This paper explores how entrepreneurs can effectively raise capital by leveraging strategic communication within investor syndicates. The study reveals that the structure of investor syndicates—hierarchical or flat—significantly impacts the flow of information and investment decisions. In hierarchical structures, differentiated incentives can lead to persuasive cascades, while flat structures promote truthful information sharing. Understanding these dynamics enables entrepreneurs to tailor their fundraising strategies, optimizing investor engagement and capital acquisition.

Raising Capital from Investor Syndicates with Strategic Communication

- Dan Luo

- The Journal of Finance, 2025

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

Key Academic Insights

Strategic Communication Drives Investment Decisions: Investors within a syndicate share information strategically, influencing each other’s decisions. Those with stronger incentives may persuade others, leading to investment cascades.

Syndicate Structure Matters: Hierarchical syndicates, with varied investor incentives, can stimulate persuasive communication but may hinder information sharing. Flat syndicates, offering uniform incentives, encourage honest communication and collective decision-making.

Entrepreneurial Strategy: Entrepreneurs can design syndicate structures based on project profitability—using hierarchical models for high-profit projects to motivate investment, and flat models for lower-profit projects to ensure transparent information flow.

Practical Applications for Investment Advisors

Assess Syndicate Dynamics: When advising clients on syndicate investments, consider the structure and communication patterns within the group to evaluate potential risks and benefits.

Guide Entrepreneurial Clients: Assist entrepreneur clients in structuring their investor syndicates to align with their project’s nature, enhancing fundraising effectiveness.

Enhance Due Diligence: Understanding the strategic communication within syndicates can inform more thorough due diligence processes, leading to better investment decisions.

How to Explain This to Clients

“When raising funds, the way investors communicate and the structure of their group can greatly influence the outcome. Some groups have leaders who guide decisions, while others operate more collaboratively. By understanding these dynamics, we can better navigate investment opportunities and tailor strategies that align with your goals.”

The Most Important Chart from the Paper

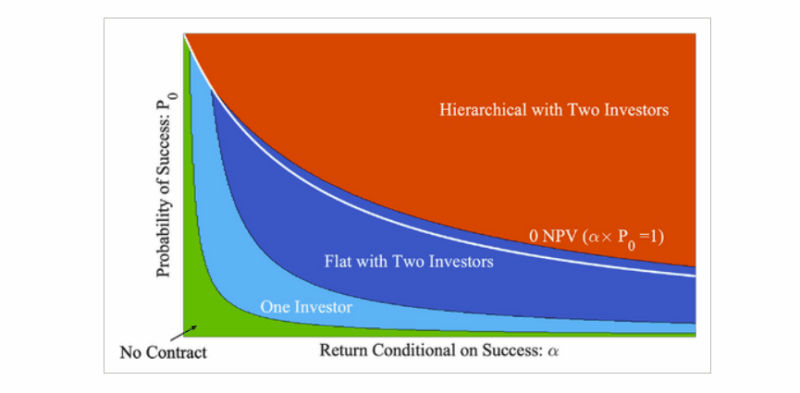

This figure illustrates optimal contracts for projects with different probability of success, P0, and return conditional on success.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

An entrepreneur makes offers to multiple investors to fund a project that requires a minimum investment. Concerned about other investors’ decisions, each investor strategically communicates information about the project to others. When investors have conflicts of interest, those with contractually stronger incentives to invest attempt to persuade others to invest. Depending on the project’s ex ante quality, the entrepreneur may promise investors different returns to create conflicts of interest and induce persuasion, or may promise investors an identical return to align their interests and induce truthful communication. The paper illustrates a new motivation for syndication and hierarchy within syndicates.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.