A large body of evidence, including the studies “Is There Momentum in Factor Premia? Evidence from International Equity Markets,” Factor Momentum Everywhere (Summary)” and “Factor Momentum and the Momentum Factor,” has demonstrated that momentum exists across financial markets (stocks, bonds, commodities, and currencies) and around the globe and that both cross-sectional (relative) and time-series (absolute) momentum are not only related to factor momentum but are explained by it.

Shaojun Zhang contributes to the literature on factor momentum with her January 2021 study, “Dissecting Currency Momentum.” She began by citing the research findings that “past currency returns contain information predictive of future currency returns. In the cross-section, past winner currencies earn higher returns relative to loser currencies”—there is momentum in currencies. To analyze the relation between momentum strategies and other factors, she decomposed currency returns to systematic returns explained by the carry and dollar factors and unexplained idiosyncratic returns. The carry factor corresponds to the change in exchange rates between baskets of high and low-interest-rate currencies, while the dollar factor corresponds to the average change in the exchange rate between the U.S. dollar and all other currencies. Her data sample spanned the period March 1976 to November 2020 and covered a comprehensive list (as many as 48) of developed and emerging market currencies.

Following is a summary of her findings:

- Carry and dollar factors are strongly autocorrelated and only earn significantly positive excess returns following positive factor returns—past currency factor returns strongly predict future factor returns.

- The carry and dollar factors only earn significantly positive returns following positive factor realizations but earn negative or insignificant returns following losses.

- Momentum returns and factor returns are closely related despite the low unconditional correlation between them.

- Momentum strategies go long currency factors following positive factor returns and short following losses.

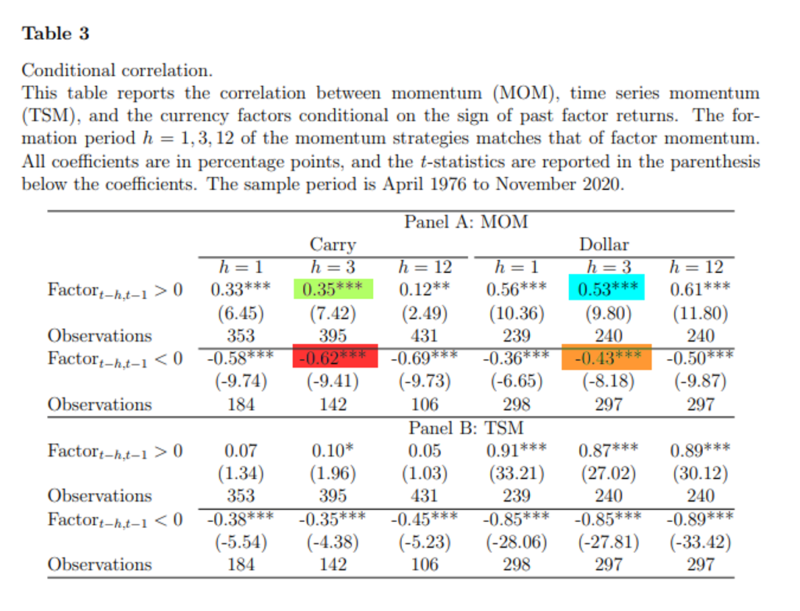

- The correlation between the momentum and carry return was 0.356 following three months of positive carry returns and -0.62 following three months of losses. The corresponding correlations with the dollar factor were 0.53 and -0.43, respectively. The results suggest that currency momentum and time-series momentum stem from the momentum embedded in other factors.

Zhang also found that carry momentum is stronger in currencies that are more volatile in total or idiosyncratic returns and thus harder to hedge—carry autocorrelation weakens as the arbitrage improves, and effective obstacles prevail in exploiting carry momentum. In contrast, she noted that:

“dollar momentum exhibits little associated with currency characteristics, but positively correlates with higher volatility expectations, such as VIX, macro uncertainty, and real uncertainty. In short, limits to [arbitrage] help to account for carry momentum consistent with underreaction whereas dollar momentum is more consistent with time-varying risk premium.”

Summary

Zhang’s findings led her to conclude:

“Factor momentum not only outperforms the cross-sectional and time-series momentum but also explains them.”

In other words, while factor momentum explains returns to momentum strategies, the carry and dollar factors cannot explain the returns to momentum strategies. The bottom line, she concluded, is that:

“factor momentum can explain most time series momentum currency by currency. However, the momentum strategy returns cannot span factor momentum and the factor momentum alphas are large and significant.”

While Zhang’s findings add to the body of research supporting the view that momentum arises from factor momentum, it would be interesting to know if the same result would have been found had she used volatility scaling when implementing time-series momentum. Volatility scaling has been found to have a significantly positive impact on time-series momentum strategies, as demonstrated in such studies as “Time Series Momentum and Volatility Scaling,” which appeared in the September 2016 issue of the Journal of Financial Markets. In addition, the study “On the Performance of Volatility-Managed Portfolios,” which appeared in the October 2020 issue of the Journal of Financial Economics, found that while volatility scaling has improved the performance of time-series momentum, it has negatively impacted the performance of factor momentum.

DISCLOSURES

Important Disclosure: This information is for educational purposes only and should not be construed as specific investment, accounting, legal or tax advice. Certain information may be based on third party data which may become outdated or otherwise superseded. Third party data is deemed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. LSR-21-23

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.