The predictability of crowding on factor strategy performance

By Tommi Johnsen, PhD|January 27th, 2020|Research Insights, Basilico and Johnsen, Academic Research Insight|

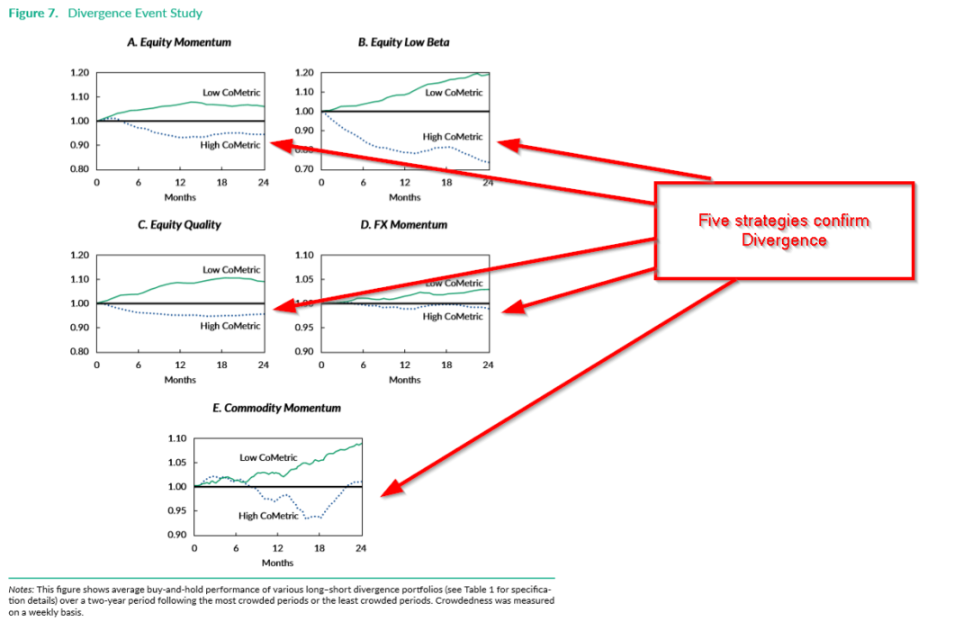

The Impact of Crowding in Alternative Risk Premia Investing Nick [...]

How to Turn Cross-Sectional into Time-Series Momentum (and be home in time for dinner)

By Darren Hom|January 24th, 2020|Research Insights, Factor Investing, Momentum Investing Research|

