The objective of research into asset pricing is to determine which characteristics are most important for predicting returns and then build simplified models using as few factors as possible—to tame the so-called “zoo of factors”—while still providing a high level of explanatory power. In recent years we have seen heightened interest in the ability of the duration of equity cash flows—ranking stocks based on whether firm value is concentrated in short- or long-term cash flows—to help explain the cross-section of returns.

A stock’s duration today is a function of the current dividend yield and expected discounted growth in future dividends. For example, if two firms have different growth opportunities but the same profitability, the one with more growth opportunities (a growth stock) will invest more and pay out fewer of its resources over the short term, becoming a long-duration company. Similarly, if two firms have different profitability but similar growth opportunities, the less profitable one will have fewer resources to distribute to investors in the near future, becoming a longer-duration firm.

Empirical Research Findings

The research into the explanatory power of equity duration, including the 2016 study “The Term Structure of Returns: Facts and Theory” by Jules van Binsbergen and Ralph Koijen, the 2018 study “Cash Flow Duration and the Term Structure of Equity Returns” by Michael Weber, the 2019 study “The Short Duration Premium” by Andrei Gonçalves, and the 2021 studies “Duration-Driven Returns” by Niels Gormsen and Eben Lazarus, and “Equity Duration” by Gary Mullins, examined whether the factors commonly found in the literature and asset pricing models (such as value, profitability, investment, low-risk, betting against beta and payout) are driven by a premium on near-future cash flows. The research has consistently found:

- Both in the U.S. and globally, low-duration stocks are also high-value, high-profitability, high-quality, low-investment, low-risk, and high-payout stocks (the opposite is true for high-duration stocks). Because low-duration firms have low growth rates, their near-future cash flows are large relative to their distant-future cash flows—the duration (the value-weighted time to maturity of a firm’s future cash flows) of their cash flows is lower.

- Duration comoves closely with value—if investors follow a duration strategy, they take on a large exposure to the value factor. The investment factor also comoves closely with duration.

- Both risk premia and Sharpe ratios are higher for short-maturity claims than for the aggregate stock market—there is a downward-sloping equity term structure, as stocks that are expected to generate most of their cash flows in the distant future earn lower returns today.

- The short-duration premium is long-lived (lasts for at least five years) and is strong even among large firms (market equity in the highest NYSE quintile).

- High-duration stocks are more exposed to substantial discount-rate risk (i.e., changes in yield), whereas low-duration stocks are primarily exposed to cash-flow risk (i.e., changes in expected cash flows). Thus, firms with short cash-flow duration are less exposed to the discount-rate shocks that account for much of the variation in aggregate prices, causing them to comove less with the market and thus have lower betas.

- The firms in the long legs of the risk factors have low growth rates, high payouts, and high expected returns, leading these firms to have short cash-flow duration.

- Risk-adjusted returns on individual cash flows decrease with the maturity of the cash flows, but they do not vary systematically across the underlying firms—the three-year claim on a high-investment firm has the same risk-adjusted return as the three-year claim on a low-investment firm. The implication is that it is the duration of cash flows, not other firm-level characteristics, that drives the return premium on short-duration firms.

- A higher equity yield curve predicts higher returns, and a more upward-sloping equity yield curve predicts lower returns.

- The results were not driven by small-cap firms or by the short leg of the portfolio alone, and they were robust across subperiods.

- Lower-duration portfolios generated larger excess returns in periods of high sentiment relative to common asset pricing models such as the CAPM and the Fama-French models. However, there was essentially no statistically significant relationship between duration and excess returns in low-sentiment months.

- In tests of robustness, similar findings were found for corporate bonds.

These findings suggest that perhaps the value and profitability premia are proxies for the short-duration premium, which does not resemble an anomaly that concentrates on small stocks.

New Research

Heiner Beckmeyer and Paul Meyerhof contribute to the asset pricing literature with their June 2022 study, “The Short-Duration Premium in the Stock Market: Risk or Mispricing?,” in which they examined prescheduled public news announcements to assess whether the premium for short-duration stocks arises because of higher risk or investor behavior. They hypothesized that:

news about the overall economy primarily conveys information about aggregate growth rates and FOMC announcements about future discount rates. In both cases, the instantaneous impact of a change in either determinant should accumulate over the term structure. Accordingly, long-duration stocks should react more to both types of information. For example, monetary policy affects discount rates directly and should affect long-term stocks the most, and surprisingly good news about the economy should increase expectations of growth rates of future cash flows which accumulate over the duration of the stock, raising prices of long-duration stocks the most.

Their data sample covered stocks on NYSE, AMEX, and Nasdaq(1) over the period 1995-2019, and more than 6 million individual stock observations.

