The rise of stock indexing has raised concerns that index investing distorts stock prices—indexers are free riders who rely on prices without contributing to price discovery, thus reducing price efficiency. Byung Ahn and Panos Patatoukas, authors of the study “Identifying the Effect of Stock Indexing: Impetus or Impediment to Arbitrage and Price Discovery?” published in the August 2022 issue of the Journal of Financial and Quantitative Analysis, examined the causal effect of indexing on arbitrage conditions and price discovery, and thus market efficiency. They used FTSE Russell’s index reconstitution as a source of exogenous variation in index investing—do stocks with different levels of index fund ownership differ along dimensions that are endogenously related to stock liquidity, the severity of short-sale constraints and the overall efficacy of the price discovery process? For their data sample, they obtained Russell 3000E Index (this index includes up to 4,000 of the largest U.S. equity securities; it combines the large-cap Russell 1000, the small-cap Russell 2000 and the Russell Microcap Indexes) constituent data for each annual reconstitution between 2007 and 2016 from FTSE Russell Client Service.

Following is a summary of their findings:

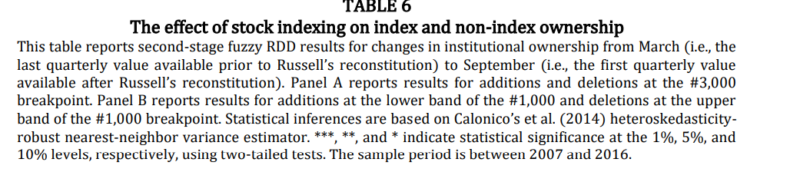

- The Russell 2000 reconstitution led to changes in the fraction of shares held by institutions. The addition effects showed a statistically significant 3.87 percentage point increase in index institutional ownership (IO), which corresponded to a 132 percent increase relative to the pre-reconstitution average value of static Russell 3000E stocks, while the change in non-index IO was indistinguishable from zero. With deletions they found a drop in total IO, consistent with forced selling by tracking institutions. Separating index from non-index IO holdings, the estimated deletion effects showed a statistically significant -4.31 percentage point decrease in index IO, a -50 percent decrease relative to the pre-reconstitution average value of static Russell 2000 stocks, and an indistinguishable from zero change in non-index IO. Similar, though smaller, effects were found in Russell 1000 reconstitutions.

