Call for speakers: Need quants with good ideas

By Wesley Gray, PhD|March 28th, 2023|Research Insights, Conferences|

This is an opportunity to get an all-expense paid trip (plus a stipend) to visit Australia! I'm sure one of our readers is qualified to deliver an excellent discussion for my friends in Melbourne.

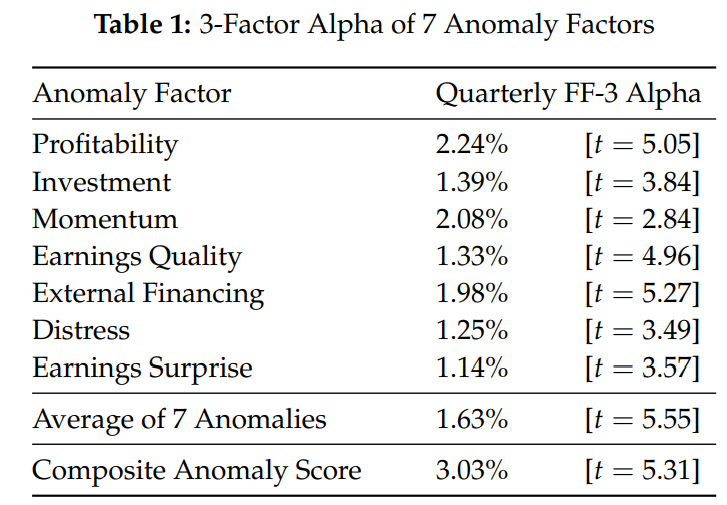

Institutional Investors’ Impact on Factor Premiums

By Larry Swedroe|March 24th, 2023|Research Insights, Factor Investing, Larry Swedroe|

For anomalies that are risk-based, that is what we should expect to see because, while risk cannot be arbitraged away, cash flows can reduce the size of the premium. For the anomalies that are behavioral based, it appears that limits to arbitrage are still sufficient to allow them to persist post-publication.

Comparing past and present inflation rates can be tricky

By Tommi Johnsen, PhD|March 20th, 2023|Inflation Investing, Research Insights, Basilico and Johnsen, Academic Research Insight|

The objective of this article is to build better estimates of CPI headline and core inflation values so inflation comparisons over time are more reliable. The run-up in inflation we are currently experiencing is difficult to contextualize because it is inconsistent with past practices, weights on expenditures have changed, and the treatment of housing costs.

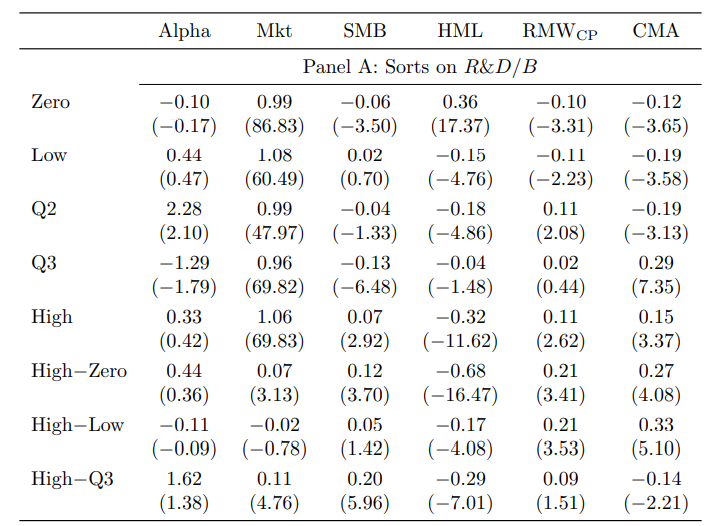

Research and Development, Expected Profitability, and Expected Returns

By Larry Swedroe|March 17th, 2023|Intangibles, Research Insights, Factor Investing, Larry Swedroe|

Regardless of the model used, an anomaly for all models is that the empirical evidence demonstrates that stocks with high research and development (R&D) expenses have delivered a premium.

