Independent RIA firms seek to do what is “right” for the client, which often boils down to minimizing fees and taxes and increasing transparency/education (i.e., ETFs). But the “right” solution for an advisor’s clients might not be available ‘off-the-shelf’ in the ETF market, or the advisor can’t use ETFs because they are stuck “managing around” legacy portfolios and tax problems.

What’s a potential solution? Allow advisors to create their own ETFs, which can be customized to deliver the specific investment program the advisor desires and allows an advisor to offer unique solutions for legacy tax issues tied to low-basis securities.

Note: If you are interested in how to start an ETF, the costs of launching an ETF, and so forth, click here.

An ETF White-Label Solution for Advisors

After a decade in the weeds of ETF operations, we’ve realized that the benefits of the ETF wrapper — tax efficiency, easy access, and transparency — should be available to a broader set of professional investors and asset owners -not just the Wall Street behemoths. This post highlights how non-traditional ETF sponsors, such as registered investment advisors, family offices, and other asset owners, can leverage the ETF wrapper to their benefit and why they should consider launching an ETF.

The good news is we have a plan to make that happen and put, “An ETF in Every Pot.”(1)

Times are a-changing in the ETF marketplace.

Background on the ETF White-Label Business

First, some background. As many readers know, we are active in the “ETF white-label” business.(2)

The easiest way to explain our “white-label” business is that we perform the entire value chain of ETF operations (small and large) required to launch and operate an ETF. The ETF sponsor can focus on what they enjoy doing — managing and selling their investment strategy. The ETF sponsor gets rich and famous; we simply sell you a high-quality and efficient shovel to get the job done.

Our goal with the ETF infrastructure business is to deliver ETF sponsors a highly transparent, low-cost, and limited brain damage solution. We think we can lower the costs of ETF operations to levels that nobody thought possible. Just over the past few years, we’ve managed to drop the all-in operating costs on a plain vanilla ETF operating with $25mm in assets from $250k+ to less than $215k…and we plan to get this under $200k in the next few years.(3)

What do lower ETF operating costs mean for the marketplace?

Historically, the break-even point was $100mm+ AUM, but as the break-even point moves from $100mm –> $50mm –> $25mm…things get exciting. In addition, we’ve built a specialized capability to facilitate tax-free ETF conversions, which means we can transition — tax-free — assets from a hedge fund structure, a mutual fund structure, or a managed account structure into an ETF vehicle. (see here for details).

Lower costs and enhanced tax flexibility mean the ETF wrapper is no longer a tool only available for the larger players — i.e., Vanguard, Fidelity, iShares, Schwab — to deliver affordable, tax-efficient, and transparent investment advice. The ETF is a tool many financial professionals can access, including financial advisors and boutique asset managers.

I’m an RIA. Why Should I Consider Creating or Converting into an ETF?

Let us be clear upfront. Starting an ETF will never be cheap and/or easy (explained here). And in the majority of situations, the complexity and costs will not be realistic for many advisors. However, that does not mean that one should never consider unique solutions to unique problems. In the end, good advisors — ranging from advisors managing bespoke stock strategies via SMAs to financial-planning-focused advisors with simple investments — should have one overarching goal: help their clients win.

Winning can mean many things to many different people, but a fiduciary advisor should always be focused on improving client outcomes.(4)

RIAs face a variety of pain points in their businesses, some of which an ETF can potentially solve (in no particular order):

- Advisor fees are not tax-deductible

- The current tax code does not allow the deductibility of financial advisory fees, which means that a 1% fee is a pre-tax expense to the client. E.g., $10,000 is paid on $1mm SMA is $10,000 out the door. (see Kitces piece).

- ETF solution

- Management fees in an ETF can be netted against dividends, interest, and income, implicitly making them tax-deductible. The value of the deduction will range depending on the situation, but at a minimum, the after-tax fee for HNW clients will likely be 25%-30%+ cheaper than an SMA equivalent. E.g., $10,000 might only be $7,000 on an after-tax basis, or a 30% cheaper after-tax fee than the SMA equivalent after-tax fee. , $10,000 (1-t) on a $1mm, where t = the blended tax rate on the dividends, interest, and income received in the ETF wrapper.

