Financial Advice and Bank Profits

- Daniel Hoechle, Stefan Ruenzi,Nic Schaub, Markus Schmid

- Review of Financial Studies, November 2018

- Versions of this paper can be found here and here.

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the Research Questions?

- What are the factors affecting bank profitability on the customer level?

What are the Academic Insights?

By analyzing a dataset with data about 20,000 clients, their 500 advisors, the financial holdings of these clients, and almost 250,000 trades executed for these clients (including revenues, costs, and profits generated from each individual client) between January 2002 and June 2005, the authors find:

- The income from securities transactions and securities holdings accounts for about 70% of quarterly revenues generated with individual clients in the sample. Interest income only contributes about one-fourth to revenues.

- Trades executed based on optional financial advice are associated with significantly higher bank profits than independently executed transactions of the same client. If clients rely on optional financial

advice, average quarterly bank profits increase by more than 50%. - In the case of clients who fully delegate account management to the bank, the bank’s profit with those customer increases by about 80% after they switch to a delegated account.

- The bank’s own mutual funds and structured products generate the highest transaction- and holding-related profits for the bank. Additionally, advised trades are indeed significantly larger than independently executed transactions and advised trades are more likely to be trades in the bank’s own mutual funds and in structured products.

- When clients switch from a self-managed to a bank-managed account, there is a permanent increase in portfolio turnover. Additionally, the share of own-bank mutual funds and structured products in clients’ portfolios increases significantly following the delegation of portfolio management to the bank.

- Wealthier clients and more risk tolerant clients are more likely to carry out advised trades that are particularly profitable to the bank. These investor types conduct larger advised trades and advised trades of these clients are more likely to be trades in the bank’s own mutual funds and in structured products.

Why does it matter?

This study shows that advisors put the interests of their employer before the interests of bank customers, potentially negating any efforts to serve as a fiduciary for their clients.

This study contributes to different strands of the literature:

- It adds to the literature on bank profitability by relating profits to the financial advice-client relation. The main contribution is to show that financial advisors play an important role in generating revenues for the bank by inducing clients to execute transactions that maximize commission and fee income.

- It contributes to the literature on financial advice. It documents that the bank’s own mutual funds and structured products are the most

profitable products from the entire product menu available and consistent with this finding, it shows that advisors recommend exactly those transactions. - It relates to to the literature on structured products. This study is the first to show that structured products generate substantial profits for distributors (and not only for issuers). Moreover, because of the high profitability of these products, financial advisors strongly promote them to their customers, providing an explanation for why these

products are so popular among many retail investors.

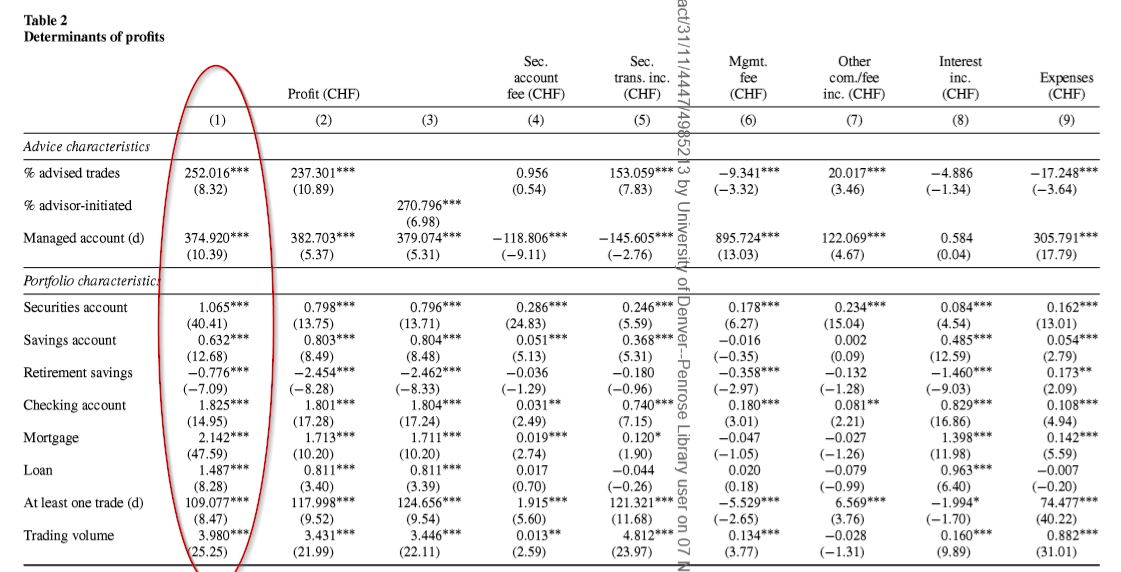

The Most Important Chart

Table 2 In Column 1, the dependent variable is quarterly profits earned by the bank from the respective client. The coefficients on the percentage of advised trades and the managed account dummy variable are both positive and statistically significant, suggesting that optional-advice-driven trading and managed accounts are profitable for the bank. On average, clients execute about one trade per quarter. Thus, the coefficient estimate on the percentage of advised trades indicates that if a client executes this trade on advice rather than independently, this increases quarterly bank profits by about CHF 252 (55.7% of the average quarterly bank profit).

Abstract

We use a unique dataset from a large retail bank containing internal managerial accounting data on revenues and costs per client to analyze how banks and their financial advisors generate profits with customers. We find that advised transactions are associated with higher profits than independently executed trades of the same client. The bank’s own mutual funds and structured products are most profitable for the bank and profits increase with trade size. Consistently, we show that advisors recommend exactly those transactions. Furthermore, we find that advised clients achieve a significantly worse net performance than independent clients. Collectively, our evidence suggests that advisors put their employer’s rather than their clients’ interest first.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.