One of the big problems for the first formal asset pricing model developed by financial economists, the CAPM, was that it predicts a positive relationship between risk and return. However, empirical studies have found the actual relationship to be basically flat, or even negative. In addition, defensive strategies, at least those based on volatility, have delivered significant Fama-French three-factor and Carhart four-factor alphas.

The superior performance of low-volatility stocks was first documented in the literature in the 1970s—by Fischer Black in 1972, among others —even before the size and value premiums were “discovered.” The low-volatility anomaly has been shown to exist in equity markets around the world. Interestingly, this finding is true not only for stocks but for bonds as well. In other words, it has been pervasive

In our book “Your Complete Guide to Factor-Based Investing,” Andrew Berkin and I included an in-depth discussion of the explanations for the existence and persistence of the anomaly. Among the explanations are:

- Many investors are constrained against the use of leverage (by their charters) or have an aversion to its use. The same is true of short-selling.

- Borrowing costs for some hard-to-borrow stocks can be quite high. Such limits can prevent arbitrageurs from correcting the pricing mistake.

- While an assumption of the CAPM is that markets have no frictions, meaning there are neither transaction costs nor taxes, in the real world there are costs. The evidence shows that the most mispriced stocks are the ones with the highest costs of shorting.

- Regulatory constraints, which often don’t differentiate between the risks of low-beta and high-beta stocks, lead some investors to prefer high-beta stocks.

- The preference for “lottery tickets”—high-beta stocks with a low average return but a small chance of a large return.

The academic research, combined with the 2008 bear market, led low-volatility strategies to become the darling of investors and cash poured into the strategy. But is it worthy of such admiration as an independent factor? Let’s examine the research.

Exposure to Other Common Factors Explain Returns to Low Beta

Both Robert Novy-Marx’s 2016 study, “Understanding Defensive Equity,” and Eugene Fama and Kenneth French’s 2015 study, “Dissecting Anomalies with a Five-Factor Model,” found that the low-volatility and low-beta anomalies were well-explained by asset pricing models that include the newer factors of profitability and investment(1).

Stefano Ciliberti, Yves Lemperiere, Alexios Beveratos, Guillaume Simon, Laurent Laloux, Marc Potters and Jean-Philippe Bouchaud, authors of the 2017 paper “Deconstructing the Low-Vol Anomaly,” studied the factor on a global basis and found that once the common factors of value and profitability are controlled for, the performance of low volatility/low beta became insignificant.

