Consumer demand drives the cash flows of consumer-oriented companies. Thus, they should serve as a reliable source of information to predict future fundamentals above and beyond the information contained in financial statements and readily available market data. For example, Jiekun Huang, author of the 2018 study “The Customer Knows Best: The Investment Value of Consumer Opinions,” analyzed abnormal customer ratings from Amazon.com and related them positively to a firm’s revenues and future stock returns; and Kenneth Froot, Namho Kang, Gideon Ozik and Ronnie Sadka, authors of the 2016 study “What Do Measures of Real-Time Corporate Sales Tell Us About Earnings Surprises and Post-Announcement Returns?,” constructed signals using location data from mobile devices as proxies for retail corporate sales and linked them to a firm’s future sales growth and earnings surprises.

Tarun Gupta, Edward Leung and Viorel Roscovan contribute to the literature with their study “Consumer Spending and the Cross-Section of Stock Returns,” published in the July 2022 issue of The Journal of Portfolio Management, in which they examined a direct measure of consumer demand, daily credit and debit card transactions data for a sample of U.S. consumer-facing firms to identify a link between consumer spending transactions and a firm’s earnings surprises as well as it subsequent stock returns. They began by noting:

Our measure is more timely and available at higher frequency compared with traditional accounting and market data and is less noisy than alternative proxies derived from customer ratings or search patterns. Although typical financial statements are released quarterly with one to two months delays, our data are available at daily frequency and are mostly available within a week after a transaction occurred. As such, credit and debit card transactions-based data can serve as a more timely and reliable source to resolve information asymmetries around earnings announcements.

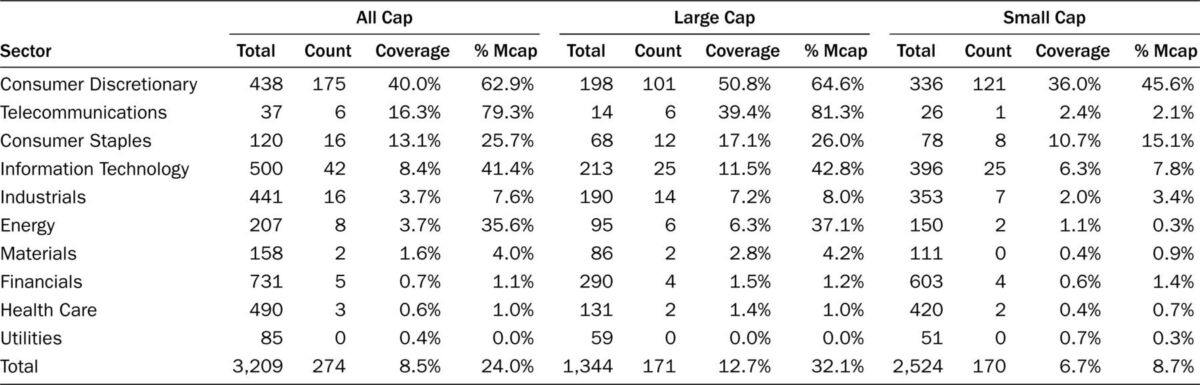

Their database was aggregated credit and debit card transactions data from 2013 to 2019 for a sample of U.S. consumer-facing firms provided by a leading alternative data, analytics and hosting service vendor with more than 20 years of experience serving more than 900 clients and more than five million consumers across the retail, consumer goods and financial services industries. It contained daily entries on sales volumes, number of consumers and number of transactions for more than 2,000 merchants including public, private and brand levels. Their final sample of public companies included, on average, 171 large-cap companies and 170 small-cap companies.

Following is a summary of their findings:

- Consumer spending data positively predicted various measures of a company’s future earnings surprises up to three quarters in the future—explaining a statistically significant (at the 1 percent confidence level) 17 percent of the variation of earnings surprises.