- Operational complexity

- Some advisors recommend holding 2-4 Vanguard funds that rebalance maybe once a year. Not a lot of complexity in this situation. But for many other advisors, there is an ever-growing complexity in managing client portfolios. There are software solutions (often expensive) that can minimize these problems, but the devil is always in the details. Moreover, even with systems in place, advisors are often tasked with taking on “inefficient” business. For example, an advisor’s large client might ask if they can manage the $5,000 IRA accounts for all their kids.

- ETF solution

- Operational complexity tied to ticker management and rebalancing is outsourced to the ETF operator. The RIA simply needs to buy/sell a ticker symbol to access its investment approach versus managing buys/sells across a bunch of ETFs and/or stock tickers.

- ETF operators also liberate resources previously consumed by back-office paperwork. While launching an ETF is expensive, so is managing payroll for traders, client relationship specialists, and the like.

- Tax optimization for taxable accounts:

- Related to the above, managing taxes across multiple accounts with varying basis situations is exceedingly complex. RIAs have leaned on outsourcing this problem to direct/custom indexing software solutions. Still, many advisors quickly realize that the benefits of direct-indexing programs are short-lived when the tax shields evaporate (or aren’t useful) and the client is stuck with an expensive, highly complex index fund with no flexibility. Yuck. (see here for a piece on TLH costs/benefits).

- ETF solution #1

- ETFs have been referred to as a great “tax swindle.” While we think that language is inflammatory, ETFs have unique tax advantages. In short, ETFs can achieve substantial deferral benefits, even in the face of substantial turnover in the underlying strategy. And with the advent of tax-free SMA–>ETF conversion capabilities, one can move legacy direct-indexing accounts with limited TLH benefits into an ETF structure to regain portfolio flexibility and minimize complexity without incurring a taxable event. For example, suppose an advisor has multiple direct indexing clients with broad US market exposure, and tax-loss-harvesting benefits have dried up. In that case, the advisor could roll up these accounts into an ETF structure, tax-free, and regain rebalance/trading flexibility and potentially lower costs.

- ETF solution #2

- SMA–>ETF conversion capabilities are more extensive than many realize when managing concentrated stock situations. We believe ETF conversion solutions often exceed the benefits delivered via direct/custom indexing solutions. Of course, these transactions are complex, and the facts and circumstances need to be assessed on a situation-by-situation basis. Still, the potential benefits are large for UHNW individuals/clients, particularly those committed to compliance and bringing their strategies to the market. Please contact us for details.

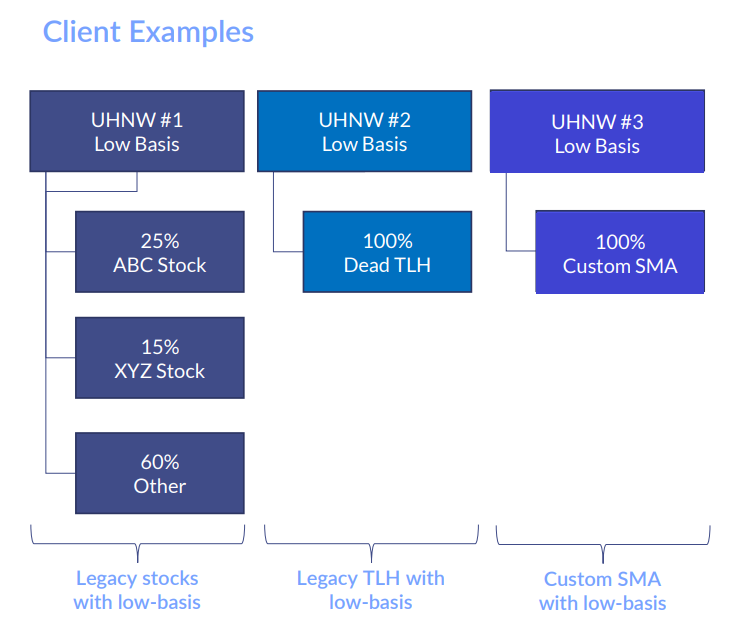

Below is a visual that maps out common situations faced by advisor clients:

