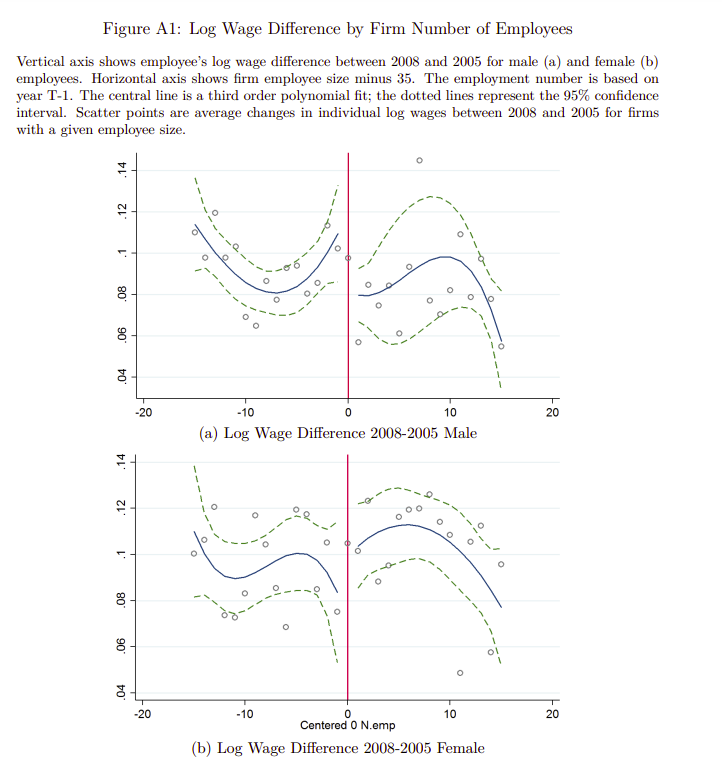

Gender Pay Gap Transparency

By Elisabetta Basilico, PhD, CFA|September 26th, 2022|Insider and Smart Money, Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight|

In this article, we examine what the research says about gender pay gap transparency. We look at the research questions and academic insights with an eye toward why it matters.

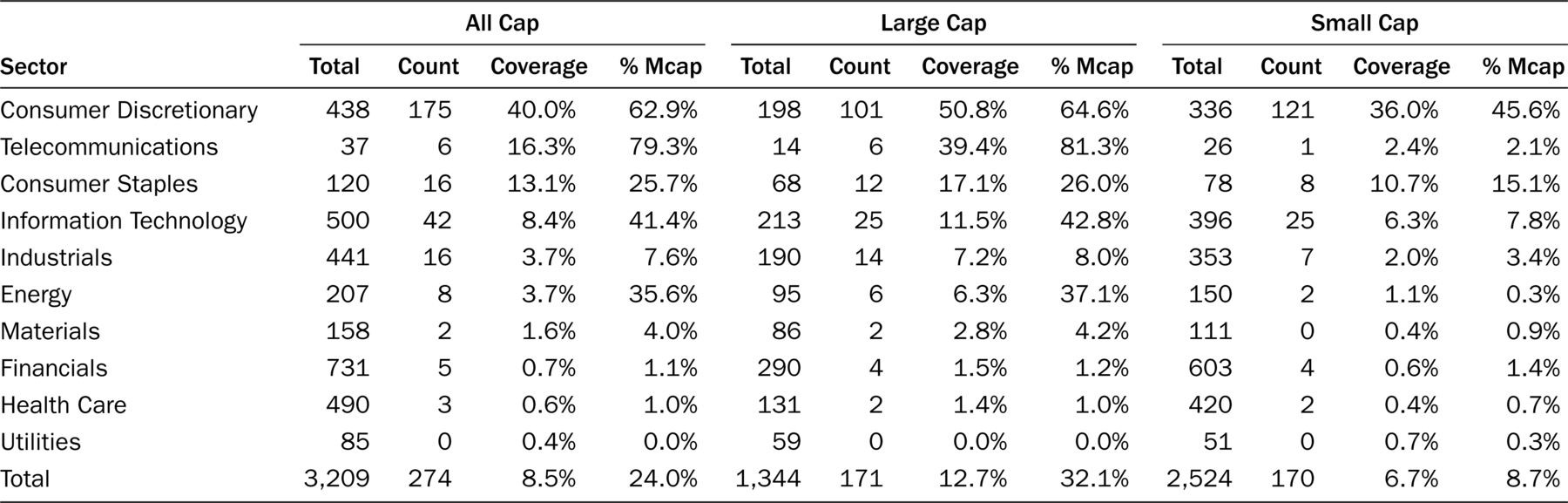

High-Frequency Consumer Spending Data and the Cross-Section of Stock Returns

By Larry Swedroe|September 22nd, 2022|Predicting Market Returns, Research Insights, Larry Swedroe, Academic Research Insight|

