Are Early Stage Investors Biased Against Women?

- Michael Ewens and Richard Townsend

- Journal of Financial Economics, forthcoming

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Recent studies of startup activity in the U.S. find that only roughly 10–15% of startups are founded by women. There are a number of potential explanations including gender differences in technical training or risk preferences. However, many have also speculated that part of the gender gap may, in fact, be due to a lower propensity for investors to fund female entrepreneurs seeking capital. This article investigates this last hypothesis.

In fact, the authors ask the following research questions:

- Are female entrepreneurs are at a disadvantage in raising capital due to their gender?

- If so, why?

What are the Academic Insights?

The authors study a proprietary dataset obtained from AngelList, a popular online platform started in 2010 that connects investors with seed-stage startups. On this platform, 15.8% of founder CEOs who try to raise capital are women (21% of all founders, including non-CEOs). By way of comparison, both Crunchbase and VentureSource, which cover funded startups, have a lower percentage of female founders.

The authors find the following:

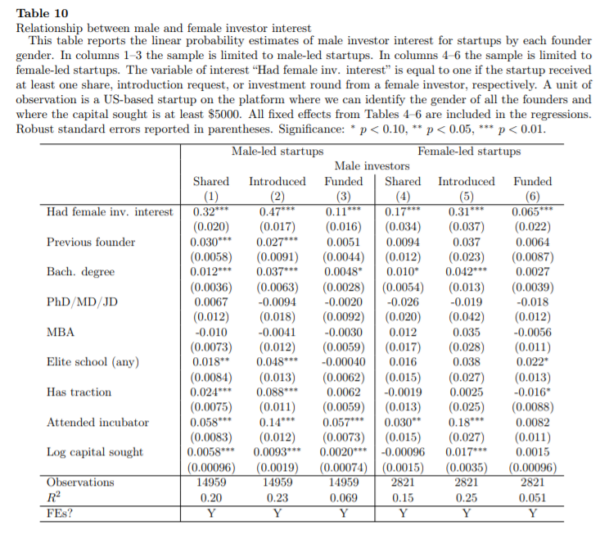

- YES, female-led startups experience significantly more difficulty garnering interest and raising capital from male investors compared to observably similar male-led startups. In particular, women are less successful with male investors, even controlling for a battery of startup/founder characteristics. Additionally, the same female-led startups are actually more successful with female investors than the same observably similar male-led startups.

- The results do not appear to be driven by differences across founder gender in startup quality, industry focus, communication costs, or risk. Differently, they appear consistent with some form of bias among male investors. The authors find weaker evidence of bias among female investors, but it is possible that they simply lack power, as there are significantly fewer female investors in our sample. Therefore, they do not rule out the possibility that male and female investors are symmetrically biased in favor of their own gender.

Why does it matter?

The behavior of male investors is particularly consequential for startups since men constitute the bulk of early-stage investors. One potential implication of these results is that more female investors may be necessary to support the entry of more female entrepreneurs. However, given that early-stage investors are often drawn from the pool of former entrepreneurs (Gompers, Lerner, and Scharfstein, 2005), which at this point is mostly male, the above conclusion gives rise to a “chicken and egg” problem. Thus, policies like the JOBS Act, which promote the democratization of capital by facilitating various forms of equity and crowdfunding, may be key to changing the existing equilibrium.

The Most Important Chart from the Paper

Abstract

We study whether early stage investors have gender biases using a proprietary dataset from AngelList that allows us to observe private interactions between investors and fundraising startups. We find that male investors express less interest in female entrepreneurs compared to observably similar male entrepreneurs. In contrast, female investors express more interest in female entrepreneurs. These findings do not appear to be driven by within-gender screening/monitoring advantages or gender differences in risk preferences. Moreover, the male-led startups that male investors express interest in do not outperform the female-led startups they express interest in—they underperform. Overall, the evidence is consistent with gender biases.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.