The article aims to examine the role of social media in venture capital financing, its impact on disparities faced by underrepresented groups, and the mechanisms through which social media usage can facilitate venture capital funding.

Social Media Alleviates Venture Capital Funding Inequality for Women and Less Connected Entrepreneurs

- Wang, Wu and Hitt

- Management Science, 2023

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Gender disparities in venture capital (VC) financing have been widely studied and documented (gender gaps and gender bias)

- Can social media be used as a tool to increase venture capital financing?

- How does social media usage affect the disparities in venture financing faced by startups founded by women and others who lack social capital?

- What are the mechanisms through which social media facilitates VC funding?

What are the Academic Insights?

By analyzing data from Twitter and Crunchbase, the authors find:

- YES – The research provides evidence that social media usage, particularly on platforms like Twitter, can help startups secure venture financing

- Social media usage can alleviate the funding disparities faced by startups founded by women and others who lack social capital. In fact, social media (particularly Twitter) can improve their visibility, attract investor interest, and reduce information barriers

- Some of the mechanism to facilitate funding used by social media are: increase VCs’ knowledge about the quality of the product or service offered by the startup, increase entrepreneurs’ visibility and network

Why does this study matter?

This study is important because it investigates whether social media can be leveraged to increase venture capital financing (especially for minorities and founders lacking connections to venture capital networks), providing insights into the potential benefits and challenges associated with its use.

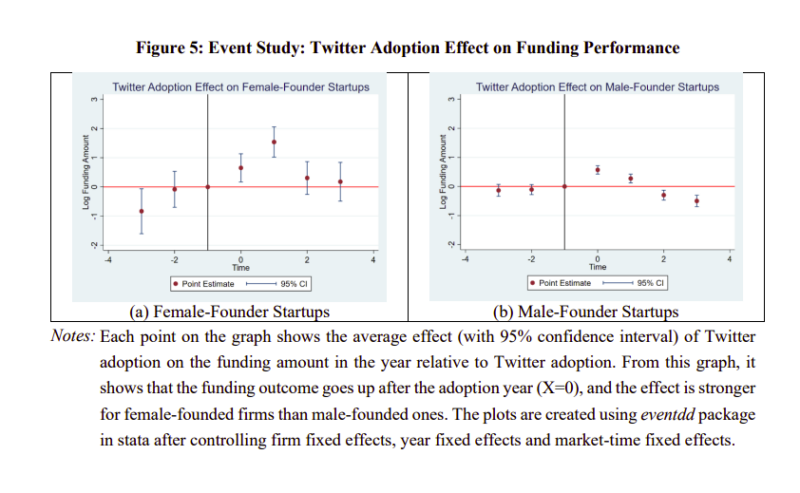

The Most Important Chart from the Paper:

Abstract on Venture Capital Funding inequalities and social media

Start-ups are increasingly using social media to signal quality and provide information to potential investors. However, the effectiveness of social media on venture capital (VC) financing is likely to be heterogeneous, differing by demographic and network characteristics of the founders. In this paper, we examine whether social media use can improve funding outcomes for firms founded by women and by other people also lacking connections to the investor network, two groups that face greater difficulties in securing VC financing. Using Twitter data and data on VC investment in start-ups from Crunchbase, we explore the interaction effect between Twitter usage and gender and between Twitter usage and the network constraint measure. Overall, we show that social media can mitigate some disparities in financing experienced by these firms through improving information access. We find that this effect is stronger for first-time entrepreneurs than for experienced ones, stronger for attracting new investors than repeat ones, and stronger in more competitive markets. Collectively, these results suggest that social media could primarily help women and less connected individuals obtain financing by alleviating information asymmetry between founders and investors.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.