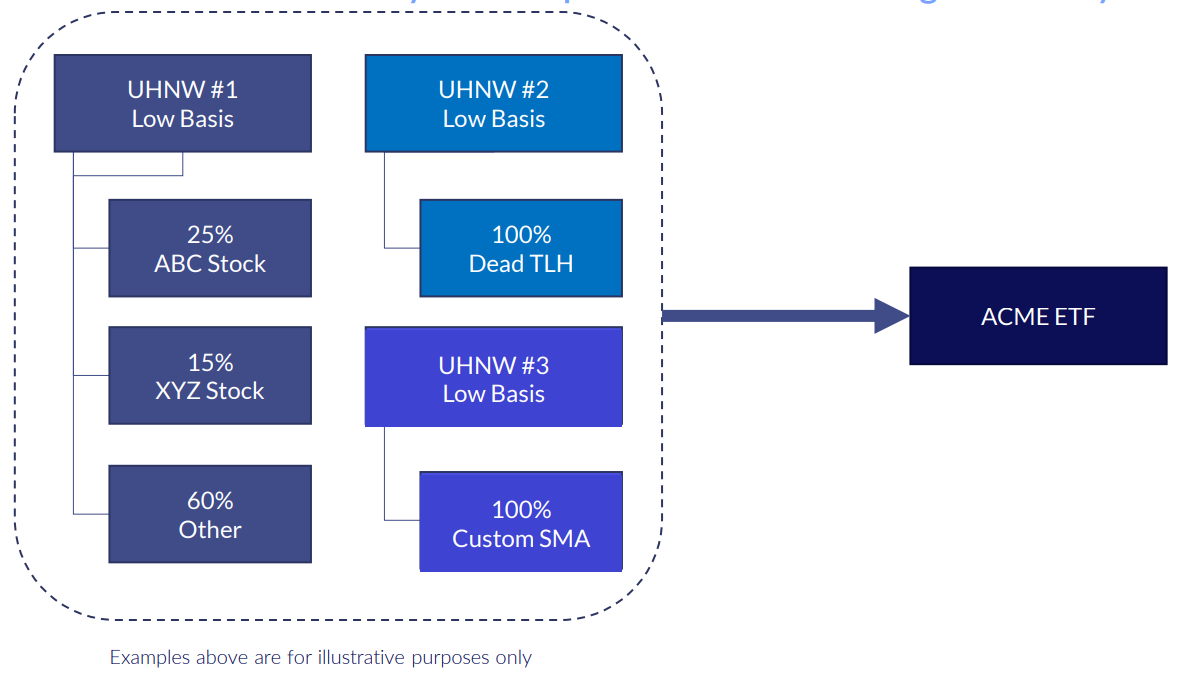

And below is a visual of the potential solution. Convert these “problems” into an ETF, tax-free, and manage the assets via the ETF structure on a go-forward basis.

- Onboarding clients

- Identifying, segmenting, and closing a new client is tough. Let’s assume you found a prospect. Now you need to pitch them on how great you are, and then you ask them to 1) set up an account at a custodian, 2) sign a bunch of legal documents, and then 3) transfer assets into the new structure. Firms are trying to solve these problems, but SMA onboarding will always be a relative pain in the rear.

- ETF solution

- If you run into a prospect that likes what you do but doesn’t want to deal with opening an SMA, the solution is simple: type in the ticker. Done.

- Brand building and business development

- Building a brand is challenging since advisors are ubiquitous in the landscape, and differentiation is challenging.

- ETF solution

- Launching an ETF is akin to having a public IPO. The financial ETF media and ecosystem (e.g., Morningstar, FactSet, and Bloomberg) will integrate you into their daily flow, and you will more easily establish awareness for your firm’s brand and your firm’s credibility.

- Competitive threats

- Vanguard (Schwab and Fidelity are other examples) is not shy about threatening to take out advisors and lower the cost of advice to the marketplace via PAS (Just listen to Tim Buckley). Advisors should take note of this threat. Especially those advisors who simply buy a handful of index-based ETFs and then charge the client 1% for their investment advice and planning services. Advisors must provide a unique value proposition and lower their cost structure if they plan on surviving through the next decade.

- Larger advisors, who have an investing value proposition and own the client relationship, might consider a vertical integration into asset management to protect their business.

