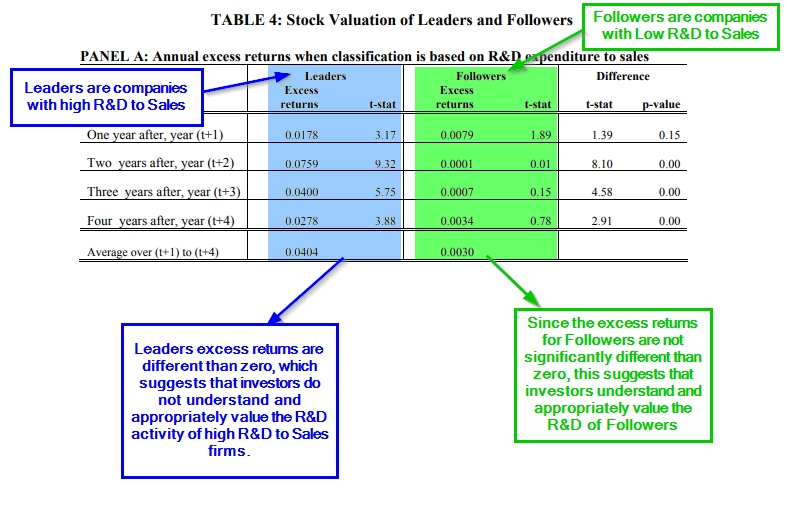

The R&D Premium: Is it Risk or Mispricing?

By Larry Swedroe|February 18th, 2021|Quality Investing, Factor Investing, Research Insights|

Asset pricing models are important because they help us understand [...]

Meb Faber Podcast: Doug Discusses 1042 QRP and ESOP Transactions

By Wesley Gray, PhD|February 18th, 2021|Research Insights, Podcasts and Video, Media, Momentum Investing Research|

Doug Pugliese, the head of our 1042 QRP business, was [...]

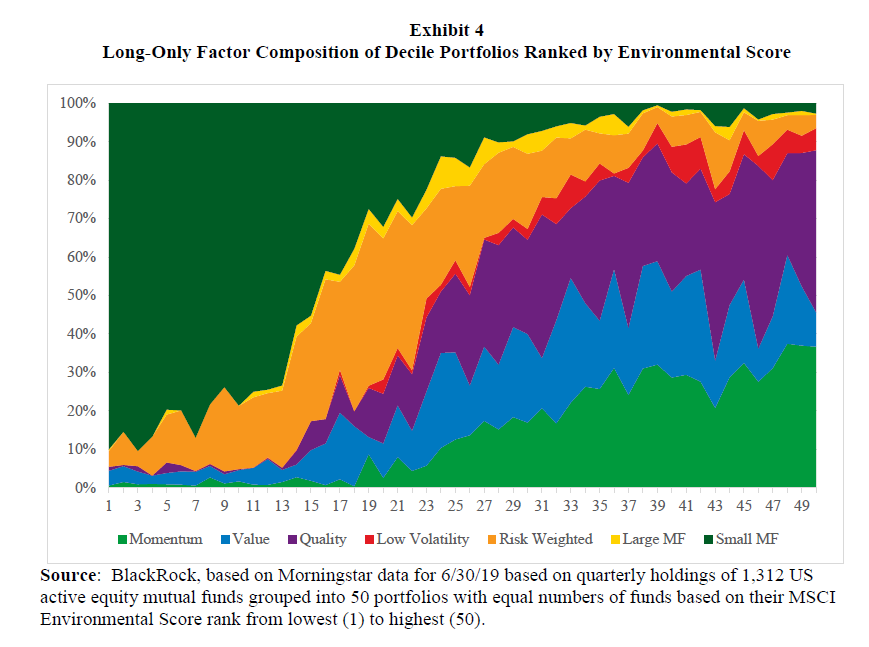

ESG Factors and Traditional Factors

By Wesley Gray, PhD|February 16th, 2021|ESG, Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Investment Advisor Education|

Toward ESG Alpha: Analyzing ESG Exposures through a Factor Lens [...]

