Socially responsible investing (SRI). Environmental, Social, and Governance investing (ESG). Impact investing…and so on…

These socially responsible investing concepts can be roughly described as portfolio strategies that allocate investment dollars based on ethical, social, sustainability, or other factors. This form of investment has become increasingly popular over the last decade (e.g., see the recent move by the Ritholtz gang into the space). Assets pursuing various flavors of these strategies are now measured in the trillions of dollars and index providers have been busy manufacturing products for this cause.

I respect the intention of those who pursue SRI and related approaches. If an investment approach makes one feel more comfortable with their portfolio and can improve their ability to maintain investment discipline, by all means — go for it. This post won’t debate the psychological benefits of the concept and won’t debate the performance characteristics of these approaches. Indeed, a significant amount of research has already been devoted to determining how these practices impact investment performance.

Does investing with a conscience impose a cost on investors via dampened performance or does this form of investing reward investors with better returns? Thus far, the findings on potential cost/benefits appear mixed (see here and here examples of the debate). Notwithstanding, we believe there is a more important concern to be addressed:

Do socially responsible investment policies affect corporate decision-making?

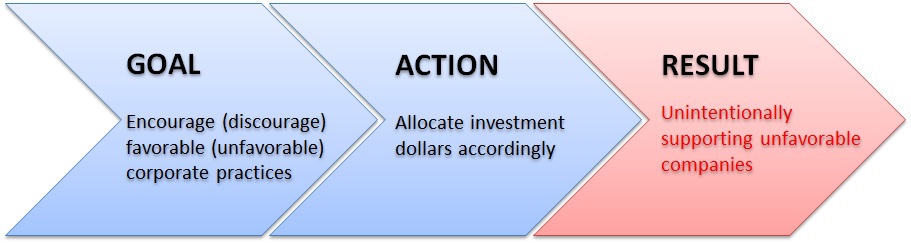

This question is important for a large population of socially responsible investors because the intent of these investment approaches is often to influence corporate behavior (e.g., discourage investment in oil and more investment in solar energy). See the figure below for a visualization of the process of socially responsible investing and the potentially flawed logic that this investment approach will influence corporate behavior.

Figure 1: Flawed Transmission Mechanism

Source: Aaron Brask Capital

I’m going to make a claim that socially responsible investing has little to no impact on corporate behavior, and may in fact make the situation worse! This article discusses the problem and suggests one simple methodology to potentially address the issue.

Socially Responsible Investing Background

For the purpose of our discussion, we will use the phrase conscientious investing or investing with a conscience to describe those strategies integrating ethical focus, impact investing, SRI (socially responsible investing), ESG (environmental, social and governance), or similar factors into their investment policies. The basic logic behind these strategies is to use the practice of investing to support corporate practices or businesses one favors and/or avoid supporting those they do not favor.

There has been ample discussion of the performance implications of investing with a conscience. While I have not conducted a comprehensive survey of the research on this topic, it seems clear there is no universal agreement. Some studies find conscientious investing increases returns while others conclude its impact to be negative. I tend to fall into the negative camp for a few reasons:

- Imposing constraints reduces the universe of stocks available to select from and this translates into less opportunity.

- Many sin stocks fall into the value/contrarian category due to the negative stigma and some have been classified as being too risky (e.g., threat of litigation).

- Analytical factor-based studies have normalized results for other drivers of return and indicated the negative impact to be statistically significant.

Whether or not the performance implications are positive or negative, I believe a more important issue has been taken for granted. In particular, how well does the practice of investing with a conscious target the intended businesses?

The Problem

Let us consider sin stocks as an example.(1) The overall purpose of avoiding investments in these stocks is to lower (or at least not help increase) their share prices and valuations. This translates into a higher cost of capital for those companies and thus raises the bar for them to raise money to fund their operations or new projects. This is assumed to have a negative (at least non-positive) impact on these companies.

There is a significant flaw in this logic, however. In particular, many companies tend to buyback their own stock. If the shares of a particular company are cheaper, this actually helps the company and its shareholders. Indeed, if the share prices are lower than they otherwise would have been, then these companies will spend less cash repurchasing shares or perhaps buy more shares back. In either case, the company and its shareholders benefit.

