The importance of the role played by short sellers has received increasing academic attention in recent years. Short sellers help keep market prices efficient by preventing overpricing and the formation of price bubbles in financial markets. Market efficiency is important because an efficient market allocates capital efficiently. If short sellers were inhibited from expressing their views on valuations, securities prices could become overvalued and excess capital would be allocated to those firms.

Research into the information contained in short-selling activity, including the 2016 study “The Shorting Premium and Asset Pricing Anomalies,” the 2017 study “Smart Equity Lending, Stock Loan Fees, and Private Information,” the 2020 studies “Securities Lending and Trading by Active and Passive Funds” and “The Loan Fee Anomaly: A Short Seller’s Best Ideas,” the 2021 study “Pessimistic Target Prices by Short Sellers,” and the 2022 study “Can Shorts Predict Returns? A Global Perspective,” has consistently found that short sellers are informed investors who are skilled at processing information (though they tend to be too pessimistic). That is evidenced by the findings that stocks with high shorting fees earn abnormally low returns even after accounting for the shorting fees earned from securities lending. Thus, loan fees provide information in the cross-section of equity returns. Interestingly, while retail investors are considered naive traders, the authors of the 2020 study “Smart Retail Traders, Short Sellers, and Stock Returns” found that retail short sellers are informed traders who profitably exploit public information when it is negative. The theory is that the high costs and the risk of unlimited losses, and the resulting absence of liquidity-motivated short selling, make short sellers more informed than average traders.

The research has also found that the predictive power of short sales for future stock returns depends on the costs and benefits of short selling. These costs and benefits depend on the state of short sale regulations (including uptick rules, short sale bans and the presence of effective security lending markets), overall market development (such as country-level openness or GDP per capita), short-selling fees (rising fees lower the expected future profitability of the short position, which may induce short sellers to exit), liquidity (reduced liquidity may limit short sellers’ ability to easily enter or exit a position) and pricing efficiency. These factors can make trading costly and potentially lower the profits from short sales to the point that these trades become unattractive even for informed short sellers.

New Research

Jesse Blocher, Xi Dong, Matthew Ringgenberg and Pavel Savor contribute to the literature on short sellers with their November 2022 study, “Short Covering.” They began by noting: “Despite the importance of short selling for asset prices and market quality, there is almost no research to date on short covering in U.S. equities.” Using data from Markit to construct measures of gross and net position closures by short sellers, they examined how different possible limits to arbitrage impact short covering. Their data sample covered approximately 6,000 U.S. stocks over the 2007-2016 period. Their measures included those that are idiosyncratic in nature, such as equity lending fees, bid-ask spreads, and stock-specific returns and volatility, as well as those that are systematic, such as intermediary funding liquidity, aggregate liquidity, VIX and market volatility. The authors noted: “The Markit data is distinct in that it allows us to track the total quantity of borrowed shares each day (i.e., the stock of positions) as well as the quantity of new shares borrowed each day and the quantity of borrowed shares returned each day (i.e., the flow).” They used the data to answer the following questions:

- Are short sellers skilled at timing their covering decisions?

- How important are limits to arbitrage in influencing short sellers to close out positions?

- If covering decisions are significantly affected by limits to arbitrage, do resulting position closures affect asset prices?

Here is a summary of their key findings:

- Many idiosyncratic limits to arbitrage affect short seller behavior—firm-specific trading frictions influence short sellers.

- Short covering increases significantly when equity lending fees are high.

- It is not only direct trading costs that influence short sellers; past stock returns and volatility are both strongly positively related to short covering.

- None of the proxies for potential systematic limits to arbitrage, which many theories suggest should represent important determinants of arbitrageur trading, have an impact on short covering.

- The effect of idiosyncratic limits to arbitrage is not limited to individual short sellers but also works for them as a group—when some short sellers cover their positions in response to higher equity loan fees, losses due to stock price increases or higher volatility, other investors do not replace them (at least not fully).

- Higher prior-month existing short positions are related to higher next-month covering with high statistical and economic significance—existing short sellers cannot maintain their short position for a long time, while new short sellers do not open new short positions when there are already high existing short positions, likely due to limits on short supply and risk management considerations.

- Larger (more liquid) stocks allow short sellers to easily close their positions.

