This paper evaluates whether socially responsible divestment strategies in secondary markets meaningfully impact firms’ cost of capital and corporate behavior. It concludes that divestment alone has minimal impact and suggests alternative approaches, like primary market investments or active shareholder engagement, are more effective for achieving social good.

The Impact of Impact Investing

- Berk and Binsbergen

- Journal of Financial Economics, 2025

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Socially conscious investing focuses on addressing social and environmental issues by guiding investment decisions. Divestment, a commonly used strategy, involves withdrawing support from companies that contribute to these issues, with the intention of creating positive societal change. Despite its appeal, the connection between divestment actions and their actual impact on society remains unclear. The main research questions addressed in this paper can be summarized as follows:

- How does divestment impact the cost of capital for firms imposing social and environmental costs?

- What level of participation by socially responsible investors is required to achieve meaningful change in corporate behavior?

- Is divestment in secondary markets an effective strategy to achieve social good compared to alternative approaches?

What are the Academic Insights?

By evaluating the impact of divestiture initiatives in secondary markets and by determining whether or not they have materially affected the cost of capital and, if not, whether they are likely to do so in the future, the authors find:

- Divestment in secondary markets has a limited impact on corporate strategy because selling shares merely replaces one investor with another, often without influencing the company’s operations. The primary mechanism through which divestment could indirectly impact firms is by increasing their cost of capital. However, the paper finds that at current participation levels, the change in cost of capital is negligible—estimated at 0.44 basis points—which is too small to materially affect firms’ investment decisions or strategies. Consequently, divestment alone is unlikely to meaningfully reduce social or environmental costs in society.

- Divestment may exert some pressure on firms to improve their behavior by signaling public disapproval and tarnishing their reputation. However, the paper concludes that reputational effects alone are insufficient to drive significant changes in firm behavior unless they are accompanied by broader societal or regulatory actions. For divestment to meaningfully influence corporate behavior, it often needs to be part of a coordinated effort involving consumers, regulators, and other stakeholders who collectively amplify its impact.

- NO-The paper finds that divestment alone has limited ability to financially impact targeted firms significantly. This is because capital markets are deep and diversified, meaning other investors often step in to replace those who divest. While there may be short-term market reactions, these effects are typically not substantial enough to alter a firm’s cost of capital or operational behavior. For divestment to generate meaningful financial pressure, it often requires widespread adoption or complementary measures, such as regulatory interventions or consumer actions, that reinforce its effects.

Why does this study matter?

This research matters because it critically examines the effectiveness of socially conscious investing, particularly divestment, as a tool for addressing social and environmental challenges. While divestment is often seen as a moral and impactful strategy, the study highlights the gaps in its actual mechanism and financial impact. By analyzing the link (or lack thereof) between investor action and societal benefits, the research provides valuable insights for policymakers, investors, and advocates seeking to use financial markets as a lever for positive change. It challenges conventional assumptions and encourages the design of more effective strategies that truly align financial decision-making with societal goals.

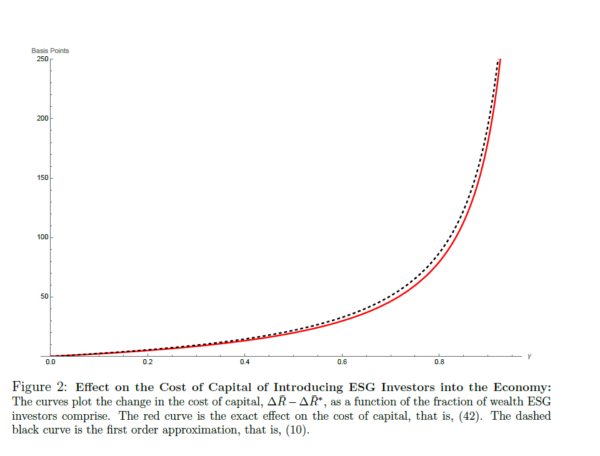

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

The change in the cost of capital that results from a divestiture strategy can be closely approximated by a simple function of three parameters: (1) the fraction of socially conscious capital, (2) the fraction of targeted firms in the economy and (3) the return correlation between the targeted firms and the rest of the stock market. When calibrated to current data, we demonstrate that the impact on the cost of capital is too small to meaningfully affect real investment decisions. We then derive the conditions that would be required for the strategy to have a meaningful impact. We empirically corroborate our theoretical results by studying firm changes in ESG status and are unable to detect an impact of ESG divestiture strategies on the cost of capital of treated firms. Our results suggest that to have impact, instead of divesting, socially conscious investors should invest and exercise their rights of control to change corporate policy.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.