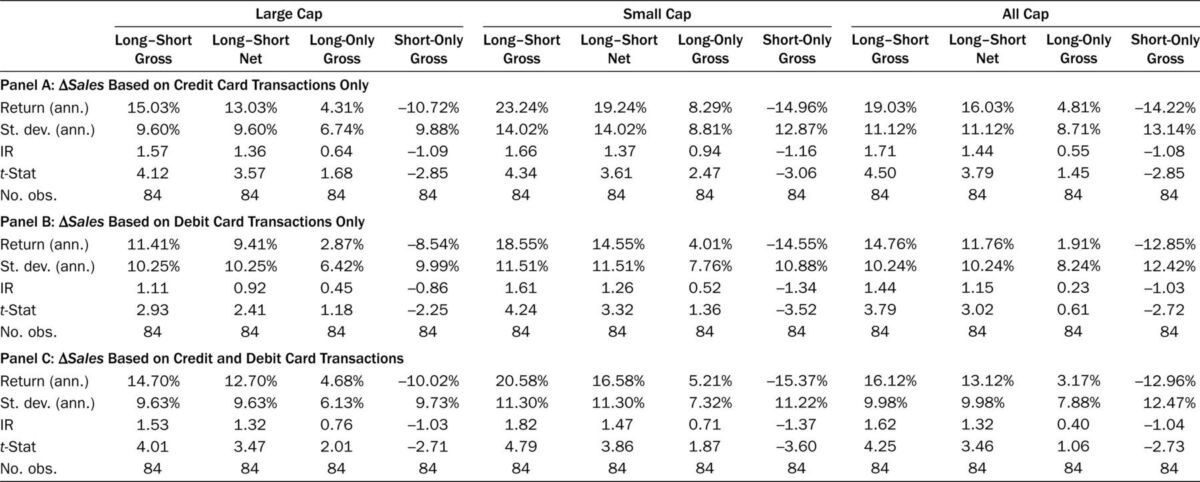

- The predictive power was strong in both large- and small-cap universes of consumer discretionary firms, was robust to the type of transactions data considered (credit card, debit card or both), although the relationship was stronger in the small-cap universe, and was robust to subperiod samples.

- Taking long-short positions in the top/bottom tercile of stocks ranked on their real-time sales signal generated statistically and economically significant returns of 16 percent per annum net of transaction costs and after controlling for common sources of systematic factor returns (size, value, price momentum, earnings momentum and profitability).

- Their long-short portfolio had some positive exposure to price momentum and negative exposure to value—an intuitive finding given the negative correlation between momentum and value.

Their findings led Gupta, Leung and Roscovan to conclude:

Our article brings forward substantial evidence that valuable information can be extracted from alternative higher-frequency data source allowing sophisticated investors to construct alternative factors that would provide them with an edge in identifying trading opportunities.

Investor Takeaways

With market efficiency, a company’s sales data should be directly incorporated into a firm’s price. Gupta, Leung and Roscovan showed that the market was not highly efficient, as they were able to predict positive earnings surprises and thus generate positive post-announcement returns. However, before jumping to conclusions, you should consider the evidence on the decaying of anomalies post-publication of findings. For example, David McLean and Jeffrey Pontiff, authors of the 2015 study “Does Academic Research Destroy Stock Return Predictability?,” found that the average characteristic’s return had a “56% post-publication decay.” And Paul Calluzzo, Fabio Moneta and Selim Topaloglu, authors of the October 2019 study “When Anomalies Are Publicized Broadly, Do Institutions Trade Accordingly?” examined the trading behavior of institutional investors in 14 well-documented anomalies and found similar evidence. These findings demonstrate the important role that both academic research and institutional investors (acting as arbitrageurs) play in making markets more efficient.

While markets are not perfectly efficient, as Andrew Berkin and I discuss in “The Incredible Shrinking Alpha,” they persistently move toward greater efficiency as researchers uncover and publish findings of anomalies, and sophisticated investors exploit those anomalies, causing them to shrink or even disappear—the adaptive markets hypothesis. Thus, for investors, the important question is whether the publication of this research can impact the future returns of the strategy employed by Gupta, Leung and Roscovan. Asking it is crucial on two fronts.

First, if anomalies are the result of behavioral errors, or even investor preferences, and the publication of research into them draws the attention of sophisticated investors, it’s possible that post-publication arbitrage would cause the premiums to disappear. Those seeking to capture these identified premiums could quickly move prices in a manner that reduces the return spread between assets with high and low exposure to the characteristic. However, limits to arbitrage, such as aversion to shorting, and its high cost, can prevent arbitrageurs from fully correcting behavioral pricing mistakes. And the research shows that this tends to be the case when mispricing exists in less-liquid stocks where trading costs are high. Second, even if the premium is fully explained by economic risks (risks which cannot be arbitraged away), as more cash flows into the funds acting to capture the premium, the size of the premium is affected.

As you consider that Gupta, Leung and Roscovan’s findings of the large return premium for stocks of companies with the strongest consumer sales cannot be related to risk (stronger sales intuitively are related to less risk), keep the following in mind: The knowledge of the anomaly is now in the public domain, and sophisticated investors like hedge funds and high-frequency traders have access to the same data. Thus, it seems highly likely that sophisticated institutional investors would act on that knowledge and arbitrage away the premium, especially in the highly liquid large-cap universe where limits to arbitrage do not present hurdles. Even in the small-cap universe, the size of the premium found should attract capital and cause it to shrink dramatically, if not entirely disappear.

The bottom line is that while Gupta, Leung and Roscovan’s research provided new insights into the cross-section of returns, investors should be skeptical of their claim that “valuable information can be extracted from alternative higher-frequency data source allowing sophisticated investors to construct alternative factors that would provide them with an edge in identifying trading opportunities.” Forewarned is forearmed.

Disclaimers

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed adequacy of this article. LSR-22-329

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.