To be fair, it is possible that cheaper valuations might alter management decisions by attracting capital to the buybacks and away from the actual sin-related business operations. However, I find this logic to be a bit of a stretch. For example, there are many companies with long histories of reinvesting capital for growth while simultaneously rewarding shareholders via dividends and buybacks. It is possible the cheaper valuations allow them to purchase a fixed amount of shares with less money and allocate more to its core business activities. In general, I doubt buyback opportunities (often seen as tax-efficient dividends) would likely sway management in one of these companies away from productive capital investment opportunities.

Putting this together, it appears the conscientious investors who intentionally avoided purchasing the shares of sin stocks may have actually helped some of those companies who were repurchasing their shares.

Figure 2: Sin Stocks Tend to Re-purchase Their Shares

Source: Aaron Brask Capital

This leads to another question: Do sin stocks tend to repurchase their shares or not? We analyzed stocks trading on the New York Stock Exchange (NYSE). Judging by the number of shares of common stock outstanding, it appears over 70% of NYSE-listed sin stocks have been net (re)purchasers of their shares over the last three years. (2)

This calls into account the viability of many conscientious investing strategies. The assumed transmission mechanism may actually help the companies and shareholders of the very firms they intended not to support.

A Simple Fix?

Regardless of the objective or subjective criteria used to define which companies are favorable or unfavorable from a conscientious perspective, we suggest cross referencing the resultant list with another list depicting the magnitudes of corporate buyback activity.

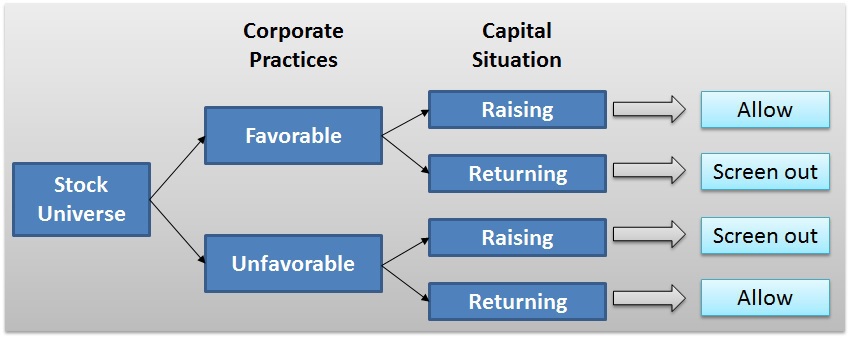

The more general goal should be to help the good companies while not helping the bad companies. A sensible strategy might be to identify the capital needs (e.g., raising capital or returning capital via buybacks) of the targeted firms and make investment decisions contingent on this variable. The simple decision tree below illustrates one simple implementation of this framework.

Figure 3: Integrating Capital Needs

Source: Aaron Brask Capital

The figure above illustrates the decision process for integrating one’s views on corporate practices into their investment strategy. For example, consider a solar firm one wishes to support. If this firm is exploring and deploying new technologies, it will likely be raising capital. Accordingly, a conscientious investor might wish to purchase the stock since this will, in theory, help the firm by supporting its share price and reduce its cost of (equity) capital. On the other hand, if there is a more mature firm engaged in a less favorable business (e.g., tobacco) that is generating sufficient cash flow to support its growth while engaging in share repurchases, conscientious investors might consider allowing this firm into their portfolio. While it might feel counter-productive and weigh on one’s conscious from a psychological perspective, supporting the share price might actually make the buybacks more expensive and thus reduce the cash it reinvests in its unfavorable business activities.

Conclusion

Many investors use their investment dollars to target corporate practices they find particularly favorable or unfavorable. However, I find many such efforts may backfire and result in precisely the opposite of what was intended.

For example, one means of expressing one’s disapproval of a company’s corporate practices is to avoid purchasing that company’s shares. However, I find the majority of sin stocks listed on the NYSE tend to repurchase their shares. So lower share prices actually help these firms and their shareholders as it allows the firm to spend less money on buybacks and/or repurchase more shares at a lower price.

To date, I have not seen any press, research articles, or related discussions addressing this significant issue. This lack of consideration further supports my belief the investment industry is quick to tend to marketing demands of brokers and advisors rather than to performance and the needs of actual investors.

Fortunately, it appears there is a relatively straightforward solution. Index providers and practitioners pursuing such strategies can cross reference their lists of favorable and unfavorable companies with the corporate buyback activity of these firms to ensure their implementation of conscientious investing does supports or does not support the correct firms.

References[+]

| ↑1 | We used NYSE-listed sin stocks as defined by www.SinStockReport.com. |

|---|---|

| ↑2 | ibid. |

About the Author: Aaron Brask

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.