Sentiment and Stock Prices: The Case of Aviation Disasters

- Guy Kaplanski and Kaim Levy

- A version of the paper can be found here.

Abstract:

Behavioral economic studies reveal that negative sentiment driven by bad mood and anxiety affects investment decisions and may hence affect asset pricing. In this study we examine the effect of aviation disasters on stock prices. We find evidence of a significant negative event effect with a market average loss of more than $60 billion per aviation disaster, whereas the estimated actual loss is no more than $1 billion. In two days a price reversal occurs. We find the effect to be greater in small and riskier stocks and in firms belonging to less stable industries. This event effect is also accompanied by an increase in the perceived risk: implied volatility increases after aviation disasters without an increase in actual volatility.

Data Sources:

The authors collect data on the entire history of large-scale aviation disasters from January 1950 to December 2007. The data on prices and fundamentals come from CRSP and COMPUSTAT. Option volatility and VIX index measures are from the CBOE.

Discussion:

Chaos is everywhere recently: Libya, Egypt, Bahrain, and of course, Japan.

In the face of the recent bedlam, I decided to hit the research archives and see if there was any literature related to disasters and the impact is has on investor decision-making. I ended up finding an assortment of cool behavioral finance literature, but this study is the best fit for the blog.

The summary conclusion from all my research is that chaos and stress affect how investors react–no doubt about it. The debate really revolves around the reaction response: Do traders overreact to disaster events? Or do they underreact? Perhaps investors underreact initially, and then correct their actions afterward? There are any number of combinations one might expect.

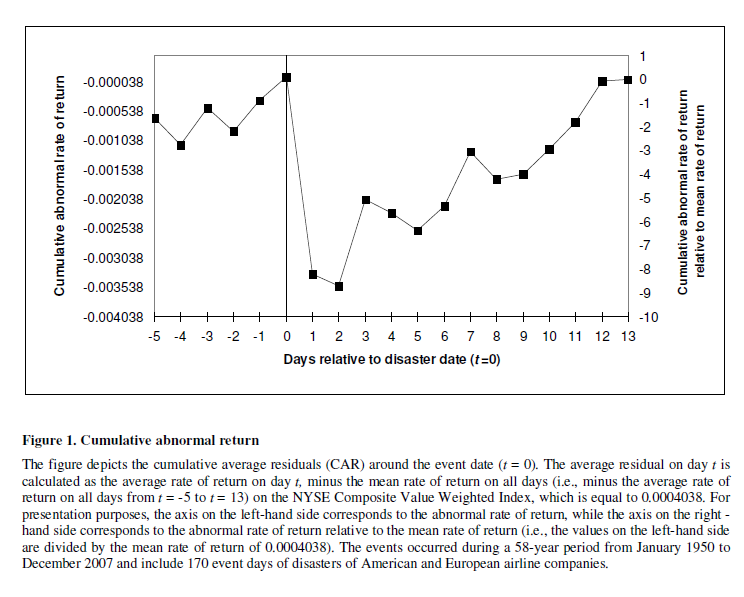

This paper specifically tests to see if people overreact to disaster events. What the authors find, in the context of airline disasters, is that traders punish stocks beyond fundamentals. Interestingly, the evidence also suggest that within a few days stock prices rebound to their appropriate levels. This result can be seen in the figure below:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

According to the authors, the first-day average loss in market value is around $60 billion per disaster, however, the actual upper-bound of the estimated damages are roughly $1 billion per disaster (see Section 4.1 for a detailed discussion on how they calculate this amount).

$60 billion haircut for what typically ends up costing a maximum of $1 billion?

Talk about some serious overreaction!

Of course, this result is not entirely surprising. After crazy events the media absolutely loves to go overboard and tell the world the sky is falling. A perfect example is the potential nuclear fallout from Japan. According to what I’ve heard on the news media, there is a chance America might endure a nuclear winter because a nuclear plant blew up over 10,000 miles away in Japan?

Are they crazy?

Regardless if they are crazy or not, I’ll admit my “primal instinct” raised the probability of me purchasing a geiger counter from .00000000001% to .00001%–so the thumb suckers in the media’s newsrooms are turning me into a thumbsucker. D’oh!

Nuclear winter is surely a scary thought, but how do airline debacles affect the “fear” in the stock market?

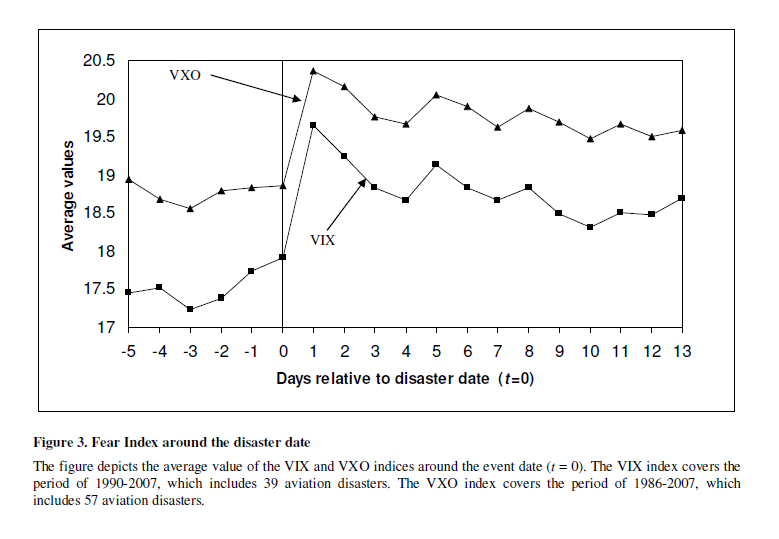

To investigate whether or not the first-day stock price overreactions are a statistical anomaly or a real market effect, the authors look at the VIX index around airline disaster events. True to form, the VIX spikes nicely around aviation disasters, suggesting that fear is indeed the reason why airline stocks coming crashing down to earth (pun not intended) when news is released (what is interesting is that the VIX marks fear for the entire market, not just airline stocks!)

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The authors provide a slew of other interesting facts and figures related to market psychology and asset price reactions to airline disasters. I encourage you to read the source document if you are interested.

Investment Strategy:

- Be on the lookout for “disaster” events.

- Once you identify an “event,” tie your hands behind your desk and hire a friend to ensure you do not open your trading windows. Maintain your composure.

- Stick with your position and/or add more when times are at their “worst”–have your friend do the purchasing, since you may feel compelled to “sell into the news.”

- Eventually make some money.

Commentary:

“Buy when there is blood in the streets.” “Be greedy when others are fearful.”

The empirical evidence often debunks Wall Street rules of thumb, however, in this particular case the Wall Street rule of thumb was proven to be valuable. When all hell breaks lose, gather your wits, and jump into the fire.

Quick note on Japan: Fortunately, I had the opportunity to live and travel throughout Japan for two years–I even spent a month working and making friends with the Japanese Self Defense Forces in Sendai, which was at the center of the current natural disaster. I’m sure quite a few of them have died. I’ll be pulling for the Japanese to make a miraculous recovery and come out of this event even stronger.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.