In his 2013 paper “The Other Side of Value: The Gross Profitability Premium,” Robert Novy-Marx documented that profitability, broadly measured, has as much power as relative price in predicting cross-sectional differences in expected returns. With the publication of that paper, profitability quickly become a prominent theme in asset pricing research. For example, Dimensional began incorporating profitability into its systematic factor-based strategies almost immediately. And in 2014 Fama and French incorporated it into a new five-factor asset pricing model. Many other firms quickly followed suit, so that profitability is now a common component of many investment strategies, often as part of so-called “quality” considerations (such as high return on equity, stable earnings, low leverage, and low measures of financial distress). And successor studies (such as here) on “quality” investing have shown that the stocks of companies with strong fundamentals tend to outperform those with weak fundamentals, especially after controlling for value.

Robert Novy-Marx and Mamdouh Medhat, authors of the March 2025 study “Profitability Retrospective: What Have We Learned?,” explored the pervasive impact of profitability on investment strategies and asset pricing. Following is a summary of their key findings:

Profitability Matters More Than You Think

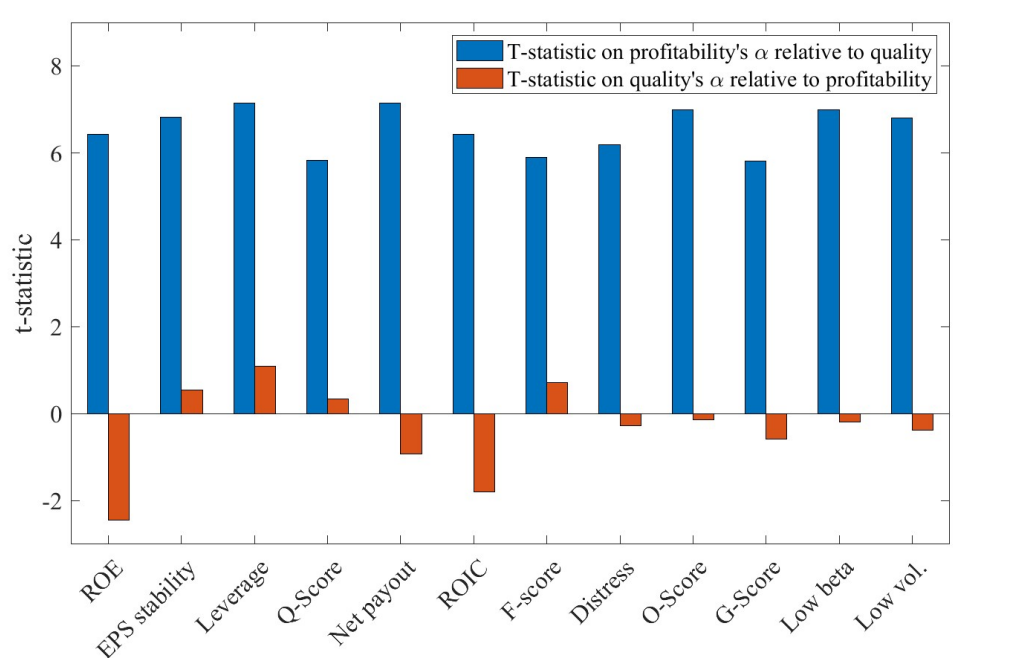

- Profitability subsumes all the quality factor, explaining both the performance of the strategies the investment industry market and the factors that academics employ—none of the quality factors generated significant positive alpha relative to profitability, the other Fama and French factors, and momentum. The pricing of the quality factors was primarily through significant positive loadings on profitability. Thus, instead of focusing on various quality metrics, investors can concentrate on a company’s ability to generate profits.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Spanning tests employing profitability and other measures of quality. This figure shows the t-statistics on the alphas from regressions of the form

PROF = α + βQualityQuality + β ′x + ϵ

Quality = α + βPROF PROF + β ′x + ϵ,

where x are other commonly used factors, those from the Fama and French (2015) five-factor model (excluding RMW) and UMD. The sample covers July 1974 to December 2023, with the start date determined by the data required to construct some quality strategies.

- Profitability explains defensive equity: Profitability metrics can explain the pricing of defensive equity strategies that focus on low-beta or low-volatility stocks.

- Alternative value strategies: Profitability explains the abnormal performance of popular “alternative value” strategies, even those adjusted for intangible assets. It also accounts for about half of value’s underperformance since 2007.

Streamlined Understanding of Returns

Pricing anomalies: Profitability is crucial for pricing various seemingly unrelated market anomalies, leading to a more straightforward understanding of expected returns.

Their findings led Novy-Marx and Medhat to conclude:

“Profitability is crucial for pricing a wide array of seemingly unrelated anomalies, yielding a more parsimonious understanding of the cross section of expected returns.” They added: “Defensive equity strategies—those based on low beta or low volatility—derive all of their performance by tilting towards profitable companies, particularly those that invest conservatively. And in terms of market efficiency and the asset pricing literature, they explained: “The fact that multiple widely studied, seemingly disparate anomalies can be largely explained by a small number of factors suggests markets may be more efficient than a cursory review of the anomalies literature would indicate. Rather than representing distinct phenomena requiring different explanations, many documented patterns in returns simply reflect different manifestations of a few underlying factors.”

Key Investor Takeaways

- Focus on profitable companies: When evaluating companies, prioritize those with a proven track record of profitability.

- Re-evaluate value strategies: Consider the role of profitability when implementing or assessing value investment strategies. For example, ensemble value strategies that use value metrics such as E/P, CF/P, and EBITDA/EV provide exposure to the profitability factor. And ensemble metrics often produce superior results to any single metric. Thus, while academics prefer a parsimonious explanation using as few variables as possible (they want only one value metric, only one quality metric, etc.) practitioners want the most practical and powerful explanation—and so will combine metrics.

- Simplify your approach: Profitability can serve as a central factor in understanding asset prices and investment performance, potentially simplifying your investment process.

Larry Swedroe is the author or co-author of 18 books on investing, including his latest Enrich Your Future. He is also a consultant to RIAs as an educator on investment strategies.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.