New Evidence

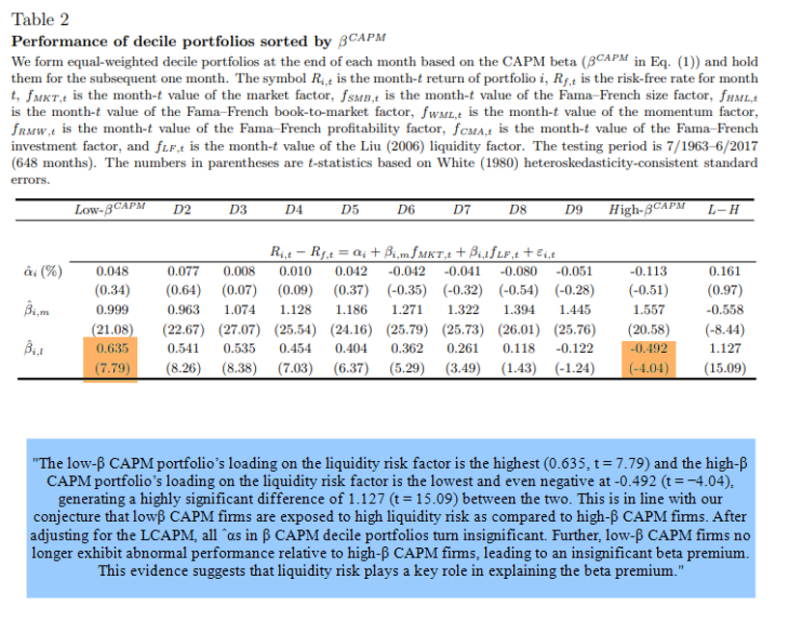

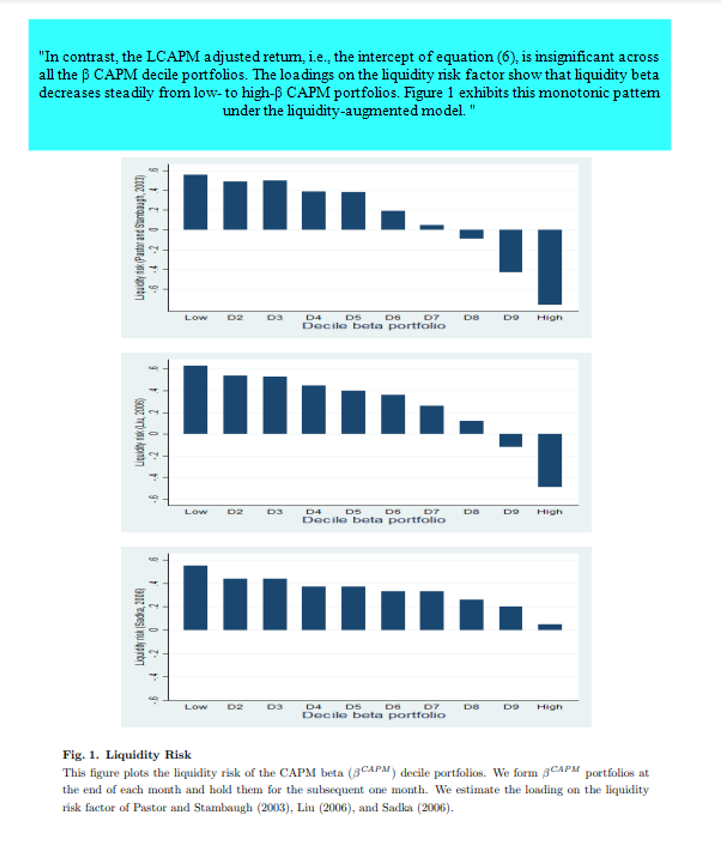

Cynthia Gong, Di Luo, and Huainan Zhao contribute to the literature on the low beta anomaly with their February 2021 study “Liquidity Risk and the Beta Premium,” in which they examined whether the low beta premium could be explained by another common factor found in the literature, the liquidity premium. Specifically, they studied the relationship of the low beta to various measures of liquidity risk. Their data sample covered NYSE/AMEX/NASDAQ data over the period 1963-2017.

Following is a summary of their findings:

- CAPM beta is positively correlated with firm size and negatively correlated with book-to-market.

- The correlation between CAPM beta and asset growth rate is positive.

- Liquidity risk decreases steadily from low- to high CAPM beta portfolios. The low-CAPM beta portfolio’s loading on the liquidity risk factor is the highest (0.635, t = 7.79) and the high-CAPM beta portfolio’s loading on the liquidity risk factor is the lowest and even negative at -0.492 (t = −4.04), generating a highly significant difference of 1.127 (t = 15.09) between the two.

- While non-liquidity-adjusted models such as the CAPM, the Fama–French three-factor model, and the Fama-French five-factor model are unable to explain the beta premium, after adjusting for liquidity, the CAPM beta premium is no longer significant—CAPM beta premiums only appear in portfolios of low-liquidity stocks.

- Low CAPM beta stocks tend to have lower trading volumes, slower trading speed, and larger price impact than high CAPM beta stocks indicating that low CAPM beta stocks tend to be more illiquid.

- Liquidity measures remain significant after controlling for funding liquidity, demonstrating that funding liquidity is different than stock liquidity.

- The results were robust for two subperiods.

Their findings led the authors to conclude:

“Investors are likely to require high compensation for holding these low beta stocks due largely to their high liquidity risk exposure.”