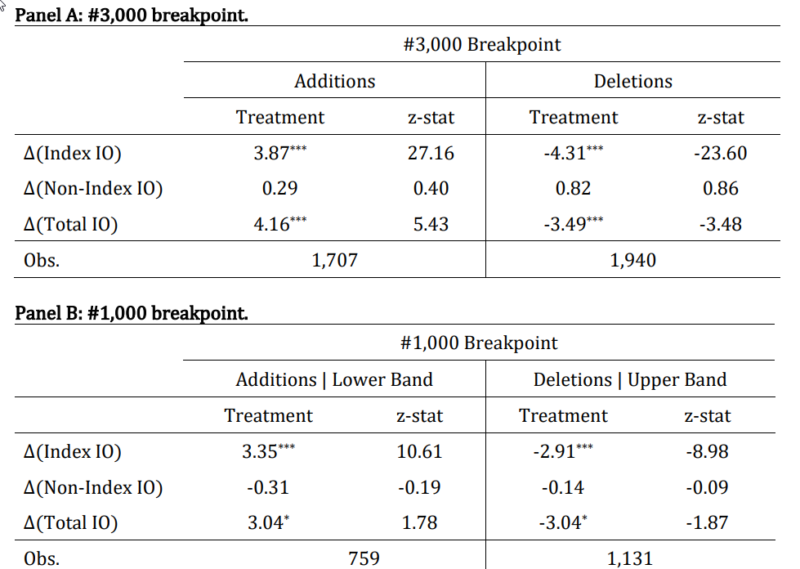

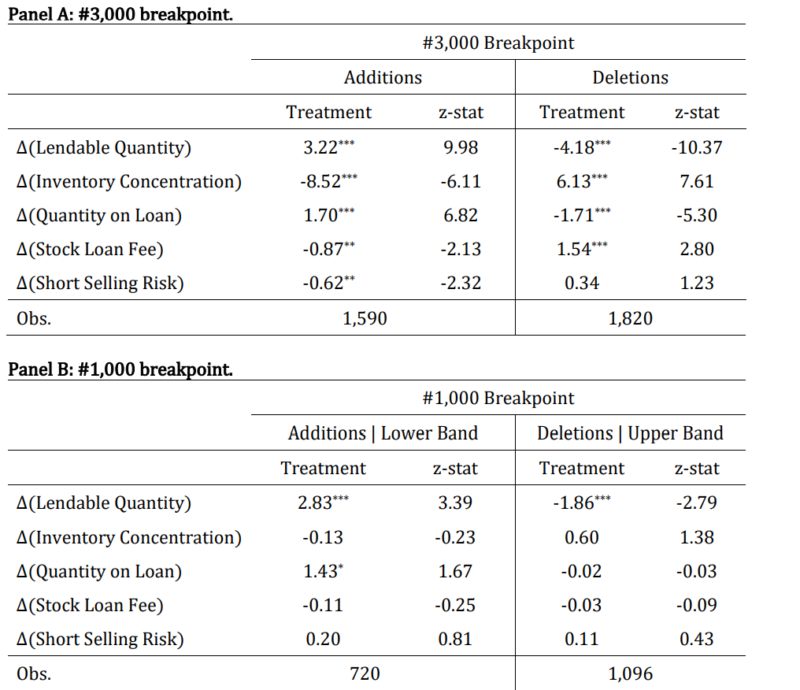

- Micro- and small-cap stocks at the lower cutoff of the Russell 2000 were significantly more arbitrage-constrained relative to mid- and large-cap stocks at the upper cutoff of the Russell 2000—micro-cap stocks have a combination of low institutional ownership, low lendable quantity, high stock loan fees, high short-selling risk, wider bid-ask spreads, and higher stock illiquidity ratios. Thus, exogenous variation in index investing is more likely to be impactful for stock additions and deletions at the lower cutoff of the Russell 2000.

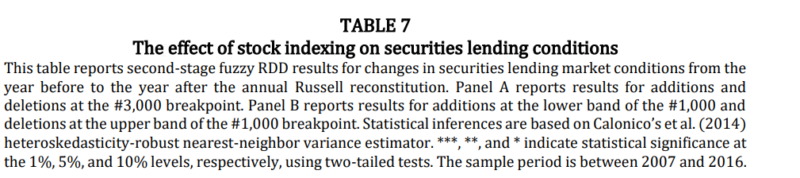

- Micro-cap stock additions to the Russell 2000 experienced a relaxation of securities lending constraints, an improvement in liquidity, an increase in synchronicity (the relation that exists when things occur at the same time) and an increase in the speed of price adjustment to market, industry and firm news. Conversely, micro-cap stock deletions from the Russell 2000 experienced a tightening of securities lending constraints, a deterioration in liquidity, a decrease in synchronicity and a decrease in the speed of price adjustment to news. On the other hand, there were no discernible effects with changes to the Russell 1000.

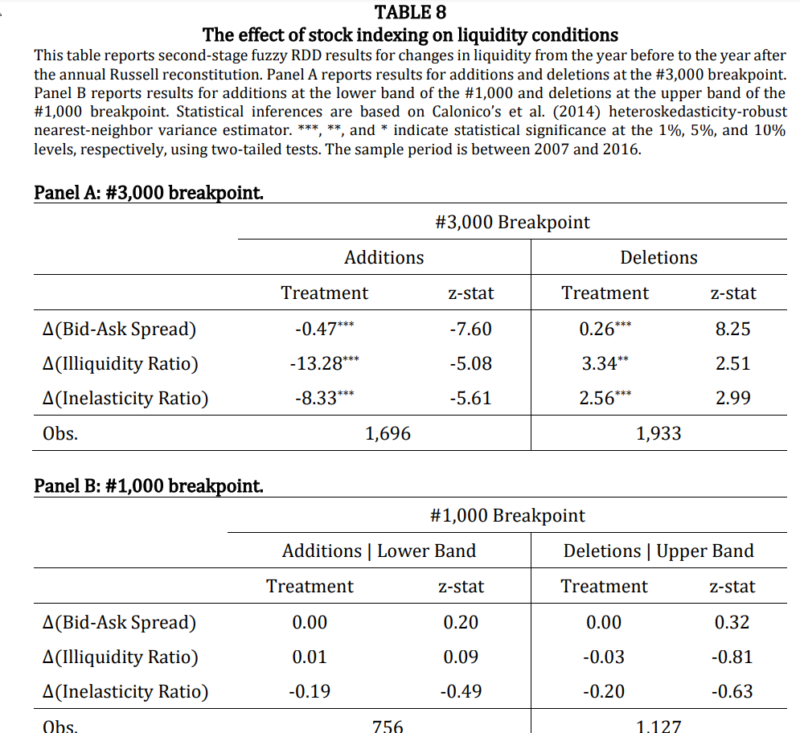

Stock indexing had a significant effect on measures of liquidity—stock additions at the 3,000 breakpoint experienced a -0.47 percentage point decrease in the bid-ask spread (a ‑39 percent decrease relative to the pre-reconstitution average spread of static Russell 3000E stocks) accompanied by a significant drop in illiquidity ratios. On the flip side, stock deletions at the 3,000 breakpoint experienced a 0.26 percentage point increase in the bid-ask spread (a 57 percent increase relative to the pre-reconstitution average spread of static Russell 2000 stocks) accompanied by a significant jump in illiquidity ratios.

- Higher price synchronicity due to an exogenous increase in index investing reflected the earlier resolution of uncertainty through the timelier incorporation of news rather than a decrease in price informativeness.

Their findings led Ahn and Patatoukas to conclude that “the relaxation of arbitrage constraints as a mechanism through which an exogenous increase in index investing enables more informed trading and improves price discovery. … Indexing can facilitate information arbitrage and increase price efficiency for more arbitrage-constrained microcap stocks.”