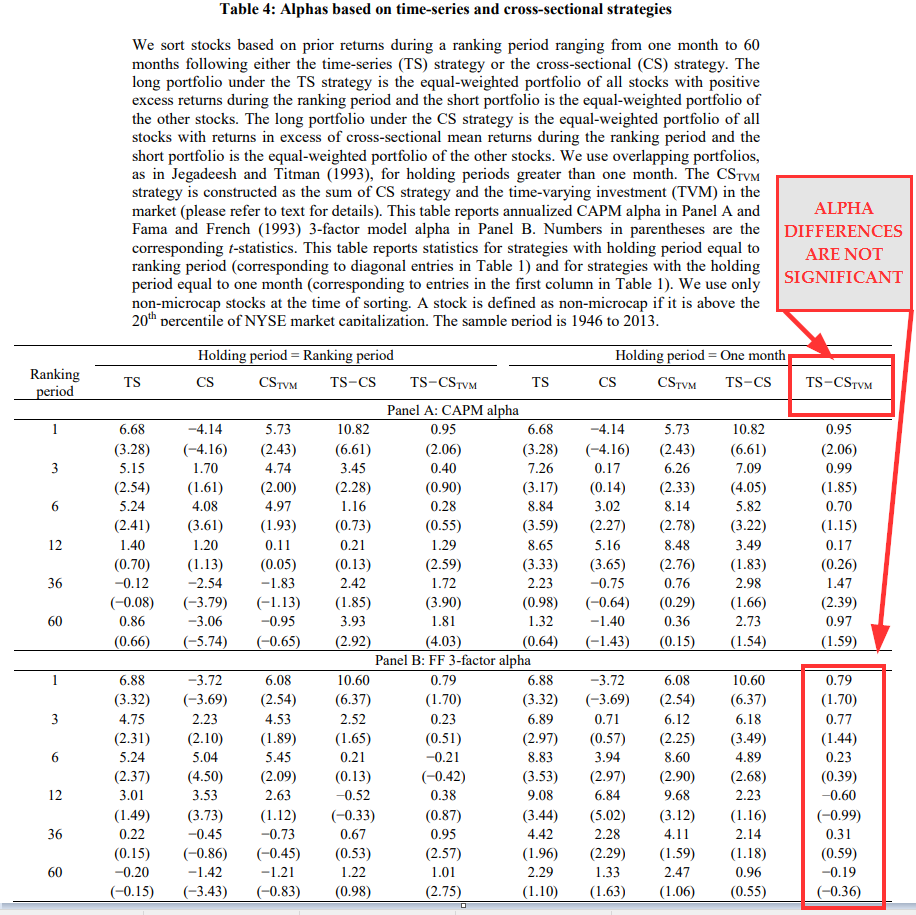

Cross-Sectional and Time-Series Tests of Return Predictability: What Is the [...]

Visualization Sector Trends with R Code

By Jonathan Regenstein|January 23rd, 2020|Reproducible Finance, Research Insights, Trend Following, Tool How-To-Guides, Momentum Investing Research|

Welcome to a year-end installment of Reproducible Finance with R, [...]

Enterprise Multiples and Expected Stock Returns

By Wesley Gray, PhD|January 21st, 2020|Financial Planning, Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight, Value Investing Research|

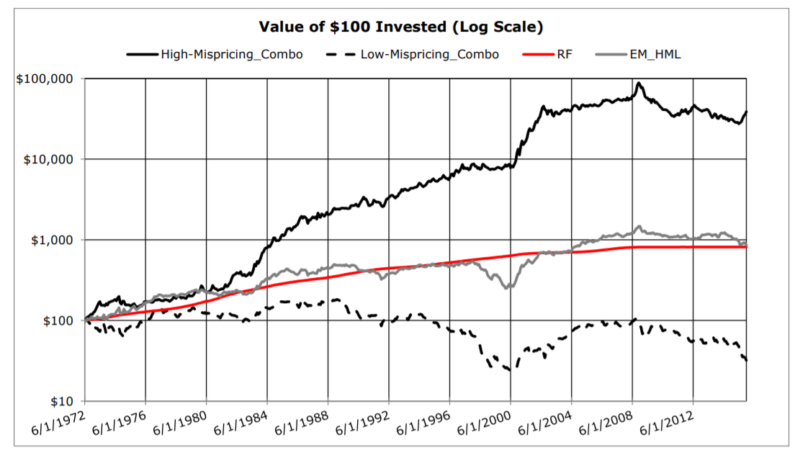

Why Do Enterprise Multiples Predict Expected Stock Returns? Steve Crawford, [...]

Timing Low Volatility with Factor Valuations

By Nicolas Rabener|January 16th, 2020|Factor Investing, Research Insights, Guest Posts, Low Volatility Investing|