These findings led Blocher, Dong, Ringgenberg and Savor to conclude that their findings were consistent with the hypothesis that their proxies for idiosyncratic limits to arbitrage induce short sellers to cover their positions. They then examined whether short covering predicts future returns and found:

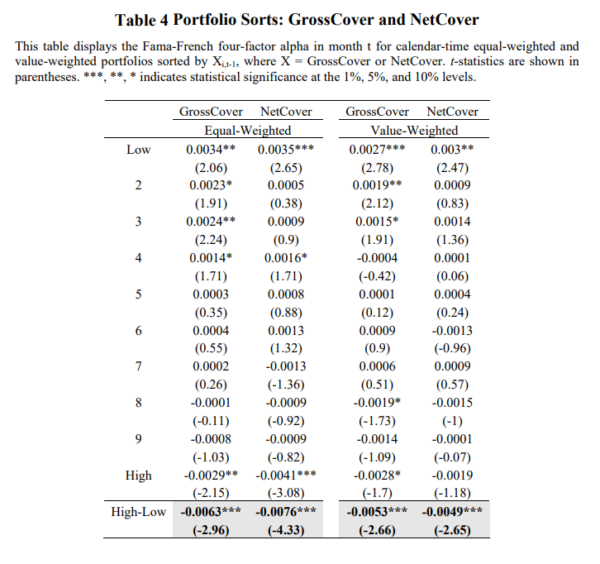

- An equal-weighted (value-weighted) portfolio that buys stocks with low net short covering and shorts stocks with high net short covering had a one-month abnormal return of 0.76% (0.49%), with a t-statistic of 4.33 (2.65)—stocks continue earning low returns after short sellers exit their positions, indicating that short sellers closed too soon.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

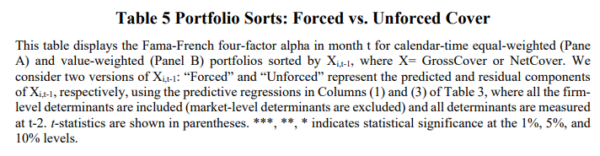

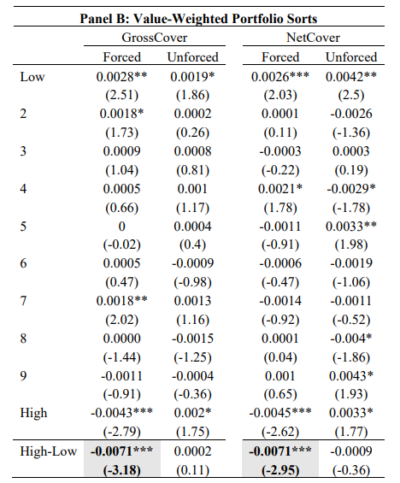

- Approximately 40% and 30% of the gross and net covering activities were explained by forced gross covering and forced net covering, respectively—a large proportion of short covering activity is likely linked to limits to arbitrage.

- A long-short equal-weighted (value-weighted) portfolio based on forced covering had an abnormal return of 1.1% (0.71%). If limits to arbitrage induce short sellers to close out positions, it could explain why short covering predicts negative future returns. By contrast, portfolios sorted on unforced covering did not exhibit any spread in returns—the large underperformance of short covering is driven by the part of the short covering that is forced by limits to arbitrage.

The evidence led Blocher, Dong, Ringgenberg and Savor to conclude: “The findings suggest that short sellers are skilled at closing their positions when facing no constraints. However, when short sellers are induced to close because of limits to arbitrage, they exit their positions too early.”

They next examined whether short covering has important implications for stock price efficiency and found that short covering was negatively related to a variety of measures for how efficiently stock prices reflect information—a given stock’s price efficiency is lower when short sellers are covering their trades.

Blocher, Dong, Ringgenberg and Savor concluded: “Overall, our results show that various idiosyncratic limits to arbitrage influence short seller trading activities. … Real-world arbitrage is risky and costly, and conditions in the stock and equity lending markets strongly influence a short seller’s decision to maintain a position. When conditions move against short sellers, they tend to close their positions too early, resulting in more mispricing and worse price efficiency … The fact that short sellers strongly respond to adverse stock price changes or increased volatility by reducing positions indicates that they, even as a group, have limited risk-bearing capacity. … When short sellers are induced to cover by idiosyncratic limits to arbitrage, the affected stocks have negative expected returns, indicating that short sellers are foregoing profits by exiting (and thus presumably doing so involuntarily).”

