Bob Pisani was on CNBC this morning chatting about whether or not the NYSE will open tomorrow. One of the biggest concerns on Wall Street is that tomorrow is month-end, a time when asset managers need to post their net asset value and spill the beans on how their portfolio is doing.

Why would this be such a concern? The prices last Friday weren’t good enough?

During the conversation on CNBC, Jim Cramer commented on the obvious, “So we can either open tomorrow and get fake numbers, or we can open on Thursday and get real numbers?” Jim’s comment suggested that money managers engage in price manipulation at month-end.

Aren’t money managers perfect angels?

How could this be? Asset managers are perfect angels and would never attempt to manipulate prices to mislead investors…

Turns out there is a lot of evidence that money managers manipulate month-end or year-end prices to mislead investors.

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1763225

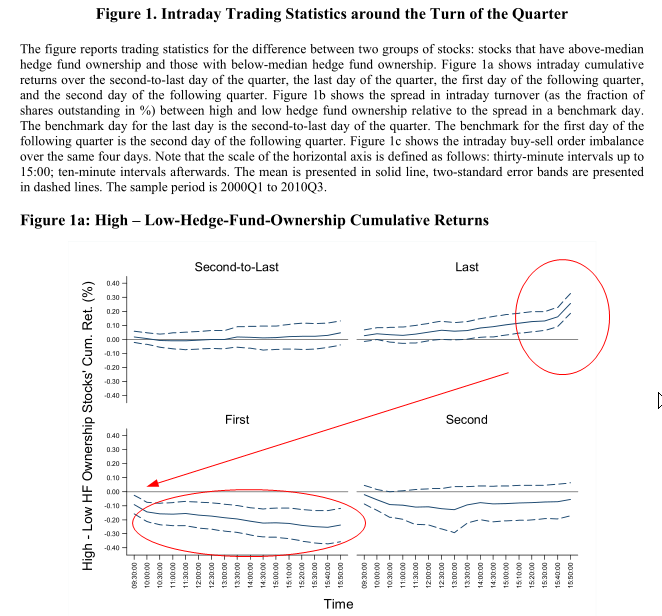

We provide evidence suggesting that some hedge funds manipulate stock prices on critical reporting dates. Stocks in the top quartile of hedge fund holdings exhibit abnormal returns of 0.30% on the last day of the quarter and a reversal of 0.25% on the following day. A significant part of the return is earned during the last minutes of trading. Analysis of intraday volume and order imbalance provides further evidence consistent with manipulation. These patterns are stronger for funds that have higher incentives to improve their ranking relative to their peers.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Prices on the last few days of the month drift upwards; these same stocks fall on the first few days of the next month.

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=891169

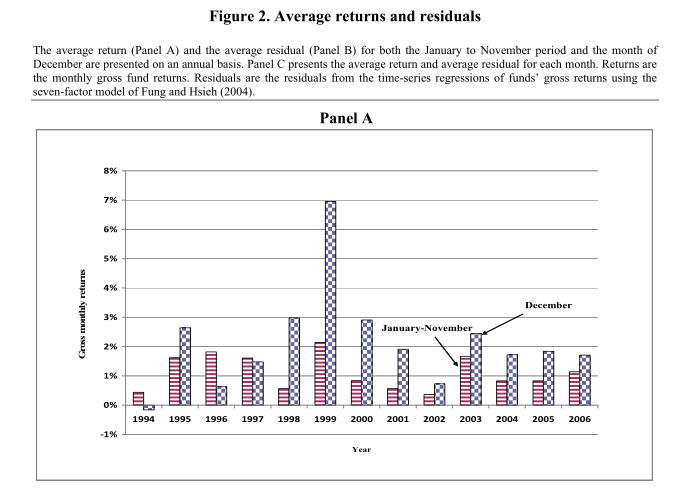

For funds with greater incentives and greater opportunities to inflate returns, we find that (i) returns during December are significantly higher than those during the rest of the year even after controlling for risk in both time-series and the cross-section; (ii) this December spike is greater than that for funds with lower incentives and opportunities to inflate returns. These results suggest that hedge funds manage their returns upwards in an opportunistic fashion in order to earn higher fees. Finally, we provide strong evidence that funds inflate December returns by under-reporting returns earlier in the year but only weak evidence that funds borrow from January returns in the following year.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Incentive fees are normally determined as of December 31, which means managers have a huge incentive to get a high year end mark. As the chart above shows, December is clearly different than your typical month.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.