This article studies how men and women differ in the returns gained from housing investments and what the drivers of that discrepancy may be.

The Gender Gap in Housing Returns

- Goldsmith-Pinkham, Shue

- Journal of Finance, 2023

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

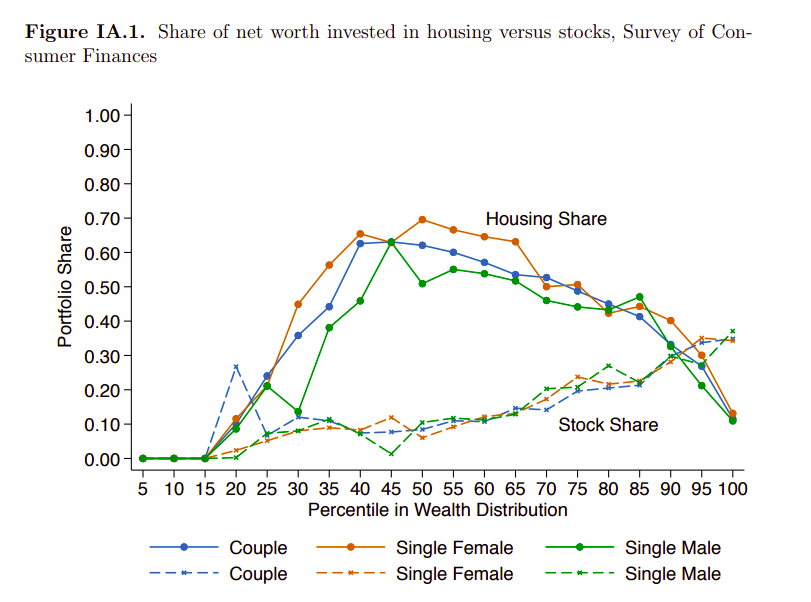

Housing accounts for the majority of American households’ wealth (Survey of Consumer Finances, 1989-2016).

The authors ask the following question:

- Do men and women differ in their financial returns on housing investments?

- What are the main drivers?

What are the Academic Insights?

By studying detailed data across the United States from 1991 to 2017 covering over 50 million housing transactions and matched property listings, the authors find:

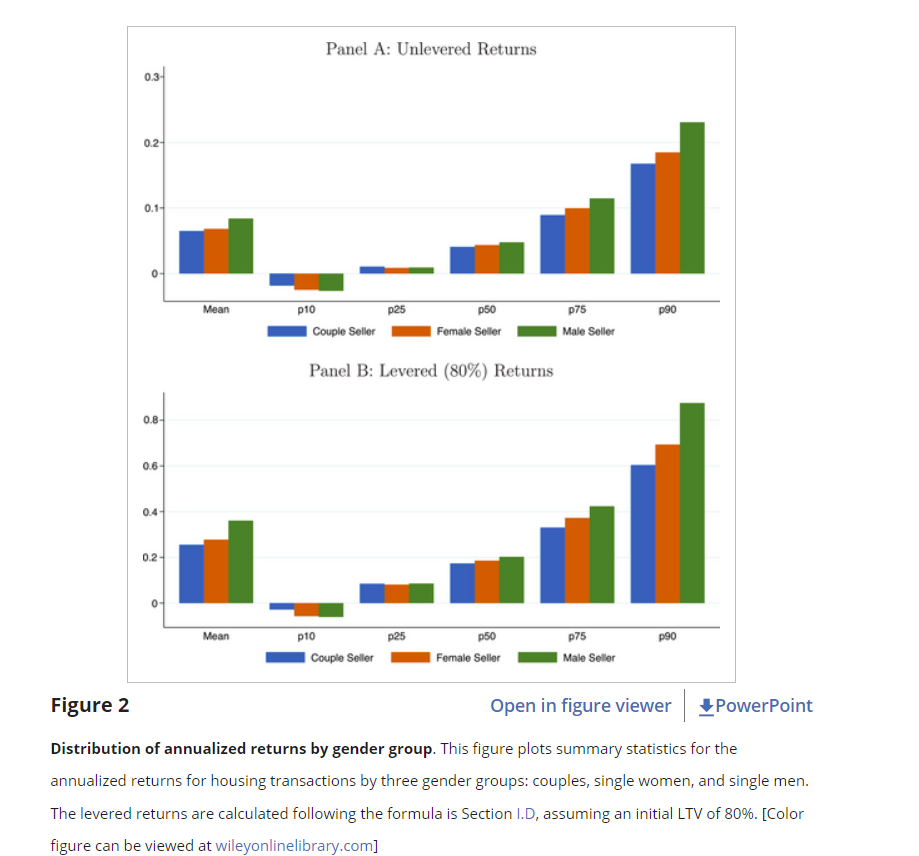

- YES – Single men earn 1.5 percentage points higher unlevered annualized returns relative to single women.

- 45% of this difference in returns is explained by market timing, the choice of where and when to buy, and when to sell. However, a large gender gap persists even after accounting for market timing. Among men and women who buy and sell in the same zip code and year-month, women still earn 0.8 percentage points lower unlevered annualized return.

- Women negotiate worse discounts relative to the list price, suggesting that gender differences in negotiation contribute to the gap in housing returns.

- The authors perform a number of robustness checks and confirm the above results.

Why does this study matter?

This study shows that gender differences in housing returns are economically large. The authors also estimate that the gender gap in housing returns can explain approximately 30% of the overall gender gap in wealth accumulation at retirement.

The Most Important Chart from the Paper:

Abstract

Using detailed transactions data across the United States, we find that single women earn 1.5 percentage points lower annualized returns on housing relative to single men. Forty-five percent of the gap is explained by transaction timing and location. The remaining gap arises from a 2% gender difference in execution prices at purchase and sale. Consistent with a negotiation channel, women list for less and experience worse negotiated discounts. The gender gap shrinks in tight markets, where negotiation is replaced by quasi-auctions. Overall, gender differences in housing explain 30% of the gender gap in wealth accumulation for the median household.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.