Cultural Biases in Equity Analysis

- Vesa Pursiainen

- Journal of Finance, 2022

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The literature shows that where we come from affects both how we perceive other people as well as how we are perceived by others. These perceptions can also affect economic behavior (see this piece on behavioral finance).

In this study, the author analyzes the role of cultural biases in analysts’ stock recommendations in Europe. He asks the following research questions:

- What are the effects of cultural biases on analyst recommendations?

- Are the recommendations affected by negative economic shocks( i.e. the European debt crisis and Brexit)?

- What is the effect of trust bias on both the perceived and actual information content in stock recommendations?

What are the Academic Insights?

By constructing a unique measure of directional generalized trust between countries, the author finds:

1. A more positive trust bias by the analyst’s country of origin toward the firm’s headquarter country is associated with significantly more positive stock recommendations. Specifically, a one-standard-deviation increase in trust bias is associated with an 8.2% increase in the likelihood of buy recommendation, relative to the sample average. Additionally, the estimated trust bias effect on recommendations is 45-60% larger for eponymous firms than for other firms as well as for larger firms generally.

2. YES- North European analysts issue significantly more negative stock recommendations on South European companies during the debt crisis, consistent with increasing negative bias introduced by the crisis. During the crisis, Northern analysts are between 10 and 23 percentage points less likely to assign Southern firms a buy recommendation, depending on the model specification. Additonally, there is a significant divergence of views on UK firms between British and European analysts during Brexit, with other European analysts issuing substantially more negative recommendations on UK firms than British analysts. The likelihood of British analysts assigning a buy recommendation to a UK firm increases by more than 30 percentage points relative to other analysts.

Why does it matter?

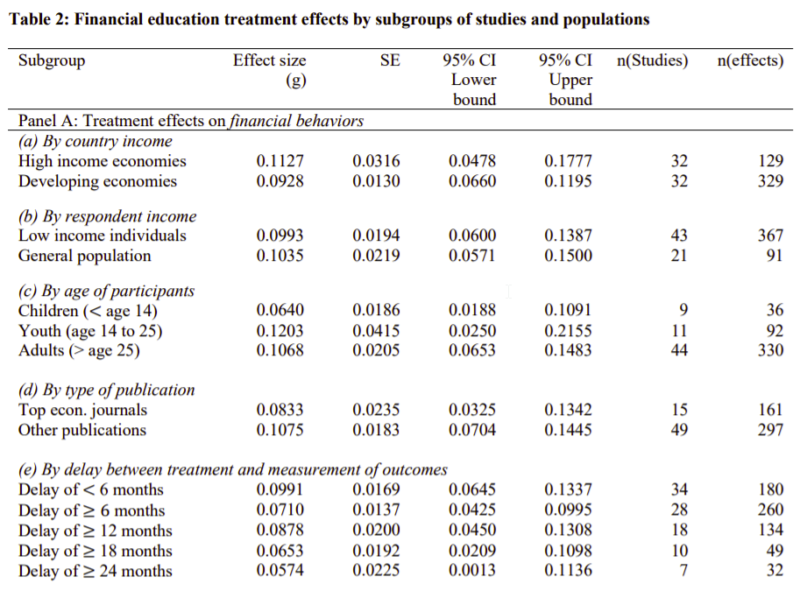

This paper is important because it updates and expands the investigation of the literature on the effectiveness of financial education. Prior literature was outdated ( Fernandes et al., 2014) and was much more limited in scope and data. So the good news is we’re going to keep empowering investors through education!

The Most Important Chart from the Paper:

Abstract

A more positive cultural trust bias by an equity analyst’s country of origin toward a firm’s headquarter country is associated with significantly more positive stock recommendations. The cultural bias effect is stronger for eponymous firms whose names mention their home country and varies over time, increasing with negative sentiment. I find evidence of a negative North-South bias during the European debt crisis and UKEurope divergence amid Brexit. Share price reactions to recommendations by more biased analysts are weaker, and more biased recommendations are worse at predicting monthly stock returns. More positively biased analysts also assign higher target prices.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.