In the evolving landscape of financial technology, innovative methods are emerging to assess creditworthiness. One such approach involves analyzing borrowers’ facial expressions during loan applications to predict delinquency risk. This study explores this novel intersection of psychology, machine learning, and finance.

A Good Sketch is Better than a Long Speech: Evaluate Delinquency Risk Through Real Time Video Analysis

- Xiangyu Chang , Lili Dai , Lingbing Feng , Jianlei Han , Jing Shi , Bohui Zhang

- Review of Finance, 2025

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

Key Academic Insights

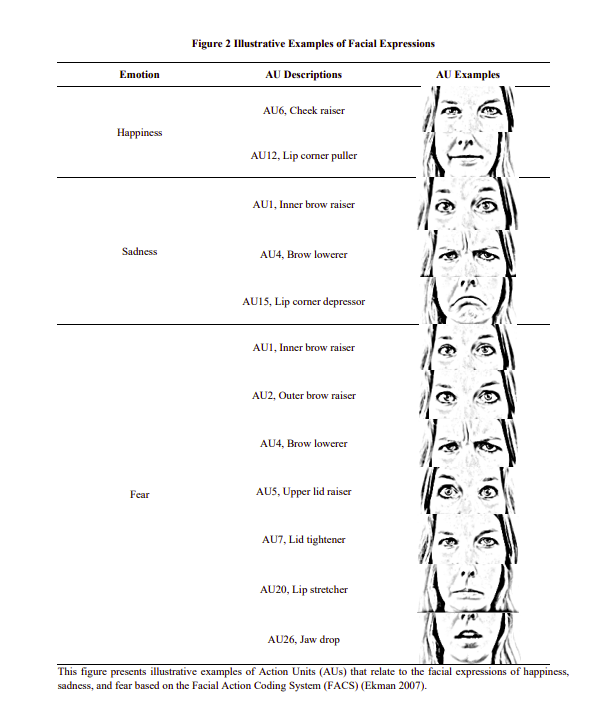

Micro-Expressions as Predictive Indicators: The research demonstrates that subtle facial expressions, specifically micro-expressions of happiness and fear, can serve as indicators of a borrower’s likelihood to default. Happier expressions correlate with lower delinquency risk, while fearful expressions suggest higher risk.

Machine Learning Integration: By employing machine learning algorithms, the study effectively analyzes real-time video data, highlighting the potential of AI in enhancing credit risk assessment.

Behavioral Economics Application: The findings align with behavioral economics theories, suggesting that non-verbal cues can provide valuable insights into financial behaviors and decision-making processes.

Practical Applications for Investment Advisors

Enhanced Risk Assessment: Incorporating behavioral analysis into credit evaluations can provide a more comprehensive understanding of a client’s financial reliability.

Personalized Client Interactions: Understanding clients’ non-verbal cues can aid advisors in tailoring communication strategies, fostering trust, and improving client relationships. In a prior post about behavioral finance we explored how emotional awareness enhances financial decision-making.

Adoption of Advanced Technologies: Embracing AI and machine learning tools can streamline risk assessment processes, leading to more informed investment decisions.

How to Explain This to Clients

Just like we can learn a lot from what people say, we can also learn from how they behave — even small things like facial expressions. New research shows that during a loan application, someone’s expressions can give clues about how likely they are to repay their loan. For example, people who look more anxious may be more likely to miss payments.

As your advisor, I always aim to stay informed about new tools that could help improve decision-making. This doesn’t mean we’ll start using facial scans! But it does show how advanced technology and behavioral insights can work together to make smarter financial choices — and it reminds us how powerful human behavior can be in money decisions.”

The Most Important Chart from the Paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

This article proposes an innovative method to assess borrowers’ creditworthiness in consumer credit markets by conducting machine-learning-based analyses on real-time video information that records borrowers’ behavior during the loan application process. We find that the extent of borrowers’ micro-facial expressions of happiness is negatively associated with loan delinquency likelihood, while the degree of fear expressions is positively associated with delinquency risk. These results are consistent with two economic channels relating to the adequacy and uncertainty of borrowers’ future income, drawn from the extant psychology and economics literature. Our study provides important practical implications for fintech lenders and policymakers.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.