- ETF solution

- Advisors can create an ETF, which allows them to vertically integrate into the asset management aspect of the business and compete with monopolistic competitors.

Sounds Compelling. What are the Downsides of launching an ETF?

At the outset, we stated that while we are trying to lower barriers to entry on the ETF wrapper, we can’t make it super cheap/easy. The reality is that launching an ETF will always be a relatively expensive and complex operation. Below we discuss some of the complexities and costs specific to advisors contemplating the launch of an ETF:

- ETF startup and ongoing costs:

- The typical costs are $50k startup, $175-$225 ongoing fixed costs, and variable costs as you scale the ETF’s assets. Here is a post with more details.

- One should only consider an SMA conversion if you have at least $25mm in hand, and it is preferable to have $50mm or more.

- Tax-free conversion complexity:

- To convert low-basis securities into an ETF, you can expect additional upfront costs, extensive client communication/education efforts, and compliance with Treasury and SEC hurdles.

- Compliance and billing complexity:

- When an advisor creates an ETF, they create an affiliated fund conflict of interest. The advisor will need to update their disclosures and implement systems to manage and document that, despite their potential conflict of interest, their decision to use affiliated funds is in the best interest of their clients.

- We often recommend that advisors seek to keep their clients “net neutral” on direct costs. For example, if an advisor charged 1% on an SMA, but now that SMA owns an ETF that costs .50%, the advisor would drop the SMA charge to .50%. This would ensure that the client is only paying 1% in fees, but also gaining access to the ETF’s benefits. One can arrange situations where the overall fees to the client are higher. Still, the burden is on the advisor to show that the higher costs are outweighed by higher potential benefits and is, therefore, in the best interest of the client. Of course, all of this requires flexible systems and updates to the billing system.

- Culture change management:

- We often identify situations where the status quo is incredibly powerful and “shaking things up” will be frowned upon by executive teams who are more concerned with maintaining their current lifestyle and less concerned with the business’s future and/or their client’s outcomes. Adding an ETF can often be a bridge too far for static organizations.

- Transparency

- We believe transparency benefits the ETF structure, but sometimes advisors are concerned that too much transparency may conceal a weak value proposition, expose their intellectual property, or lead to poor investor behavior. There is merit to these arguments.

- Stickiness

- Advisors often note that managed accounts are “sticky” and it is difficult for clients to leave once they have established an SMA. In contrast, an ETF, which is too simple/easy, may lead to clients leaving. On the one hand, this could be true; on the other hand, if an advisor has a weak value proposition, the client will eventually leave that advisor anyway. In addition, because the ETF structure rarely distributes capital gains, taxable investors will be reluctant to sell a low-basis ETF position. This tax-adverse reaction may increase client stickiness and improve client behavior (i.e., force clients to be long-term investors).

Summary

The ETF wrapper is not a panacea, but the tax efficiency, easy access, and transparency are powerful benefits to bring to a client. This can be a competitive advantage for an RIA firm facing competition from larger firms. We envision a future where accessing the ETF wrapper is cheaper and more user-friendly for financial professionals. We are on the frontier of building creative solutions to help investors improve their after-tax, after-fee investment outcomes. Please contact us if you’d like to learn more.

References[+]

| ↑1 |

|

|---|---|

| ↑2 | Here is a link on how to launch an ETF. |

| ↑3 | Adjusted for inflation, which could be substantial in the current environment. |

| ↑4 | Financial advisors often claim that they do not have conflicts of interest, but if they didn’t have conflicts of interest, the SEC would not require a compliance manual! The reality is all fiduciary advisors have indirect and direct conflicts of interest that need to be managed, but the mission should never change: help clients win. I bring this up because advisors often mention that because they don’t get paid based on the investment products they choose, they don’t have any conflicts of interest. We could write an entire book on why this is fraught with poor logic. But one thing is clear, if an advisor sets up an ETF, there is a direct conflict of interest identified in the eyes of regulators — the fiduciary advisor may prefer to allocate to their ETF versus whatever they were allocating to previously. And while this might be true, what if the allocation is no different, but the outcome is greatly improved for the client? In some sense, one could argue that not delivering their advice via an ETF is worse for the client in many circumstances. |

About the Author: Pat Cleary

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.