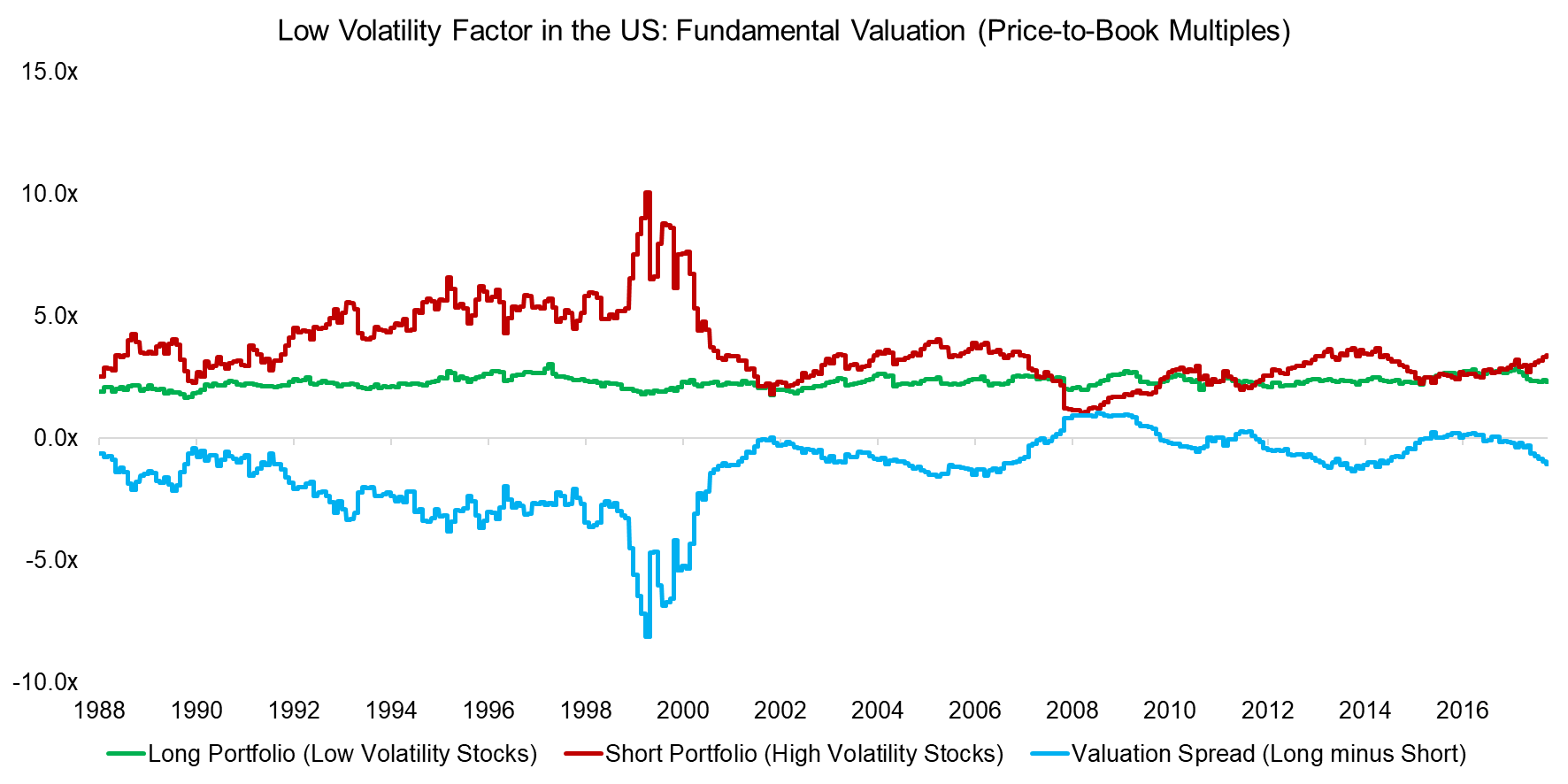

INTRODUCTION Funds flows are frequently analyzed by investors to gauge [...]

Top 5 Most Interesting Papers from the Annual Finance Geek Fest

By Wesley Gray, PhD|January 14th, 2020|Research Insights, Conferences|

The American Finance Association Annual Meetings have now come and gone [...]