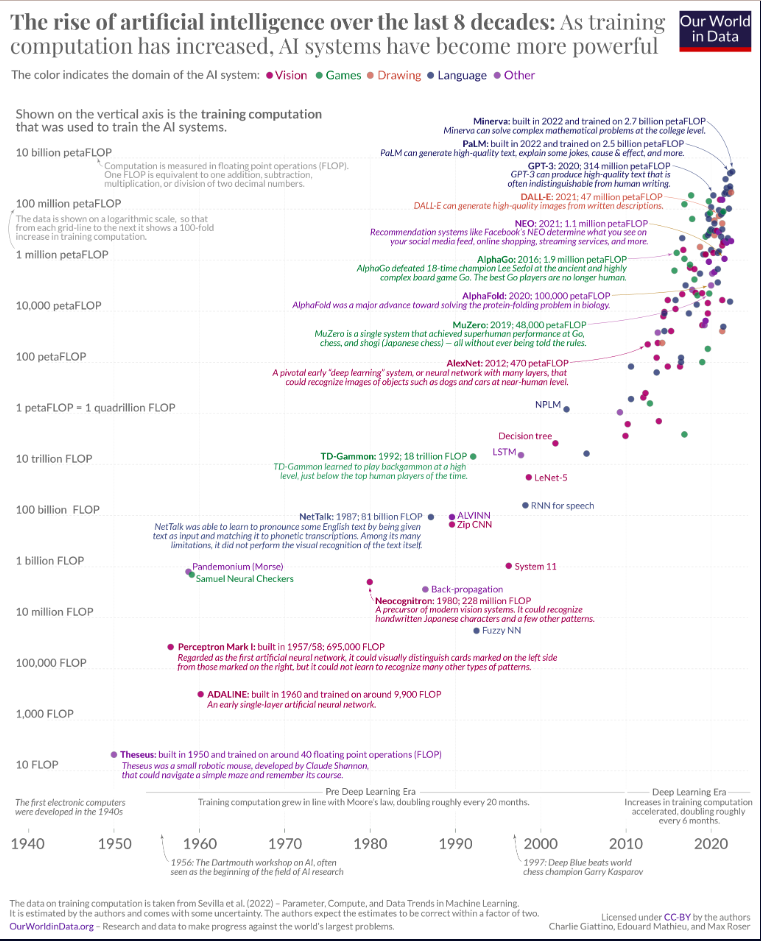

Artificial Intelligence: the Past, the Present and the Future

By Elisabetta Basilico, PhD, CFA|March 13th, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning|

This article examines the state of Artificial Intelligence (AI). We examine its history with an eye toward what it may mean for the world in years to come.

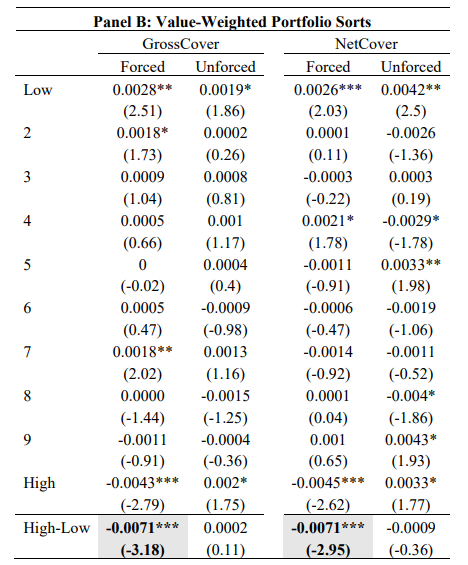

Are Short Covering Trades Informative?

By Larry Swedroe|March 10th, 2023|Larry Swedroe, Factor Investing, Research Insights|

The importance of the role played by short sellers has received increasing academic attention in recent years. Short sellers help keep market prices efficient by preventing overpricing and the formation of price bubbles in financial markets. Market efficiency is important because an efficient market allocates capital efficiently. If short sellers were inhibited from expressing their views on valuations, securities prices could become overvalued and excess capital would be allocated to those firms.

