This paper explores the connection between financial literacy and understanding of cryptocurrencies (crypto literacy) in Canada. It delves into how these two aspects influence financial decisions, particularly related to cryptocurrency ownership.

Crypto and financial literacy of cryptoasset owners versus non-owners: The role of gender differences

- Daniela Balutel,Walter Engert,Christopher Henry,Kim P. Huynh,Doina Rusu and Marcel C. Voia

- Journal of Financial Literacy and Wellbeing, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The research questions are as follows:

- Is there a difference in crypto and financial literacy levels between people who own Bitcoin and those who don’t?

- Is there a gender gap in crypto and financial literacy, and how does it differ between Bitcoin owners and non-owners?

- How do factors like age, education, and income affect crypto and financial literacy levels?

- Are crypto and financial literacy levels independent, or do they influence each other?

- How well do Canadians understand cryptocurrencies (crypto literacy) and traditional financial concepts (financial literacy)?

What are the Academic Insights?

By focusing on Bitcoin as the most well-known cryptocurrency and analyzing data from the Bank of Canada’s Bitcoin Omnibus Survey (BTCOS), the authors find:

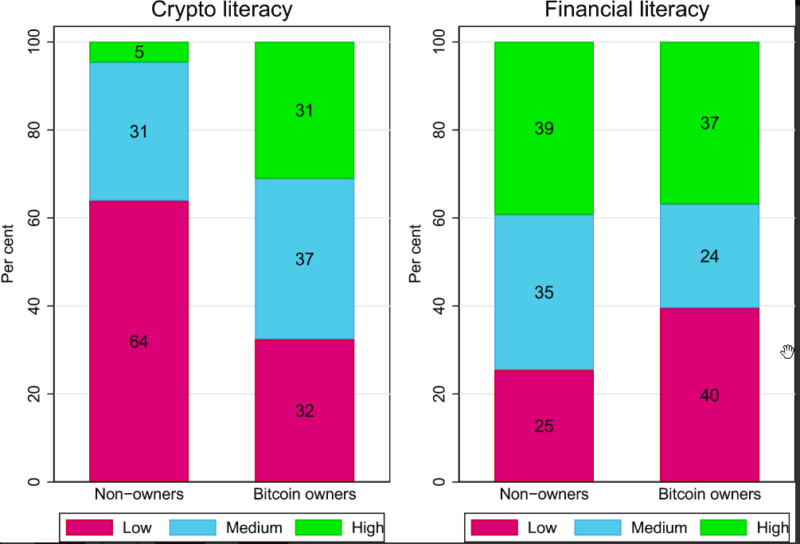

- YES, Bitcoin owners have higher levels of crypto literacy compared to non-owners. This means they have a better understanding of cryptocurrencies and their features. However, Bitcoin ownership may not necessarily guarantee strong financial literacy.

- YES, there is a gender gap in crypto and financial literacy levels between Bitcoin owners and non-owners in Canada:

- Crypto Literacy: There’s a consistent gender gap in crypto literacy, regardless of Bitcoin ownership. Women tend to have lower crypto literacy than men.

- Financial Literacy: The gap is present among non-owners but not for Bitcoin owners. There’s no significant difference between male and female Bitcoin owners in financial literacy.

- Age, education, and income have varying effects on crypto and financial literacy levels in Canada:

- Age: The impact of age is mixed:

- Bitcoin Owners: People aged 35-54 and above 55 tend to have higher financial literacy.

- Non-Owners: Younger non-owners tend to have lower crypto literacy compared to older non-owners.

- Education: Having a university degree has a positive effect on both crypto and financial literacy, regardless of Bitcoin ownership.

- Income: High income (over 70,000 CAD) does not affect crypto literacy but has a positive effect on financial literacy for both Bitcoin owners and non-owners.

- Age: The impact of age is mixed:

- Crypto and financial literacy levels might influence each other, but the relationship is complex and needs further research:

- Possible Link: The research points towards a potential interdependence between the two. There’s evidence that an increase in one might lead to an increase in the other; but in which direction is unclear.

- The study paints a picture of Canadians having a lower overall understanding of cryptocurrencies compared to traditional financial concepts.

Why does this study matter?

This study is important because it sheds light on the knowledge gap surrounding cryptocurrencies. This can help policymakers and financial institutions develop educational initiatives to inform Canadians about crypto and make informed investment decisions. Additionally, the study goes beyond crypto, highlighting the importance of financial education for using new financial technologies like open banking and Central Bank Digital Currencies (CBDCs). With the rise of Fintech, ensuring consumer understanding is crucial. Finally, the research reveals a persistent gender gap in crypto literacy. This can inform strategies to encourage women’s participation in the crypto market and bridge the gap in financial knowledge.

The Most Important Chart from the Paper:

Abstract

We measure crypto and financial literacy using microdata from the Bank of Canada’s Bitcoin Omnibus Survey. Our crypto literacy measure is based on three questions covering basic aspects of Bitcoin. The financial literacy measure we use is based on three questions covering basic aspects of conventional finance (the “Big Three”). We find that a significant share of Canadian Bitcoin owners have low crypto knowledge and low financial literacy. We also find gender differences in crypto literacy among Bitcoin owners, with female owners scoring lower in Bitcoin knowledge than male owners. We do not, however, find significant gender differences in financial literacy amongst Bitcoin owners. In contrast, non-owners show gender differences in both crypto and financial literacy.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.