Capacity Constraints, Profit Margins and Stock Returns

- Bjorn Jorgensen, Gil Sadka, and Jing Li.

- A recent version of the paper can be found here.

Abstract:

This paper studies the effects of capacity utilization on accounting profit margins and stock returns. Since accounting profit margins represent the average profit per unit and not the economists’ concept of unit contribution margin, the marginal/variable profit per unit, a firm with idle capacity can increase its profit margins by increasing sales (output). But, if the firm is operating at full capacity, an increase in output must be preceded by an increase in capacity (and fixed costs resulting in lower profit margins. Our empirical findings suggest that firms’ profit margins increase in sales when there is idle capacity, but decreases in sales when the firm approaches full capacity. We show that firms experiencing high growth in sales operating in industries with high capacity utilization experience abnormally low stock returns in the following period.

Data Sources:

The Federal Reserve Board provides data on the capacity utilization of 26 industries (primarily Manufacturing, Mining, and Utilities). The authors use this data and match it to data from Compustat on the basis of NAICS industry codes. Thus the data is constrained by the limited number of industries for which the Fed provides data. The period analyzed is 1977 through 2008. http://www.federalreserve.gov/releases/g17/current/

Discussion:

First, I’d like to say that I have potential bias in this study–Gil Sadka is a good friend from my early days at the University of Chicago. That said, I really do think this is a great paper that highlights an interesting investment insight I’ve never really explored in the past.

This research is really a test of some basic concepts in microeconomics 101.

Hypothesis 1: firms with idle capacity have increased profit margins following increased sales–For example, we have $100 fixed costs and a widget costs $5 to make (variable costs). If we sell 100 widgets at $10, we have revenues of $1000, costs of $600 ($500+$100), and a profit margin of $400/$1000=40%. If we sell one more widget–assuming fixed costs stay the same–we have $1010 revenue and $605 costs, or a profit margin of 405/1010=40.099%.

Hypothesis 2: For a firm that is close to capacity, profit margins are decreasing–We have $100 fixed costs and a widget costs $5 to make, BUT a plant can only produce 100 widgets. In this situation, if we sell 100 widgets at $10 we have a profit margin of 40% (just like above). However, if we sell 101 widgets we have $1010 revenue, but our costs move from $605 to $705 (5*101+100(first plant)+100(second plant)), then profit margins drop below 40%.

Here is another explanation outlining the concepts:

Suppose a manufacturer has a single plant and is operating at 50% capacity, meaning that it produces and sells 50% of what it is capable of producing with its current resources. If the manufacturer’s sales grow by 100% it can continue to sell all its product without any new fixed expenses. This will boost profit margin because the only marginal costs will be the variable costs of the inputs. But if sales grow by 200% the company will not be able to meet this demand with its current resources and will need to buy a new facility, new machinery or hire new workers. With these new costs, profit margins may in fact fall even though sales are increasing.

Unfortunately, the authors of this paper cannot test capacity utilization on an individual firm basis because the data is not available. But they can look at capacity an industry basis.

What do they find?

First, they confirm hypothesis 1 by finding that revenue growth is generally associated with higher profit margins. Next, using the capacity utilization data, they show that firms in industries with higher capacity utilization have higher profit margins.

However, they also find that among those industries with the highest capacity utilization, increases in sales are associated with declines in profit margins. These findings support the hypothesis that profit margins increase as sales increase to the extent that a firm still has the capacity to increase sales without making any capital expenditures.

The bottomline is that capacity utilization can predict future profitability, and profitability matters to investors.

The natural question: Do investors actually use this predictable information regarding profitability?

Are investors aware of a firms’ positions with respect to the capacity utilization? This is an important question because it goes to the ability of GAAP standards to fully reflect the real accounting profitability of a firm. It would certainly seem possible that when valuing a stock some investors would assume constant profit margins unaware that the growth they assume in their valuation implies new capital expenditures.

The important variable is the interaction variable—the product of sales growth and capacity utilization.

This should reflect the ability of the firm to grow with the level of capacity it has to work with. We should expect this variable to be associated with lower profit margins. If investors are not anticipating lower profit margins, then this variable should also be associated with lower subsequent stock returns.

- Bad stocks: high sales growth in high capacity utilization industry–investors are unlikely to identify that profit margins are likely to fall

- Good stocks: low sales growth in low capacity utilization industry–investors are not aware that profit margins will have a lot of upside if sales increase

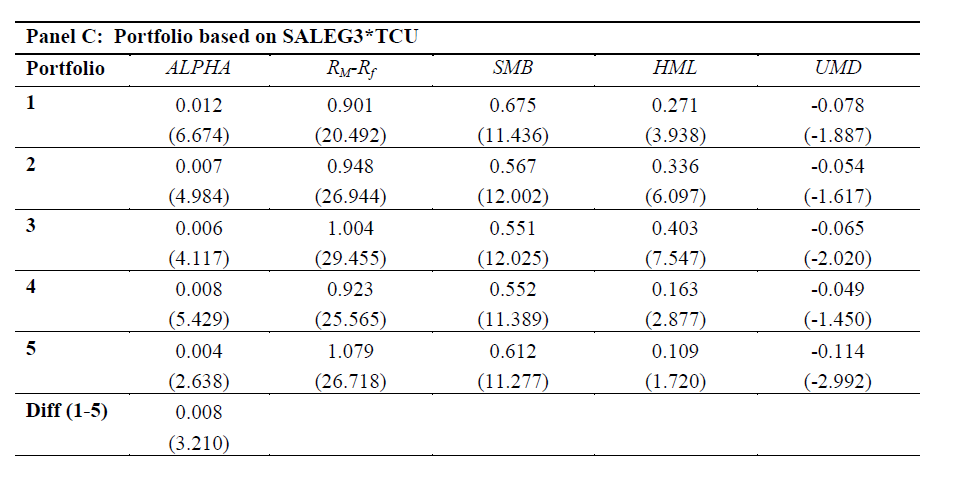

On the basis of this variable, the authors sort all firms in to five mock portfolios and track the performance of each. They measure abnormal returns (alpha) using the Four-Factor model which controls for beta, size, book-to-market ratio and momentum. The return to the first portfolio (those firms with the lowest values of capacity utilization times sales growth) earn abnormal returns of 1.1% per month. This result is statistically significant. A hedged return also seems possible, as the difference between the return to the lowest portfolio and the highest portfolio is 0.7% per month.

“The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.”

“The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.”

Investment Strategy:

- Retrieve industry capacity utilization data and calculate the interaction variable (capacity utilization times sales growth) for all firms for which data is available.

- Rank all firms and assign each to one of five groups on the basis of this variable.

- Buy firms in the lowest group.

Commentary:

This paper addresses an investment opportunity because it deals with a phenomenon that is very difficult to describe with present accounting standards. Thus, it reiterates that if investors are too reliant on as-reported earnings, they may not be able accurately assess the economic reality of the firm.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.