Following is a summary of their findings:

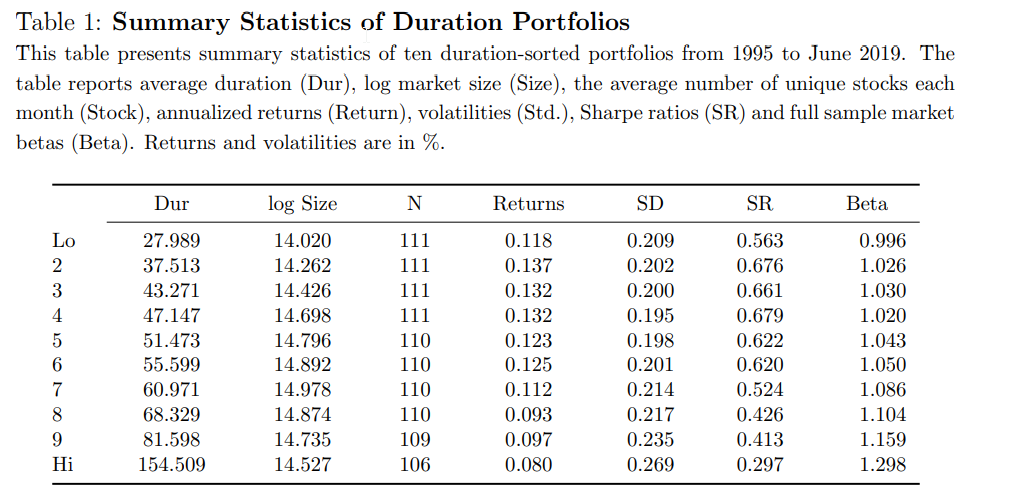

- While the bottom 10 percent of stocks had a duration of 28 years on average, the top 10 percent had a duration of about 155 years!

- Average returns decreased in the average duration, confirming the overwhelming evidence of a downward-sloping equity term structure.

- The beta spread between the highest- and lowest-duration portfolio was around 0.30, rendering short-duration assets safer when judged by their sensitivity to systemic risk proxied by market excess returns.

- As measured by the return volatility, the highest-duration stocks appear riskier, with an annualized volatility of 26.9 percent versus 20.9 percent for the lowest-duration stocks.

Lower gross returns and higher return variation resulted in a significantly lower Sharpe ratio for long-duration stocks—0.297 for the highest-duration stocks versus 0.563 for the lowest-duration stocks.

- Neither the duration-dependent response to interest rates nor to economic news can explain the short-duration premium.

- There was a flat term structure for monetary policy announcements (FOMC), and a positive slope for news about the broader economy (gross domestic product and non-farm payroll). In contrast, short-duration stocks earned statistically and economically significant larger returns on earnings announcements.

- On earnings announcement days, there was no link between a stock’s duration and riskiness. This evidence suggests that the short-duration premium around earnings releases cannot be explained by differential sensitivity to aggregate risk.

- Better-than-expected future economic growth and lower-than-expected future interest rates have a disproportionate and positive effect on long-duration stocks.

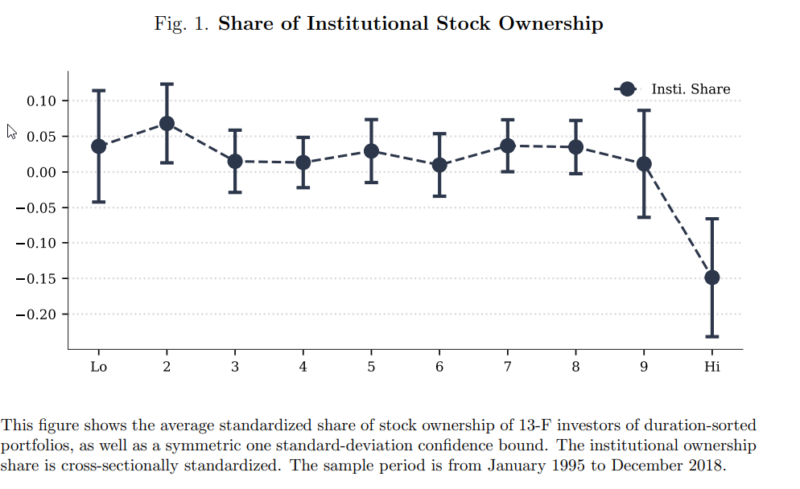

- Long-duration stocks are prone to mispricing due to the sentiment-driven trading behavior by non-institutional investors, explaining not only the existence of the unconditional short-duration premium (long-duration stocks experience the largest forecast errors at earnings announcements) but also its variation over time. However, the low-duration premium existed only in the stocks with low institutional ownership (retail investors are driving the premium).

- Long-duration stocks have the lowest institutional ownership, exhibit the largest forecast errors at earnings announcements and show the highest mispricing scores (institutions provide the vast majority of the supply of securities for loans, and their low ownership causes costs of shorting to be high).

