Option Return Predictability with Machine Learning and Big Data

- Bali, Beckmeyer, Moerke, Weigert

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

Though classical option pricing models assume that options are redundant assets, more recent research rejects this idea. However, research on cross-sectional predictors of option returns is relatively scarce and not very well understood. Contrarily, extensive literature examines cross-sectional determinants of stocks, bonds, currencies, mutual funds, and hedge funds. In this paper, the authors use machine learning models to study the cross-section of delta-hedged option returns.

The authors ask the following research questions:

- Are individual option excess returns predictable?

- Which characteristics give rise to option return predictability?

- What are the economic underpinnings of option return predictability?

What are the Academic Insights?

The authors draw upon more than 12 million US delta-hedged option return observations in the period from 1996 to 2020 and apply 270 option-based and stock-based characteristics as predictors.

The authors find that:

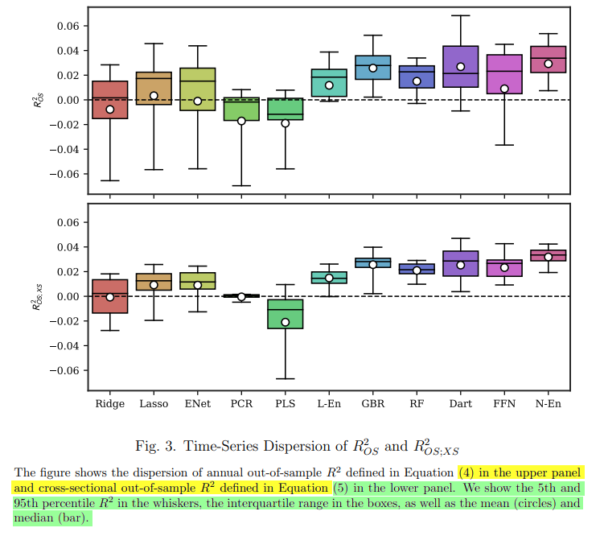

- Monthly Option returns are more predictable than stock returns with out-of-sample R2s reaching values of more than 2.5%.

- Nonlinear machine learning models outperform linear models.

- Predictability of option returns leads to economically sizeable trading profits even when accounting for conservative transaction costs.

- Option-based characteristics are more important than stock-based characteristics in the prediction exercise. However, stock-based measures add substantial incremental predictive power when considered alongside option-based characteristics.

- Predictability of option returns is higher for options on stocks characterized by low institutional ownership and low analyst coverage, and with little demand by professional traders, but outsized demand by public customers. Additionally, the empirical results provide evidence that costly arbitrage and mispricing are also related to predictability.

Why does it matter?

Predicting option returns is of foremost relevance for retail and institutional investors as the importance of options markets for hedging and speculation purposes has strongly increased in the past years. According to the Futures Industry Association (FIA)’s annual statistical review, options trading on exchanges worldwide has increased from $9.42 billion contracts in 2013 to $21.22 billion contracts in 2020 (a percentage growth of more than 125%). Approximately 60% of these contracts are written on individual stocks and stock indices, making equity the most popular option underlying of financial market participants.

The most important chart from the paper

Abstract

We investigate the cross-sectional return predictability of delta-hedged equity options using machine learning and big data. Drawing upon more than 12 million observations over the period from 1996 to 2020, we find that allowing for nonlinearities significantly increases the out-of-sample performance of option and stock characteristics in predicting future option returns. Besides statistical significance, the nonlinear machine learning models generate economically sizeable profits in the long-short portfolios of equity options even after accounting for transaction costs. Although option-based characteristics are the most important standalone predictors, stock-based measures offer substantial incremental predictive power when considered alongside option-based characteristics. Finally, we provide compelling evidence that option return predictability is driven by informational frictions, costly arbitrage, and option mispricing.

About the Author: Mathis Moerke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.