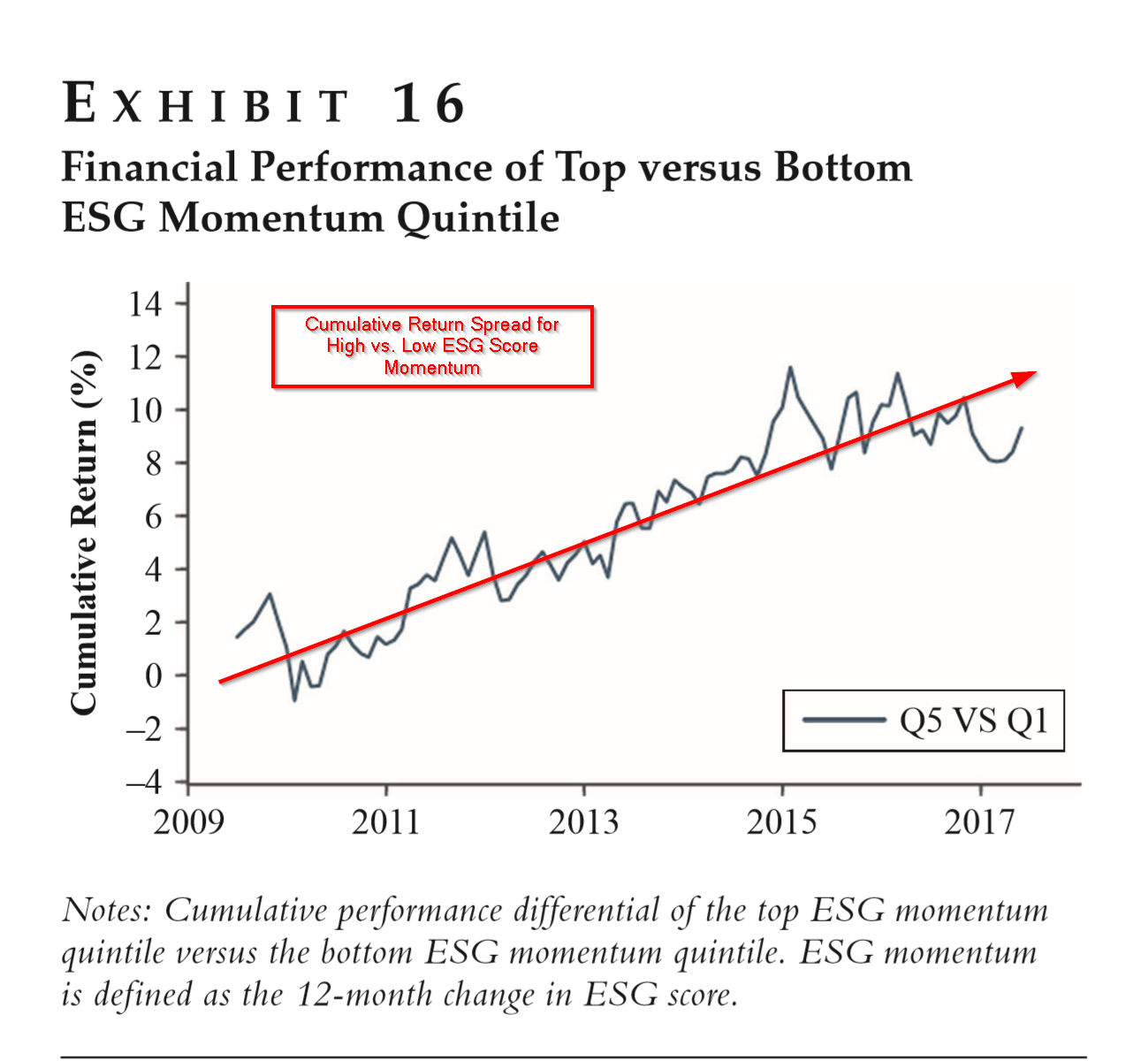

How ESG Affects Valuation, Risk, and Performance

By Tommi Johnsen, PhD|January 13th, 2020|ESG, Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight|

Foundations of ESG Investing: How ESG Affects Equity Valuation, Risk, [...]