Consumer demand drives the cash flows of consumer-oriented companies. Thus, they should serve as a reliable source of information to predict future fundamentals above and beyond the information contained in financial statements and readily available market data.

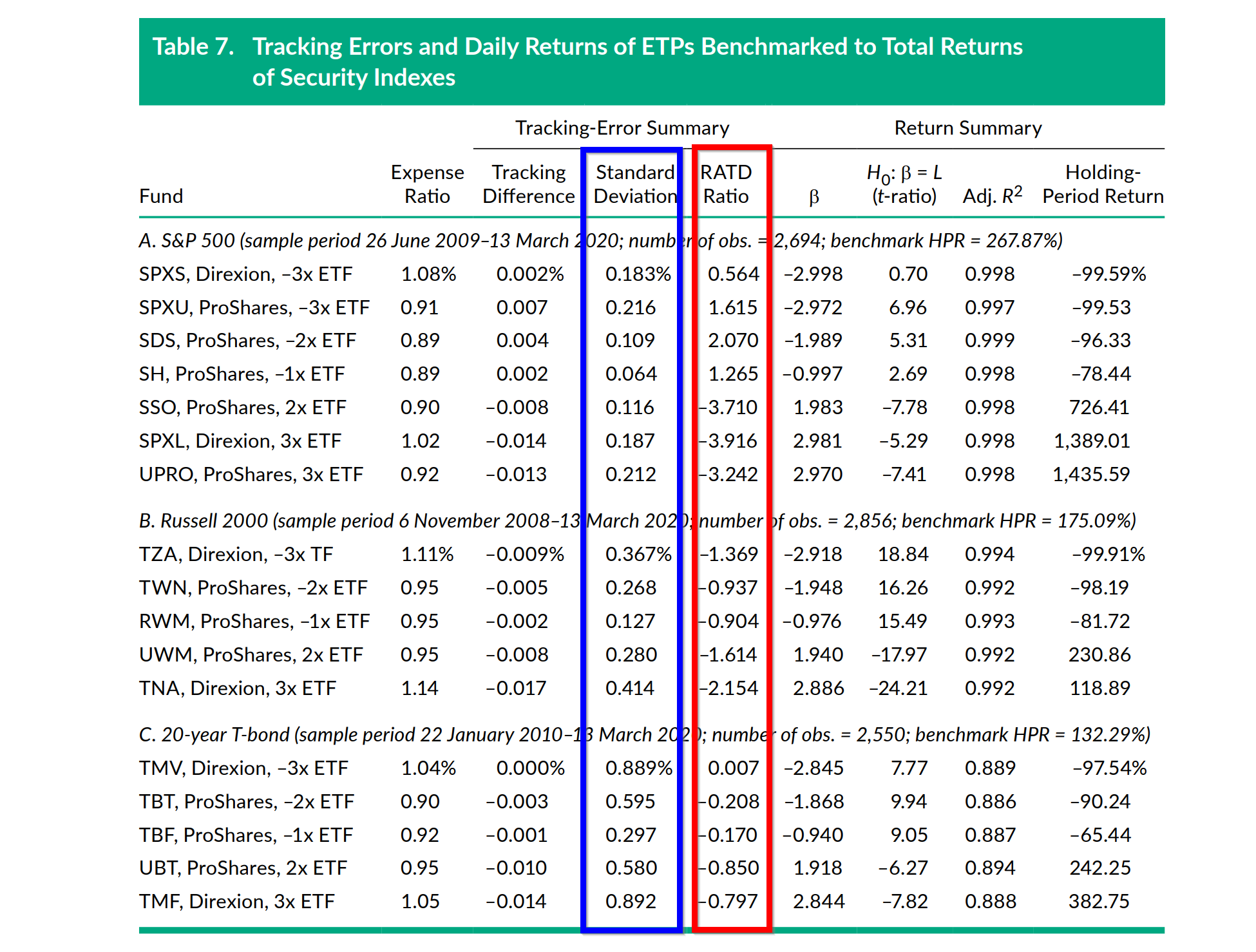

Should Levered and Inverse ETFs Even Exist?

