This paper examines the rising costs investors face in accessing private capital markets, highlighting how

fees have grown significantly alongside the sector’s expansion.

Accessing Private Markets: What Does It Cost?

- Wayne Lim

- FAJ, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The main research questions addressed in this paper can be summarized as follows:

- What is the cost to investors for accessing private markets?

- What are the determinants of these costs?

- Are fees and fee structures aligned with investors’ interests?

What are the Academic Insights?

By analyzing a proprietary dataset of 10,791 private capital funds, covering a diverse range of fund types within private capital markets, the authors find:

- The paper estimates that the cost to investors for accessing private markets ranges from $0.05 to $0.26 per dollar committed over the funds’ lifetimes. This amount is lower than the $0.30 to $0.40 per dollar that hedge fund investors typically pay. The study further finds that:

- Non–performance-related management fees constitute a significant portion of these costs, accounting for 53% to 75% of total fees, meaning that only a portion of the fees are performance-based.

- The fee drag on gross-to-net returns (Total Value to Paid-In Capital, or TVPI) is estimated at 0.1x to 0.7x, equivalent to an annualized impact of 5% to 8% on returns. This impact is notably higher for buyout funds (7.9%) and venture capital funds (8.5%) than previously documented.

- The determinants of costs for accessing private capital markets, as identified in the paper, include the following:

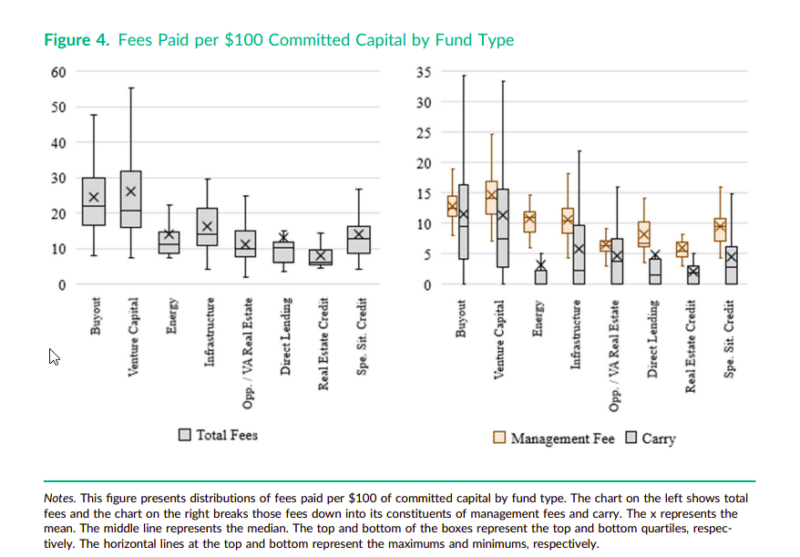

- Fund Type: Different private capital fund types (e.g., buyout, venture capital, real estate) have distinct fee structures and levels, impacting the overall costs investors bear.

- Performance-Related vs. Non-Performance-Related Fees: Non-performance-related fees, such as fixed management fees, make up a significant portion of costs (53% to 75%), indicating that a substantial part of investor costs is not tied to fund performance.

- Fund Size and Scale: Larger funds tend to benefit from economies of scale, leading to a lower cost per dollar committed. This means that as private capital funds grow, the management fees per dollar of investor capital may decrease, allowing investors in larger funds to incur relatively lower costs.

- Fee Structure Design: The allocation between management fees and performance fees in the fee structure affects total investor costs. A structure weighted heavily toward fixed management fees, as is common in some fund types, leads to higher non-performance-related costs.

- Fund Lifecycle and Duration: The time horizon of funds affects total costs, as management fees accumulate annually, while performance fees (such as carried interest) only materialize upon successful fund performance, usually at fund maturity or exit.

- The paper suggests that fees and fee structures in private capital markets may not be fully aligned with investors’ interests. Here’s why:

- High Proportion of Non-Performance-Related Fees: The study finds that non-performance-related management fees make up between 53% and 75% of the total fees. This heavy reliance on fixed fees means that a significant portion of investors’ costs is paid regardless of fund performance, potentially reducing the incentive for fund managers to maximize returns for investors.

- Performance Fees Play a Minor Role: Since less than half of the fees are performance-based, the current fee structures may lack adequate incentives for fund managers to align their interests with those of investors, who typically seek strong performance returns.

- Economies of Scale and Cost Efficiency: As fund sizes grow, management fees per dollar committed decrease due to economies of scale. However, these savings do not always translate into reduced costs for investors; instead, they often lead to increased profits for fund managers.

- Fee Drag on Returns: The study notes a substantial “fee drag” on gross-to-net returns, estimated to be 5% to 8% annually. This drag raises concerns that high fees may significantly erode investors’ returns, potentially outweighing the benefits of investing in private capital markets.

Why does this study matter?

This study is important because it addresses the growing yet under-researched area of fees and costs in private capital markets, a sector now valued at over $9 trillion. As more investors, including institutional and everyday investors, gain access to private capital, understanding the costs they bear becomes crucial for making informed investment decisions. The study’s findings on fee structures and their impact on net returns offer transparency in a traditionally opaque industry, helping investors assess the true value and efficiency of their investments. Furthermore, by quantifying how non-performance-based fees dominate the cost structure, the research questions whether current fee models effectively align with investor interests, which could influence future fee arrangements and industry standards.

The Most Important Chart from the Paper:

Abstract

This paper provides the first empirical analysis of the costs of financial intermediation across private markets and a framework to estimate ex-post costs using observed fund terms. I access a proprietary dataset, develop a novel model, and estimate that it costs investors $0.05 to $0.26 per dollar committed over funds’ lifetimes. The corresponding fee drag on gross-to-net total value to paid-in capital is 0.1x to 0.7x and 5% to 8% in annualized terms. The results demonstrate cost economies of scale in which larger funds cost less in management fees. Finally, the fraction of costs attributable to non-performance fees is 53% to 75%.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.