Ahn and Patatoukas’ findings are consistent with those of Jeffrey Coles, Davidson Heath, and Matthew Ringgenberg, authors of the study “On Index Investing,” published in the September 2022 issue of the Journal of Financial Economics. Also examining the Russell reconstitution effect, they found that while more index investing did lead to less information production about individual index stocks, with Google search volume falling by 3.8 percent, EDGAR page views by 14.1 percent, and the number of analyst reports by 10.8 percent, price efficiency remained unchanged—across a range of measures of price informativeness, including anomaly mispricing and post-earnings announcement drift (PEAD), no effect was found.

Of particular interest was their finding that higher short interest correlated with increased indexing—an increase (decrease) in passive investing led to a 1.9 percent increase (1.5 percent decrease) in short interest. It is intuitive because a significant part of many passive funds’ revenue stream is derived from lending shares they hold to short sellers—low-cost index funds actively use stock loan fees generated from such programs to enhance fund performance and offset fees for index investors. The increased supply of lenders lowers the cost of shorting, reducing the limits to arbitrage, and helping to keep markets efficient.

While the two studies we reviewed were consistent in their findings, there is some evidence to the contrary.

Evidence of a Negative Impact on Market Efficiency

In order to determine if there was a relationship between increases in passive ownership and price informativeness, in his June 2022 study “Passive Ownership and Price Informativeness,” Marco Sammon focused on the period before earnings announcements. His intuition was that if investors are not gathering private signals, public information releases should be the dominant source of stock volatility. To establish causality, he showed that price informativeness decreased after increases in passive ownership arising from index additions/rebalancing: “Over the past 30 years, pre-earnings-announcement price informativeness has been declining on average. In cross-sectional regressions, passive ownership is correlated with lower pre-earnings drift and a lower quadratic variation share [the share of volatility occurring on non-earnings-announcement days]. These effects are economically large, with an increase in passive ownership of 15% – which is roughly the value-weighted average increase over my sample – able to explain 33%-40% of the aggregate trends.”

Sammon hypothesized that passive ownership decreases learning about stock-specific information. Consistent with this hypothesis, he found that high passive ownership stocks receive less attention from analysts and institutional investors; have more ex-ante earnings uncertainty (options spanning earnings announcements became relatively more expensive); are traded less before earnings announcements; and react more to fundamental news (if investors have less precise beliefs before an announcement, they will update significantly afterwards, leading to a larger price change—there was an increased reaction to negative idiosyncratic news). Sammon also found that following the release of negative earnings news, stocks with more passive ownership had a larger increase in short interest—consistent with previously inattentive investors adding significantly to their short positions after the bad news was revealed.

Sammon’s finding of an increase in short interest in stocks with higher passive ownership is consistent with the other research we covered. And an increase in shorting is consistent with a reduction in the limits to arbitrage that prevent sophisticated investors from correcting mispricing. Thus, it is consistent with more price efficiency. Finally, while Sammon found evidence of decreased pre-earnings announcement price drift (an indicator of less market efficiency), the other research we reviewed found a decline in post-earnings announcement drift (an indicator of greater efficiency).

Investor Takeaways

The above findings provide evidence on the effects of stock indexing on arbitrage conditions and price discovery, with some evidence on both sides. While critics of indexing often argue that index investing reduces price informativeness, there is no compelling evidence that the rise of indexing has made the markets less efficient. In fact, the evidence shows that the rise of indexing reduces the limits to arbitrage by making more stocks available to borrow and reduces borrowing costs. In addition, the evidence of the reduction in the PEAD anomaly demonstrates that a rise in indexing leads to increases in the speed of price adjustment to news, especially for more arbitrage-constrained micro-cap stocks.

Finally, it is hard to make the case that the price discovery function has been impaired—implying that securities are mispriced—when not only has trading volume been rising, but the percentage of active managers that outperform has been on a steep decline for the past 20 years. As evidence of the declining ability of active management to deliver alpha, the study “Conviction in Equity Investing” by Mike Sebastian and Sudhakar Attaluri found that the percentage of skilled managers was about 20 percent in 1993. By 2011 it had fallen to just 1.6 percent. This closely matched the result of the 2010 paper “Luck versus Skill in the Cross-Section of Mutual Fund Returns.” The authors, Eugene Fama and Kenneth French, found that only managers in the 98th and 99th percentiles showed evidence of statistically significant skill. On an after-tax basis, that 2 percent would be even lower.

While the active management industry continues to criticize the role of indexing, don’t be fooled by criticisms such as these:

- Sanford C. Bernstein & Co. strategist Inigo Fraser-Jenkins called it worse than Marxism.

- David Smith, fund manager at Hargreaves Lansdown, called passive investors parasites on the financial system.

- Tim O’Neill, global co-head of Goldman Sachs’ investment management division, warned investors that if passive investing gets too big, the market won’t function.

They all come from people and firms who don’t have your interests at heart. That is why they are not fiduciaries and fight to prevent being required to act solely in your interest. While passive investing may not be exciting, being a free rider allows you to achieve market rates of return in a low-cost and tax-efficient manner, giving you the greatest chance of achieving your life and financial goals.

Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data and may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively known as Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined, or confirmed the adequacy of this article. LSR-22-367

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.