By Tommi Johnsen, PhD|September 21st, 2022|Research Insights, Basilico and Johnsen, Academic Research Insight, ETF Investing|

In this article, we explore Levered and Inverse ETPs (exchange-traded products); their purpose, the circumstances in which they tend to succeed and fail, and the research questions associated with them.

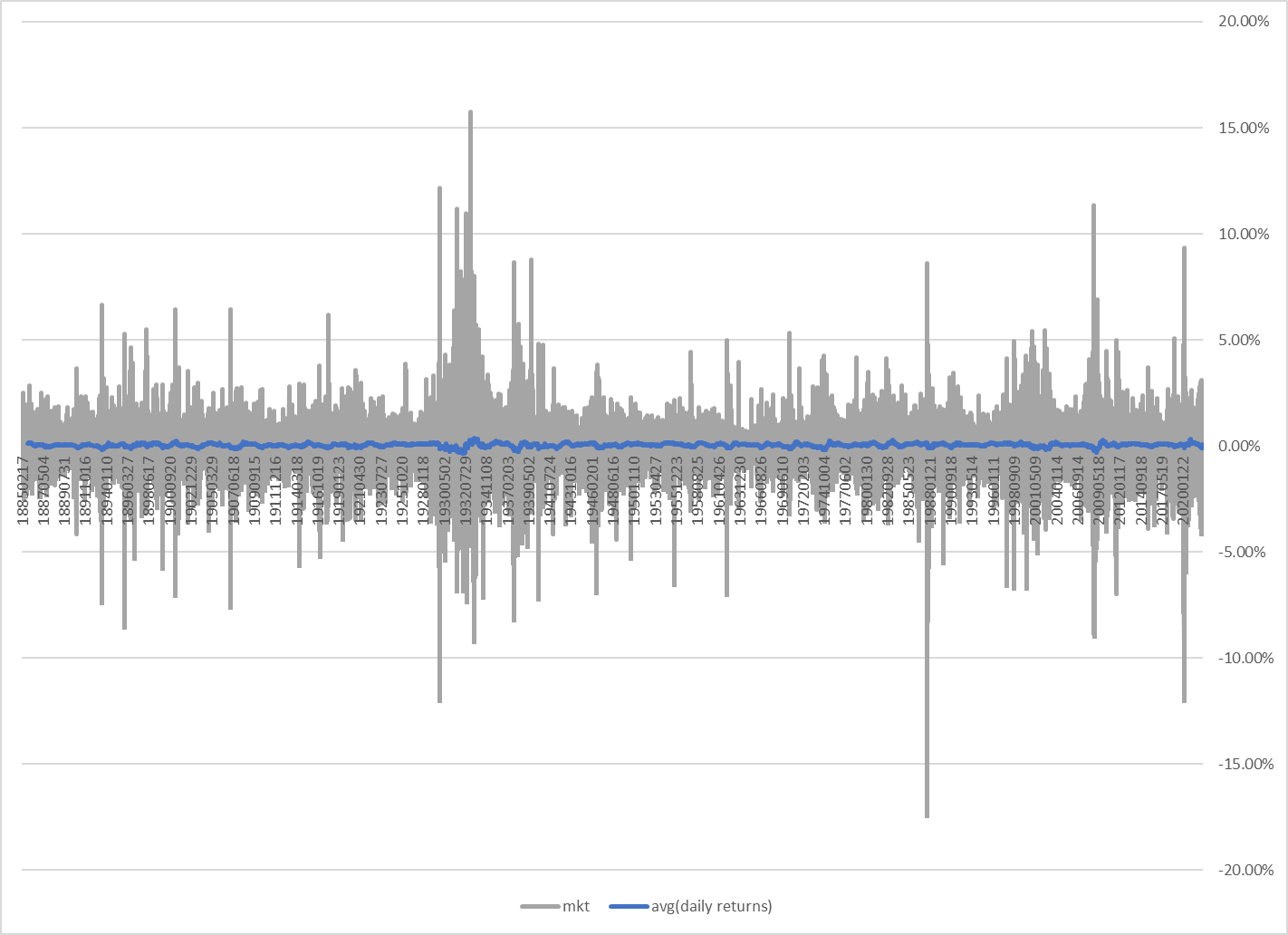

Has the Stock Market Systematically Changed?

