The coincidence of historically low-interest rates and the increased gift tax exemption under the 2017 Tax Cuts and Jobs Act has temporarily created an opportunity for high net worth families to tax-efficiently transfer wealth from generation to generation. Of course, families can use their exclusion by giving outright to their children and grandchildren, but most do not want to provide the funds with no guidance. One potential avenue to explore is the use of a trust, to which assets can be gifted and/or loaned, effectively maintaining control of the assets while housing them outside of the taxable estate.

We’re going to show how a family could take advantage of the increased gift tax exemptions as well as low-interest rates to fund a life insurance policy. Trust me, even if your first thought is to cut and run at the words “life insurance,” stick with me — we will try and make it worth your while.

The goal of this process is to move the assets out of a taxable estate early, and allow the returns to accumulate in the tax free or deferred tax haven.

Why do this now?

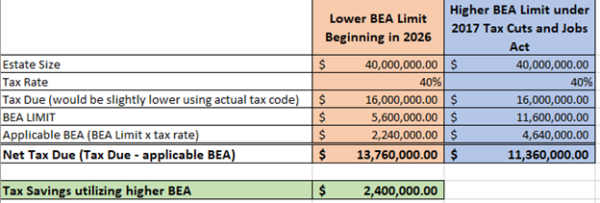

Under the Tax Cuts and Jobs Act, there was a change to the basic exclusion amount (BEA), which is the tax exclusion applied against a person’s lifetime of cumulative taxable gifts. This exclusion, previously $5.49 million in 2017, has been more than doubled for the years 2018 to 2025. The BEA for 2020 is $11.58 million(1). The increased exclusion will apply to any gifts made between these years. After expiration in 2025, if there is no further legislation to extend the increase, the BEA will return to its pre-2018 level of $5 million as adjusted for inflation. However, assets that were gifted during the 2018-2025 period will be grandfathered under the increased exclusion. Because of the uncertainty associated with the BEA in the future, it may be advantageous to utilize the increased exclusion while it still exists.

So in the example above a family that chooses to maximize its gifting ability between 2018 and 2025 would realize a net tax savings of $2.4 million dollars. (2)

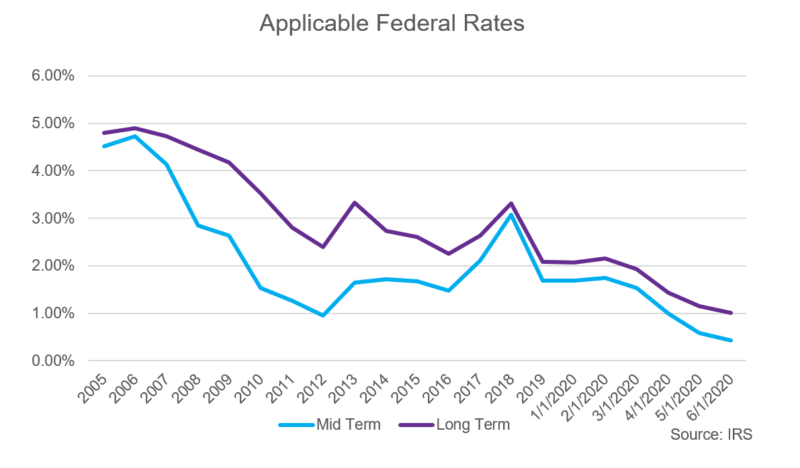

The second component of timing is the historically low-interest-rate environment. The graph below illustrates the steep drop in the Applicable Federal Rate (AFR) over the last 15 years. These rates are used to determine the interest rate that must be applied to any loans made to the trust. The mid-term rate is applicable to loans between three and nine years, and the long-term rates are applicable to loans that mature in more than nine years.

Many corporations have taken advantage of low-interest rates and have increased their allocation to debt financing. The concept of using loans as a conduit for wealth transfer can be challenging for many families. However, in this scenario, we are discussing private financing. A traditional bank/lender is not involved. The grantor is loaning money to the trust. The grantors are acting as the bank receiving interest on the loan, while the trust invests the loan. In the case of structuring the transfer of assets to a trust, debt may in fact be a low-cost way to provide funding.

