Can We Measure Inflation Expectations Using Twitter?

- Cristina Angelico, Juri Marcucci, Marcello Miccoli, Filippo Quarta

- Journal of Econometrics, 2022

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Twitter is an interesting dataset for researchers interested in consumer beliefs. (200 million monthly active users worldwide (Elon Musk may disagree!) and about 10 million active users in Italy in 2019 (AGCOM 2020)).

Inflation expectations are at the heart of any consumption and investment decision of households and firms in the economy. There are two commonly used sources of inflation expectations: surveys and prices of financial assets linked to inflation. Both measures have relative advantages and drawbacks. The first is more accurate and less timely, the second more timely but less accurate.

The authors propose a new method that can be both timely and accurate and asks the following questions:

- Do tweets say something about inflation expectations?

- Does observing the Twitter-based indicators give an informative advantage on consumers’ expectations (given that survey data are not timely)?

What are the Academic Insights?

By drawing on Italian tweets, the authors employ textual data and machine learning techniques to build new real-time measures of consumers’ inflation expectations and find:

- YES, comparing the Twitter-based measures with lower frequency survey-based measures of consumers’ inflation expectations by ISTAT, they are strongly correlated (same result with market-based measures of inflation.

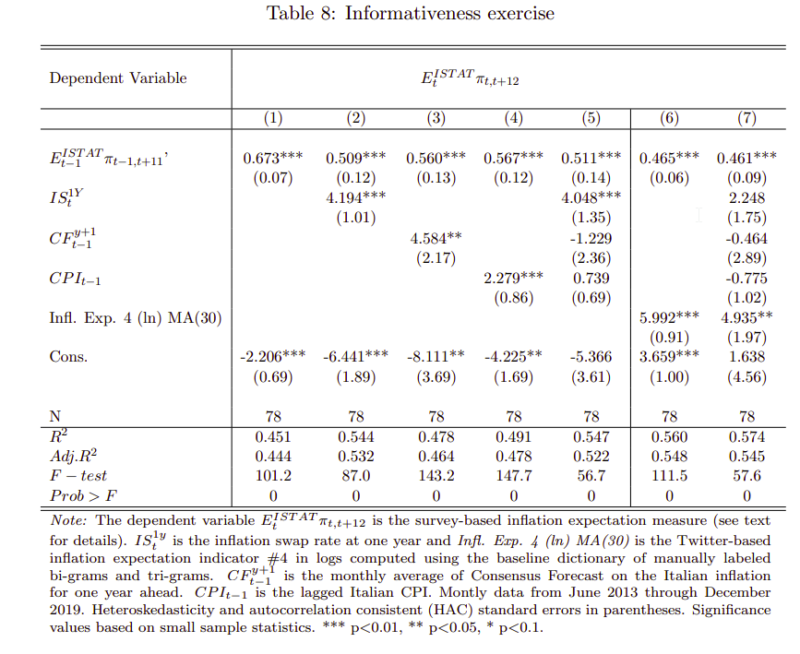

- YES, Twitter and the indicators developed by the authors capture relevant information, not included in market-based or consensus expectations.

Why does it matter?

This paper proposes a new source of data to measure inflation expectations that has some advantages

compared to the standard ones. First, it involves a wide variety and a large number of individuals, relative to market-based data that reflect traders’ opinions and survey measures that consider small samples of agents. Second, the high frequency of the data allows for the building of daily indicators, whereas polls are available at the monthly or quarterly frequency. Lastly, this data source is not linked specifically to any country, so it can be used and replicated in several instances.

The Most Important Chart from the Paper:

Abstract

Drawing on Italian tweets, we employ textual data and machine learning techniques to build new real-time measures of consumers’ inflation expectations. First, we select keywords to identify tweets related to prices and expectations thereof. Second, we build a set of daily measures of inflation expectations around the selected tweets, combining the Latent Dirichlet Allocation (LDA) with a dictionary-based approach, using manually labeled bi-grams and tri-grams. Finally, we show that Twitter-based indicators are highly correlated with both monthly survey-based and daily market-based inflation expectations. Our new indicators anticipate consumers’ expectations, proving to be a good real-time proxy, and provide additional information beyond market-based expectations, professional forecasts, and realized inflation. The results suggest that Twitter can be a new timely source for eliciting beliefs.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.