This finding is particularly important because low beta strategies are supposedly less risky, yet they are exposed to liquidity risk.

Low Volatility and Short Interest

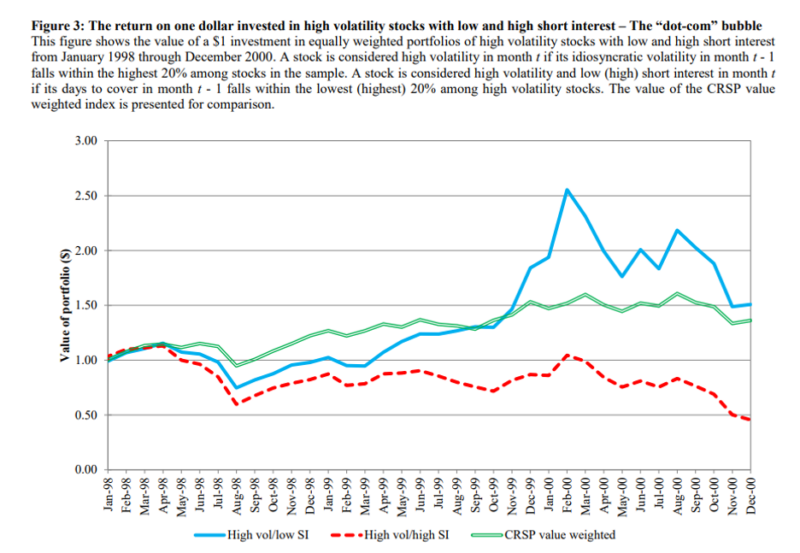

The 2016 study by Bradford Jordan and Timothy Riley, “The Long and Short of the Vol Anomaly,” which covered the period from July 1991 through December 2012, was motivated by prior research showing that both high-volatility stocks and stocks with high short interest exhibit poor risk-adjusted future performance. The authors found that among high-volatility stocks, only those with low short interest actually experience extraordinary positive returns. On the other hand, those with high short interest experience equally extraordinary negative returns. The bottom line is that high volatility on its own is not an indicator of poor future returns—in other words, it’s not an independent factor.

We now turn to research showing that the low beta premium has been highly dependent upon the existing economic regime.

Low Beta Premium is Regime Dependent

In his 2012 paper, “Enhancing a Low-Volatility Strategy is Particularly Helpful When Generic Low Volatility is Expensive,” Pim van Vliet found that while, on average, low-volatility strategies tend to have exposure to the value factor, that exposure was time-varying. The low-volatility factor spent about 62 percent of the time in a value regime and 38 percent of the time in a growth regime. The regime-shifting behavior affects the performance of low-volatility strategies. When low-volatility stocks have value exposure, they, on average, outperformed the market by 2.0 percent. However, when low-volatility stocks have growth exposure, they underperformed by 1.4 percent, on average.

Luis Garcia-Feijóo, Lawrence Kochard, Rodney Sullivan, and Peng Wang, authors of the 2015 study “Low-Volatility Cycles: The Influence of Valuation and Momentum on Low-Volatility Portfolios,” also found that there was no alpha in a four-factor model except in extremely cheap, low volatility environments. This finding is important because, as you will see in the following table, the “curse of popularity” has caused low-beta stocks to move away from the value, and in mid-caps they had higher valuations than did the midcap index. Data is from Morningstar.

