This article explores how much trust investors place in their financial advisors and how it influences their willingness to take risks. A study found that when investors trust their advisors more, they are more likely to invest in riskier assets, even if the advisor charges higher fees. This suggests that trust plays a significant role in investment decisions.

Trust and Delegated Investing: A Money Doctors Experiment

- Maximilian Germann, Lukas Mertes, Martin Weber, and Benjamin Loos

- Review of Finance, 2025

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

Key Academic Insights

Increased Risk-Taking: Investors are willing to take more risks when they trust their financial advisors, even if those advisors charge higher fees.

Trustworthiness Measurement: The study used a “trust game” to measure how trustworthy advisors appeared, finding that higher trust led to more risk-taking by investors.

Cost Tolerance: Investors are willing to accept higher costs for investments managed by advisors they trust more

Practical Applications for Investment Advisors

Building Trust: Establishing trust with clients can lead to more open discussions about risk and investment opportunities.

Transparency: Being clear about fees and investment strategies can enhance trust and encourage clients to consider a broader range of investment options.

Client Education: Educating clients about the relationship between risk and return can help them make informed decisions aligned with their trust in the advisor.

How to Explain This to Clients

“Trust between us is crucial for your financial success. When you trust my advice, you’re more comfortable exploring various investment opportunities, which can potentially enhance your portfolio’s growth. Let’s continue to build this trust through open communication and transparency.“

The Most Important Chart from the Paper

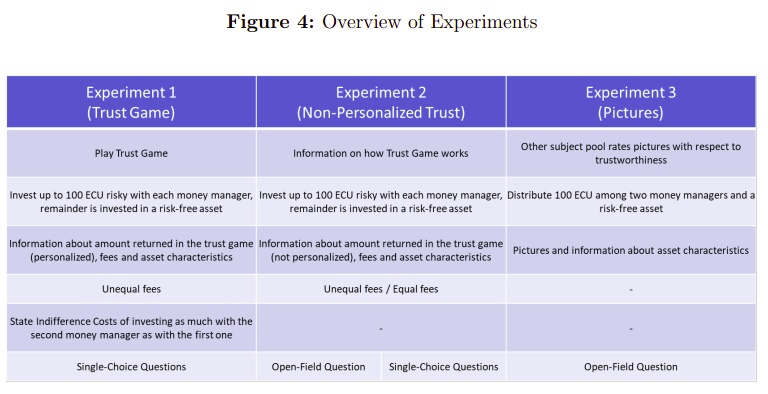

This table illustrates the experimental setup used to assess how trust influences investment decisions.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

The more trust investors place in a money manager, the more confident they are to take risk (Gennaioli, Shleifer, and Vishny, 2015). We test this theory in a laboratory experiment using the amount returned from a trust game as measure of trustworthiness. Investors increase the share invested risky with high-cost money managers compared to those with low costs when the high-cost money managers are more trustworthy than the low-cost ones. The willingness to take more risk with high-cost money managers is increasing in the difference in trustworthiness. Up to a third of the difference in trustworthiness translates into an increasing risky share. Vice versa, investors are willing to accept higher costs for investments made through more trustworthy money managers. Our findings are robust to alternative explanations, demonstrating that the risk-aversion channel can be sufficient for trust to influence behavior

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.