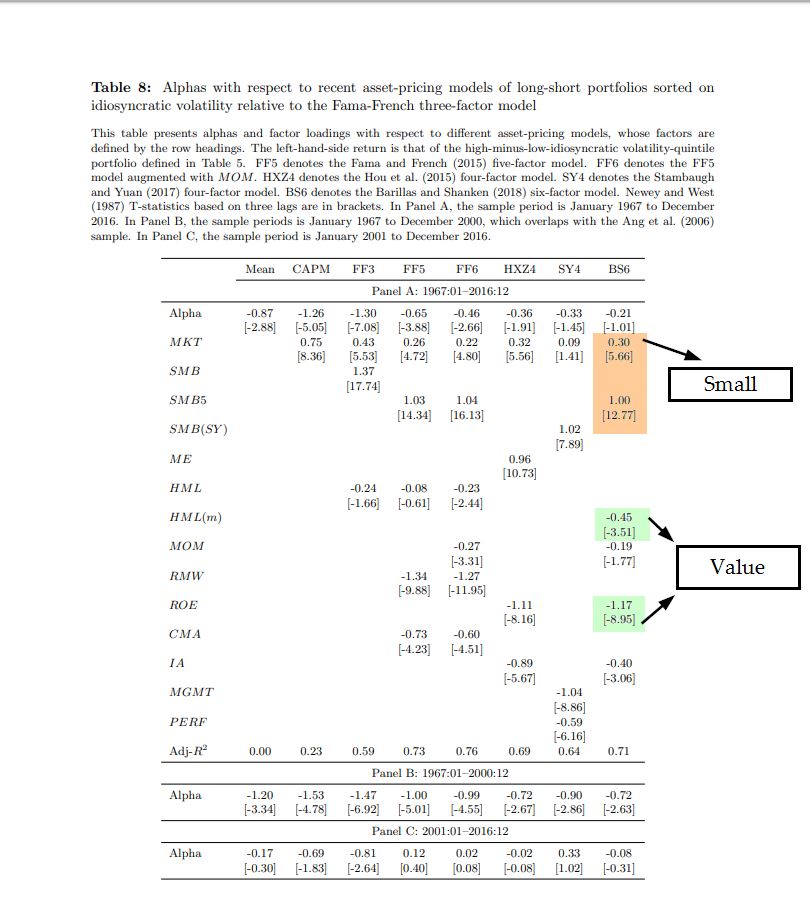

The Idiosyncratic Volatility Puzzle: Then and Now

By Larry Swedroe|January 9th, 2020|Larry Swedroe, Research Insights, Low Volatility Investing|

One of the interesting puzzles in finance is that stocks [...]