| ETF | P/E |

| iShares MSCI USA Minimum Volatility ETF (USMV) | 21.9* |

| Vanguard Total Market (VTI) | 21.2* |

| Vanguard Value (VTV) | 15.6** |

| Invesco S&P MidCap Low Volatility ETF (XMLV) | 20.3* |

| Vanguard Mid-Cap (VO) | 21.2* |

| Vanguard Mid-Cap Value (VOE) | 15.4** |

| Invesco S&P Small Cap Low Volatility Portfolio (XSLV) | 18.3* |

| Vanguard Small-Cap (VB) | 15.9* |

| Vanguard Small-Cap Value (VBR) | 12.5** |

*Data as of January 27,2022 ** Data as of December 31, 2021

Adam Zaremba contributed to the literature with his August 2018 study “Small-Minus-Big Predicts Betting-Against-Beta: Implications for International Equity Allocation and Market Timing” in which he examined returns on betting-against-beta (BAB) and small-minus-big (SMB) factor portfolios in 24 developed markets for the years from 1989 through June 2018. An equal-weighted portfolio going long (short) in BAB factors in the quintile of countries with the highest (lowest) three-month SMB return produced a mean return of 1.5 percent per month. This return was highly significant (t-stat of 7.8). The effect was robust to formation periods and to controlling for major risk factors in equity markets, alternative portfolio construction methods, and sub-period analysis. The predictability of BAB performance using SMB returns was also present in time-series of individual country returns. BAB performance is particularly strong following months with high small-firm premiums within and across countries.

Zaremba’s findings are consistent with the findings of Esben Hedegaard, author of the June 2018 study, “Time-Varying Leverage Demand and Predictability of Betting-Against-Beta,” who found that high (low) past returns on the market forecasted high (low) future returns on the BAB factor—realized BAB returns were higher (lower) following high (low) past market returns. Because expected returns moved opposite to prices, high (low) market returns led to contemporaneously low (high) returns on the BAB factor.

The research shows not only that returns to the low-volatility anomaly are explained by exposure to other equity factors, but also that they are explained by exposure to the term premium.

Term Exposure

The fact that low-volatility strategies have exposure to term risk (the duration factor) should not be a surprise. Generally speaking, low-volatility/low-beta stocks are more “bond-like.” They are typically large stocks, the stocks of profitable and dividend-paying firms, and the stocks of firms with mediocre growth opportunities. In other words, they are stocks with the characteristics of safety as opposed to risk and opportunity. Thus, they show higher correlations with long-term bond returns.

The findings from the following papers are all consistent in showing low volatility’s exposure to the term factor: The 2011 study “Understanding Low Volatility Strategies: Minimum Variance” by Ronnie Shah; the 2014 study “A Study of Low-Volatility Portfolio Construction Methods” by Tzee-man Chow, Jason Hsu, Li-lan Kuo and Feifei Li; and the 2014 study “Interest Rate Risk in Low-Volatility Strategies” by David Blitz, Bart van der Grient and Pim van Vliet.

Before summarizing, using the regression tool at Portfolio Visualizer, we can analyze the performance of three low-volatility ETFs through a factor model lens to see if the results are consistent with the academic research I have reviewed. The loadings on each factor are in parentheses.

We begin with the iShares Edge MSCI Minimum Volatility USA ETF (USMV). Data is available for the period November 2011-December 2021. As of the end of January 2022, the fund had $28.1 billion of assets. The table presents the annualized alphas.

| Factors | Annualized Alphas (%) |

| CAPM Beta (0.7) | +2.0 |

| Beta (0.7), Size (-0.3), Value (-0.1) | +1.3 |

| Beta (0.8), Size (-0.3), Value (0.1), Momentum (0.2), Quality (0.1) | +0.1 |

| Beta (0.9), Size (-0.2), Value (0.2), Momentum (0.1), Quality (0.2), Term (0.2), Credit (-0.0) | -1.5 |

| Beta (0.9), Size (-0.2), Value (0.2), Momentum (0.1), Quality (0.2), Low Beta (0.2), Term (0.2), Credit (-0.1) | -2.4 |

First, the loadings should not be surprising. For example, low-volatility stocks tend to be large (hence the negative loading on size) and high-quality, defensive stocks. The negative loading on credit also reflects the high quality of low-volatility stocks.

Second, in terms of alpha, the results are generally consistent with the findings we have been discussing. While low-volatility strategies have had high alphas in a single-factor CAPM and three-factor world, the alphas turned negative (implementation costs matter) once the newer factor of quality, as well as the term and credit factors, were considered. The size of the negative alphas, however, is surprising.