By Wesley Gray, PhD|September 20th, 2022|Volatility (e.g., VIX), Research Insights, Active and Passive Investing|

This time is almost always different, it seems, but the data suggest that things are typically always the same: chaotic and volatile. Stock market investors should be prepared for large short-term moves in stocks and they should be skeptical of narratives suggesting a causal relationship between environmental variables and future volatility.

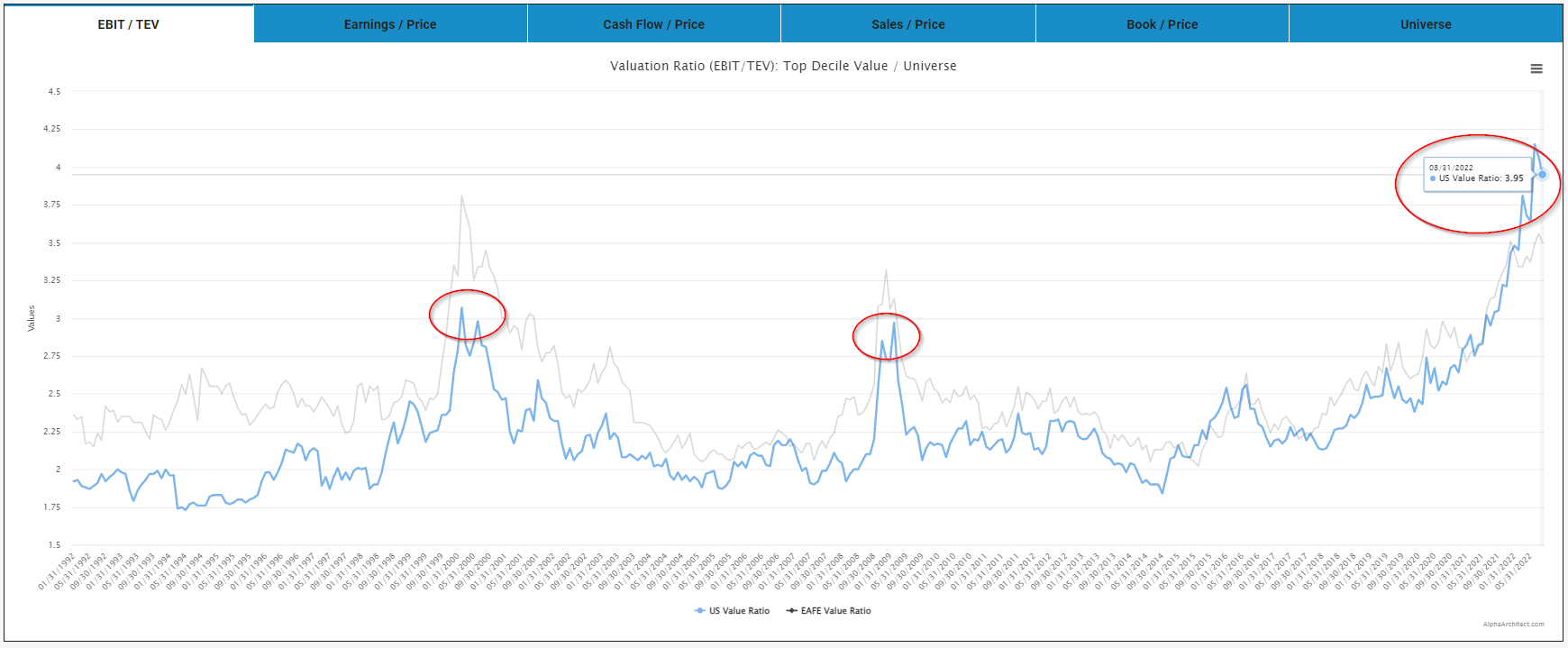

Momentum Investing: How Did Momentum Investing Perform After the Previous Two Valuation Peaks?

