DIY Asset Allocation Weights: July 2018

By Wesley Gray, PhD|July 3rd, 2018|Tool Updates|

Do-It-Yourself tactical asset allocation weights for the Robust Asset Allocation [...]

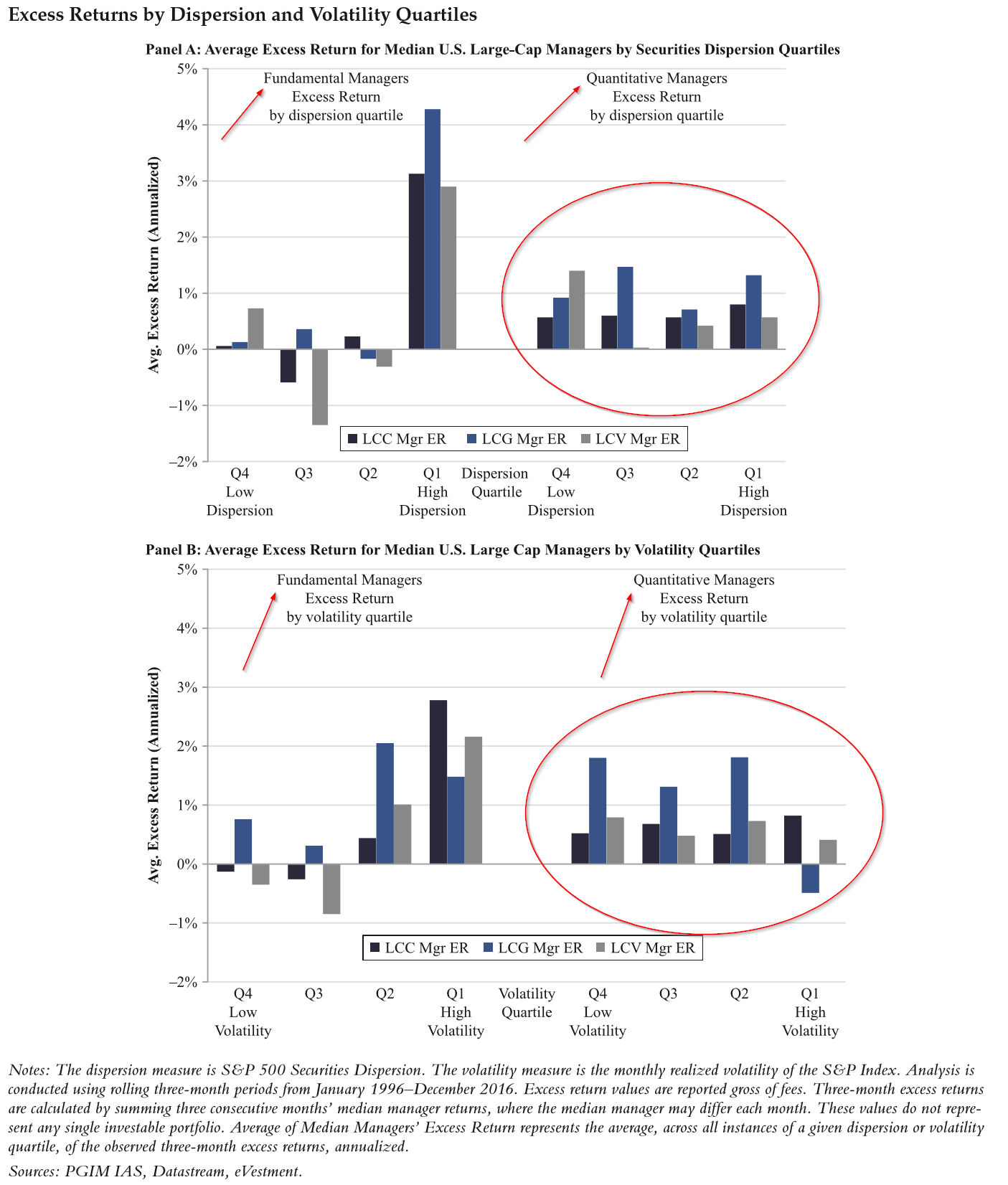

For Consistency Across Market Conditions, Try a Quant Manager

By Tommi Johnsen, PhD|July 2nd, 2018|Research Insights, Basilico and Johnsen, Academic Research Insight|

The Impact of Market Conditions on Active Equity Management Harsh [...]

Podcast: Momentum in Theory, Momentum in Practice (Jack)

By Wesley Gray, PhD|June 29th, 2018|Podcasts and Video, Momentum Investing Research|

Here is a link to our podcast on Flirting with [...]

