This paper explores the state of financial literacy in Canada.

Financial literacy and knowledge of the retirement income system in Canada

- David Boisclair, Colin Busby and Philippe d’Astou

- Journal of Financial Literacy and Wellbeing ,2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The authors ask the following questions:

- What is the current state of financial literacy among middle-aged Canadians?

- How does financial literacy correlate with knowledge of the Canadian retirement system?

- What is the relationship between financial literacy and retirement planning among Canadians?

- How has recent inflation affected Canadians’ understanding of inflation?

What are the Academic Insights?

By analyzing data collected from a Survey administered to approximately 3,000 Canadians aged 35 to 54 years old from all 10 provinces, the authors find:

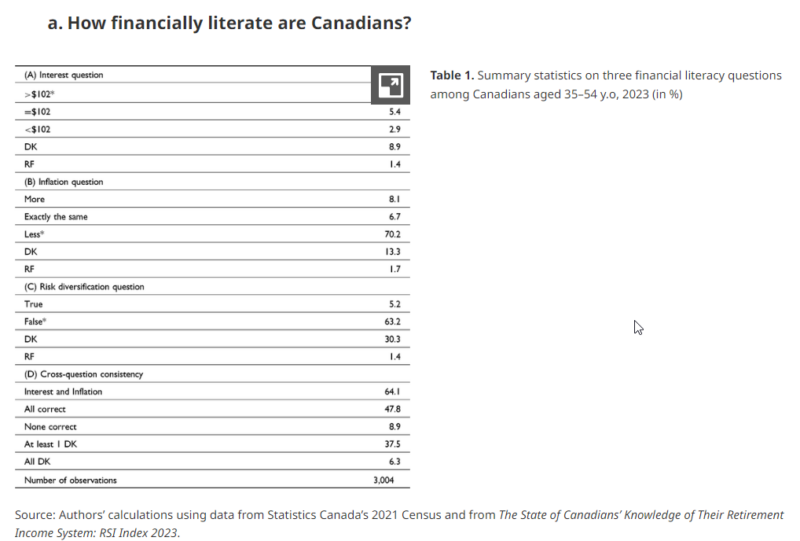

- The financial literacy of middle-aged Canadians aligns with findings from international literature (in particular with those of Northern European countries): 47.8% of respondents correctly answered all the three big questions (Lusardi and Mitchell). When considered individually, 81.4% of respondents correctly answered the question on interest, 70.2% answered the question on inflation correctly, and 63.2% correctly answered the question on risk diversification. Men tend to score better on financial literacy assessments than women. This gender gap in financial literacy is a consistent finding both in Canada and internationally. Older Canadians generally score better on financial literacy assessments compared to younger ones. This suggests that financial literacy may improve with age and experience. Education and employment status have significant effects on financial literacy results. Those with higher levels of education and those who are employed or self-employed tend to have higher financial literacy scores. Despite higher inflation in recent years, there has not been a material increase in individuals’ understanding of inflation among middle-aged Canadians.

- There is a high correlation coefficient of 0.5 between the retirement system knowledge score and the number of correctly answered “Big 3” financial literacy questions. This indicates a strong relationship between general financial literacy and understanding of the retirement system.

- There is a strong positive correlation between financial literacy and the likelihood of having a retirement plan. Canadians who score higher on financial literacy assessments are more likely to have a structured plan for their retirement. Additionally, financially literate individuals tend to have a better understanding of the various components of the retirement system, which enhances their ability to plan effectively. This includes knowledge of public basic programs, compulsory public contribution plans, employer plans, and private savings.

- Recent inflation has not significantly improved Canadians’ understanding of inflation, according to the findings of the paper. Despite experiencing higher inflation rates in recent years, there has not been a notable increase in Canadians’ comprehension of inflationary concepts. This suggests that real-world economic conditions alone may not be sufficient to enhance financial literacy regarding inflation.

Why does this study matter?

This study is important because it provides valuable insights into the current state of financial literacy in Canada, its relationship to retirement planning, and the factors that influence financial literacy outcomes. By addressing these findings, policymakers and organizations can work towards building a more financially literate and prepared population in Canada.

The Most Important Chart from the Paper:

Abstract

This paper examines financial literacy in Canada using a dataset from early 2023 that measures the knowledge of middle-aged Canadians regarding their retirement income system. We first document important financial literacy differences across gender, age, education, and labor market status. Using detailed questions on the four main aspects of the retirement income system, we then show a strong correlation between financial literacy and the knowledge of the retirement system in Canada. Finally, we provide evidence that general financial literacy and knowledge of the retirement system matter for retirement preparation, by showing that Canadians with higher financial literacy scores and better knowledge of the retirement system are more likely to have a plan for retirement.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.