By Jack Vogel, PhD|September 16th, 2022|Research Insights, Factor Investing, Momentum Investing Research|

How did Momentum investing perform after the previous two valuation peaks?

This article answers this question.

Key finding: Momentum investing also performed well following episodes when value stocks were cheap. Of course, momentum portfolios did not perform nearly as well as value portfolios, but they did still beat the generic market.

We dig into the details below.

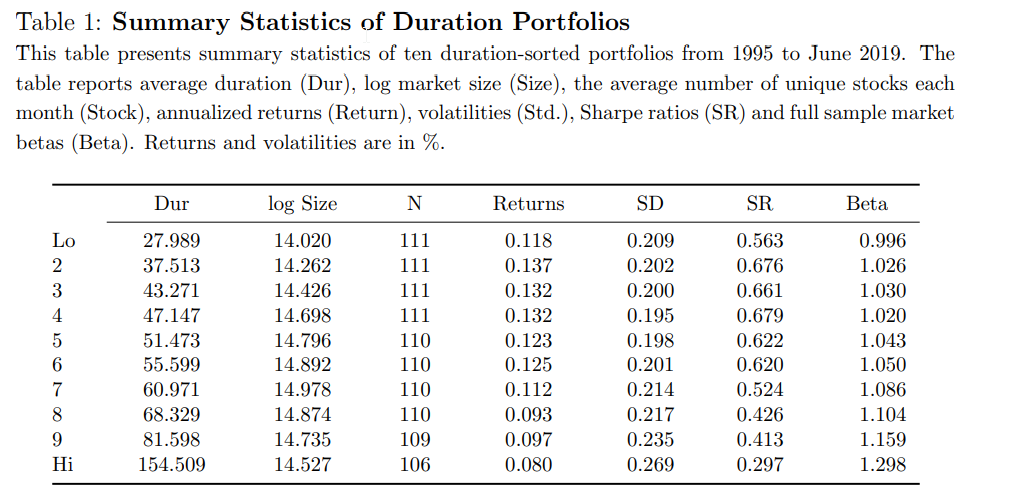

The Short-Duration Equity Premium

By Larry Swedroe|September 15th, 2022|Larry Swedroe, Research Insights, Factor Investing, Academic Research Insight, Low Volatility Investing|

We examine the short-duration premium using pre-scheduled economic, monetary policy, and earnings announcements. We provide high-frequency evidence that duration premia associated with revisions of economic growth and interest rate expectations are consistent with asset pricing models but cannot explain the short-duration premium. Instead, we show that the trading activity of sentiment-driven investors raises prices of long-duration stocks, which lowers their expected returns, and results in the short-duration premium. Long-duration stocks have the lowest institutional ownership, exhibit the largest forecast errors at earnings announcements, and show the highest mispricing scores.