- The trading activity of sentiment-driven (specifically, retail) investors raises the prices of long-duration stocks, which lowers their expected returns and results in the short-duration premium.

- The stock-level mispricing score of Robert Stambaugh and Yu Yuan’s study “Mispricing Factors,” based on 11 prominent anomalies in the literature, was monotonically increasing in a stock’s duration.

- The mispricing of long-duration stocks is at least partially corrected at earnings announcements as informed investors correct the overvaluation. In line with that, there was no reversal of the duration-dependent price reaction to earnings announcements on subsequent days. Further corroborating the notion that the trading behavior of noninstitutional investors explains the short duration premium, price correction at earnings announcement only occurred for stocks with low institutional ownership.

- The returns of long-duration stocks were particularly negative after periods of high market sentiment as sentiment-driven investors purchased long-duration stocks. In contrast, short-duration stocks were unaffected by market sentiment.

Their findings led Beckmeyer and Meyerhof to conclude:

“Duration premia associated with changes in economic growth and interest rate expectations are in line with a risk-based explanation (the duration premium is upward sloping). The unconditional short-duration premium, however, remains.”

They added:

“Retail traders with biased expectations purchase long-duration stocks during good times, which inflates their prices, and ultimately results in a premium for short-duration stocks.”

They also noted that their findings provided the following advantage:

“It predicts an upward-sloping term structure when sentiment-driven investors with biased expectations leave the market. This finding is in line with the predictions of leading theoretical asset pricing models.”

Finally, they observed:

“Our empirical finding suggests that augmenting ‘standard’ models with the beliefs and trading behavior of non-institutional investors may be more appropriate in explaining the downward-sloping and countercyclical equity term structure.”

Risk-Based Explanation for the Short-Duration Premium

The risk-based explanation for the premium return on short-duration equities is that the return on short-term dividend claims is risky, being highly exposed to the worst states of the world. For example, the value of near-future dividends dropped by as much as 40 percent during February and March 2020 as the coronavirus crisis unfolded—if near-future dividends are highly exposed to such bad economic shocks, it may help explain why their returns are high relative to more conventional measures of risk.

However, there is a challenge for the risk-based explanation. The problem is that, logically, the longer you extend the duration of cash flows, the greater the uncertainty about those cash flows. And greater uncertainty should produce a greater risk premium, thus presenting a challenge to the risk-based explanation for a downward-sloping equity risk premium. On the other hand, behavioral economists can provide explanations.

Behavioral-Based Explanation for the Short-Duration Premium

Behavioral-based explanations are also proposed for the higher returns on short-duration assets. For example, investors tend to overestimate the growth rates of high-growth firms and underestimate the growth rates of low-growth firms. This is especially true in periods of high investor sentiment, which results in the over-optimistic evaluation of high-duration, high-growth stocks. Subsequent realized performance tends to disappoint, leading to higher risk-adjusted returns on low-duration, stable stocks.

Another behavioral explanation is that some investors have a preference for lottery-like stocks (which tend to be long-duration stocks), leading to their overvaluation. The behavioral explanation is supported by Weber’s finding relating to limits to arbitrage, which allows anomalies to persist: “The spread in excess returns is strongest among stocks that are potentially the most short-sale constrained: low-duration stocks outperform high-duration stocks on average by 1.32% per month in the lowest institutional ownership class.”

Investor Takeaways

The research we have reviewed provides investors with some new and important insights into the cross-section of expected returns. It also provides us with insights into the debate on the source of the value premium, behavioral- or risk-based, providing us with findings on both sides. My own view is that the issue, at least as it relates to the value premium, is neither black nor white—it is likely that the value premium has two sources, with some risk-based explanations (such as value companies having more irreversible capital and greater volatility of earnings and dividends) and some behavioral ones (such as investors confusing familiarity with safety, anchoring, loss aversion and underestimating the reversion to the mean of abnormal earnings for both growth and value companies). The behavioral explanations help explain why the value premium has historically been much larger in small stocks, where limits to arbitrage are stronger.

Similarly, we have hypotheses for both behavioral- and risk-based explanations for the short-duration premium. However, given that it exists only in stocks with low institutional ownership, it seems hard to make the case for a risk-based explanation. In addition, the evidence also shows that in times of low investor sentiment, the duration premium is positive, which is logical from a risk perspective because cash flows further in the future are more uncertain/risky.

Finally, while I am not aware of any short-duration funds, the findings that short-duration stocks are closely related to value stocks and also have exposure to the profitability/quality factor mean that investors can gain exposure to the short-duration premium by investing in funds (such as those of AQR, Bridgeway and Dimensional) that have high loadings on those factors. The findings also show that investors can benefit from avoiding the stocks in the short side of Stambaugh and Yuan’s 11 anomalies (stocks that are overweighted by naive retail investors and underweighted by institutional investors).

Disclaimers

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. LSR-22-320

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.