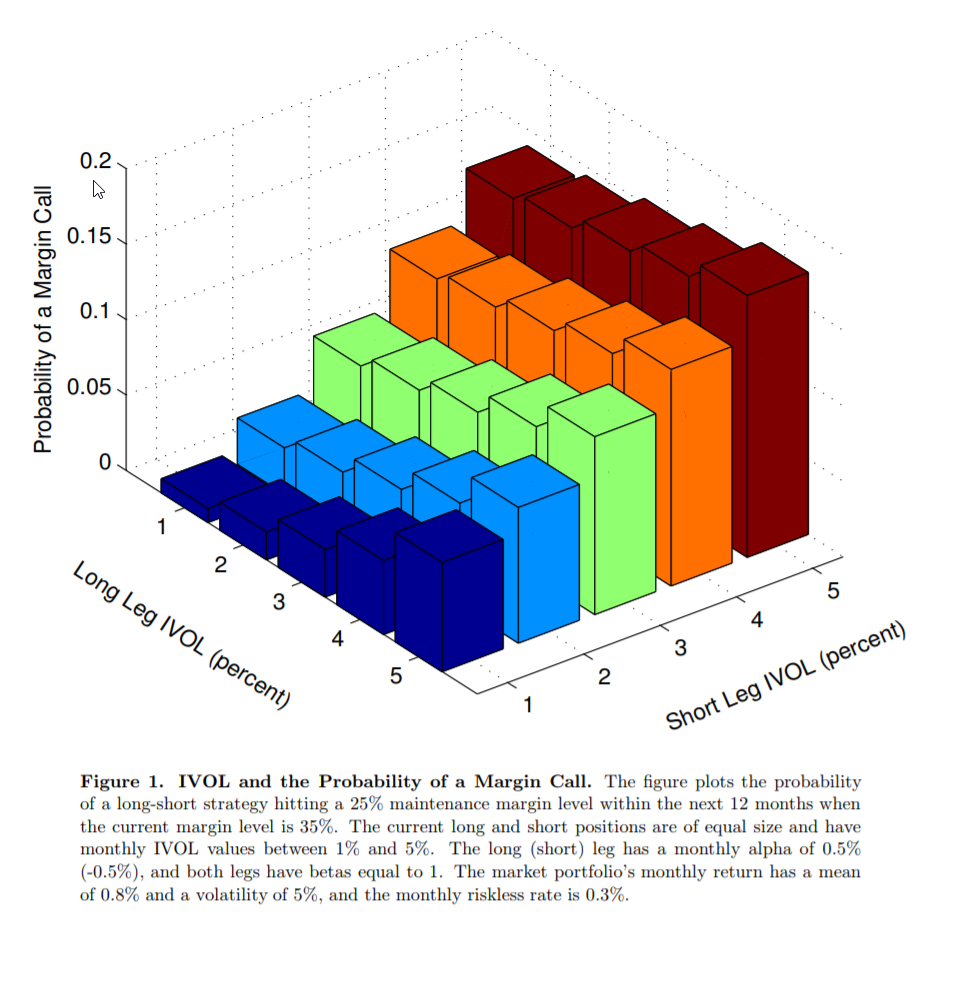

Explaining the Beta Anomaly

By Larry Swedroe|June 28th, 2018|Research Insights, Low Volatility Investing, Active and Passive Investing|

The superior performance of low-beta and low-volatility stocks was documented [...]

Podcast: Corporate Bankruptcy with Kate Waldock (Wes)

By Wesley Gray, PhD|June 26th, 2018|Podcasts and Video, Corporate Governance|

Here is a link to our podcast on Behind the [...]

