In their paper “Time Series Momentum,” published in the May 2012 issue of the Journal of Financial Economics, Tobias Moskowitz, Yao Hua Ooi and Lasse Pedersen documented significant time-series momentum (trend) in equity index, currency, commodity and bond futures—delivering substantial abnormal returns with little exposure to standard asset pricing factors and performing best during extreme markets. AQR Capital Management’s Brian Hurst, Yao Hua Ooi and Lasse Pedersen updated that earlier work in their June 2017 paper “A Century of Evidence on Trend-Following Investing.” Their evidence documented that time-series momentum had not only been persistent across time and economic regimes, as well as pervasive around the globe and across asset classes, but also robust to various definitions.

Aleksi Pitkäjärvi, Matti Suominen, and Lauri Vaittinen contribute to the literature on time-series momentum with the February 2019 study “Cross-Asset Signals and Time Series Momentum.” Building on the work from the aforementioned papers, the authors documented a related cross-asset phenomenon in bond and equity markets they called “cross-asset time-series momentum.” For a strategy buying an equity index, they required positive excess returns from both stock and bond markets. If not, the strategy moved to cash. For a strategy trading a bond index, they required a positive excess return from the bond market and a negative excess return from the equity market. If the excess returns of the asset and the cross-asset predictor disagreed, they held the risk-free asset. Their data sample covered bond and equity market indices from 20 leading developed countries. The earliest return series started in January 1980, and it all ended in December 2016. All local currency index returns were converted into U.S. dollar indexes.

The following is a summary of their findings:

- Past positive (negative) bond market returns predict positive (negative) future equity market returns. Past equity market returns are negative predictors of future bond market returns.

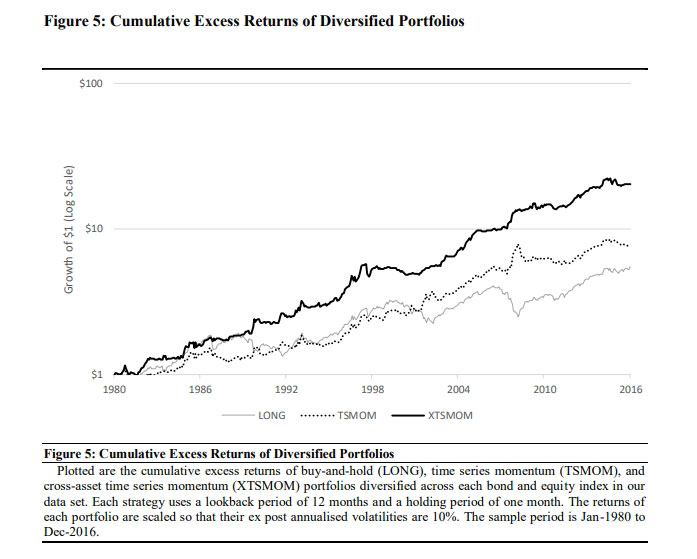

- A diversified portfolio of the cross-asset time-series momentum strategies yields a Sharpe ratio 45 percent higher than a similarly diversified time-series momentum portfolio, and almost 70 percent higher than a similarly diversified buy-and-hold portfolio.

- Controlling for the returns of the cross-asset time-series momentum portfolio, the alpha of the time-series momentum portfolio is insignificant.

- Cross-asset time-series momentum portfolios outperform time-series momentum portfolios across a wide range of time horizons and in all but one of the 20 countries.

- Equity return is highest during positive bond and equity momentum regimes—while the equity return is 0.81 percent per month during positive equity momentum regimes, the return increases to 1.04 percent per month when the bond regime is also positive.

- The lowest bond return occurs during periods where the bond momentum regime is negative and the equity momentum regime is positive, while the highest bond returns occur in those regimes where the past equity returns are negative.

- Positive past returns in bond and equity markets attract fund flows to equity funds for a prolonged period of time, supporting cross-asset time-series momentum. Similarly, positive bond returns and negative equity returns predict fund flows to bond funds for several months ahead.

- Simultaneously positive momentum regimes in bond and equity markets predict better outcomes for the economy, with high industrial production growth, high investment, and decreasing unemployment over the next 12 months. In contrast, simultaneously negative momentum regimes predict negative industrial production growth, low investment, and increasing unemployment. Thus, time-series momentum and cross-asset time-series momentum are not just financial market phenomena; they also contain information about fundamental changes in economic activity.

- In a test of robustness, the results were qualitatively similar when they scaled momentum for volatility.

Pitkäjärvi, Suominen and Vaittinen provided an explanation for the findings:

“Capital moves particularly slowly across asset classes (due to impediments to the frictionless movement of capital, such as time-consuming organizational decision-making and frictions in funding capital [that] are resolved only gradually) creating long-term predictability in securities market flows and returns.”

They added:

“We can view the positive predictability from bonds to equities as originating from slow portfolio rebalancing of cross-market investors following shocks in the bond market. We can also view the negative predictability from equities to bonds in the slow-moving capital context.”

They also observed that negative past equity returns seem to be a stronger positive predictor of future bond returns than past bond returns, highlighting the importance of considering cross-asset predictors in a time-series momentum context.

Their findings led the authors to conclude that their “results thus show that time-series momentum and cross-asset time-series momentum are not just financial market phenomena; they also contain information about future changes in asset demand and economic activity.” These findings also help explain the time-series momentum effect documented by other researchers. They are also consistent with prior research findings:

- The study “Time‐Varying Expected Returns in International Bond Markets” by Antti Ilmanen, published in the June 1995 issue of The Journal of Finance, found predictable variation in long‐maturity government bond returns in six countries.

- The 2017 study by Jordan Brooks, “A Half Century of Macro Momentum,” found that a systematic global macro strategy that takes long positions in assets for which fundamental macroeconomic trends are improving and short positions in assets for which fundamental macroeconomic trends are deteriorating has the potential to deliver strong positive returns with low correlation to traditional asset classes across various macroeconomic and market environments, including the potential to provide important diversification benefits in bear equity markets and rising yield environments.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.