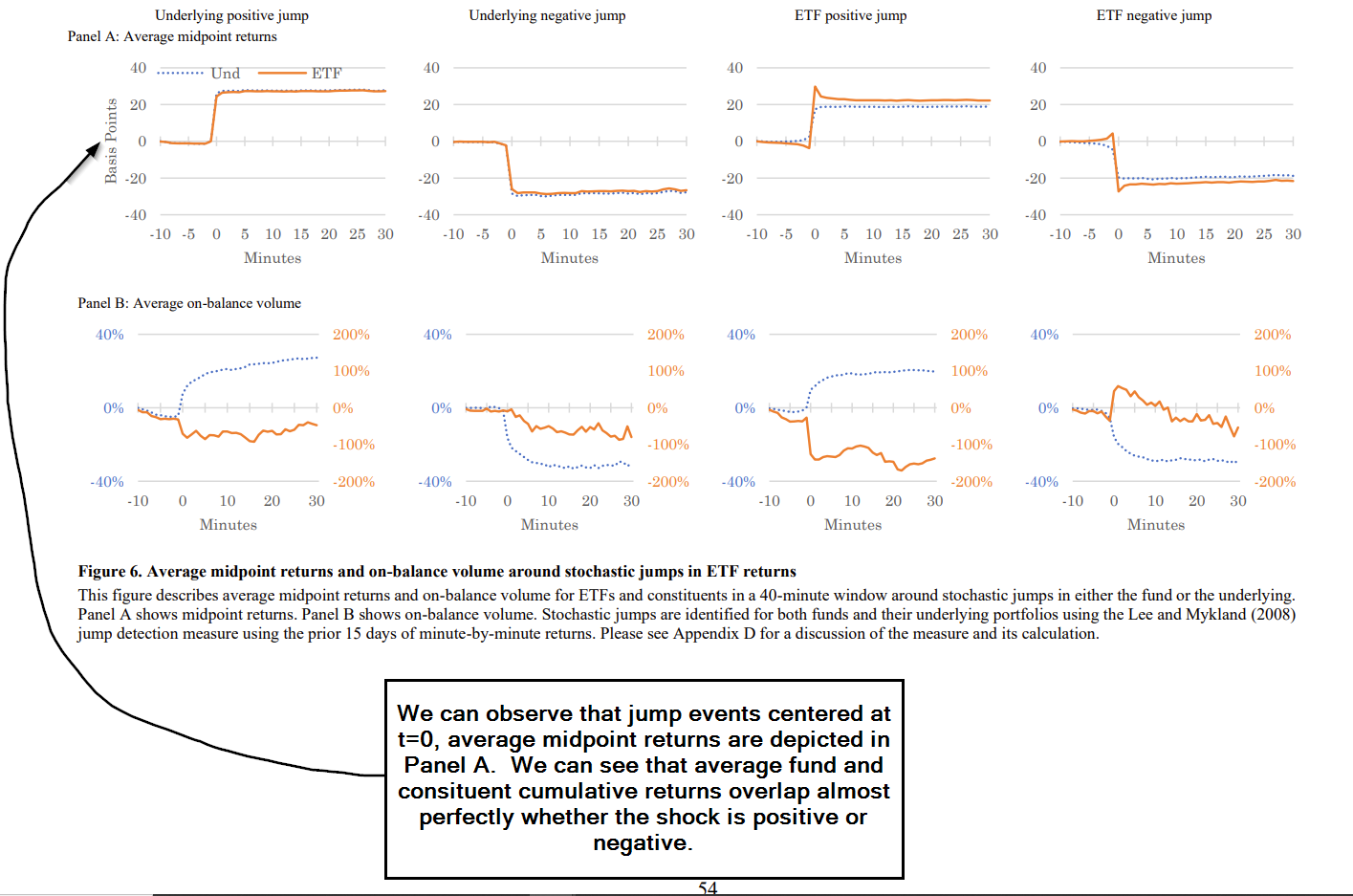

Do ETFs Adversely Affect Market Quality? Nope.

By Wesley Gray, PhD|February 11th, 2021|Research Insights, Academic Research Insight, ETF Investing|

Intraday Arbitrage Between ETFs and their Underlying Portfolios Box, Davis, [...]

Global Factor Performance: February 2021

By Wesley Gray, PhD|February 9th, 2021|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index [...]