We see similar results looking at the performance of the Invesco S&P MidCap Low Volatility ETF (XMLV). As of the end of January 2022, the fund had $1.3 billion of AUM. The period covers the time for which data is available, from March 2013 through November 2021.

| Factors | Annualized Alphas (%) |

| CAPM Beta (0.8) | +0.2 |

| Beta (0.7), Size (0.0), Value (0.2) | +1.3 |

| Beta (0.8), Size (0.2), Value (0.3), Momentum (0.2), Quality (0.3) | -1.3 |

| Beta (0.9), Size (0.3), Value (0.4), Momentum (0.2), Quality (0.4), Term (0.3), Credit (-0.1) | -3.3 |

| Beta (0.9), Size (0.4), Value (0.3), Momentum (0.1), Quality (0.4), Term (0.4), Credit (-0.3), Low Beta (0.2) | -4.4 |

Again, we see that once we account for all common exposures, the alphas turn negative. And we see similar results when looking at the performance of the Invesco S&P SmallCap Low Volatility ETF (XSLV). The fund had $1.1 billion of AUM as of January 2022. The period also is from March 2013 through November 2021.

| Factors | Annualized Alphas (%) |

| CAPM Beta (0.9) | -2.3 |

| Beta (0.8), Size (0.5), Value (0.4) | +2.3 |

| Beta (0.9), Size (0.9), Value (0.6), Momentum (0.3), Quality (0.6) | -2.2 |

| Beta (0.9), Size (0.9), Value (0.6), Momentum (0.3), Quality (0.7), Term (0.2), Credit (0.1) | -1.2 |

| Beta (0.9), Size (0.9), Value (0.6), Momentum (0.2), Quality (0.7), Term (0.2), Credit (0.2), Low Beta (0.2) | -4.3 |

Among the three low-volatility funds we examined, there are more than $30 billion in assets generating large negative risk-adjusted alphas. This is just another example of what we can call “the curse of popularity”—cash inflows raise valuations, negatively impacting future returns. An interesting question is: Are investors aware of the large negative alphas? If they are, it could lead to a dramatic outflow from low volatility funds, negatively impacting their performance in the short-term, while improving their future expected returns.

Investor Takeaway

The low-beta anomaly was documented almost 50 years ago. It has been persistent and pervasive around the globe and across asset classes. However, newer research demonstrates not only that returns to the anomaly are well explained by exposure to what are now considered other common factors (including now liquidity risk), but also that the premium is dependent on whether low volatility is in the value or growth regime, whether past recent returns were high or low, and the performance of the size premium. Unfortunately for investors in low-beta strategies, the popularity of the strategy has caused valuations to leave the regime where they had historically generated alphas.

The bottom line is that returns to the low beta anomaly have only justified investing when low-beta stocks were in the value regime, after periods of a strong market and small-cap stock performance, and when they excluded high-beta stocks that have a low short interest. This may be why live funds have been generating large negative alphas once we account for common factor exposures.

It is also important to note that long-only funds that don’t focus on this anomaly can benefit from screening out lottery stocks that drive the poor performance of securities in the highest quintile of beta. For example, firms such as Alpha Architect, Bridgeway Capital Management, and Dimensional Fund Advisors have long screened out such stocks. Bridgeway Capital Management and Dimensional Fund Advisors also have suspended purchases when stocks are “on special” (that is, they have high-security lending fees). Thus, they are able to benefit from the anomaly without shorting. (Full disclosure: My firm, Buckingham Strategic Wealth, recommends Bridgeway and Dimensional funds in constructing client portfolios.)

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, however its accuracy and completeness cannot be guaranteed. Mentions of specific securities are for illustrative purposes only and should not be construed as a recommendation of shown securities. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Information from sources deemed reliable, but its accuracy cannot be guaranteed. Performance is historical and does not guarantee future results. Index total return includes reinvestment of dividends and capital gains. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of the Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the accuracy of this article. LSR-22-

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.