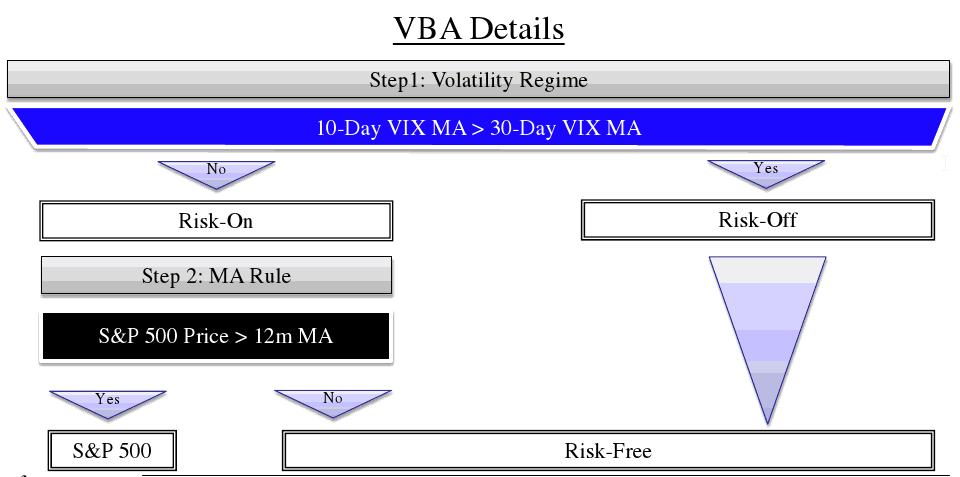

My research team at Empiritrage, LLC posted an interesting idea–very new and in need of further R&D–on volatility-based allocation:

When Empiritrage released the initial report we were hoping others in the blogosphere would continue to work on the idea.

Our dream came true:

- First, CXOAdvisory.com rebacktested the strategy

- Next, Meb highlighted the concept in his sweet “Idea Farm”

- Finally, Woodshedder, a blog I was previously unfamiliar with, but am now happy to add to my RSS feed, just did some analysis on the system.

If you’ve done any work on the system, please share and I’ll post. I know there are multiple ways in which investors can improve upon the VBA system Empiritrage originally explored.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.