Similar to some better-known factors, such as size and value, time-series momentum (TSMOM) historically has demonstrated abnormal excess returns. For the less familiar with trend following it’s worth your time to review Alpha Architects white paper on trend following here. TSMOM is measured by a portfolio that is long assets that have had recent positive returns and short assets that have had recent negative returns.

Trend-following investing has attracted a lot of attention over the past decade due to its strong performance during the global financial crisis and the academic research findings showing its persistence across long periods of time and economic regimes, pervasiveness (across sectors, countries and asset classes), robustness to various definitions (formation period) and implementability (low costs, as the markets for major indexes are highly liquid).

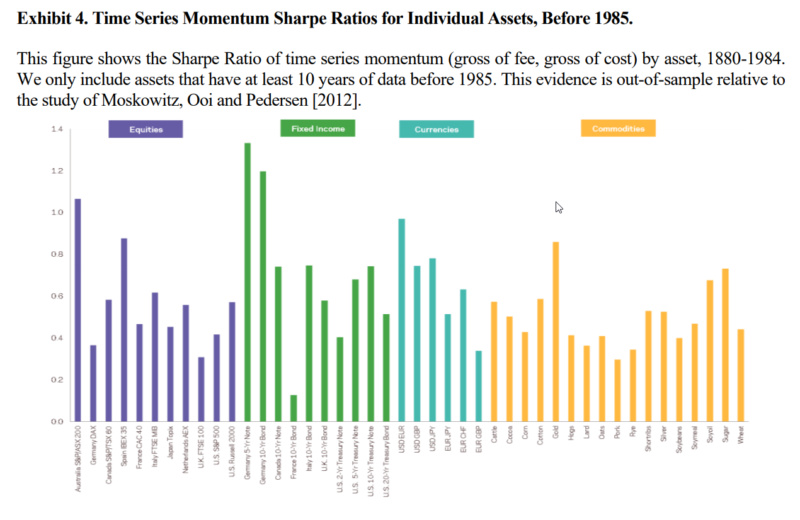

Among the many papers showing support for TSMOM is the June 2017 paper “A Century of Evidence on Trend-Following Investing.” The authors, Brian Hurst, Yao Hua Ooi and Lasse Pedersen of AQR Capital Management, examined the performance of TSMOM for 67 markets across four major asset classes (29 commodities, 11 equity indices, 15 bond markets and 12 currency pairs) from January 1880 to December 2016. Positions were scaled such that a portfolio has an annualized ex-ante volatility target of 10 percent. Volatility scaling ensures that the combined strategy targets a consistent amount of risk over time, regardless of the number of markets that are traded at each point in time.

After implementation costs, they found the following:

- Performance was remarkably consistent over an extended time horizon, one that included the Great Depression, multiple recessions and expansions, multiple wars, stagflation, the global financial crisis of 2008, and periods of rising and falling interest rates.

- Annualized gross returns were 18.0 percent over the full period, with net returns (after fees) of 11.0 percent, higher than the return for equities but with approximately half the volatility (an annual standard deviation of 9.7 percent).

- Net returns were positive in every decade, with the lowest net return, at 4.1 percent, coming in the period beginning 1919.

- There was virtually no correlation to either stocks or bonds, providing a strong diversification benefit.

Hurst, Ooi and Pedersen wrote that

“a large body of research has shown that price trends exist in part due to long-standing behavioral biases exhibited by investors, such as anchoring and herding [and I would add to that list the disposition effect and confirmation bias], as well as the trading activity of non-profit-seeking participants, such as central banks and corporate hedging programs.” They observed, for instance, that “when central banks intervene to reduce currency and interest-rate volatility, they slow down the rate at which information is incorporated into prices, thus creating trends.”

Hurst, Ooi and Pedersen continued:

“The fact that trend-following strategies have performed well historically indicates that these behavioral biases and non-profit-seeking market participants have likely existed for a long time.” Why would this be the case? They explain: “The intuition is that most bear markets have historically occurred gradually over several months, rather than abruptly over a few days, which allows trend followers an opportunity to position themselves short after the initial market decline and profit from continued market declines. … In fact, the average peak-to-trough drawdown length of the 10 largest drawdowns of a 60 percent stocks/40 bonds portfolio between 1880 and 2016 was approximately 15 months.”

They noted that trend following has done particularly well in extreme up or down years for the stock market, including the most recent global financial crisis of 2008. In fact, they found that during the 10 largest drawdowns experienced by the traditional 60/40 portfolio over the past 135 years, the time-series momentum strategy experienced positive returns in eight of those stress periods and delivered significant positive returns during a number of those events.

Recent Challenges to TSMOM

Despite the strong evidence, TSMOM has received some challenges from researchers, including the study “Time series momentum: Is it there?” by Dashan Huang, Jiangyuan Li, Liyao Wang and Guofu Zhou, which appeared in the March 2020 issue of the Journal of Financial Economics. (A summary of their findings by Elisabetta Basilico can be found at Alpha Architect.) The basic argument is that returns to TSMOM may be partly due to static bets to common factors and the benefits of volatility scaling.