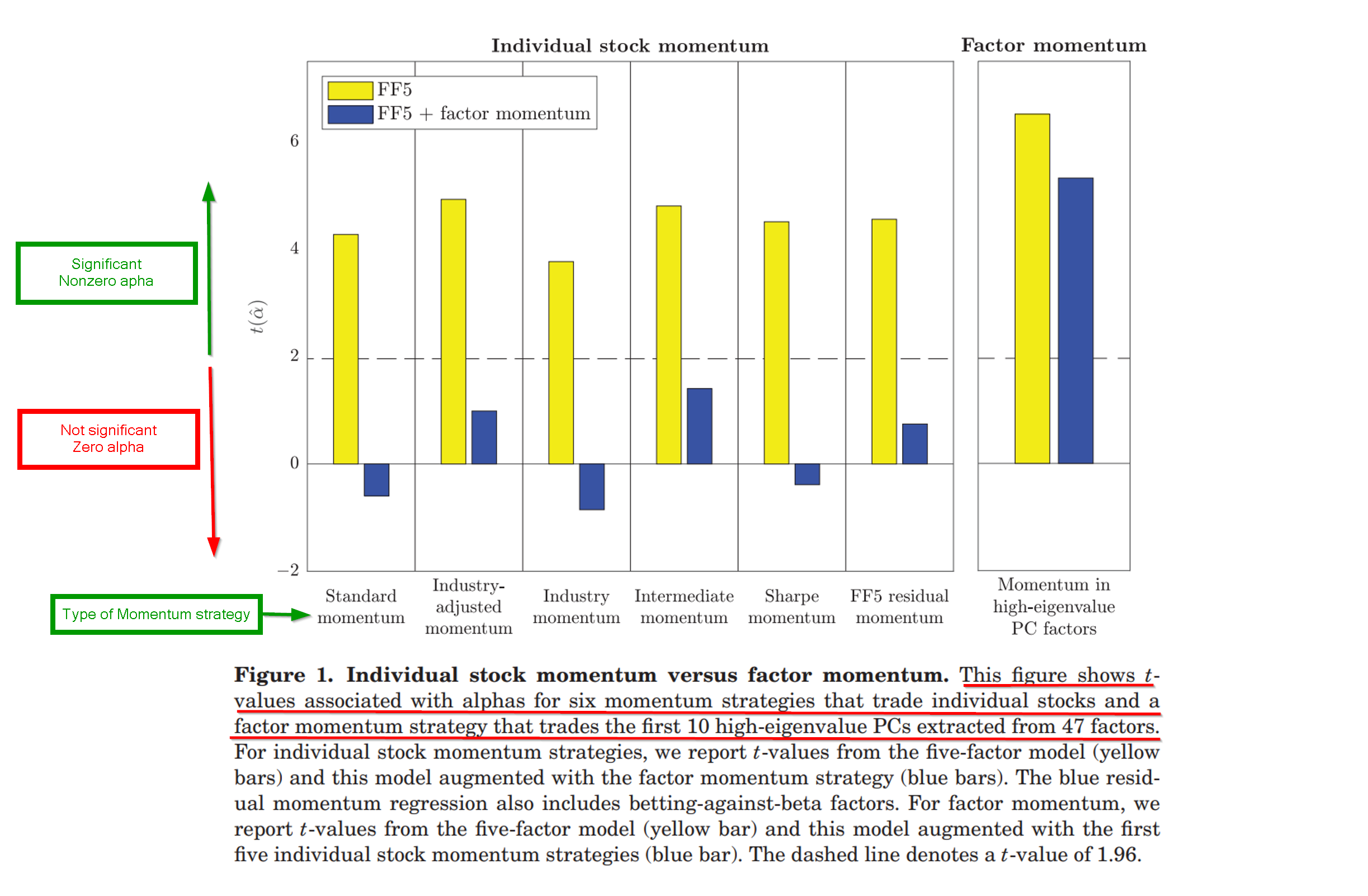

Is Momentum a Separate Factor?

By Tommi Johnsen, PhD|September 12th, 2022|Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight, Momentum Investing Research|

We find that factor momentum concentrates in factors that explain more of the cross section of returns and that it is not incidental to individual stock momentum: momentum-neutral factors display more momentum.