Investment Strategy Implications

The research on short selling has led some “passive” (systematic) money management firms (such as AQR, Avantis, Bridgeway and Dimensional) to suspend purchases of small stocks that are “on special” (securities lending fees are very high). Dimensional has done extensive research on securities lending. Using data for 14 developed and emerging markets from 2011 to 2018, it found that stocks with high borrowing fees tend to underperform their peers over the short term. Moreover, stocks that remain expensive to borrow continue to underperform, but persistence of high borrowing fees is not systematically predictable. While the information in borrowing fees is fast decaying, it can still be efficiently incorporated into real-world equity portfolios.

Dimensional also found that while high borrowing fees are related to lower subsequent performance, it is not clear this information can be used to make a profit by selling short stocks with high fees. Borrowing fees are just one cost associated with shorting; short sellers must also post collateral, typically at least 100% of the value of borrowing securities, and incur transaction costs. In addition, its research shows there is relatively high turnover in the group of stocks that are on loan with high borrowing fees. For example, fewer than half of high-fee stocks are still high-fee one year after being identified as such. Therefore, excluding these stocks may lead to high costs if buy and sell decisions are triggered by stocks frequently crossing the high-fee threshold. After considering the trade-offs between expected return, revenue from lending activities, diversification, turnover and trading costs, Dimensional believes that an efficient approach to incorporate these findings into a real-world investment process is to consistently exclude from additional purchase small-cap stocks with high borrowing fees.

Avantis takes a different approach in designing its fund construction rules. It tries to avoid holding securities that tend to have characteristics associated with high borrowing fees and shorting. AQR also uses the information in some of its portfolios—a high shorting fee is used as a signal to sell short the hard-to-borrow names, assuming AQR forecasts a positive expected return (net of the fee). It does so based on the academic evidence showing that high short-fee names are predictive of lower returns even net of their higher fee.

Individual investors can also benefit from the research findings without shorting stocks. They can do so by avoiding purchasing high-sentiment stocks where borrowing fees are “on special.”

As noted, short sellers play a valuable role in keeping market prices efficient by preventing overpricing and the formation of price bubbles in financial markets. It is the limits to arbitrage, the high risks and high costs of shorting that allow some inefficiencies to persist, explaining the information provided by short sellers. The recent GameStop episode in which retail investors banded together to engineer a short squeeze demonstrated just how risky shorting can be, with the potential for unlimited losses. That type of risk, with retail investors using social media to band together with sufficient capital to attack the short positions of well-capitalized hedge funds, was one that had never been experienced and almost certainly was not expected.

Compounding the risks of shorting is that, as Xavier Gabaix and Ralph Koijen demonstrated in their 2021 study “In Search of the Origins of Financial Fluctuations: The Inelastic Markets Hypothesis,” markets have become less liquid and thus more inelastic. Gabaix and Koijen estimated that today $1 in cash flows results in an increase of $5 in valuations. One explanation for the reduced liquidity is the increased market share of indexing and passive investing in general. Reduced liquidity increases risks of shorting. Adding further to the risks is the now-demonstrated ability of retail investors to “gang up” against shorts; they might be right in the long term but dead before they reach it. The bottom line is that the limits to arbitrage have now increased, allowing for more overpricing of what can be called “high sentiment” stocks, making the market less efficient. This has important implications, as the evidence presented by Blocher, Dong, Ringgenberg and Savor demonstrates that short squeezes are not just a theoretical concept; they can and do occur. They found that stock price increases are associated with more short covering, and if this generates price pressure, it could cause a cycle of more price increases and more short covering. And if short sellers are a sophisticated group, they will foresee this possibility and be less aggressive initially when taking positions. That can lead to market inefficiency and bubbles, as was the case with GameStop. The combination of less liquid markets and the risks related to social media “gangs” means that risks of shorting have increased, likely making markets somewhat less efficient.

Investor Takeaways

There is a large body of evidence demonstrating that short sellers are informed investors who play a valuable role in keeping market prices efficient—short selling leads to faster price discovery. Another important takeaway is that fund families, such as those mentioned above, that invest systematically have found ways to incorporate the research findings to improve returns over those of a pure index replication strategy. It seems likely this will become increasingly important, as the markets have become less liquid, increasing the limits to arbitrage and allowing for more overpricing.

Larry Swedroe is head of financial and economic research for Buckingham Wealth Partners.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data and may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. LSR-22-452

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.