Addressing the Challenges

Abhilash Babu, Ari Levine, Yao Hua Ooi, Lasse Pedersen and Erik Stamelos addressed the issues raised in their new working paper “Trends Everywhere,” which will appear in a forthcoming issue of the Journal of Investment Management. They used out-of-sample evidence on trend-following investing—the best way to test the robustness and efficacy of a trading strategy is to consider whether it works across many different assets, especially assets that were not part of the original research.

Their data contains 156 assets, of which 58 are the “traditional assets” studied in the literature cited above; 82 are “alternative assets,” meaning futures, forwards and swaps not previously studied (such as emerging market equity index futures, fixed income swaps, emerging market cross currency pairs, commodity futures, credit default swap indices and volatility futures); and 16 are “factors” constructed as long-short equity portfolios. The number of new assets outnumbers the “traditional assets” studied in the literature. All are liquid assets or strategies. Their equity factor data begins in 1968, though alternative assets have varying data start dates ranging from 1973 to 2008. For the evaluation of time-series momentum strategies, they relied on a sample starting in 1985 to ensure that a comprehensive set of instruments have data, unless they noted otherwise. Their data sample ends in 2017.

Following is a summary of their findings of a simple 12-month momentum strategy:

- There was strong evidence for TSMOM across the assets and factors studied.

- There was pervasiveness of return continuation for the most recent 12 months, but not for returns beyond 12 months, across a range of assets and equity factors.

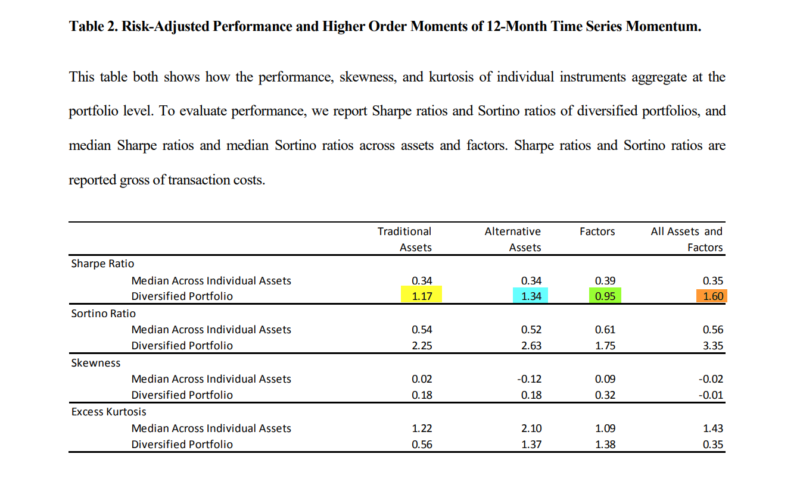

- Average pairwise correlations were small and positive, indicating a mild tendency for these strategies to perform well at similar times. However, the small magnitudes imply significant diversification benefits from combining TSMOM strategies within and across traditional assets, alternative assets and equity factors—portfolio Sharpe ratios were considerably larger than median asset Sharpe ratios.

- The maximum portfolio kurtosis (degree of fat tail) across all groups was only half the kurtosis of the U.S. equity market portfolio during the same time period. And skewness was more positive, a longer right tail in the distribution (a favorable trait, as it reduces the risk of large losses).

- The median Sharpe ratio per asset was positive for every group considered. Over their sample period, the gross Sharpe ratio of 12-month TSMOM for traditional assets was 1.17, and the strategy delivered an even higher Sharpe ratio of 1.34 for the alternative assets. The Sharpe ratio for long-short equity factors was 0.95, and 1.60 when they diversified across all three asset groups. Results were similar for the Sortino ratio, the average excess in relation to the downside risk.

The authors specifically addressed the question of whether TSMOM performance comes from static bets, exposure to assets with high average returns (being long, on average, assets that have gone up over the full sample and short, on average, assets that have gone down over the full sample). While it is true that TSMOM does benefit from these average positions (though having a small bias toward higher expected return assets isn’t a bad thing given that TSMOM tends to get out of them at the right time), controlling for this benefit, TSMOM is still economically and statistically profitable.

The authors concluded:

“The strong historical performance of trend-following strategies is robust across a large number of instruments, and this strong performance is neither explained by volatility scaling nor static exposures, but, rather, out-of-sample evidence of the trending nature of capital markets around the world.”

Summary

As an investment style, trend following has existed for a long time. The data from the research provides strong out-of-sample evidence beyond the substantial evidence that already existed in the literature. It also provides consistent, long-term evidence that trends have been pervasive features of global stock, bond, commodity and currency markets.

Addressing the issue of whether investors should expect trends to continue, the AQR researchers concluded:

“The most likely candidates to explain why markets have tended to trend more often than not include investors’ behavioral biases, market frictions, hedging demands, and market interventions by central banks and governments. Such market interventions and hedging programs are still prevalent, and investors are likely to continue to suffer from the same behavioral biases that have influenced price behavior over the past century, setting the stage for trend-following investing going forward.”

The bottom line is that, given the diversification benefit and the downside (tail-risk) hedging properties, an allocation to trend-following strategies does merit consideration. Note, however, that the generally high turnover of trend-following strategies renders them relatively tax-inefficient. Thus, investors should strongly prefer to hold such strategies in tax-advantaged accounts.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.