The study examines how households adjust their labor supply in response to changes in mortgage payments due to fluctuating interest rates. Using data from Poland, where floating-rate mortgages are prevalent, the research finds that households increase their income by approximately 35% of the rise in mortgage payments. This response is notably stronger when payments increase, with significant variations across demographics—women and younger workers exhibit more pronounced adjustments. The findings highlight the interplay between monetary policy and household labor decisions, offering insights into the broader economic implications of interest rate changes.

Working More to Pay the Mortgage: Household Debt, Interest Rates, and Family Labor Supply

- Zator

- The Journal of Finance, 2025

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

Key Academic Insights

Asymmetric Labor Response: Households respond more vigorously to increases in mortgage payments than to decreases, indicating an asymmetric adjustment in labor supply.

Demographic Variations: The study reveals that women and younger individuals are more responsive to rising mortgage costs, suggesting that debt obligations influence labor decisions differently across groups.

Policy Implications: The research underscores the importance of considering household debt structures when formulating monetary policies, as interest rate changes can have significant effects on labor markets.

Practical Applications for Investment Advisors

Client Cash Flow Analysis: Advisors should assess clients’ debt profiles, especially those with variable-rate mortgages, to anticipate potential labor income adjustments in response to interest rate fluctuations.

Financial Planning for Dual-Income Households: Understanding the dynamics of labor supply adjustments can aid in creating more resilient financial plans, particularly for households where one partner may need to increase work hours due to rising debt obligations.

Risk Management: Incorporating potential labor supply changes into risk assessments can lead to more comprehensive strategies that account for income variability linked to debt servicing pressures.

How to Explain This to Clients

“Recent research indicates that when mortgage payments rise, many households respond by working more to meet these obligations. This is especially true for families with variable-rate mortgages. Understanding this behavior helps us plan better for your financial future, ensuring that we account for potential changes in income and work-life balance when interest rates fluctuate.”

The Most Important Chart from the Paper

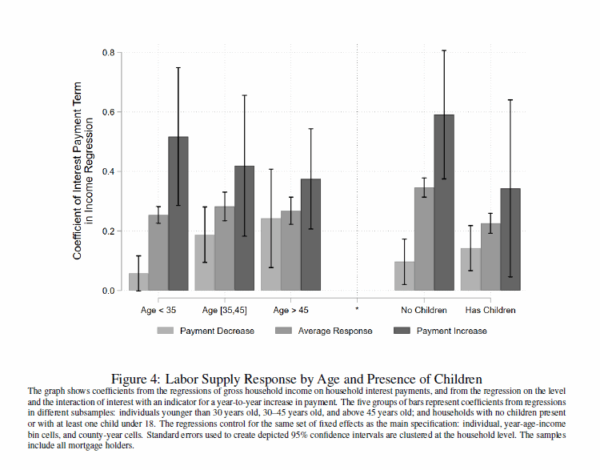

This figure shows how different types of households respond to changes in mortgage interest payments by changing their income from work. For each group, the figure shows whether people earn more money from work when their mortgage payments increase. It also compares how much of that change is driven by an actual increase (versus just the level of payments). Younger households and families with kids are the most likely to work more when mortgage payments go up. Older households and those without children are less responsive.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

I show that households work and earn more (less) when their floating-rate mortgage payments quasi-exogenously increase (decrease). The response is sizable and asymmetric: on average, households adjust their income by 35% of the change in their mortgage payment, but the response is significantly stronger following an increase in payments. While men in dual-earner, childless households respond the most on average, the asymmetry is most pronounced for women and young workers, who respond particularly strongly to payment increases. The asymmetry of the labor supply elasticity may help explain the wide range of elasticities found in previous research.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.