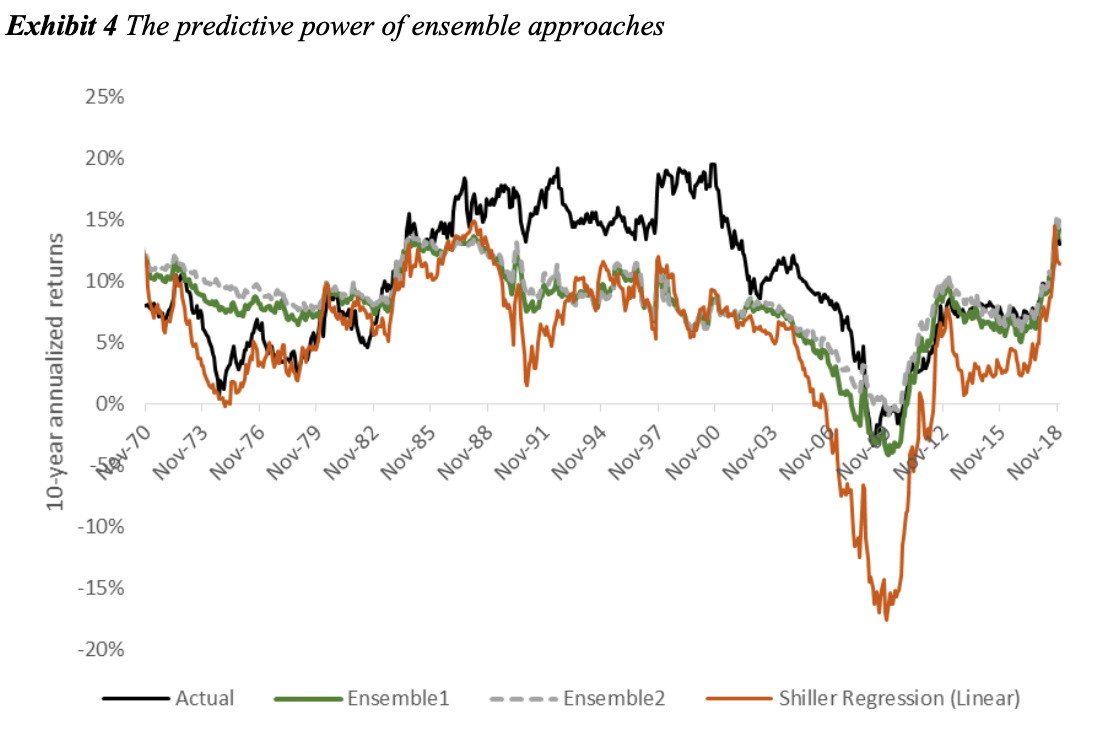

Forecasting US Equity Market Returns with Machine Learning

By Druce Vertes|January 7th, 2020|Research Insights, AI and Machine Learning, Tactical Asset Allocation Research|

Shiller's CAPE ratio is a popular and useful metric for [...]

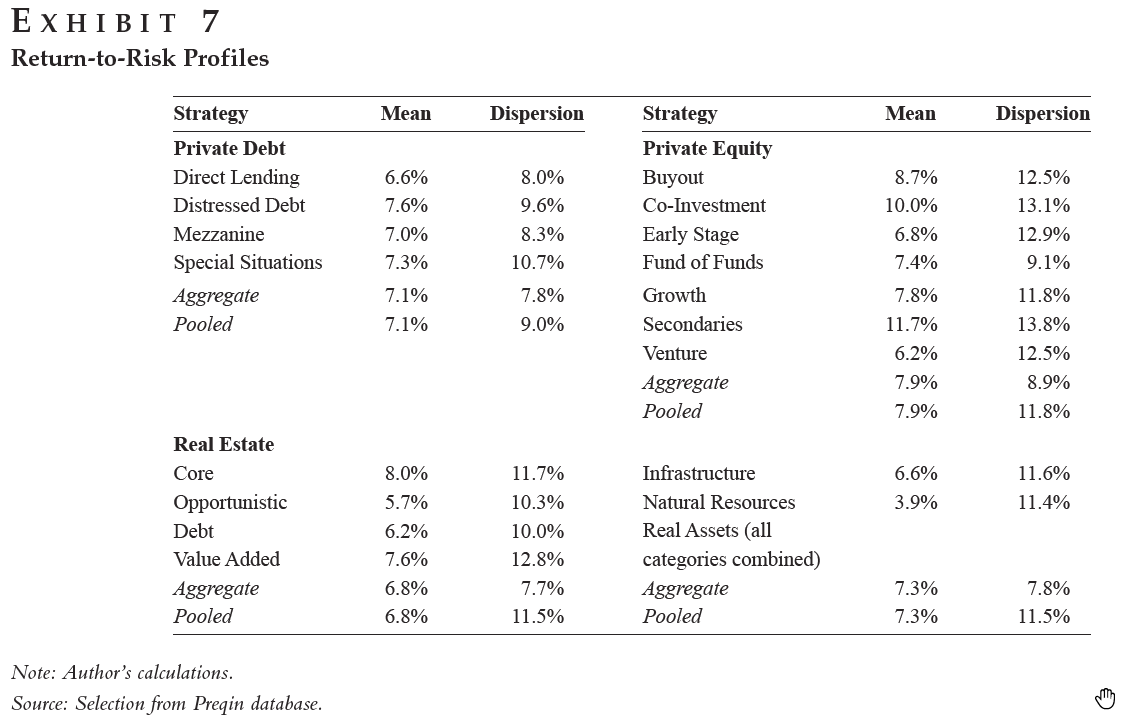

Quant Tools for Private Equity and Real Assets

By Wesley Gray, PhD|January 6th, 2020|Basilico and Johnsen, Academic Research Insight, Tactical Asset Allocation Research|

The Covariance Matrix of Real Assets Marielle De JongThe Journal [...]