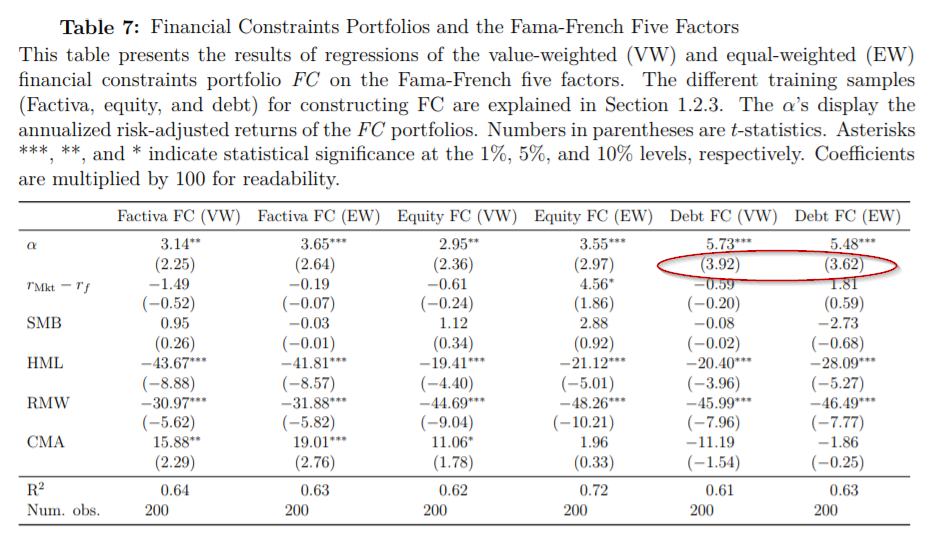

Financial Constraints Generate a 6.5% 5-Factor Fama-French Alpha?

By Wesley Gray, PhD|June 25th, 2018|Basilico and Johnsen, Academic Research Insight|

Are Financial Constraints Priced? Evidence from Textual Analysis Matthias Buehlmaier [...]

Fund of Funds Selection of Mutual Funds: Are Managers Skilled At It?

By Wesley Gray, PhD|June 24th, 2018|Basilico and Johnsen, Academic Research Insight|

Fund of Funds Selection of Mutual Funds Edwin Elton, Martin [...]

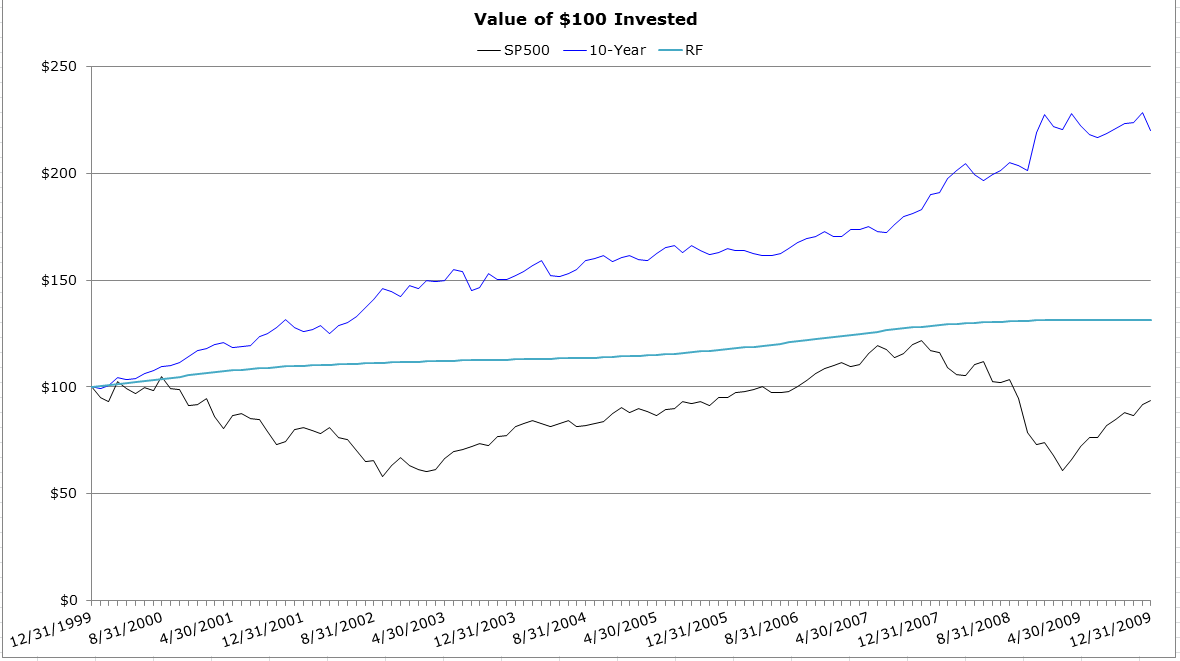

Why you should trust the investment process (even though it’s hard)

By Jack Vogel, PhD|June 21st, 2018|Factor Investing, Research Insights, Trend Following, Key Research, Value Investing Research, Momentum Investing Research|

In this article, we discuss why trusting an investment process [...]