For most clients, this is a head-scratching moment. Wondering how or why lending to the trust at a low-interest rate is helping. The answer is that we are trying to take advantage of the difference between the expected return the assets can generate in the trust and this low-interest rate. For example: If the family lends to a trust at the Mid Term rate of 0.5% while the trust assets have an expected return of 6%, the trust is left with a net 5.5% return after paying the interest expense. Increasing that interest rate while maintaining the same expected return clearly leaves less in the trust.

How should the trust be funded?

We’ve outlined two reasons why this might be a good time to fund a trust. Depending on the unique circumstances of each family they may wish to utilize the higher BEA and gift the funds, take advantage of the low-interest rates and loan the funds to the trust, or utilize some combination of the two. Unlike the aforementioned corporate finance decision, other factors will contribute to a family’s decision. Do they have gifting availability? How important is flexibility or control? How comfortable are they with leverage? What type of return rate can they expect on your assets/investment portfolio? Furthermore, it is important to consider that a loan can be refinanced or even forgiven and reclassified as a gift, but a completed gift cannot become a loan.

The timing issues associated with the BEA should also be considered here. If the loan would need to be forgiven(3) later when the increased BEA is no longer in effect, the reclassification as a gift would be against the significantly lowered $5 million exclusion. If gifting has been part of the estate plan and the full exclusion has already been used, the grantor would be responsible for the gift tax. Taking advantage of the current BEA levels may be a limited-time opportunity to shift assets outside of the taxable estate.

How should the trust assets be invested?

The most straightforward consideration is a traditionally invested portfolio that generates more than the loan interest rate. To maximize the benefits of using the trust and moving assets outside the taxable estate, the investment must be one that provides leverage while minimizing the probability of failure due to asset volatility.

One asset that can offer these features is life insurance. Life insurance is often a misunderstood and underutilized financial tool, but it offers many attractive features when housed within a trust. First, it provides leverage in the form of a death benefit without the uncertainty of downside volatility. The cash flows used to pay the premium can be structured such that they are regular and predictable. Second, life insurance can provide much-needed liquidity for the estate. Many wealthy families have significant positions in illiquid assets such as a business interest(4), land, properties, etc. These assets are included in the estate for tax purposes, but the heirs might not want to sell these assets, and it is also possible that the sale would be highly sensitive to timing considerations. Rather than liquidating these assets under inopportune conditions, the death benefit provided by the life insurance in the trust can be used to purchase the assets from the estate, thereby generating the liquidity needed to fund the estate tax at the exact moment when it is most necessary.

Introducing life insurance into the trust can also create additional optionality. The choice of product as well as the amount of cash value can influence the amount of leverage that is available. In addition, if the insurance has a higher cash value, that cash value can also be used to support loan payments if necessary.

How should the trust be funded around life insurance?

For illustration purposes, let us assume a 65-year-old couple wishes to move $40 million outside of their taxable estate as a planning strategy to address the federal estate tax on a $100 million gross estate. The estate tax amount(5) is used as the death benefit of the life insurance.