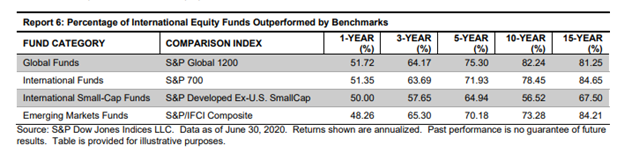

Will the Real Value Factor Funds Please Stand Up?

By Tommi Johnsen, PhD|February 8th, 2021|Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Value Investing Research|

Characteristics of Mutual Fund Portfolios: Where Are the Value Funds? [...]

Excess Returns Podcast: Jack discussing Momentum and Trend

By Jack Vogel, PhD|February 5th, 2021|Research Insights, Podcasts and Video, Media, Momentum Investing Research|

I was recently invited on the Excess Returns podcast with [...]

Do Security Analysts Follow the Academic Evidence?

By Larry Swedroe|February 4th, 2021|Research Insights, Larry Swedroe, Factor Investing, Academic Research Insight|

As my co-author Andrew Berkin and I explain in our [...]

DIY Asset Allocation Weights: February 2021

By Ryan Kirlin|February 2nd, 2021|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Do-It-Yourself tactical asset allocation weights for the Robust Asset Allocation [...]

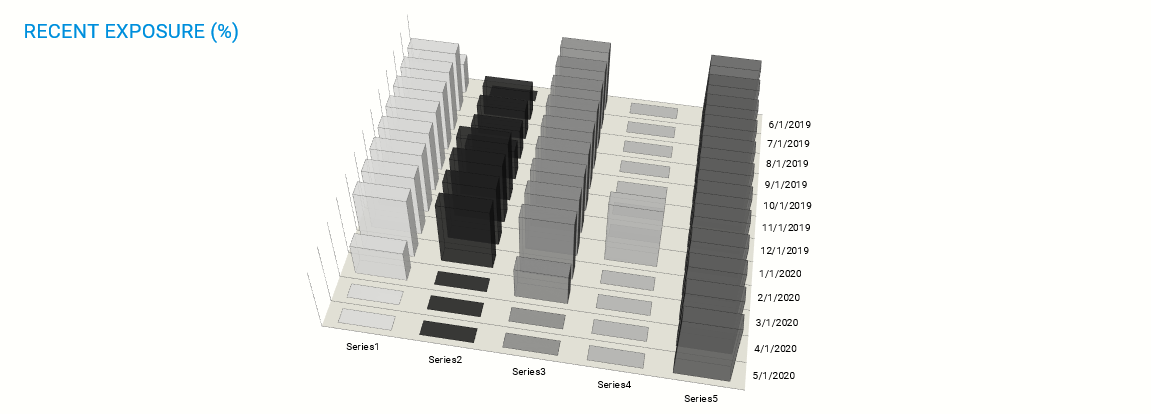

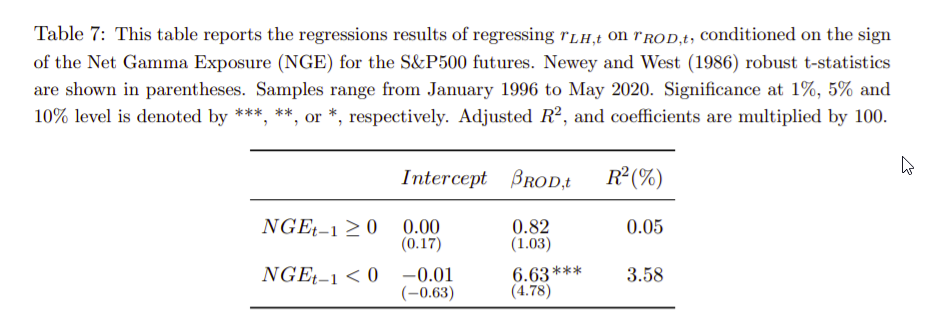

Hot Topic: Does “Gamma” Hedging Actually Affect Stock Prices?

By Wesley Gray, PhD|February 1st, 2021|Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Momentum Investing Research|

Hedging Demand and Market Intraday Momentum Guido Baltussen, Zhi Da, [...]