This article explores how many American households have retirement and bank accounts, focusing on those with lower incomes. It highlights the challenges faced by low-income families in accessing financial services and discusses how policies like automatic enrollment in retirement plans could improve financial inclusion.

Financial Inclusion Across the United States

- Motohiro Yogo, Andrew Whitten, and Natalie Cox

- Journal of Financial Economics, 2025

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

Key Academic Insights

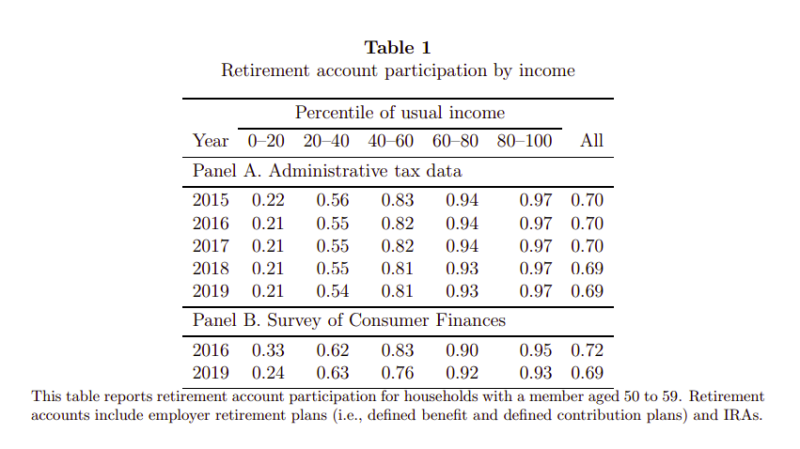

- Low Participation Rates: In 2019, only 21% of households in the lowest income group had retirement accounts, and 70% had bank accounts.

- Employer Retirement Plans: Access to employer-sponsored retirement plans was available to 38% of households in the lowest income group.

- Influence of Income and Race: Geographic differences in financial participation are more closely related to income levels than racial composition.

- Policy Impact: Implementing universal access to retirement plans with automatic enrollment could increase participation by 17 percentage points in the lowest income group over ten years.

Practical Applications for Investment Advisors

Targeted Outreach: Focus efforts on low-income communities to educate and encourage participation in retirement and banking services.

Employer Collaboration: Work with employers to establish or enhance retirement plans, especially those featuring automatic enrollment, to boost employee participation.

Customized Solutions: Develop financial products tailored to the needs of low-income households to promote greater financial inclusion.

How to Explain This to Clients

“I understand that saving for the future can feel overwhelming, especially when money is tight. But even small steps can make a big difference. If your job offers a retirement plan, I can help you enroll and explain how employer contributions can boost your savings. If you don’t have a plan at work, we can explore low-cost retirement options that fit your budget. I can also help you find a bank account with no or low fees to keep more of your money working for you. My goal is to make managing your money easier and set you up for a more secure future—one step at a time.“

The Most Important Chart from the Paper

This table reports retirement account participation for households with a member aged 50 to 59. Retirement accounts include employer retirement plans (i.e., defined benefit and defined contribution plans) and IRAs.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We study retirement and bank account participation for the universe of U.S. households with a member aged 50 to 59 in the administrative tax data. ZCTA-level average income, income inequality, and racial composition predict retirement account participation for low-income households, conditional on household income and regional price parities. Income inequality also predicts bank account participation for low-income households. We estimate the causal effect of access to an employer retirement plan on participation. Recent policy proposals for universal access with automatic enrollment could increase participation by 19 percentage points in the lowest income quintile over ten years.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.