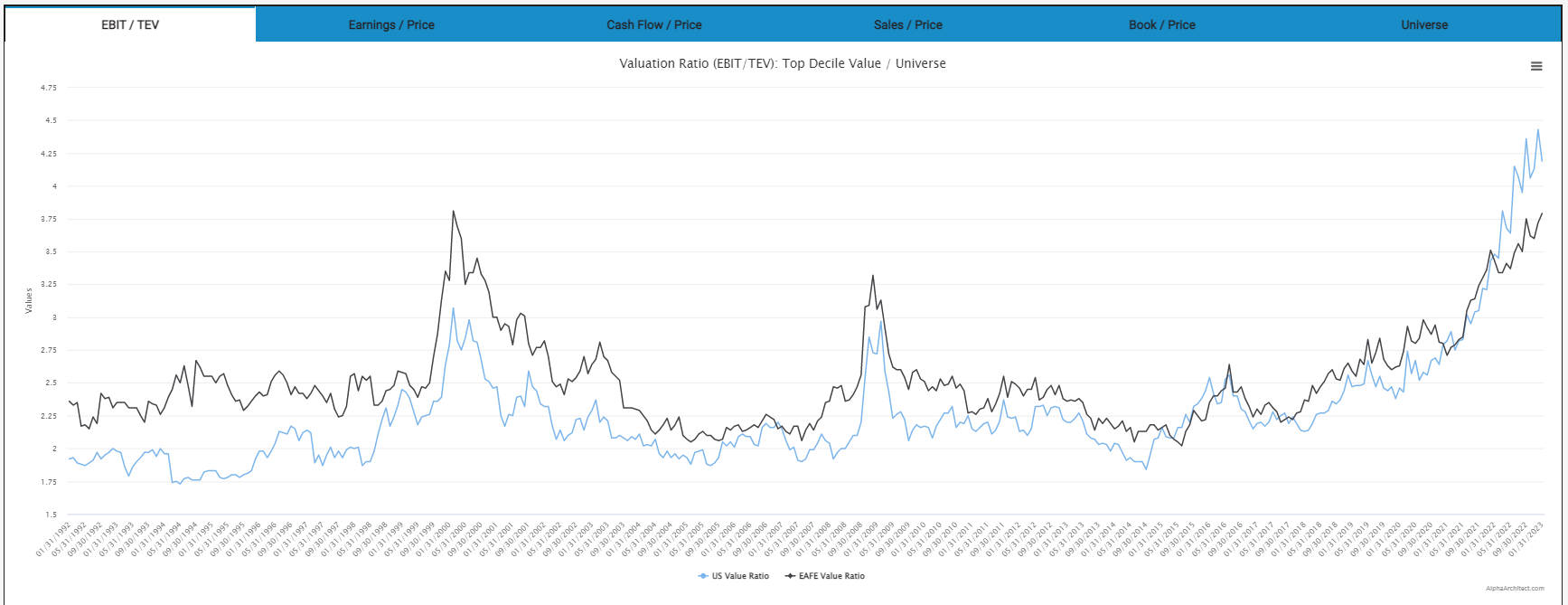

Compression: Can the Value Spread Expand Forever?

By Ryan Kirlin|March 9th, 2023|Factor Investing, Research Insights, Value Investing Research|

We believe owning deep-value stocks is potentially interesting at these valuation peaks. But as I said in the previous two times I wrote this, the spread can get more extreme. At some point, we'd like to stop talking about the valuation spread and its potential effect on forward expected returns...and see that spread COMPRESS!

Global Factor Performance: March 2023

By Wesley Gray, PhD|March 7th, 2023|Index Updates, Factor Investing, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Standardized Performance Factor Performance Factor Exposures Factor Premiums Factor Attribution Factor Data Downloads

Can We Improve Momentum Factor Investing via Salience Theory?

By Tommi Johnsen, PhD|March 6th, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, Behavioral Finance, Momentum Investing Research|

The contribution of salience theory to the theory of asset pricing turns out to be quite a profitable insight for momentum strategies.

Intangibles and the Value Factor

By Larry Swedroe|March 3rd, 2023|Intangibles, Larry Swedroe, Factor Investing, Research Insights|

This figure shows the long, short and long-short leg performance of the intangible value factor in comparison to the traditional value factor. The performance is shown for each of the four regions: U.S., Europe, Japan and Asia Pacific between June 1983 and December 2021. The monthly returns are ex-post volatility scaled to 5% p.m