination method to benchmark constituents and then equal weighting those that remain, their portfolios outperformed all the universes sampled (Russell 1000®, S&P 500, Russell 2000® Value, Russell 2000® Growth, and MSCI EAFE), with average annual excess of returns of 2–3.6% and risk levels comparable to their benchmarks or lower. Alpha was also positive against the equal-weighted versions of the indexes, showing that outperformance is incremental to the small-cap bias inherent in equal weighting.

- The composition of the portfolios generally runs countercyclical to market environments—avoiding more lottery stocks (like the tech stocks in the Internet bubble) when investor sentiment is high and more safety stocks when sentiment is low, tilting away from sectors or industries generating a lot of investor attention.

- A negative of the strategy is that it generated very high turnover—104 percent a year, which they note “left unchecked, could cut into the alpha actually generated in a real-world portfolio construction setting.” To address this problem they used intelligent design, “adopting so-called confidence bands, so that no trading would take place in a stock if its weight at the rebalancing date was already within 10% of the desired position weight based on factor scoring.” They also moved from monthly rebalancing to quarterly. That cut turnover in half. And while negatively impacting performance, the reduction in returns was on the order of just 0.2 percent. Patient trading can also reduce the negative impacts of turnover.

Summary

The elimination approach discussed by the research team at QMA is a logical approach to improving on pure indexing strategies. It’s similar to the approached used by such firms as Dimensional, which has long screened out the group of stocks that include penny stocks, IPOs, stocks in bankruptcy, and small growth stocks with high investment and low profitability. The potential for outperformance comes from avoiding high positive-skew stocks that trade at high valuations and thus have low expected returns. The research done by QMA shows that the approach can be used to enhance the performance of not only low volatility strategies, but index strategies in general.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.