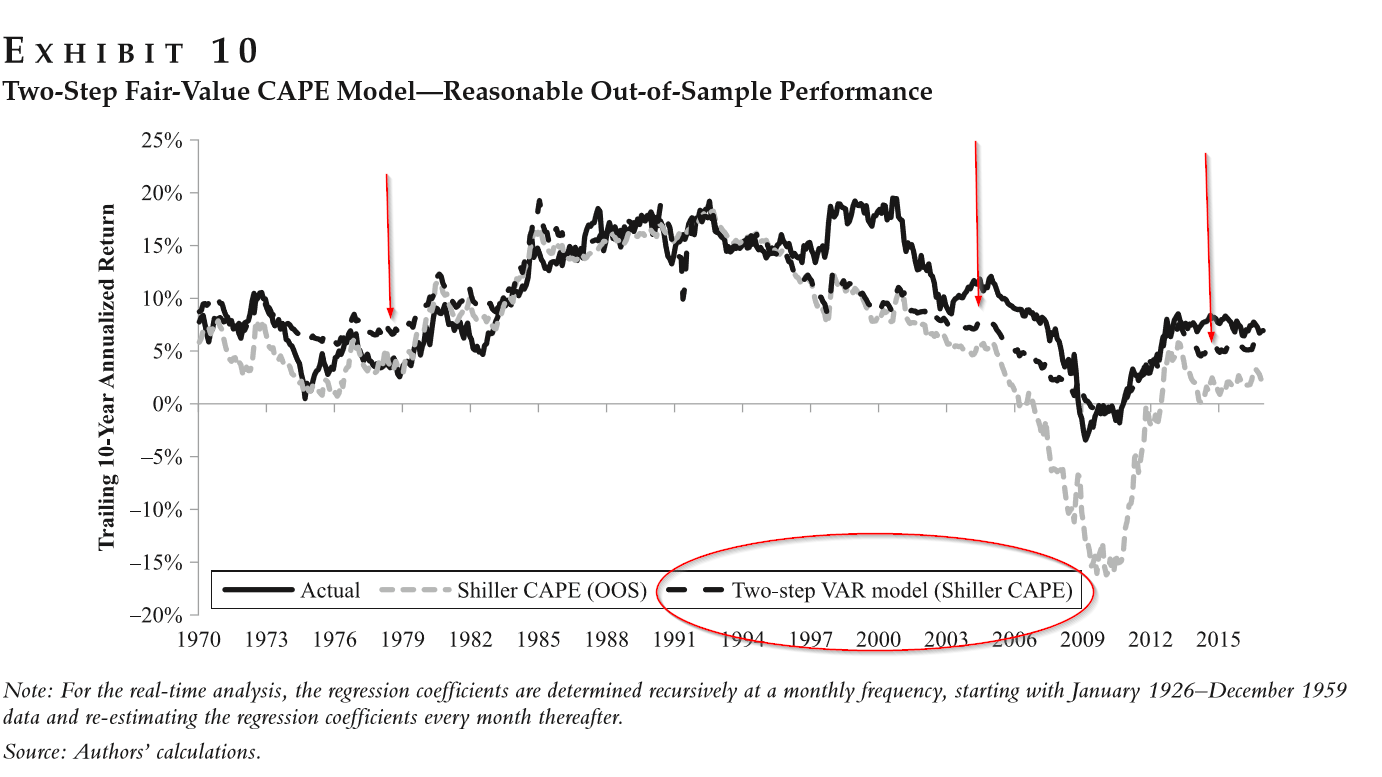

A Smarter CAPE Ratio to Better Forecast Expected Stock Returns

By Tommi Johnsen, PhD|June 18th, 2018|Research Insights, Basilico and Johnsen, Academic Research Insight, Tactical Asset Allocation Research|

Improving U.S. Stock Return Forecasts: A “Fair-Value” CAPE Approach Joseph [...]

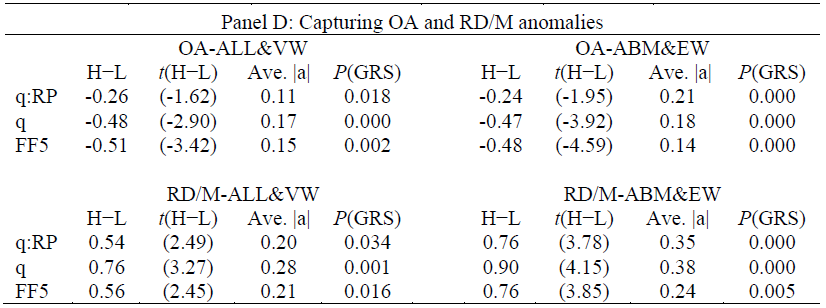

The 52 Week High and the Q-Factor Investment Model

By Jack Vogel, PhD|June 14th, 2018|Research Insights, Factor Investing, Momentum Investing Research|

In the past, we have examined the following two topics: [...]