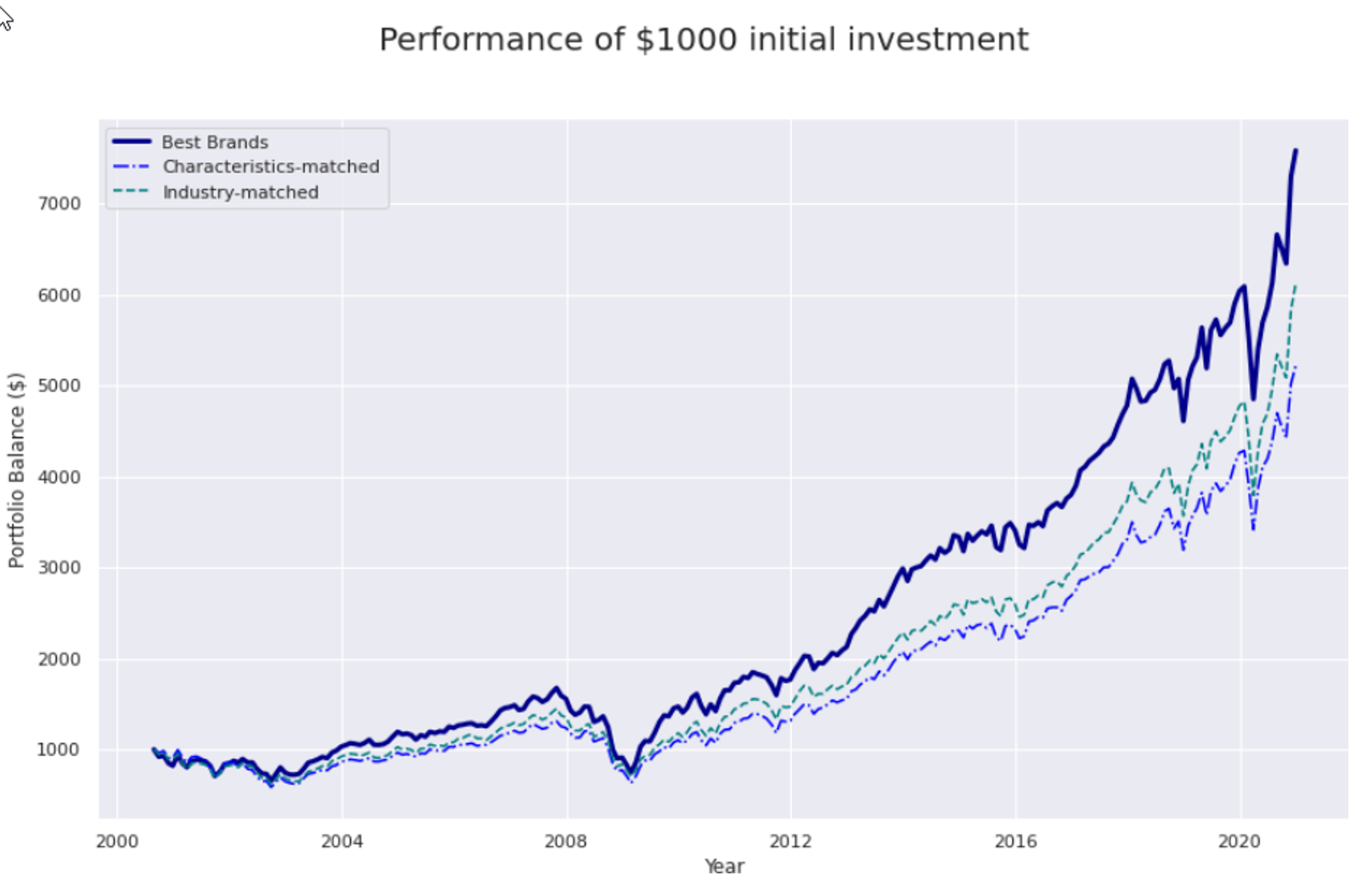

Brand Values and Long-Term Stock Returns

By Larry Swedroe|September 8th, 2022|Smarter in 10 Minutes, Intangibles, Larry Swedroe, Factor Investing, Academic Research Insight|

An equal-weighted portfolio of Best Brands (BBs) in the U.S. earns an excess return of 25 to 35 bps per month during the period 2000-2020. This result is remarkably robust across various factor models and therefore is not driven by exposure to common (risk) factors. The excess returns of the BB portfolio are not due to firm characteristics, industry composition, or small-cap stocks. We provide evidence suggesting that expensing investments in brands (instead of capitalizing them) and the tendency to underestimate the effect of brand name on generating future earnings are two mechanisms contributing to the excess returns.

Global Factor Performance: September 2022

By Wesley Gray, PhD|September 7th, 2022|Index Updates, Factor Investing, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Standardized Performance Factor Performance Factor Exposures Factor Premiums Factor Attribution Factor Data Downloads

ESG Ratings how do they Compare Across Data Providers?

By Elisabetta Basilico, PhD, CFA|September 7th, 2022|ESG, Research Insights, Basilico and Johnsen, Academic Research Insight|

Investments aligned with environmental, social, and governance (ESG) principles are rapidly growing globally. In the exchange traded fund (ETF) industry, this gives rise to the power of ESG rating firms that have the influence to direct capital flows into ETFs tracking the indexes. This article examines the issues of substantial ESG rating divergence across rating firms, the impact on investors’ choices, and the influence on the ETF industry. The divergence appears to be the greatest in social and governance components, and is often qualitative in nature. The author found that certain economic sectors are more prone to ESG rating divergence than others. She presents a case study about two ESG ETFs that are viewed quite differently under various rating lenses, and offers suggestions to investors, advisors, and analysts on how to research ESG ETFs, given the major rating divergence. The article concludes with ways the ETF industry could improve its practices collectively to better serve investors with clarity and to sustain the growth of ESG impact investments.