This paper introduces a model of subjective belief choice to study how investors interpret information in financial markets. Drawing from psychology and behavioral economics, it considers how individuals distort their beliefs to enhance current utility, even at a cost.

Choosing to Disagree: Endogenous Dismissiveness and Overconfidence in Financial Markets

- Banerjee, Davis, and Gondhi

- Journal of Finance, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The authors ask the following questions:

- How do investors interpret and incorporate information in financial markets, especially considering the role of subjective beliefs and biases?

- What are the implications of wishful thinking and subjective belief choice for endogenous disagreement among investors, and how does this variation predictably change with economic conditions?

- How does the degree of price informativeness affect investment strategies, market dynamics, and the relation between return predictability and volatility?

- What are the implications of investors’ choice of subjective beliefs for individual and consensus forecasts?

What are the Academic Insights?

The authors find:

- Investors interpret and incorporate information in financial markets by forming subjective beliefs influenced by biases and anticipatory utility.

- The implications of wishful thinking and subjective belief choice for endogenous disagreement among investors are substantial and can vary with economic conditions:

- Endogenous Disagreement: Wishful thinking leads investors to choose subjective beliefs that align with their desires rather than objective reality. This behavior results in endogenous disagreement among investors regarding the interpretation of signals and market prices. Some investors may dismiss the information contained in market prices, while others may incorporate it more fully into their decision-making process. This disagreement arises even among symmetrically informed, homogeneous investors.

- Variation with Economic Conditions: The extent of endogenous disagreement among investors predictably changes with economic conditions, particularly with the degree of price informativeness. When prices are less informative, there tends to be a higher level of disagreement, as investors rely more on their private signals and less on market prices. Conversely, when prices are more informative, disagreement may decrease as more investors incorporate price information into their beliefs.

- The degree of price informativeness significantly influences investment strategies, market dynamics, and the relationship between return predictability and volatility. When prices are less informative, investors tend to dismiss price signals and focus more on their private information, leading to higher diversity in investment strategies, lower market volatility, and a positive correlation between return predictability and volatility. In contrast, in environments where prices are highly informative, some investors efficiently incorporate price information into their strategies, while others continue to ignore it, resulting in higher correlation in investment styles, higher market volatility, and a negative relationship between return predictability and volatility.

- The implications of investors’ choice of subjective beliefs for individual and consensus forecasts are significant and can have profound effects on market dynamics:

- Individual Forecasts: When investors over-react to private information but under-react to price information, individual forecast revisions tend to exhibit over-reaction. This means that investors may place too much weight on their private information and not enough on the information contained in market prices. As a result, their forecasts may be excessively optimistic or pessimistic relative to the true value of the asset.

- Consensus Forecasts: In contrast to individual forecasts, consensus forecast revisions tend to exhibit under-reaction. This occurs because the collective interpretation of market prices is influenced by the aggregation of individual beliefs. If individual investors under-react to price information, the consensus forecast may not fully reflect the information contained in market prices, leading to slower adjustments in expectations compared to what would be predicted by rational expectations.

Why does this study matter?

This study contributes to the literature on financial markets by offering a nuanced perspective on how investors form beliefs and make decisions, with implications for market efficiency, forecasting accuracy, and policy interventions.

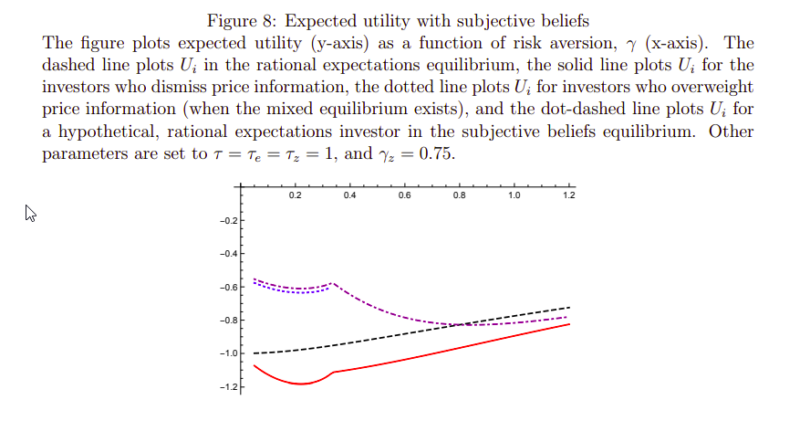

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index

Abstract

The psychology literature documents that individuals derive current utility from their beliefs about future events. We show that, as a result, investors in financial markets choose to disagree about both private and price information. When objective price informativeness is low, each investor dismisses the private signals of others and ignores price information. In contrast, when prices are sufficiently informative, heterogeneous interpretations arise endogenously: most investors ignore prices, while the rest condition on it. Our analysis demonstrates how observed deviations from rational expectations (e.g., dismissiveness, overconfidence) arise endogenously, interact with each other, and vary with economic conditions.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.