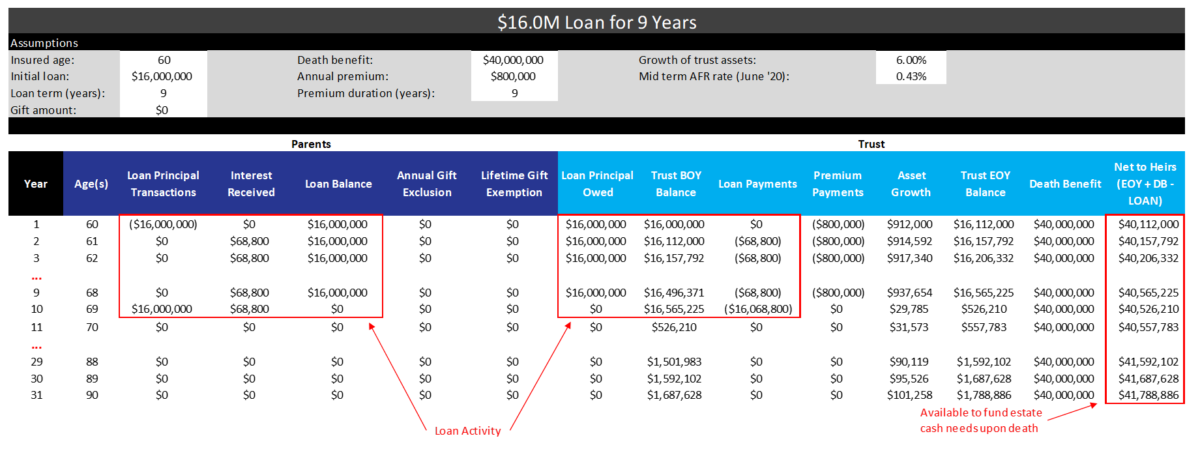

A base case implementation would be to plan the amount and duration of the loan around the premium payments required for the life insurance. For simplicity, in our example, the gift is excluded. The duration of both premium payments and the loan is kept to 9 years in order to take advantage of the mid-term loan rate.

Highlights from the Table

- Trust borrows $16 million from Grantor for 9 years.

- The Trust will pay Grantor $68,800 in annual loan interest every year for 9 years.

- At the end of the 9-year period, the Trust repays the Grantor the principal payment of $16 million.

- Trust pays $800,000 in insurance premiums ($7.2 Million total over 9 years)

- Trust owns a $40 million paid-up insurance policy at the end of 9 years.

In this illustration, we can see that the low-interest rate netted the trust a relatively small annual outflow of $68,800, leaving the trust with ample returns to fund the insurance premiums. In our example the trust is overfunded(6) if judged purely by the values within the financial model above. However, the additional cushion provides a contingency plan in case of an adverse market event. It not only enables the trust to be better positioned to meet loan and premium payments but also serves as a source of cash should the life insurance need to be replenished, much like rebalancing a traditional portfolio. This cushion is still invested within the trust and continues to grow, just as if it was held outside of the trust. There is a twofold benefit to this approach – there are liquid assets available to the trust should the policy require it, and the gift assets and the growth on both loan and gift assets all exist outside of the taxable estate.

There is additional optionality built into this situation. If interest rates continue to fall to still lower levels, the loan can be refinanced at the new, lower rate. If the loan is long-term and the grantor is in need of the assets, assuming the trust is funded enough to support any ongoing premium payments, the trust can pay off the loan early.

In Summary

By combining the heightened BEA with historically low AFRs, there is a planning opportunity using loans and/or gifts to shift assets and the growth of those assets outside of the taxable estate. The use of life insurance within the trust can create leverage and offer flexibility while also providing a level of certainty. The funding source decision, as well as the life insurance design, should be based upon your gifting availability, willingness to gift, understanding and comfort with leverage, capital market assumptions, and current versus future opportunities for optionality.(7)(8)

References[+]

| ↑1 | It should be noted that this exemption is doubled for married couples |

|---|---|

| ↑2 | For a more detailed discussion of the BEA visit here. |

| ↑3 | AKA turned into a gift |

| ↑4 | If you happen to be in this particular situation take a look at Doug Puglesies post on 1042 QRP’s |

| ↑5 | $100M estate taxed at 40% = $40M |

| ↑6 | we say it’s overfunded only because the trust is expected to have returns of 912,000 with a required $868,800 outflow |

| ↑7 | This material is prepared by Cornerstone Institutional Investors, LLC (“Cornerstone”) and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of June 2020 and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by Cornerstone to be reliable, are not necessarily all-inclusive, and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Cornerstone, its officers, employees or agents. This material may contain ‘forward-looking’ information that is not purely historical in nature. Such information may include, among other things, projections, and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Any accounting or tax advice contained in this communication is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties. The information is provided solely for informational purposes and therefore should not be considered an offer to buy or sell a security. Except as otherwise required by law, Cornerstone shall not be responsible for any trading decisions or damages or other losses resulting from this information, data, analyses or opinions or their use. Please read any prospectus carefully before investing. Variable life insurance values are subject to market-related fluctuations. Product guarantees, including the death and any living benefits, are subject to the claims-paying ability of the issuing insurance company and do not apply to the investment return or principal value of the variable component of your policy. Important information about product features, including charges, fees, and surrender terms, are contained in the prospectus which should be read carefully before investing further. Loans and partial withdrawals will decrease the death benefit and cash value and may be subject to policy limitations and income tax. |

| ↑8 | Alpha Architect has no affiliation with Cornerstone. This article is provided for informational purposes only. |

About the Author: Brian Bobeck

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.